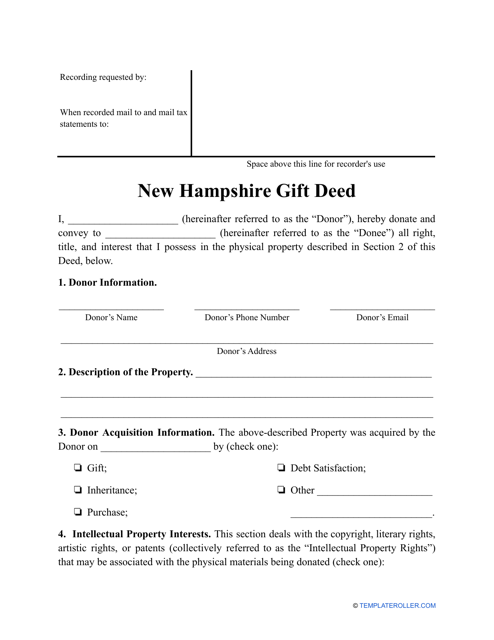

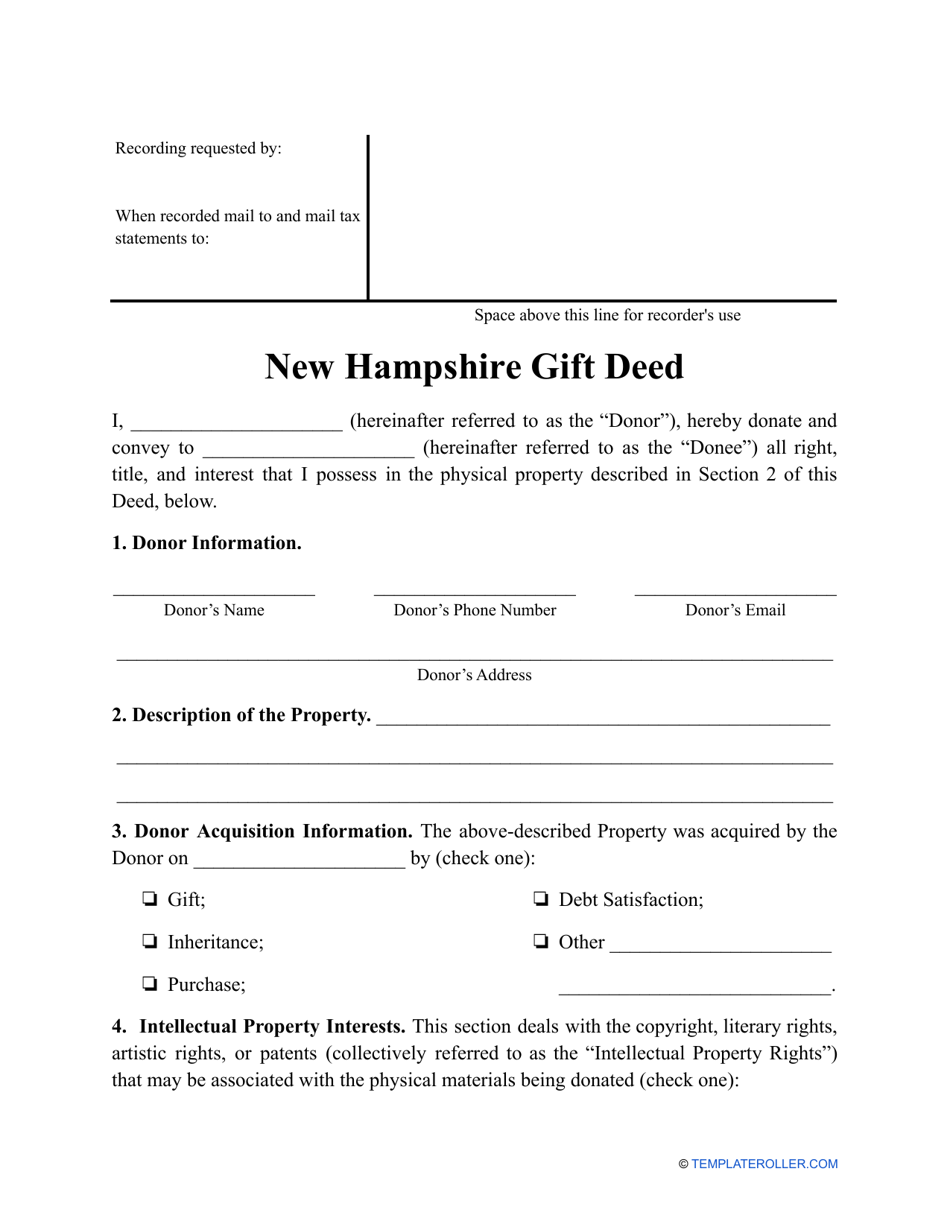

