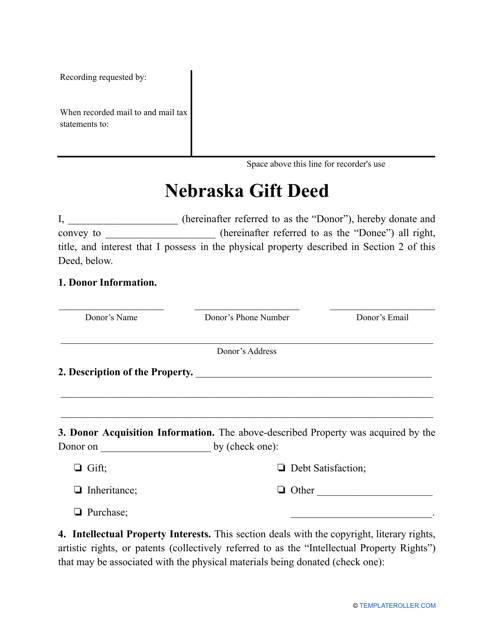

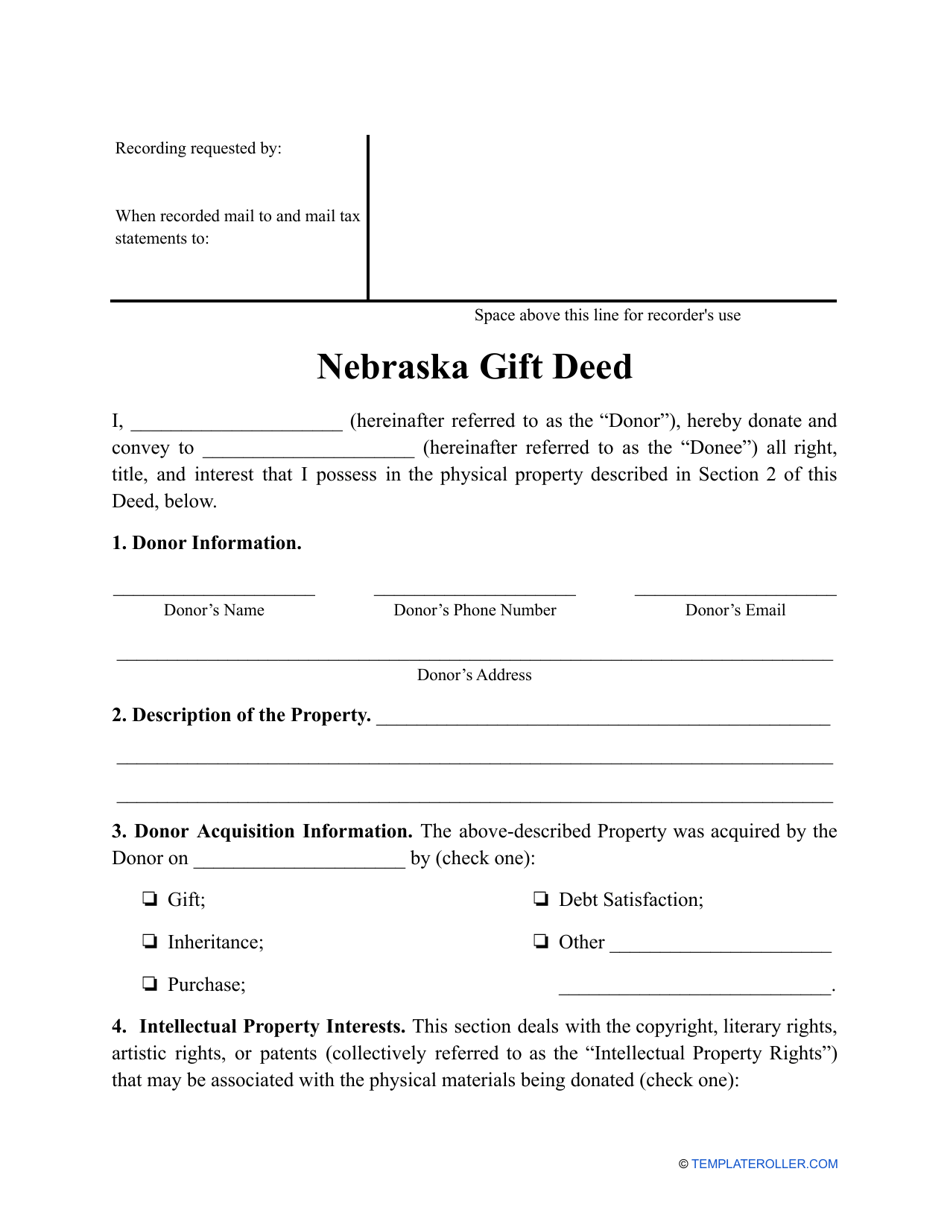

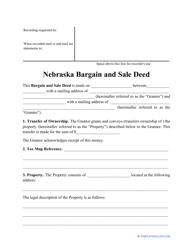

Gift Deed Form - Nebraska

Fill PDF Online

Fill out online for free

without registration or credit card

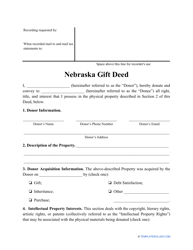

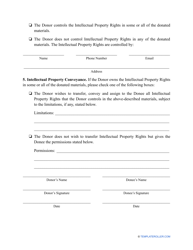

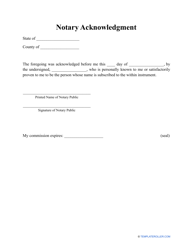

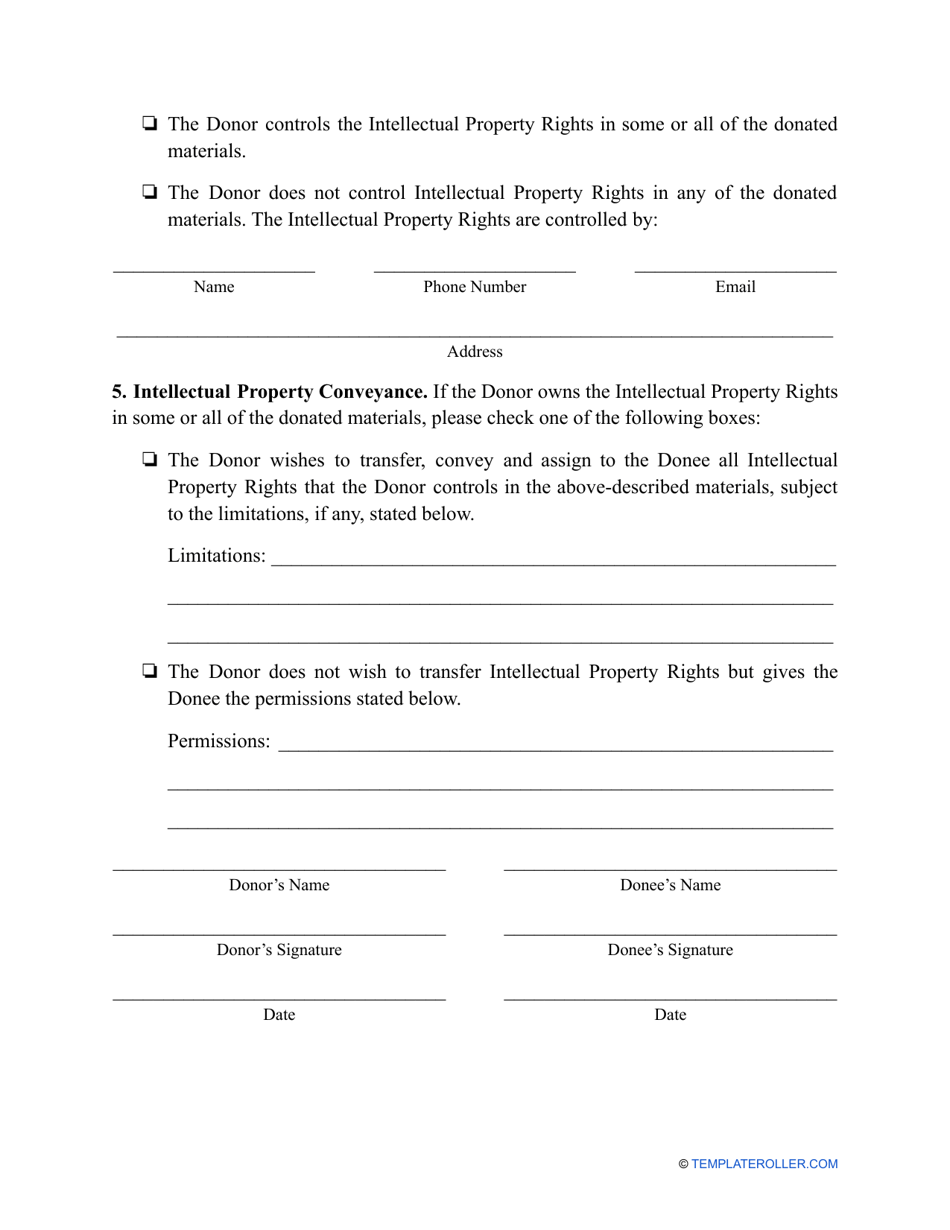

