This version of the form is not currently in use and is provided for reference only. Download this version of

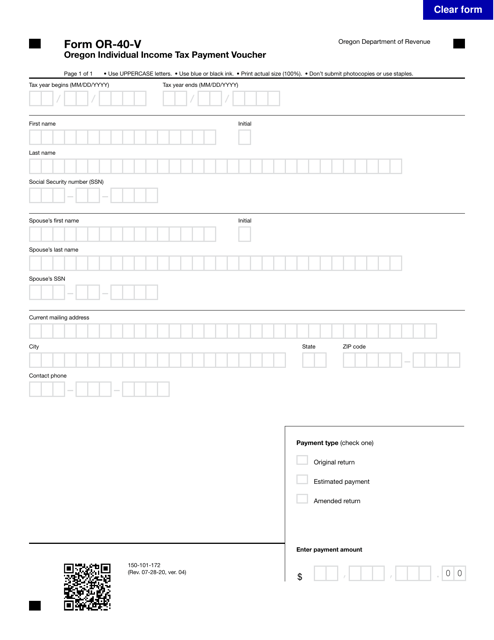

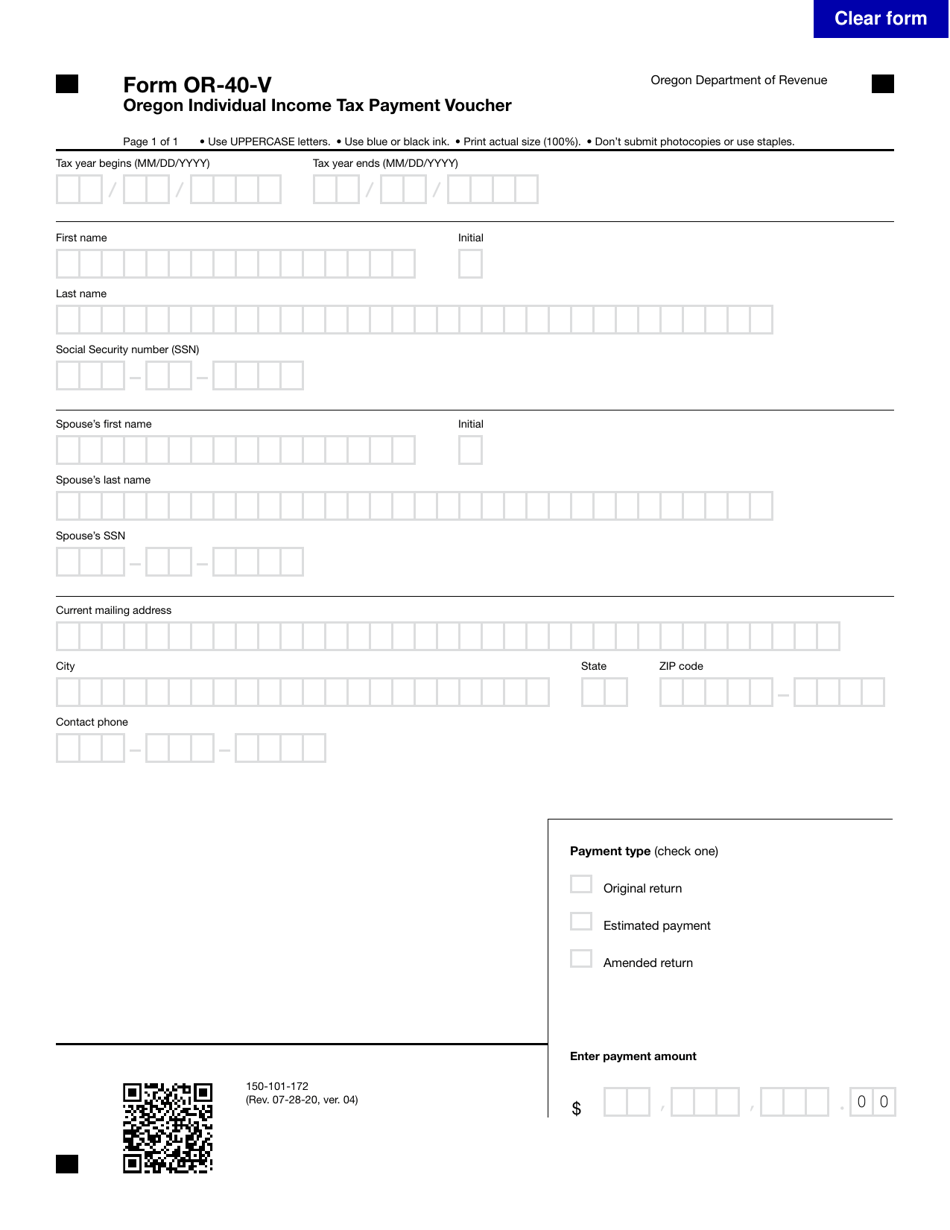

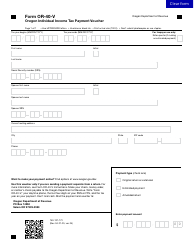

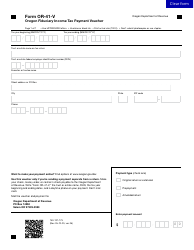

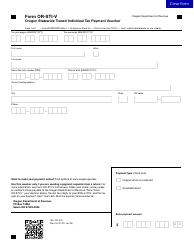

Form OR-40-V (150-101-172)

for the current year.

Form OR-40-V (150-101-172) Oregon Individual Income Tax Payment Voucher - Oregon

What Is Form OR-40-V (150-101-172)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-40-V?

A: Form OR-40-V is the Oregon Individual Income Tax Payment Voucher.

Q: What is the purpose of Form OR-40-V?

A: The purpose of Form OR-40-V is to make a payment for your Oregon individual income tax.

Q: What is the form number for Form OR-40-V?

A: The form number for Form OR-40-V is 150-101-172.

Q: Who should use Form OR-40-V?

A: Individuals in Oregon who need to make a payment for their state income tax should use Form OR-40-V.

Q: Do I need to include Form OR-40-V when filing my tax return?

A: No, Form OR-40-V is a separate payment voucher and should not be attached to your tax return. It is used only for making tax payments.

Q: When should I use Form OR-40-V?

A: You should use Form OR-40-V when you need to make a payment for your Oregon individual income tax, such as if you owe additional tax or are making an estimated tax payment.

Q: Is Form OR-40-V for both state and federal income tax payments?

A: No, Form OR-40-V is only for Oregon individual income tax payments. You will need to use the appropriate federal payment voucher for federal income tax payments.

Q: Are there any penalties for not using Form OR-40-V?

A: There may be penalties if you do not use Form OR-40-V or do not make a timely payment for your Oregon individual income tax. It is important to follow the instructions and deadlines provided by the Oregon Department of Revenue.

Form Details:

- Released on July 28, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40-V (150-101-172) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.