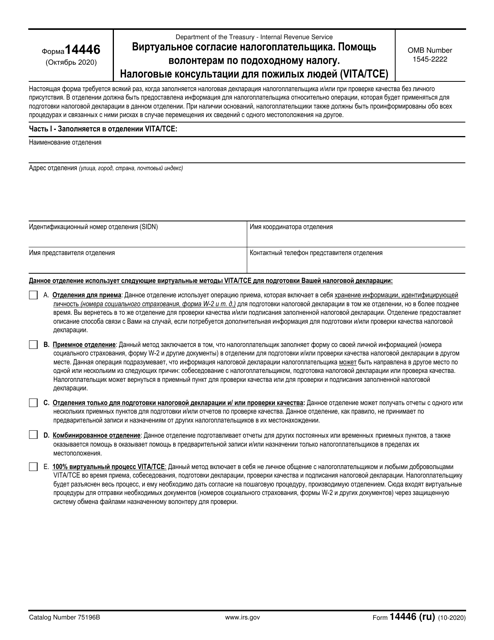

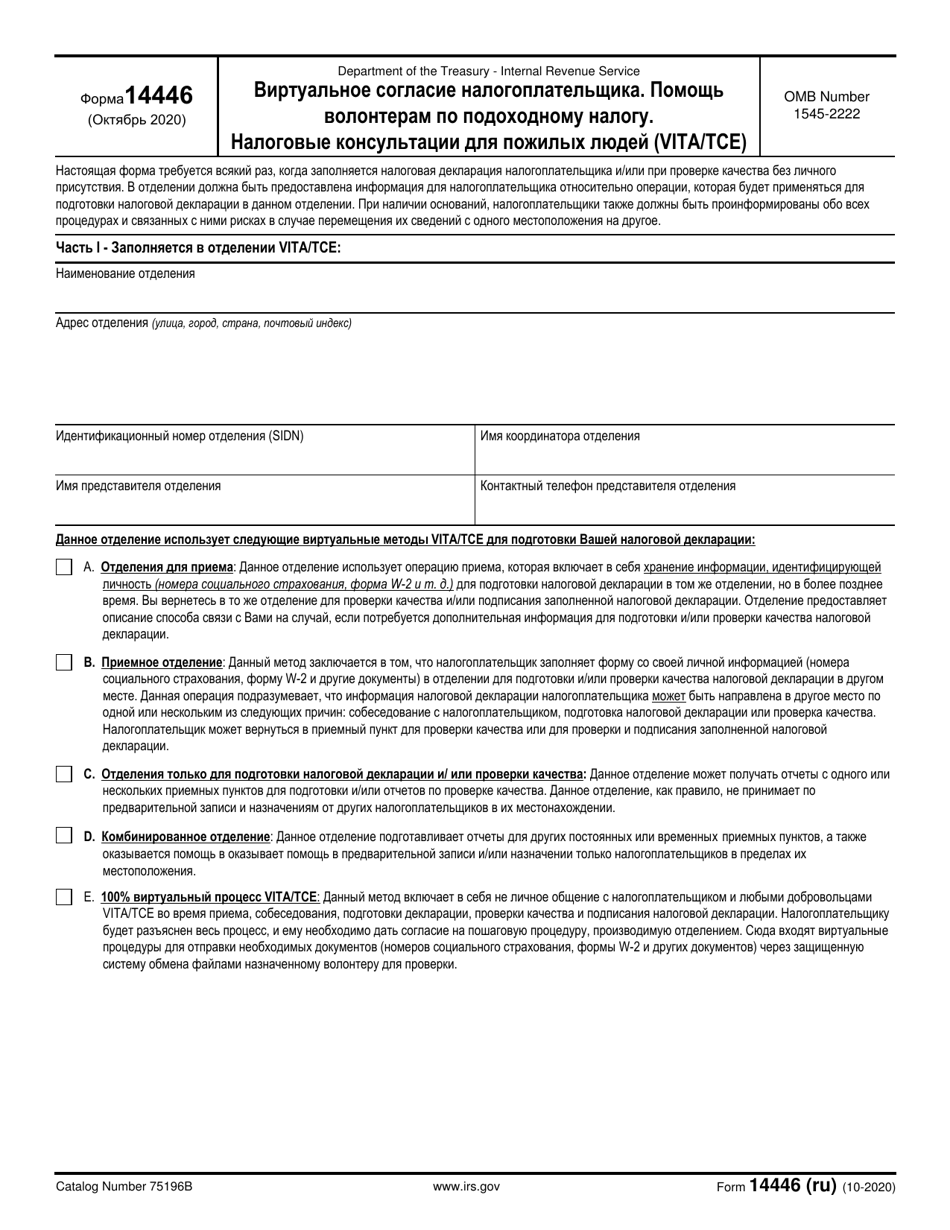

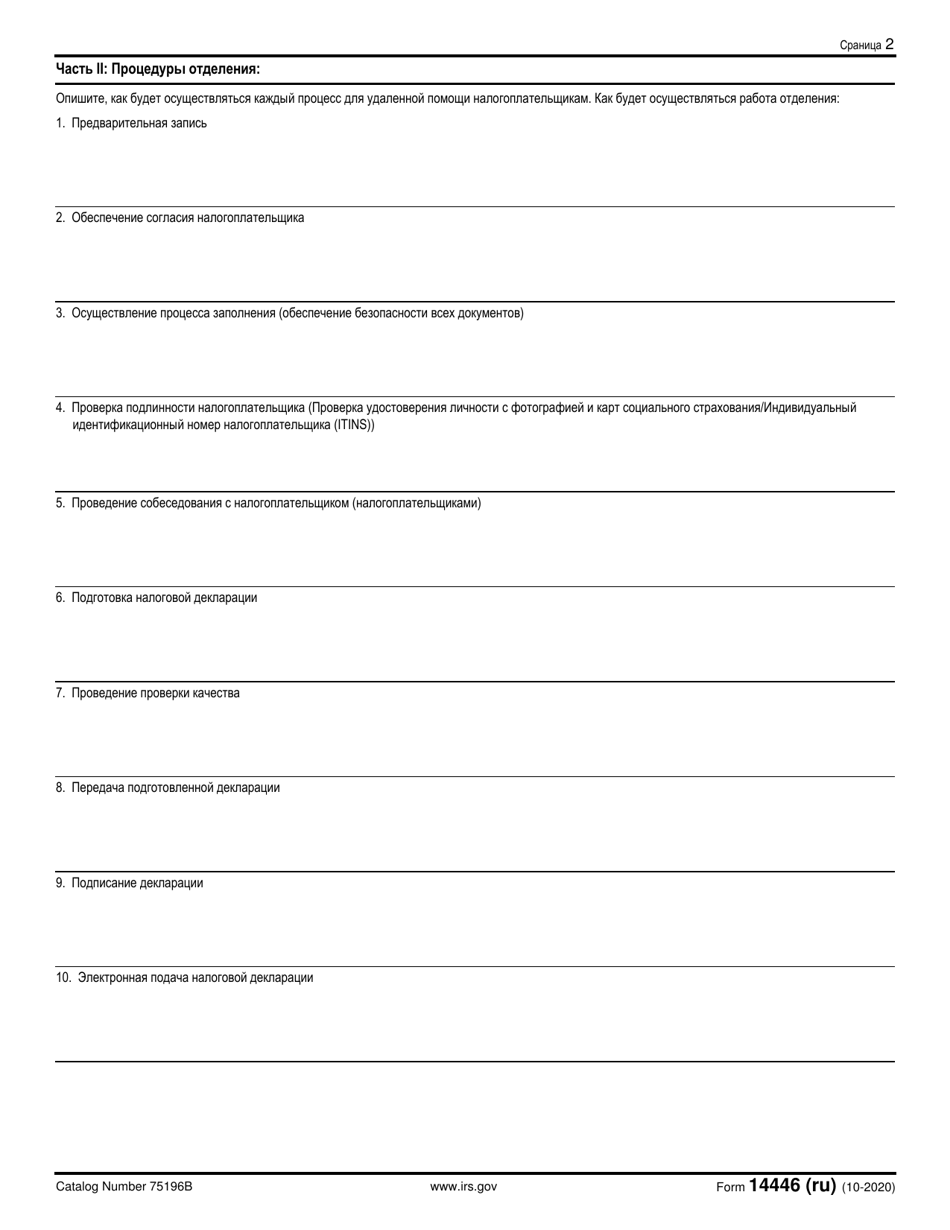

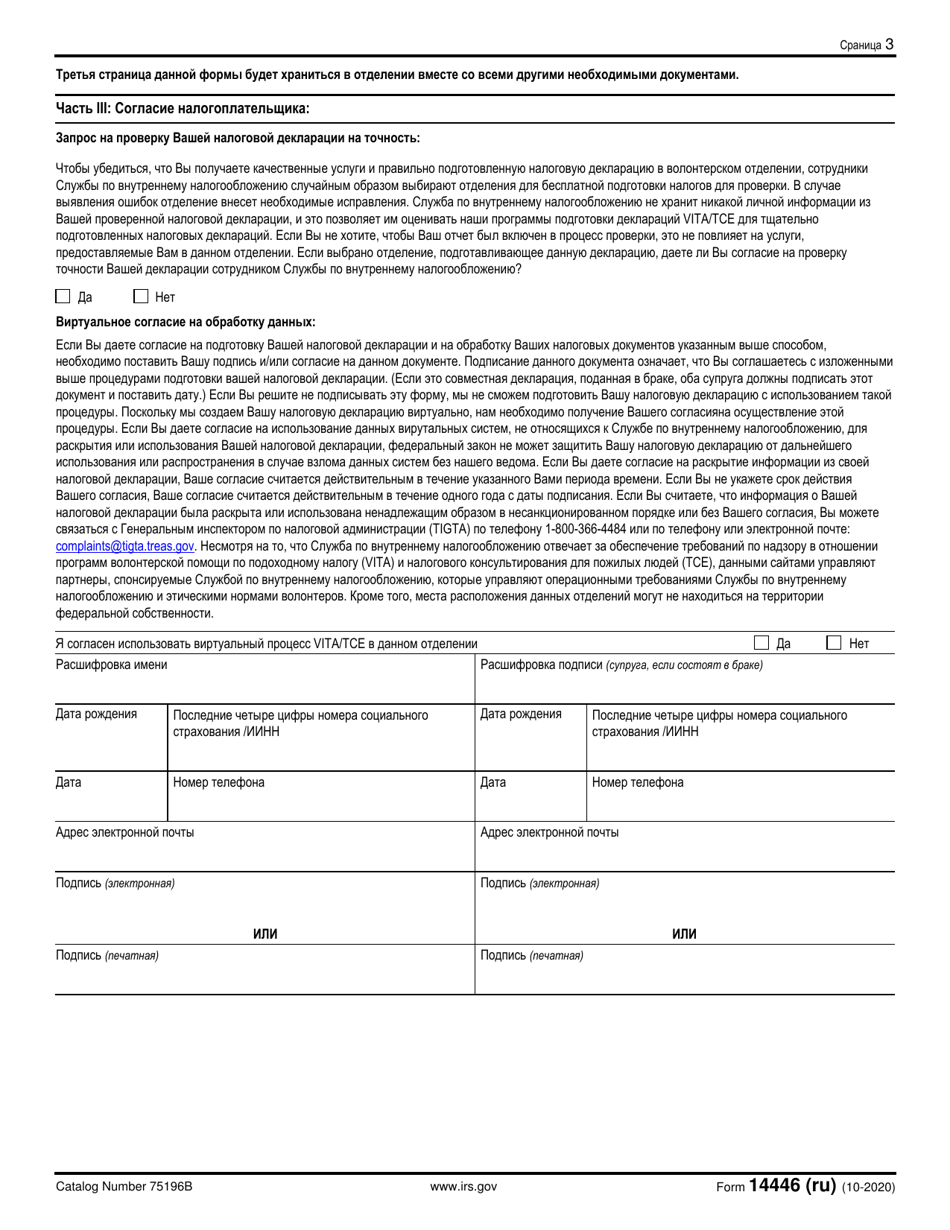

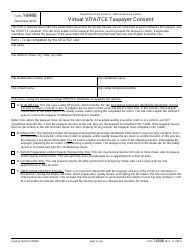

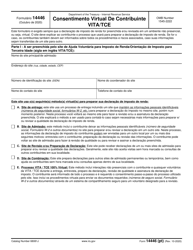

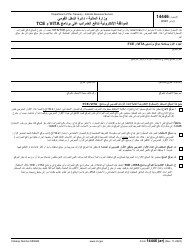

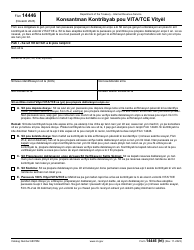

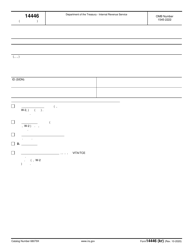

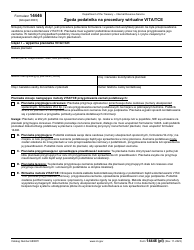

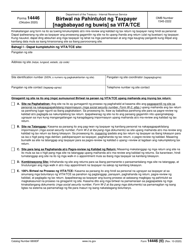

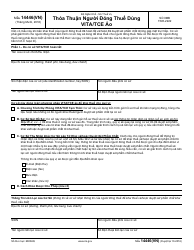

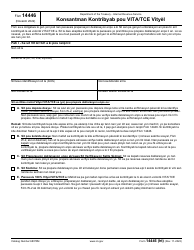

IRS Form 14446 Virtual Vita / Tce Taxpayer Consent (Russian)

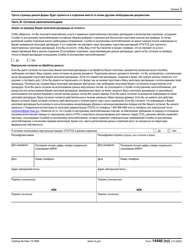

IRS Form 14446 Virtual Vita/Tce Taxpayer Consent (Russian) allows Russian-speaking taxpayers to give consent for receiving tax assistance and guidance through virtual Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

FAQ

Q: What is IRS Form 14446?

A: IRS Form 14446 is the Virtual Vita/Tce Taxpayer Consent form that allows taxpayers to give consent for virtual assistance in Russian.

Q: What is Virtual Vita/Tce?

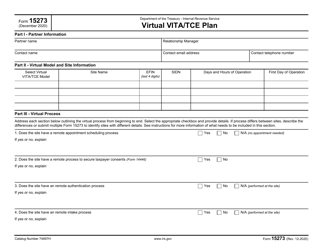

A: Virtual Vita/Tce is a program that provides free tax return preparation and assistance to taxpayers through virtual interactions with IRS-certified volunteers.

Q: Who can use IRS Form 14446?

A: IRS Form 14446 is specifically designed for taxpayers who need assistance in the Russian language and wish to participate in the Virtual Vita/Tce program.

Q: What is the purpose of the form?

A: The purpose of IRS Form 14446 is to obtain taxpayer consent for the use of virtual assistance in preparing their tax returns and providing tax-related assistance.

Q: Do I need to fill out IRS Form 14446 if I don't require assistance in Russian?

A: No, IRS Form 14446 is specifically for taxpayers who need assistance in the Russian language. If you don't require assistance in Russian, you do not need to fill out this form.