This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14446 (HT)

for the current year.

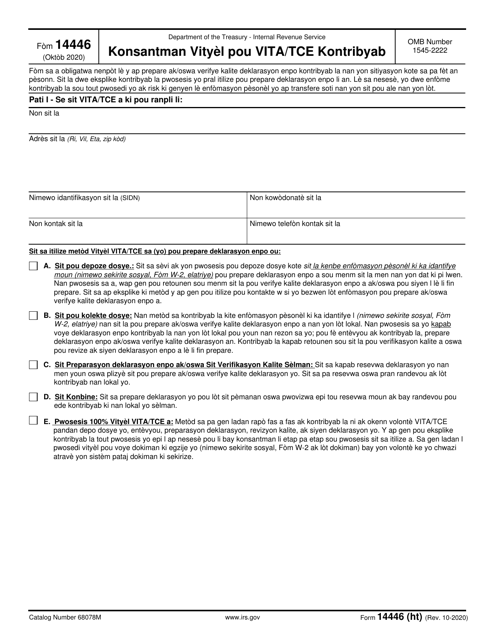

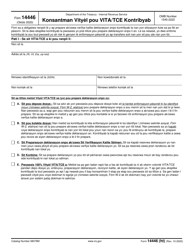

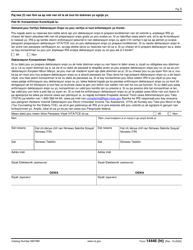

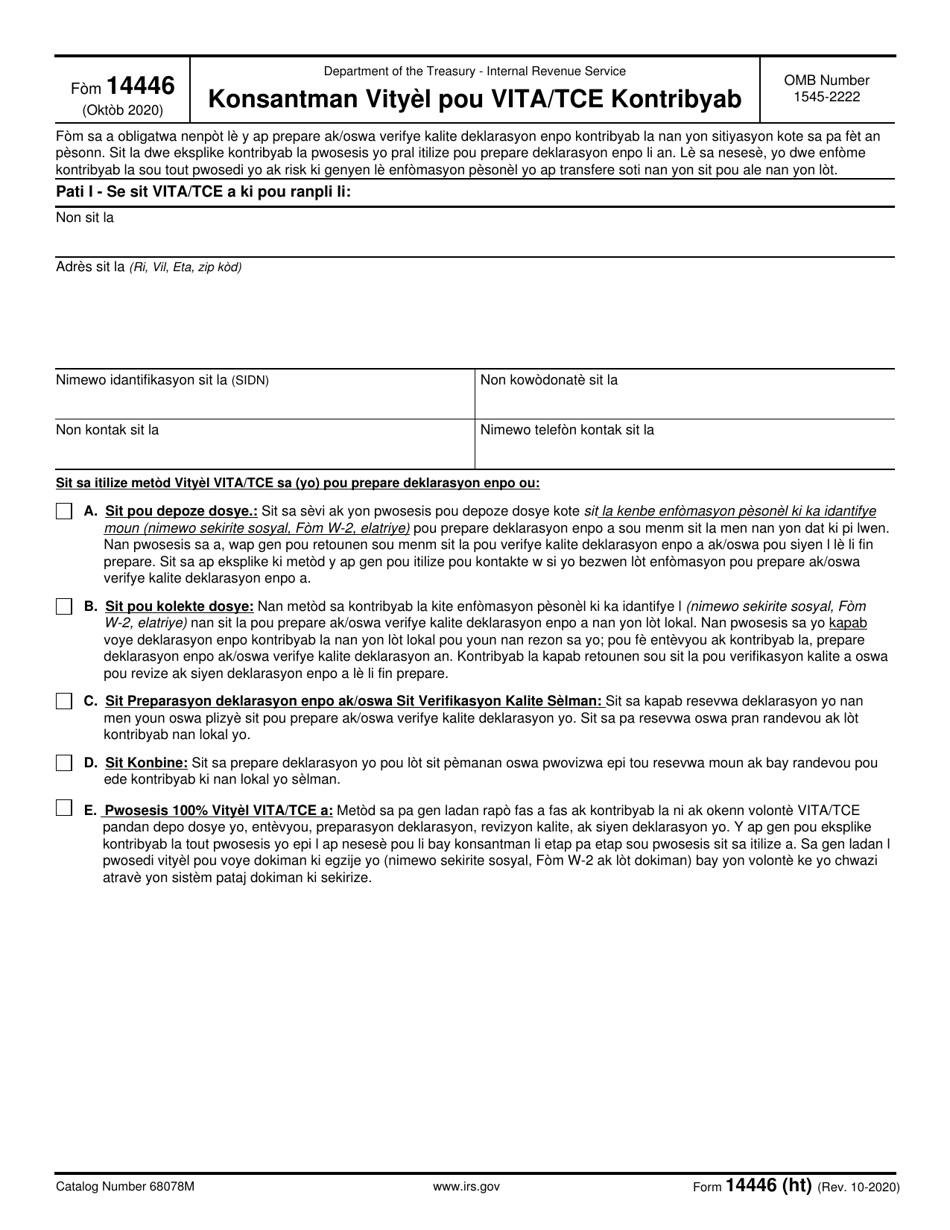