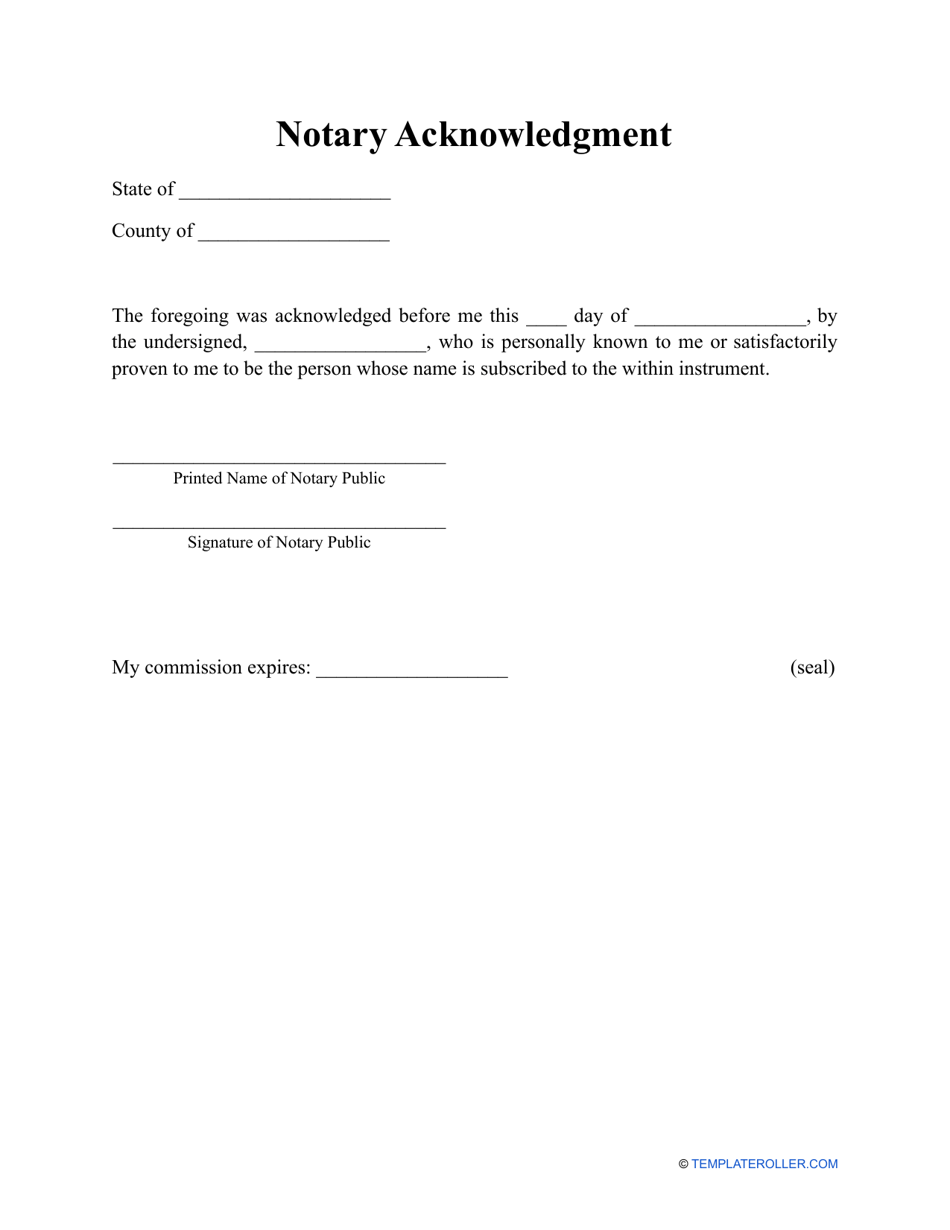

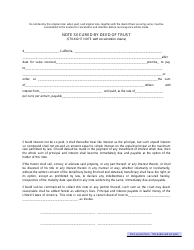

A Nebraska Gift Deed is written when an individual will be gifting real estate or other valuable property to another individual or party without an expectation of payment. The language within the gift deed must be clear and precise, as any implicit or unclear language can later be contested by a court of law. A full legal description of the property, including the chain of title and potential restrictions related to the property. The documentation must also contain a Form 521, Real Estate Transfer Statement (Neb. Rev. Stat. 76-214). The records and all additional documents must be sent to the local Register of Deed's office and a documentary stamp tax will be due at that point (Neb. Rev. Stat. 76-902).

Related Forms and Topics: