This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941-SS

for the current year.

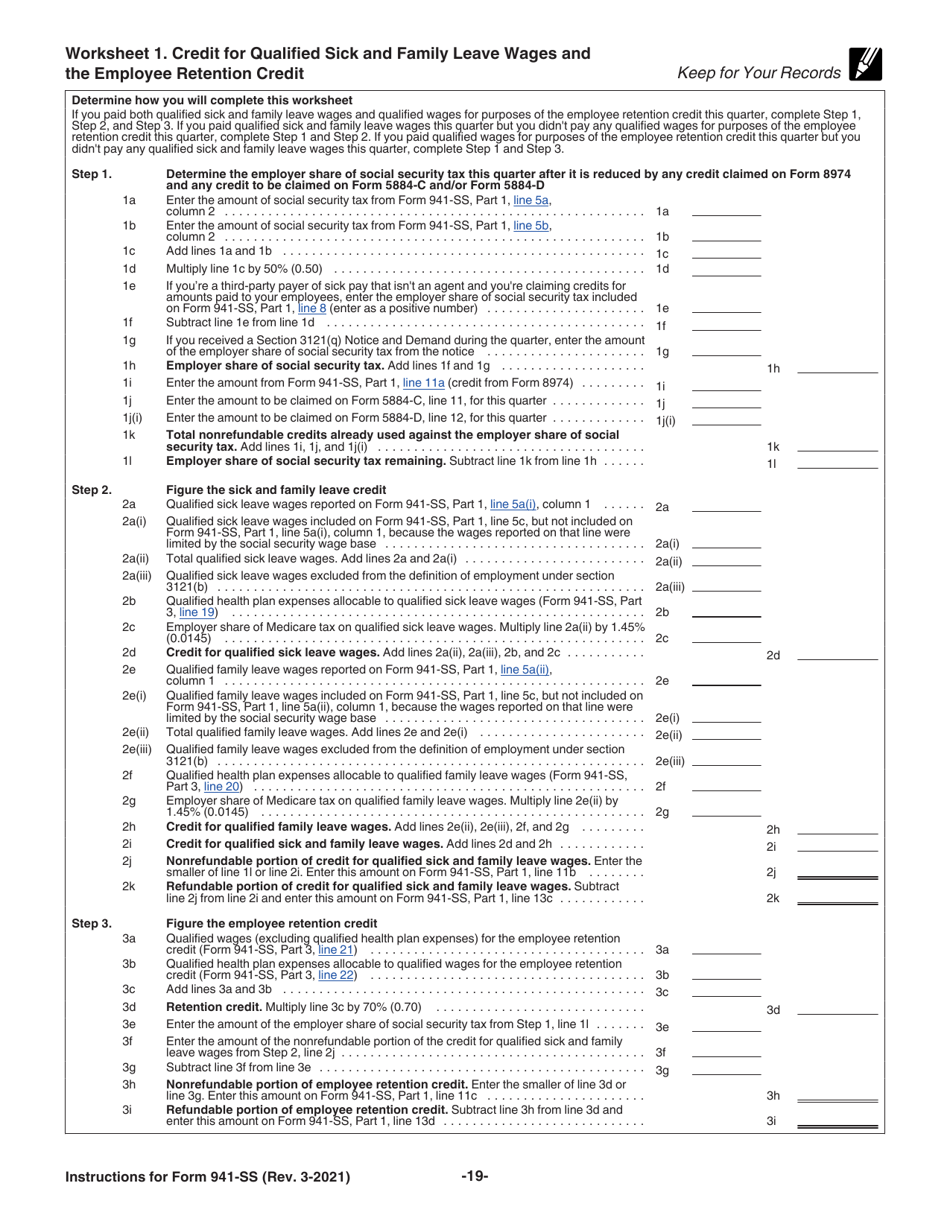

Instructions for IRS Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

This document contains official instructions for IRS Form 941-SS , Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Q: Who needs to file IRS Form 941-SS?

A: Employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands need to file IRS Form 941-SS.

Q: What information do I need to complete IRS Form 941-SS?

A: You will need to provide information about your employees, wages paid, and taxes withheld.