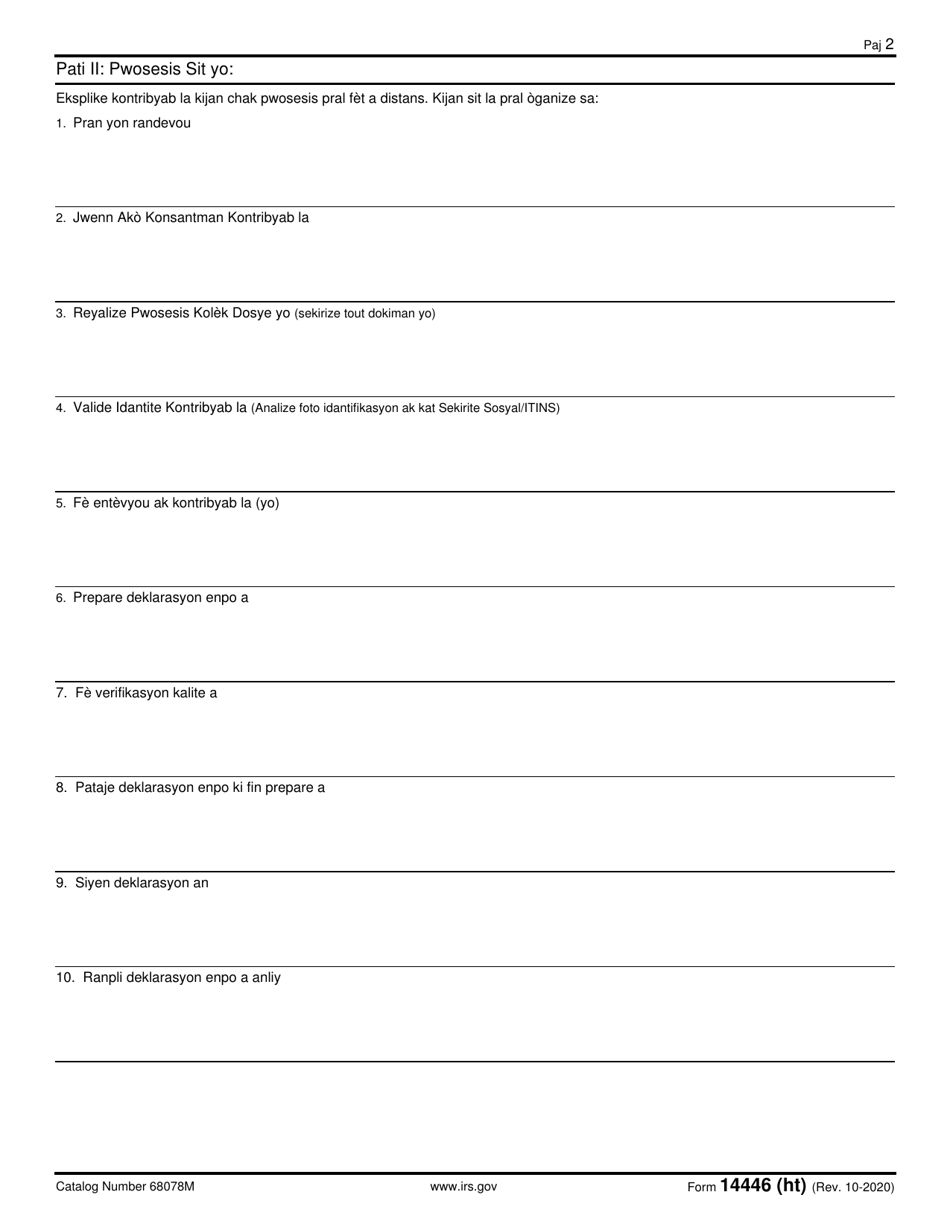

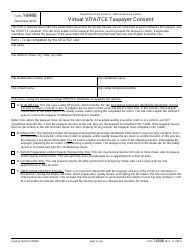

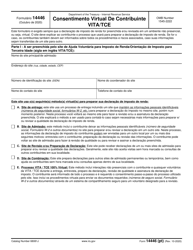

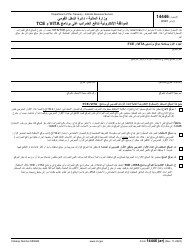

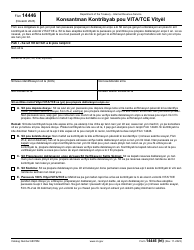

IRS Form 14446 (HT) Virtual Vita / Tce Taxpayer Consent (French Creole)

