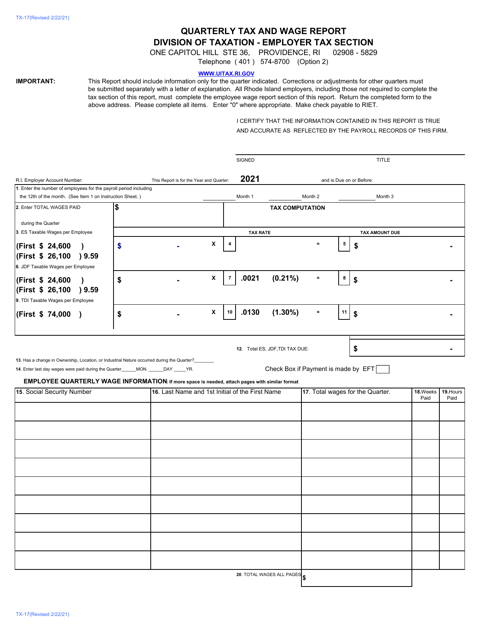

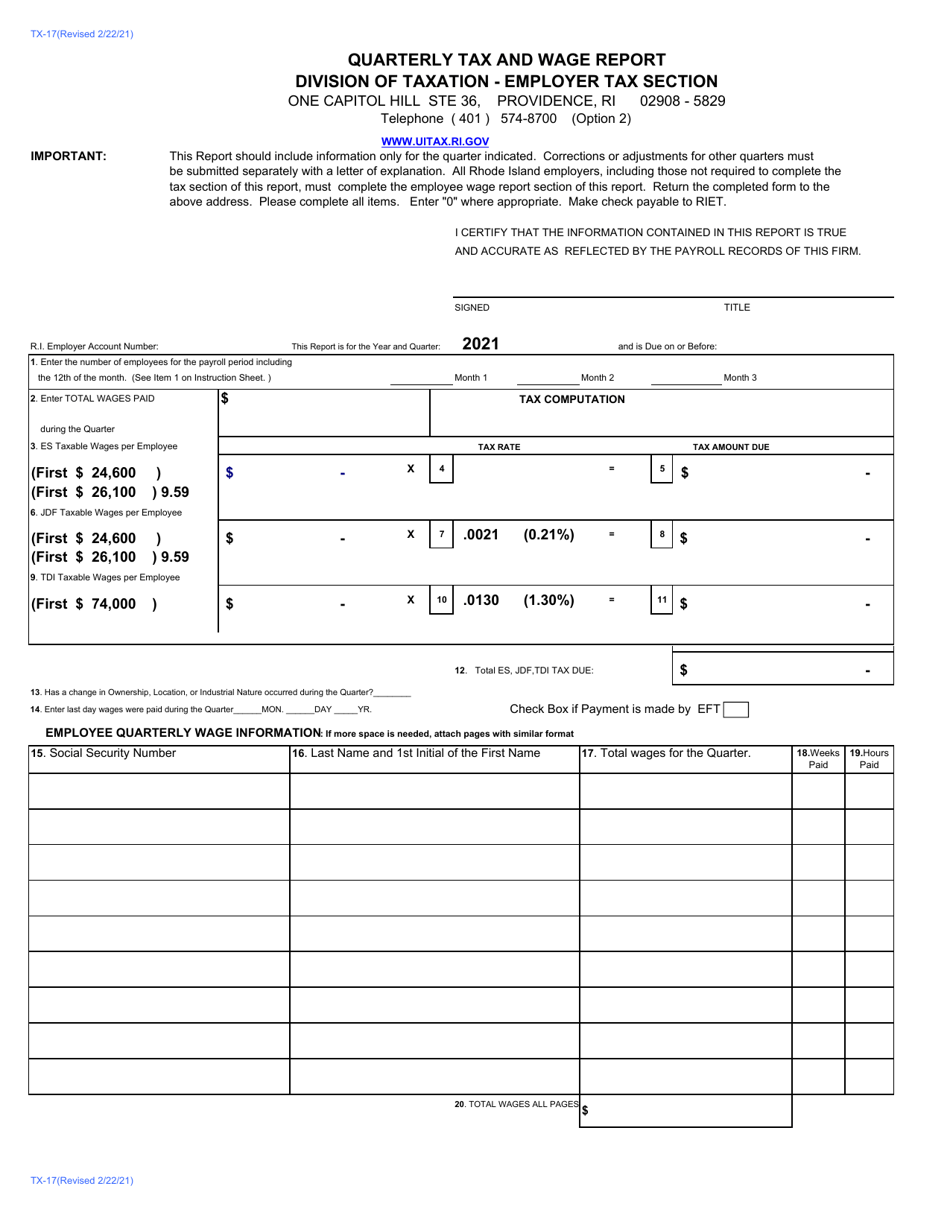

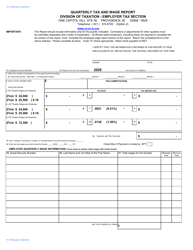

Form TX-17 Quarterly Tax and Wage Report - Rhode Island

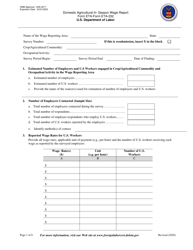

What Is Form TX-17?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TX-17?