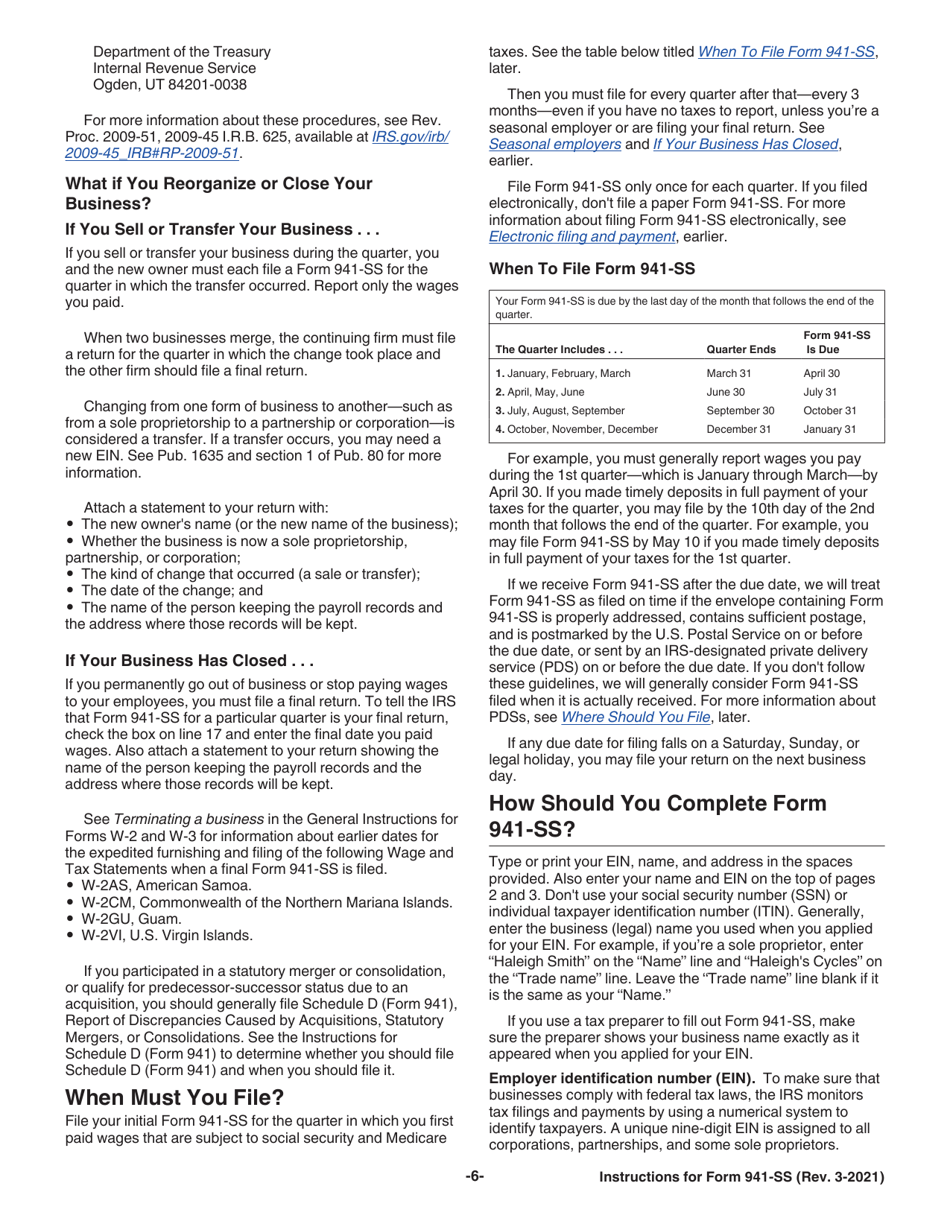

Q: When is the deadline to file IRS Form 941-SS?

A: The deadline to file IRS Form 941-SS is the last day of the month following the end of the quarter. For example, the deadline for the first quarter (January to March) is April 30th.

Q: Are there any penalties for not filing IRS Form 941-SS?

A: Yes, there can be penalties for not filing IRS Form 941-SS, including late filing penalties and interest on unpaid taxes.

Q: Can I file IRS Form 941-SS electronically?

A: Yes, you can file IRS Form 941-SS electronically using the IRS e-file system.

Q: What should I do if I make a mistake on IRS Form 941-SS?

A: If you make a mistake on IRS Form 941-SS, you should file an amended return using Form 941-X.

Q: Can I hire a professional to help me with IRS Form 941-SS?

A: Yes, you can hire a tax professional or accountant to help you with IRS Form 941-SS.

Instruction Details:

- This 19-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.