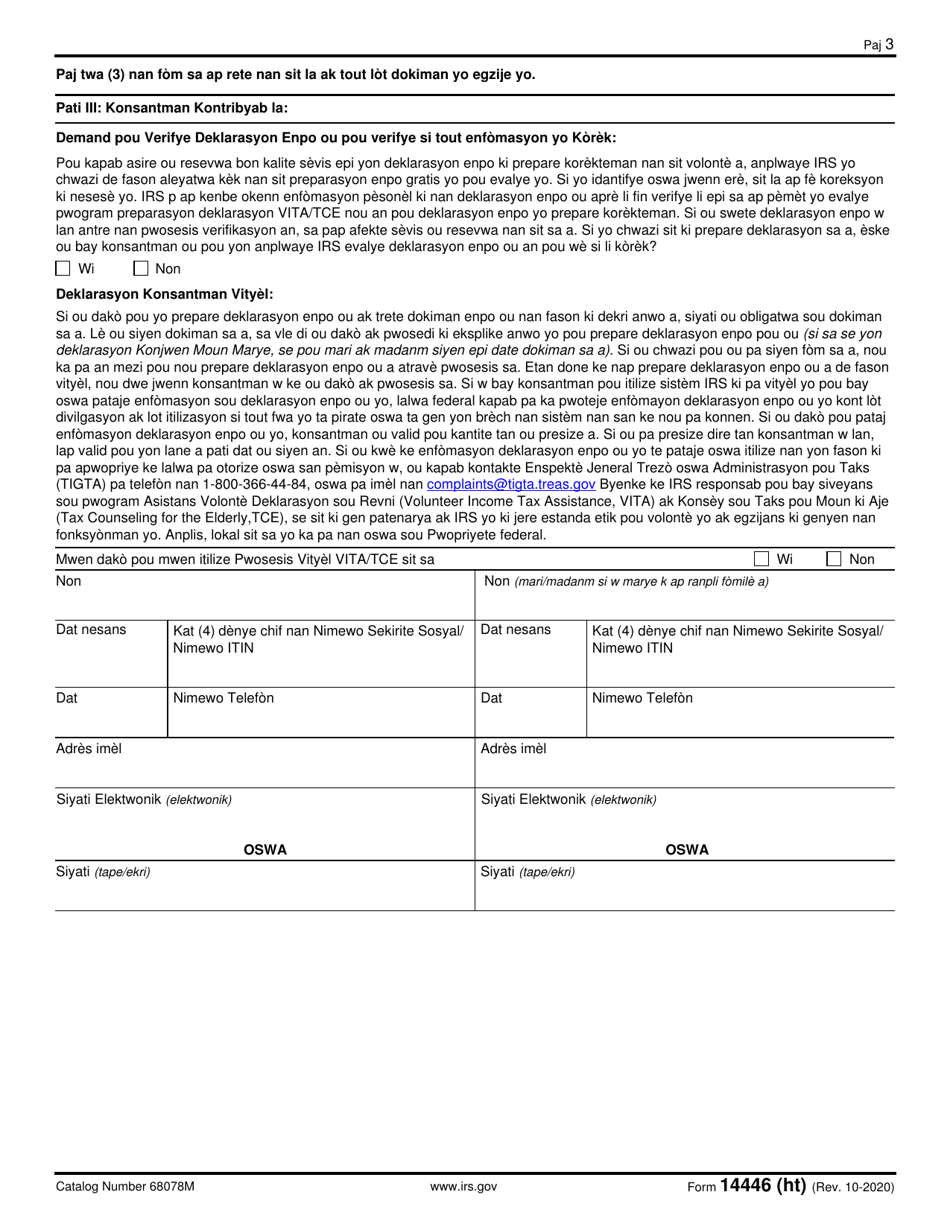

IRS Form 14446 (HT) Virtual Vita/Tce Taxpayer Consent (French Creole) is a form used by the Internal Revenue Service (IRS) in the United States. It is specifically designed for taxpayers who speak French Creole and wish to participate in the Virtual VITA/TCE (Volunteer Income Tax Assistance/Tax Counseling for the Elderly) program. This form grants consent to receive tax preparation assistance from certified volunteers through virtual means, such as video conferencing or telephone calls. It enables taxpayers to communicate with IRS volunteers effectively and receive free tax preparation services in their preferred language, ensuring that language barriers do not hinder their access to important tax resources.

The IRS Form 14446 (HT) Virtual Vita/Tce Taxpayer Consent (French Creole) is filled out by taxpayers who need assistance with their taxes and prefer to communicate in French Creole. This form allows the taxpayer to give their consent for the IRS to use video conferencing technology to provide them with virtual tax assistance services.

FAQ

Q: What is IRS Form 14446 (HT)?

A: IRS Form 14446 (HT) is a consent form that allows taxpayers to receive virtual assistance with their tax returns through the Virtual VITA/TCE program. It specifically caters to taxpayers who prefer assistance in French Creole.

Q: What is the Virtual VITA/TCE program?

A: The Virtual VITA/TCE program is a service offered by the IRS (Internal Revenue Service) that provides free tax preparation assistance to eligible taxpayers. Through this program, taxpayers can receive help with their tax returns remotely, using virtual platforms.

Q: Who is eligible for the Virtual VITA/TCE program?

A: The Virtual VITA/TCE program is available to taxpayers who meet certain eligibility criteria. Generally, it is aimed at low-to-moderate-income individuals, senior citizens, persons with disabilities, and limited English proficient taxpayers.

Q: What does Form 14446 (HT) consent to?

A: Form 14446 (HT) allows taxpayers to consent to receive virtual tax assistance in French Creole through the Virtual VITA/TCE program. By signing this form, taxpayers authorize the IRS to share their tax information with certified volunteers for assistance.

Q: Is IRS Form 14446 (HT) mandatory?

A: No, IRS Form 14446 (HT) is not mandatory. It is entirely optional and is specifically for taxpayers who prefer to receive virtual assistance in French Creole through the Virtual VITA/TCE program.