A: Form TX-17 is the Quarterly Tax and Wage Report for Rhode Island.

Q: What is the purpose of Form TX-17?

A: The purpose of Form TX-17 is to report the taxes and wages associated with each employee for a specific quarter in Rhode Island.

Q: Who needs to file Form TX-17?

A: Employers in Rhode Island are required to file Form TX-17.

Q: How often should Form TX-17 be filed?

A: Form TX-17 should be filed on a quarterly basis.

Q: What information do I need to complete Form TX-17?

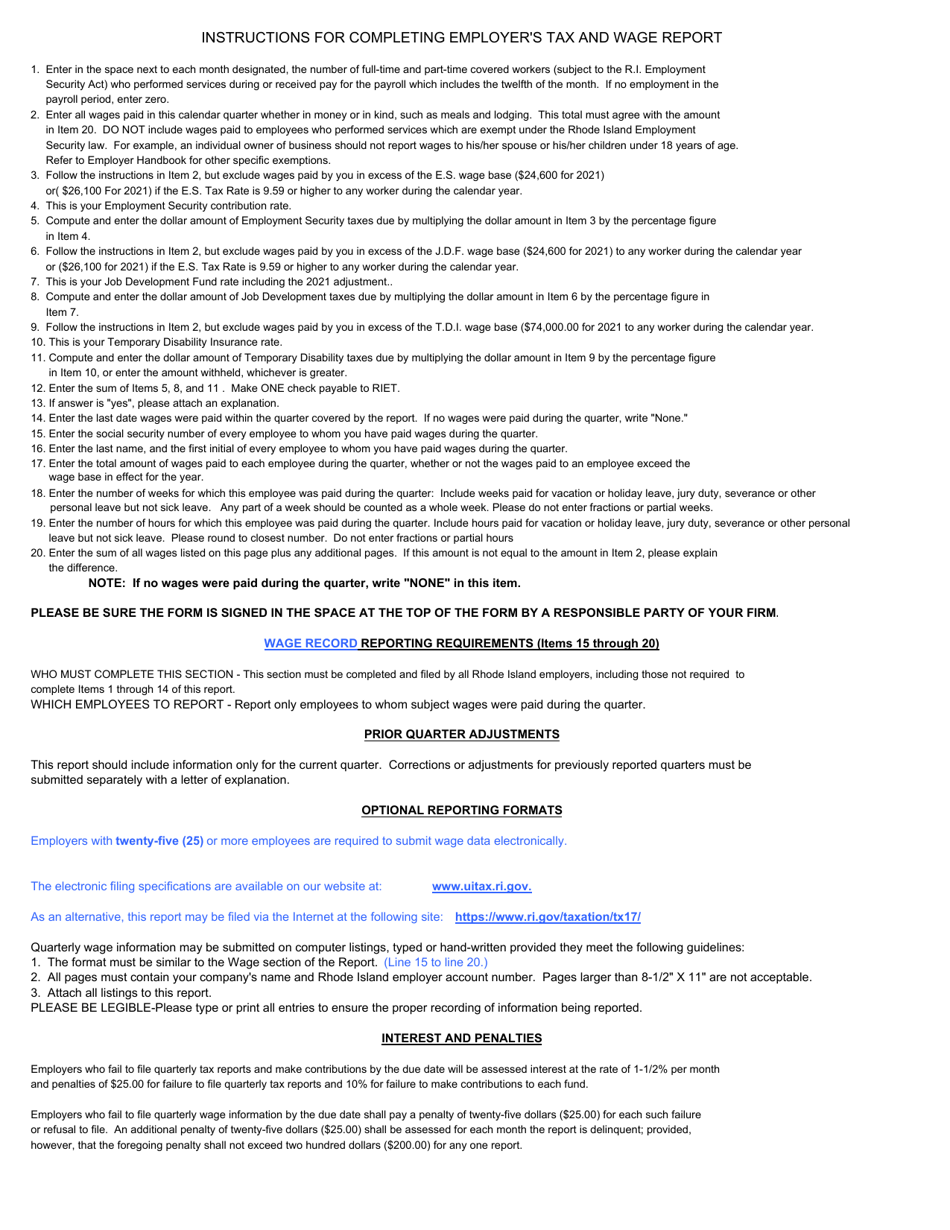

A: You will need to provide information such as employee wages, hours worked, and the amount of taxes withheld.

Q: When is the deadline for filing Form TX-17?

A: Form TX-17 is due on the last day of the month following the end of the quarter.

Q: What happens if I don't file Form TX-17?

A: Failure to file Form TX-17 or to pay the required taxes may result in penalties and interest charges.

Q: Is Form TX-17 only for reporting taxes?

A: No, Form TX-17 also includes reporting wage information for each employee.

Form Details:

- Released on February 22, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TX-17 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.