This version of the form is not currently in use and is provided for reference only. Download this version of

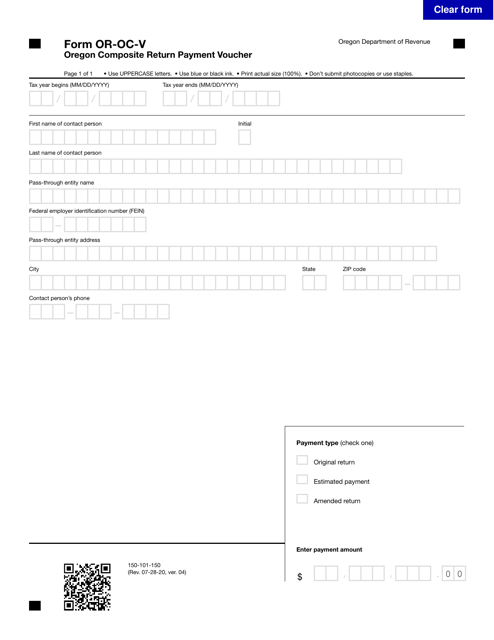

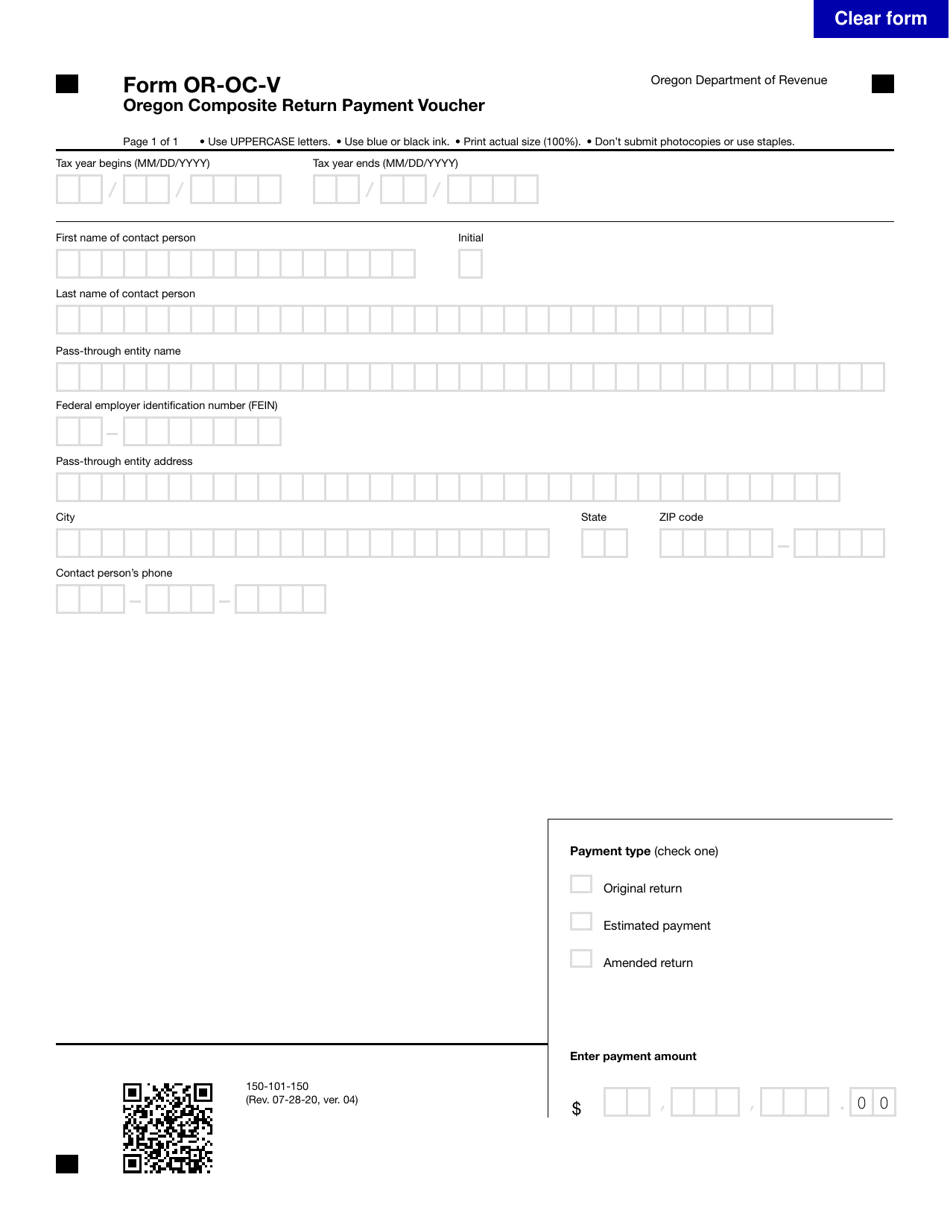

Form OR-OC-V (150-101-150)

for the current year.

Form OR-OC-V (150-101-150) Oregon Composite Return Payment Voucher - Oregon

What Is Form OR-OC-V (150-101-150)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-OC-V?

A: Form OR-OC-V is the Oregon Composite Return Payment Voucher.

Q: What is the purpose of Form OR-OC-V?

A: Form OR-OC-V is used for making payments related to the Oregon Composite Return.

Q: Who should use Form OR-OC-V?

A: Form OR-OC-V should be used by individuals or entities filing a composite return in Oregon.

Q: When is Form OR-OC-V due?

A: Form OR-OC-V is typically due on or before the original due date of the Oregon Composite Return.

Q: Are there any additional requirements for using Form OR-OC-V?

A: Yes, you must include your Oregon Department of Revenue account number and the tax year on the form.

Q: What should I do with Form OR-OC-V after completing it?

A: After completing Form OR-OC-V, you should attach it to your payment and mail it to the address provided on the form.

Form Details:

- Released on July 28, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-OC-V (150-101-150) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.