Gift Deed Form - Colorado

Fill PDF Online

Fill out online for free

without registration or credit card

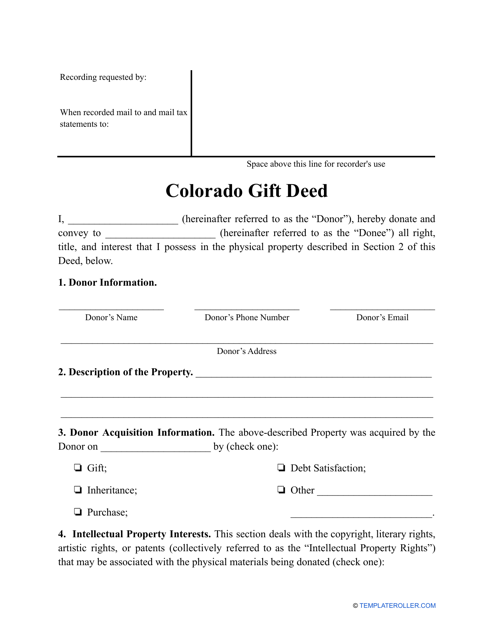

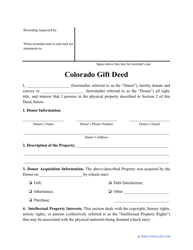

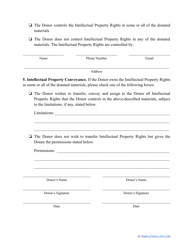

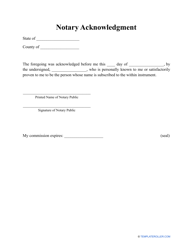

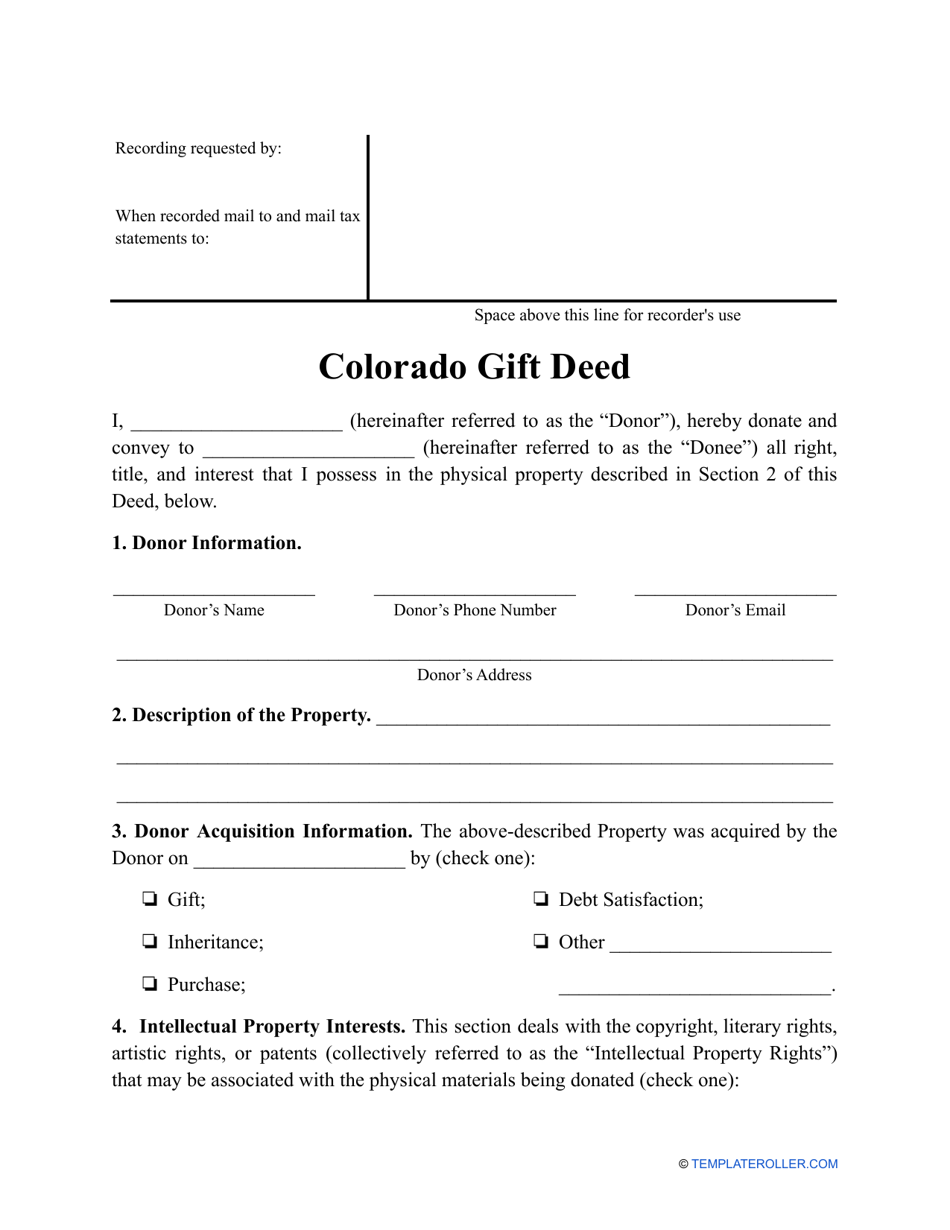

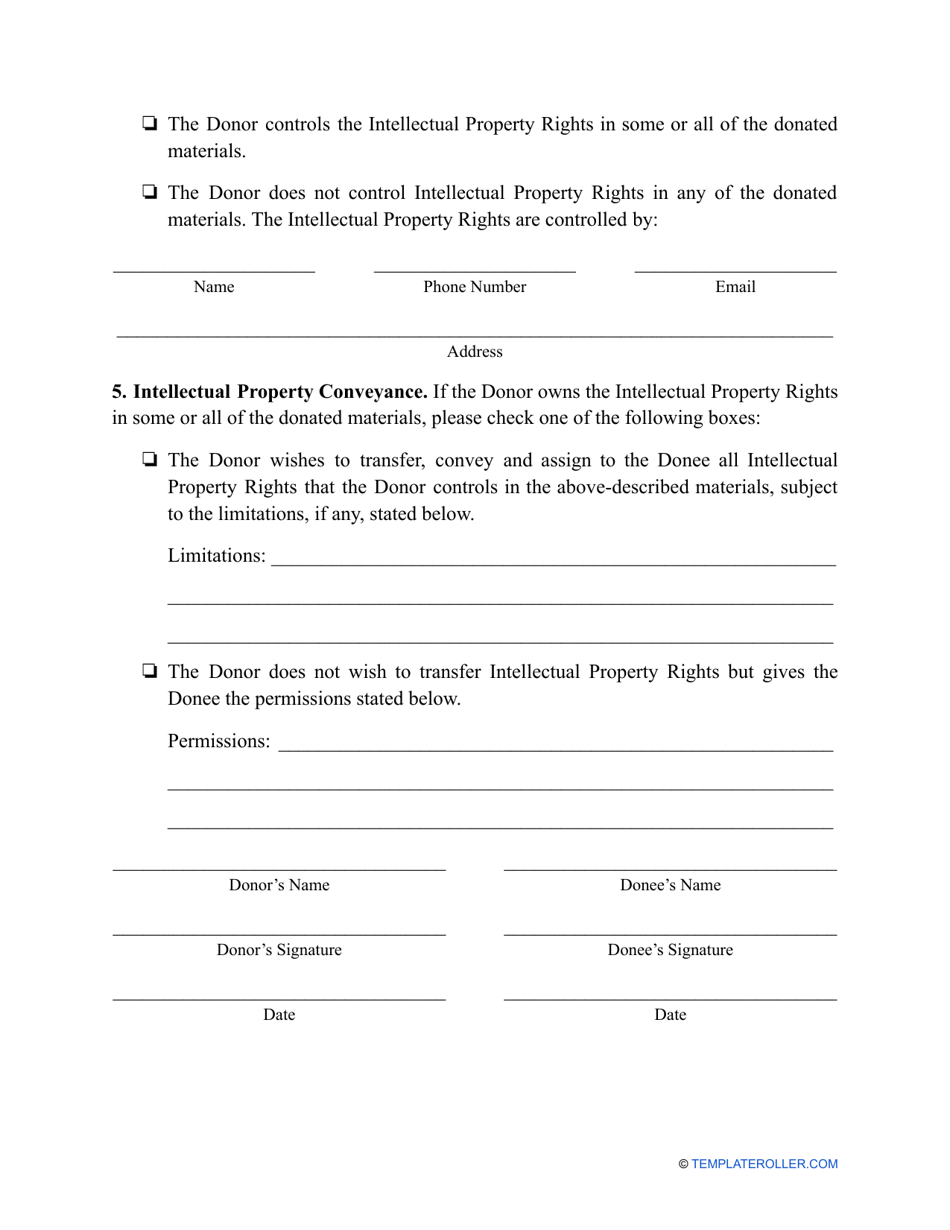

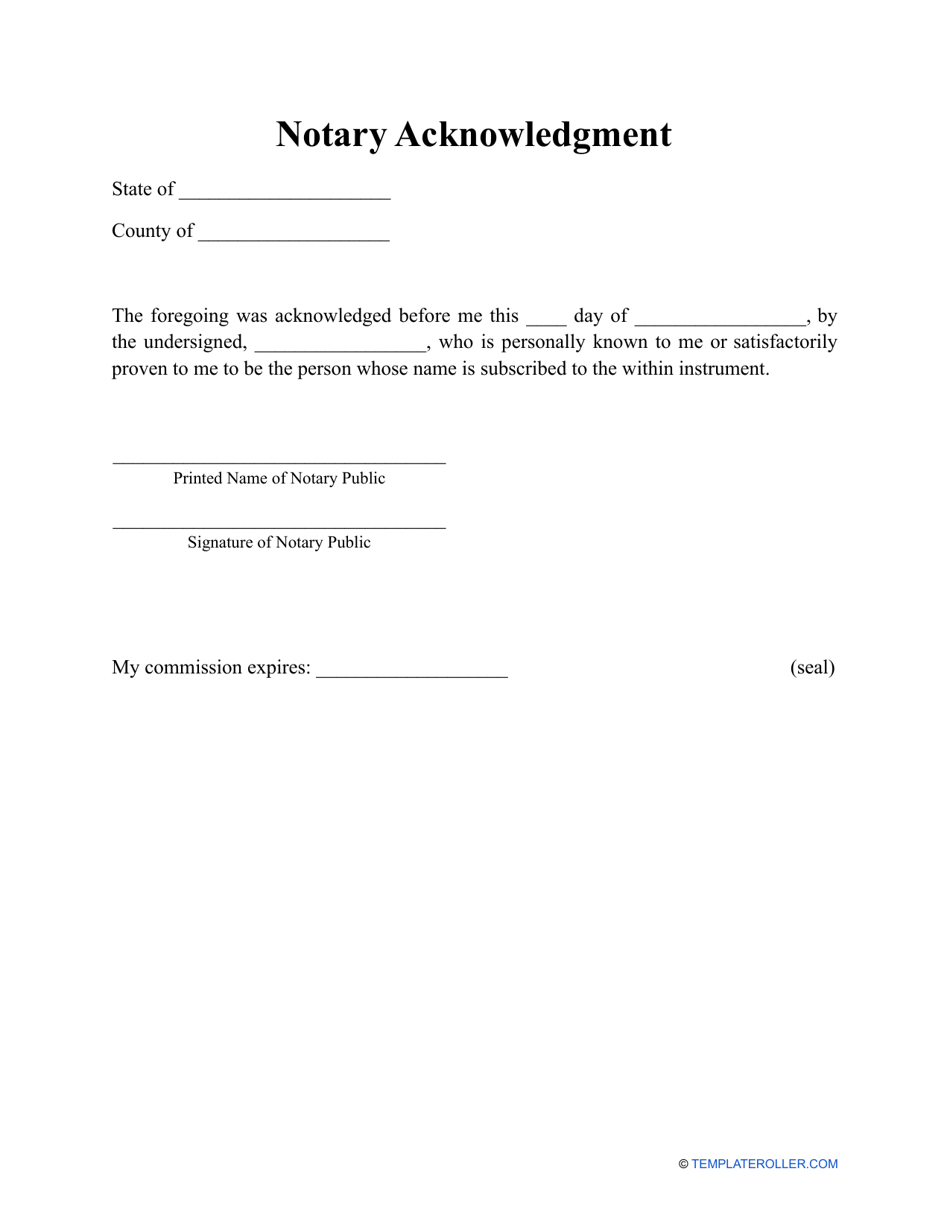

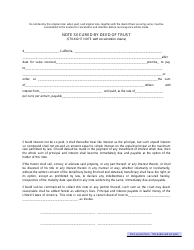

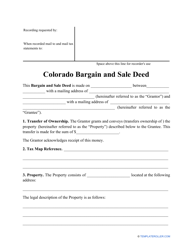

A Colorado Gift Deed is necessary to officially transfer a gift of property or real estate from one person to another, where there is no expectation of payment in return. The gift deed must contain clear and explicit language regarding the transfer, and any unclear language can run the risk of being contested in court. All persons donating the property will need to sign the document before a notary and a documentary fee will be exempt in the case of a gift deed filing (13-102(2)(a), 39 C.R.S.). The state does require a real property transfer declaration form (TD-1000) to be submitted alongside the deed and all other materials to the clerk and recorder's office in the county where the property is situated.

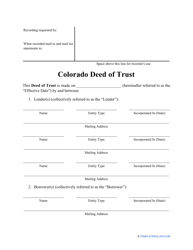

Related Forms and Topics: