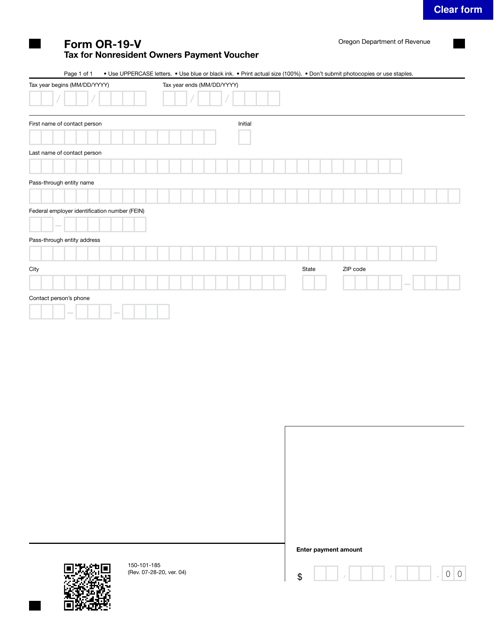

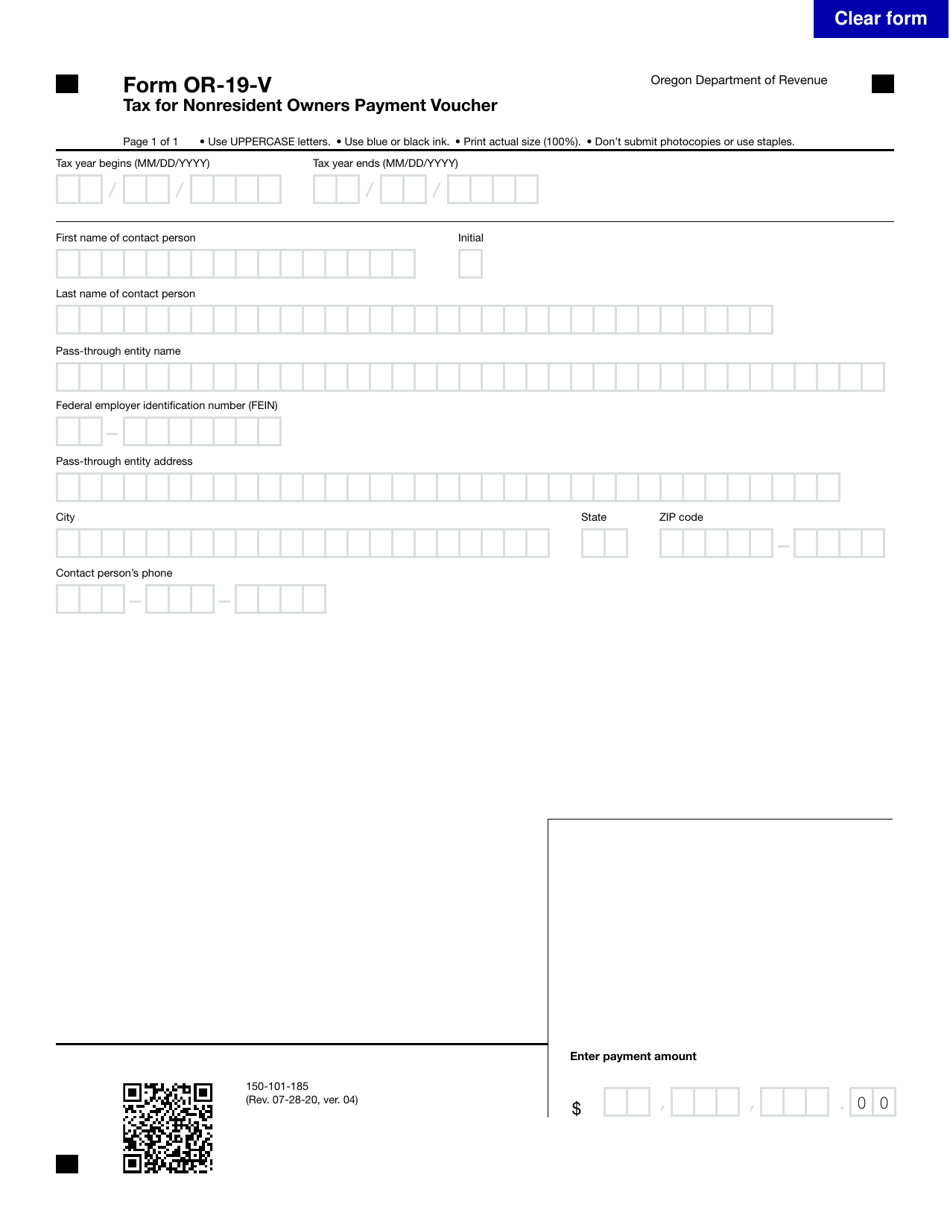

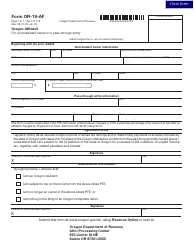

This version of the form is not currently in use and is provided for reference only. Download this version of

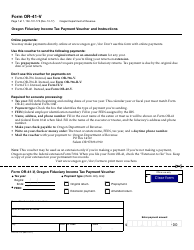

Form OR-19-V (150-101-185)

for the current year.

Form OR-19-V (150-101-185) Tax for Nonresident Owners Payment Voucher - Oregon

What Is Form OR-19-V (150-101-185)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-19-V?

A: Form OR-19-V is a payment voucher used by nonresident owners to pay taxes in Oregon.

Q: Who needs to use Form OR-19-V?

A: Nonresident owners who owe taxes in Oregon need to use Form OR-19-V.

Q: What is the purpose of Form OR-19-V?

A: Form OR-19-V is used to make tax payments for nonresident owners in Oregon.

Q: What information is required on Form OR-19-V?

A: Form OR-19-V requires information such as the tax year, the nonresident owner's name and address, and the tax amount.

Q: When is Form OR-19-V due?

A: Form OR-19-V is typically due on or before the tax filing deadline for nonresident owners in Oregon.

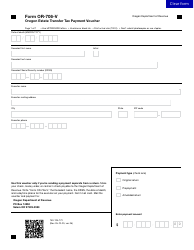

Form Details:

- Released on July 28, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-19-V (150-101-185) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.