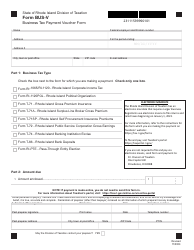

This version of the form is not currently in use and is provided for reference only. Download this version of

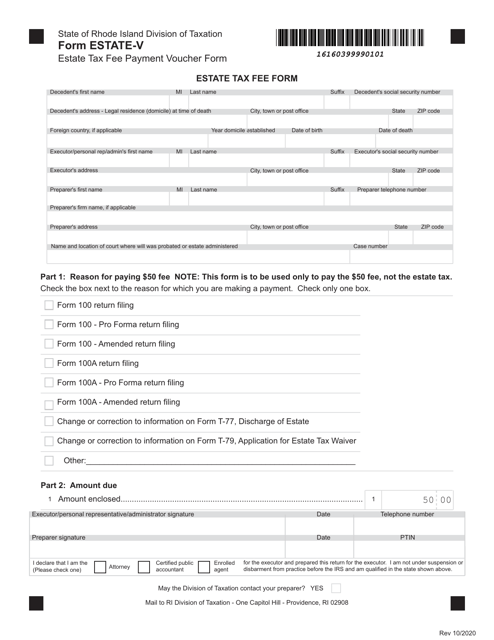

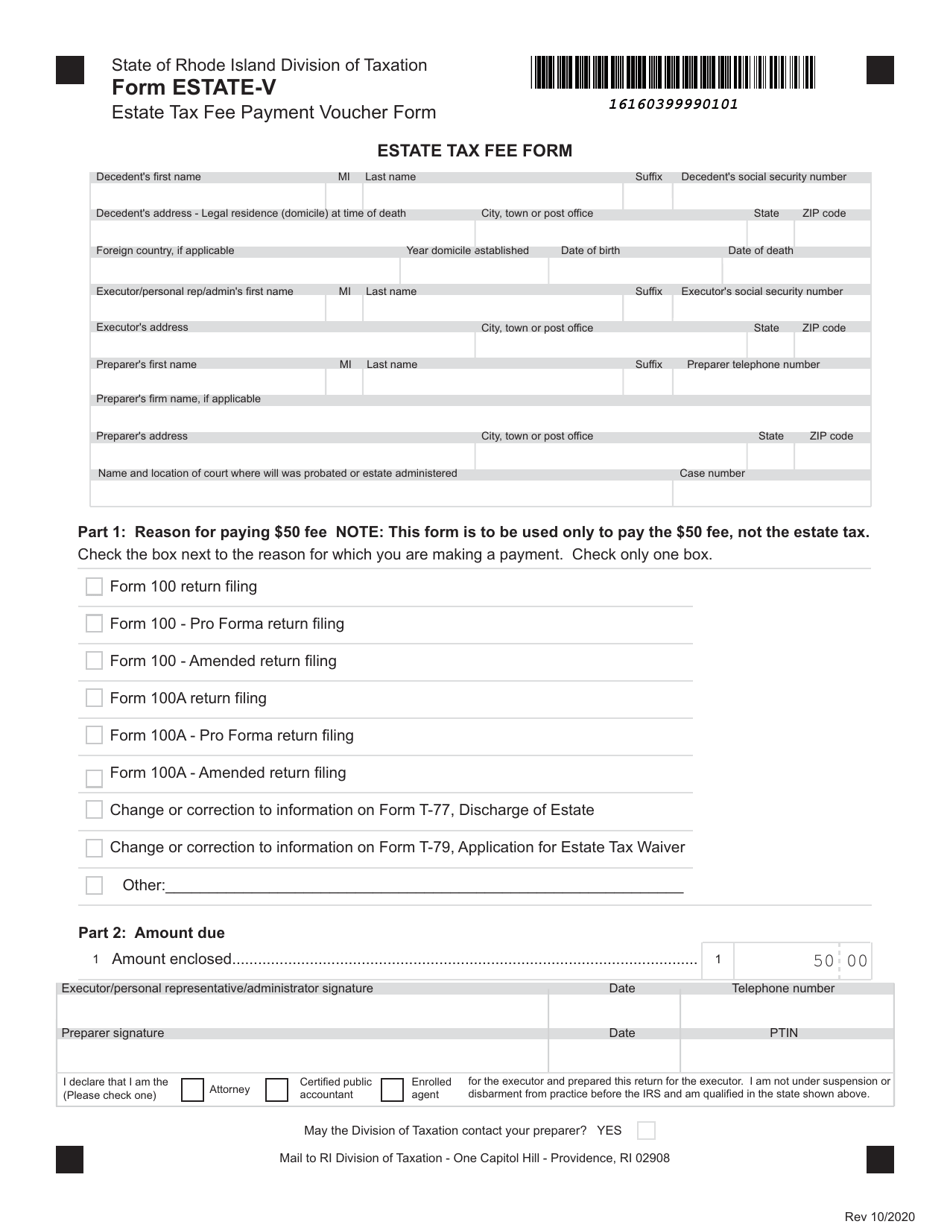

Form ESTATE-V

for the current year.

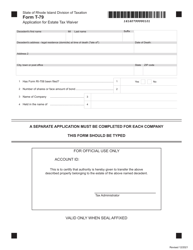

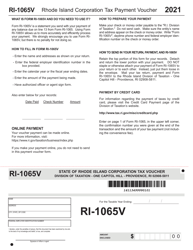

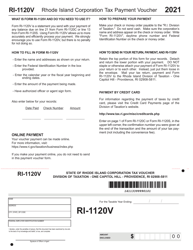

Form ESTATE-V Estate Tax Fee Payment Voucher Form - Rhode Island

What Is Form ESTATE-V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ESTATE-V?

A: Form ESTATE-V is the Estate Tax Fee Payment Voucher form for Rhode Island.

Q: What is the purpose of Form ESTATE-V?

A: Form ESTATE-V is used to submit payment for estate taxes owed in Rhode Island.

Q: Who needs to file Form ESTATE-V?

A: This form must be filed by individuals responsible for paying estate taxes in Rhode Island.

Q: Do I need to include any supporting documentation with Form ESTATE-V?

A: No, Form ESTATE-V does not require any supporting documentation.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ESTATE-V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.