This version of the form is not currently in use and is provided for reference only. Download this version of

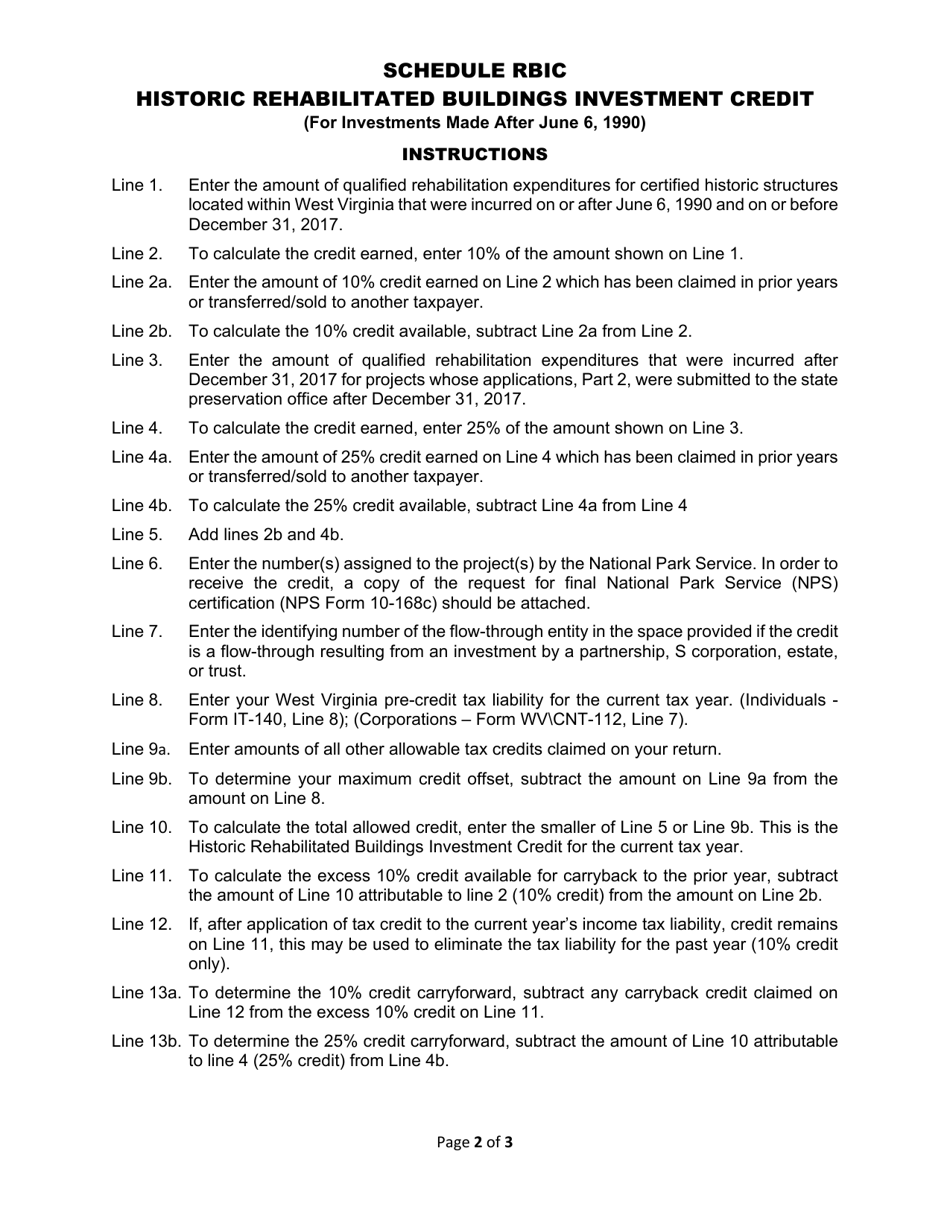

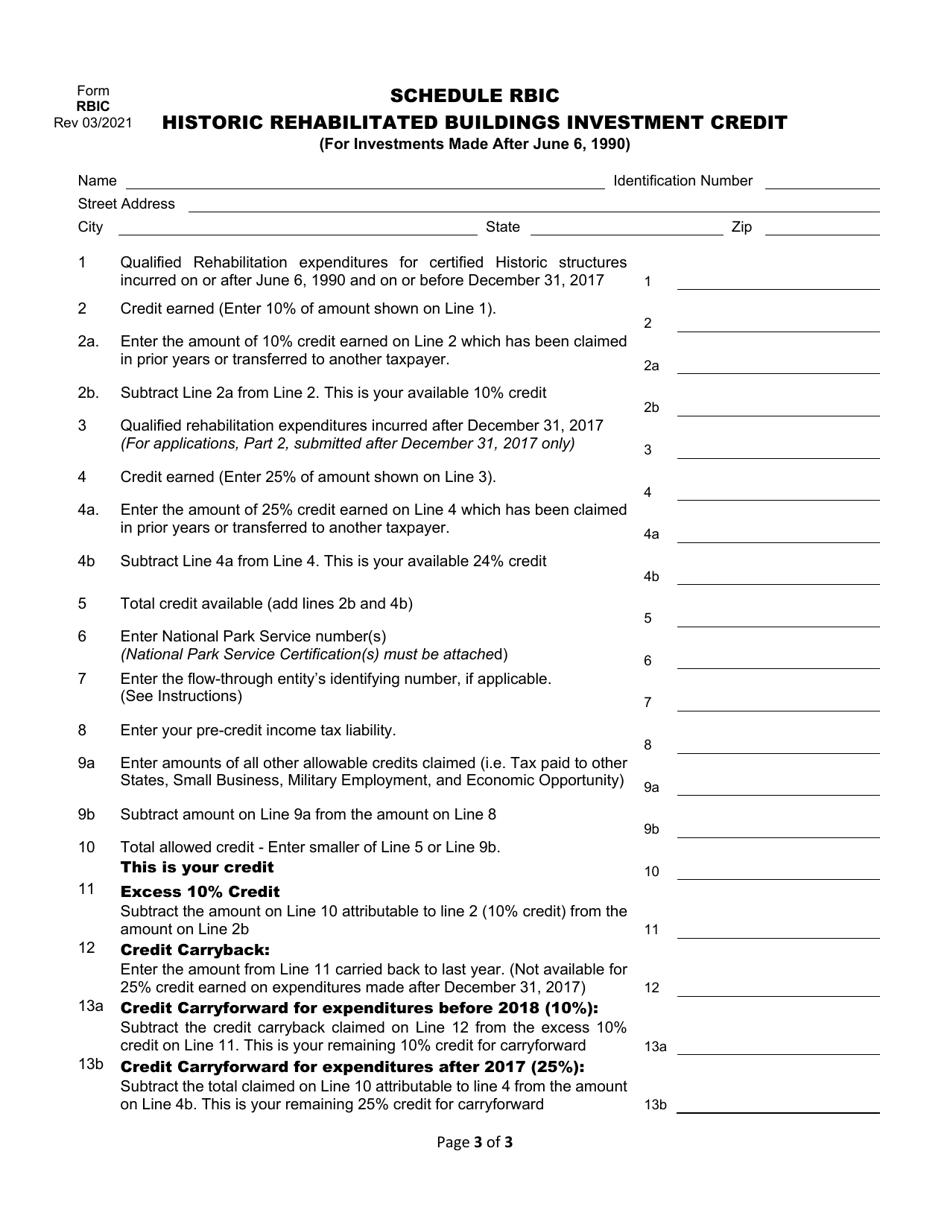

Schedule RBIC

for the current year.

Schedule RBIC Historic Rehabilitated Buildings Investment Credit - West Virginia

What Is Schedule RBIC?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

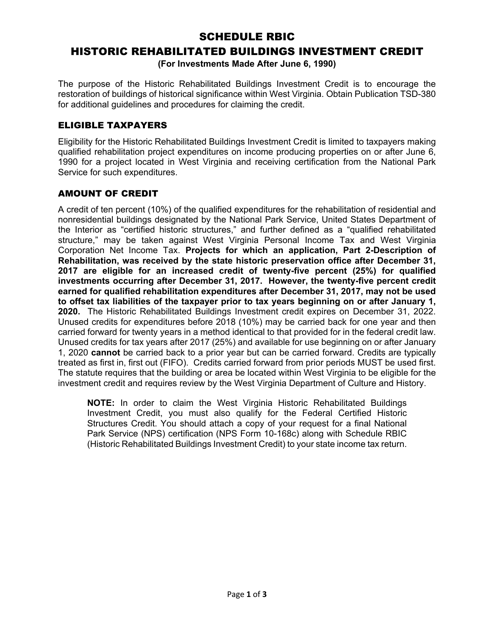

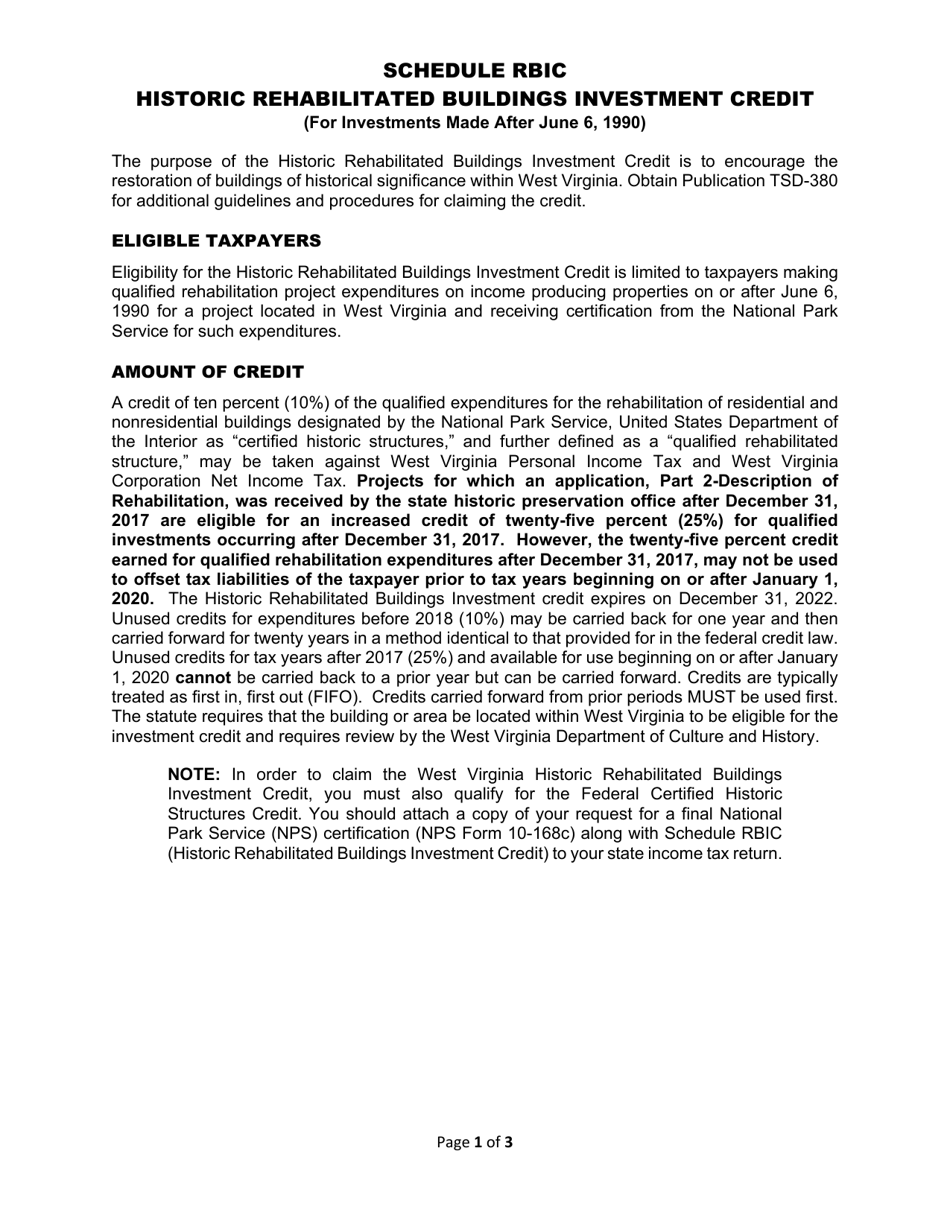

Q: What is the RBIC Historic Rehabilitated Buildings Investment Credit?

A: The RBIC Historic Rehabilitated Buildings Investment Credit is a tax credit available for the rehabilitation of historic buildings in West Virginia.

Q: What is the purpose of the RBIC Historic Rehabilitated Buildings Investment Credit?

A: The purpose of the credit is to incentivize the rehabilitation and preservation of historic buildings.

Q: Who is eligible for the RBIC Historic Rehabilitated Buildings Investment Credit?

A: Owners of historic buildings in West Virginia who undertake qualified rehabilitation projects may be eligible.

Q: What is a qualified rehabilitation project?

A: A qualified rehabilitation project is a project that meets certain criteria set by the West Virginia State Historic Preservation Office.

Q: How much is the RBIC Historic Rehabilitated Buildings Investment Credit?

A: The credit can be up to 25% of the qualified rehabilitation expenses.

Q: How do I apply for the RBIC Historic Rehabilitated Buildings Investment Credit?

A: To apply for the credit, you need to submit an application to the West Virginia State Historic Preservation Office.

Q: Are there any limitations or restrictions on the use of the RBIC Historic Rehabilitated Buildings Investment Credit?

A: Yes, there are limitations on the credit, including a maximum credit amount per project and a minimum investment requirement.

Q: Is the RBIC Historic Rehabilitated Buildings Investment Credit transferable?

A: Yes, the credit is transferable, which means you can sell or transfer the credit to another taxpayer.

Q: Are there any deadlines or timeframes associated with the RBIC Historic Rehabilitated Buildings Investment Credit?

A: Yes, there are deadlines for submitting applications and completing the rehabilitation project, and the credit must be claimed within a certain timeframe.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule RBIC by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.