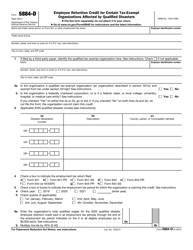

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-D

for the current year.

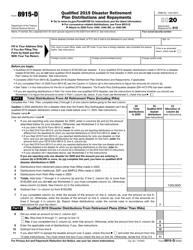

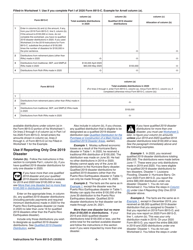

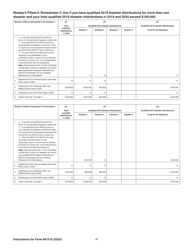

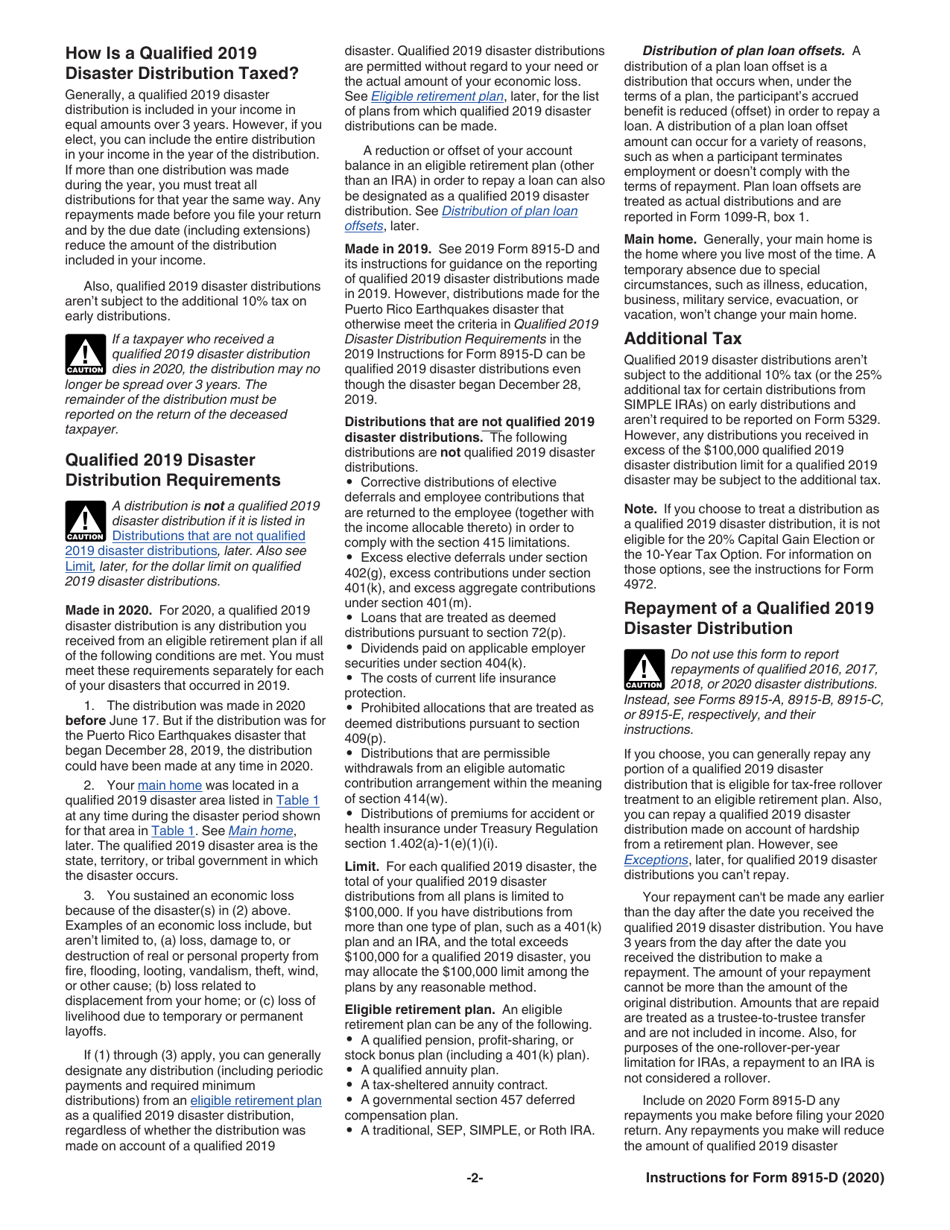

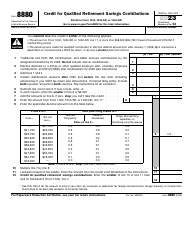

Instructions for IRS Form 8915-D Qualified 2019 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-D , Qualified 2019 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-D is available for download through this link.

FAQ

Q: What is IRS Form 8915-D?

A: IRS Form 8915-D is used for reporting qualified 2019 disaster retirement plan distributions and repayments.

Q: What is a qualified 2019 disaster retirement plan distribution?

A: A qualified 2019 disaster retirement plan distribution is a distribution from a retirement plan made in response to a qualified disaster declared by the President in 2019.

Q: Who is eligible to use Form 8915-D?

A: Taxpayers who received qualified 2019 disaster retirement plan distributions are eligible to use Form 8915-D.

Q: What is the purpose of Form 8915-D?

A: The purpose of Form 8915-D is to report the qualified 2019 disaster retirement plan distributions and any repayments made by the taxpayer.

Q: Is there a deadline to file Form 8915-D?

A: Yes, the deadline to file Form 8915-D is the due date of your tax return, including extensions.

Q: Are there any penalties for not filing Form 8915-D?

A: Yes, there may be penalties for not filing Form 8915-D or for not including all required information on the form.

Q: Can Form 8915-D be filed electronically?

A: No, Form 8915-D cannot be filed electronically and must be filed by mail.

Q: What documentation should I include with Form 8915-D?

A: You should include any supporting documentation for the qualified 2019 disaster retirement plan distributions and repayments with Form 8915-D.

Q: Can I use Form 8915-D for distributions and repayments from other years?

A: No, Form 8915-D is specifically for reporting qualified 2019 disaster retirement plan distributions and repayments.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.