This version of the form is not currently in use and is provided for reference only. Download this version of

Form BM-FS

for the current year.

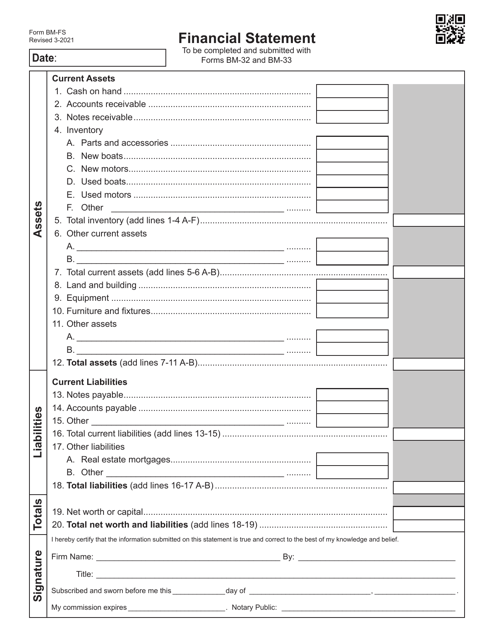

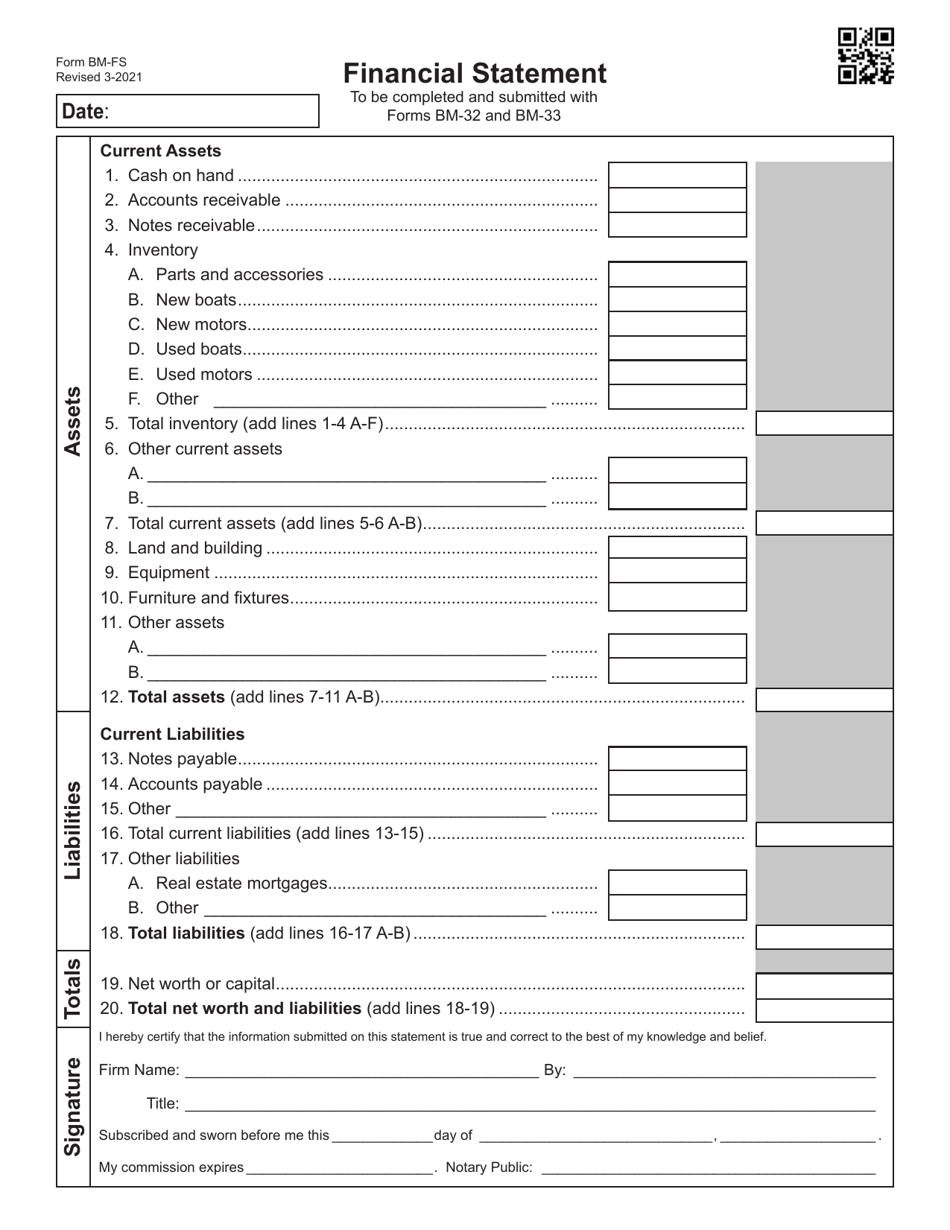

Form BM-FS Financial Statement - Oklahoma

What Is Form BM-FS?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form BM-FS Financial Statement?

A: Form BM-FS Financial Statement is a document used in Oklahoma to report financial information.

Q: Who needs to file a Form BM-FS Financial Statement?

A: Entities and individuals who are licensed, registered, or regulated by the Oklahoma State Banking Department are required to file a Form BM-FS Financial Statement.

Q: What information is included in a Form BM-FS Financial Statement?

A: A Form BM-FS Financial Statement includes information such as assets, liabilities, income, and expenses.

Q: When is the deadline to file a Form BM-FS Financial Statement?

A: The deadline to file a Form BM-FS Financial Statement is determined by the Oklahoma State Banking Department and may vary.

Q: Are there any penalties for not filing a Form BM-FS Financial Statement?

A: Yes, failure to file a Form BM-FS Financial Statement may result in penalties and/or fines imposed by the Oklahoma State Banking Department.

Q: Are there any exceptions or exemptions to filing a Form BM-FS Financial Statement?

A: There may be exceptions or exemptions to filing a Form BM-FS Financial Statement, but they would be determined by the Oklahoma State Banking Department.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BM-FS by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.