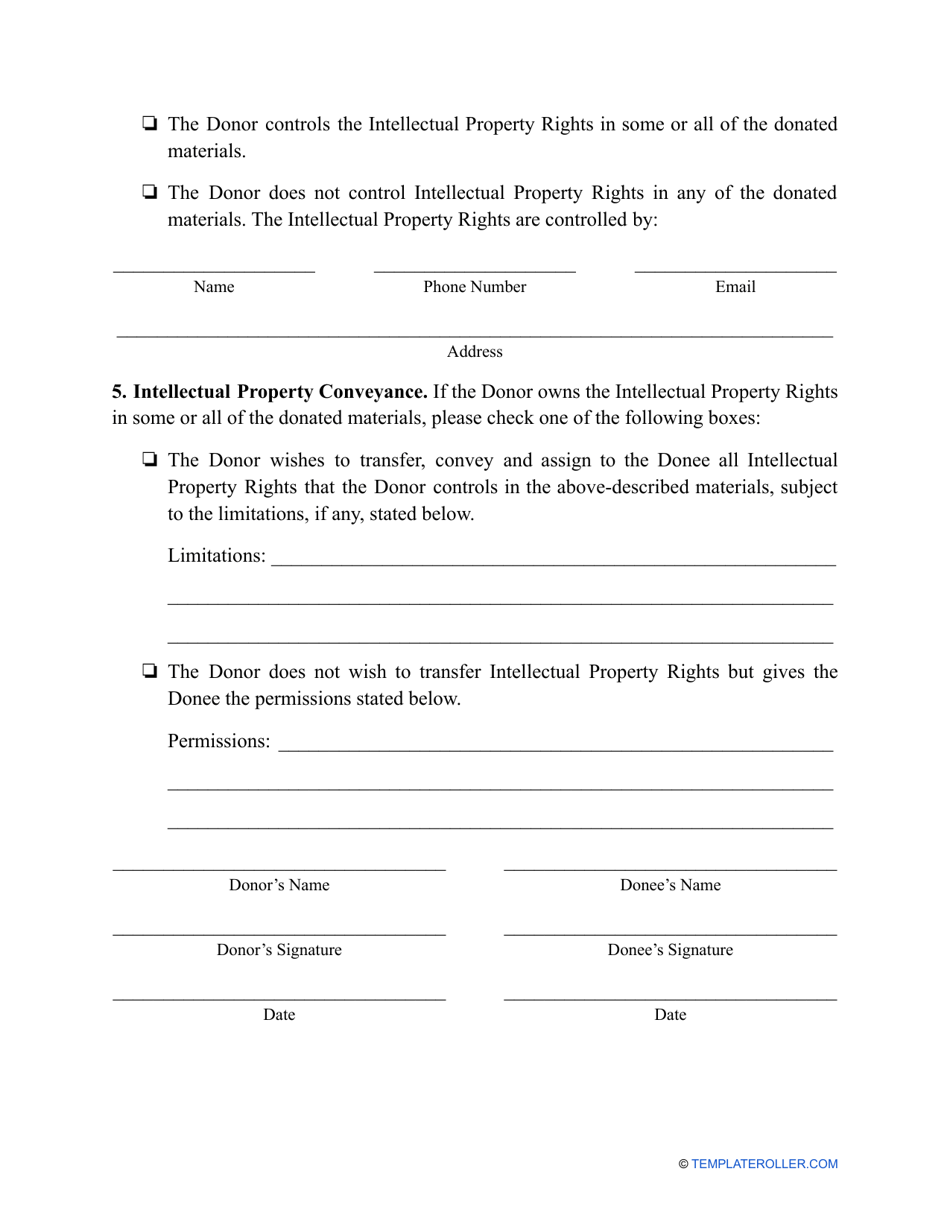

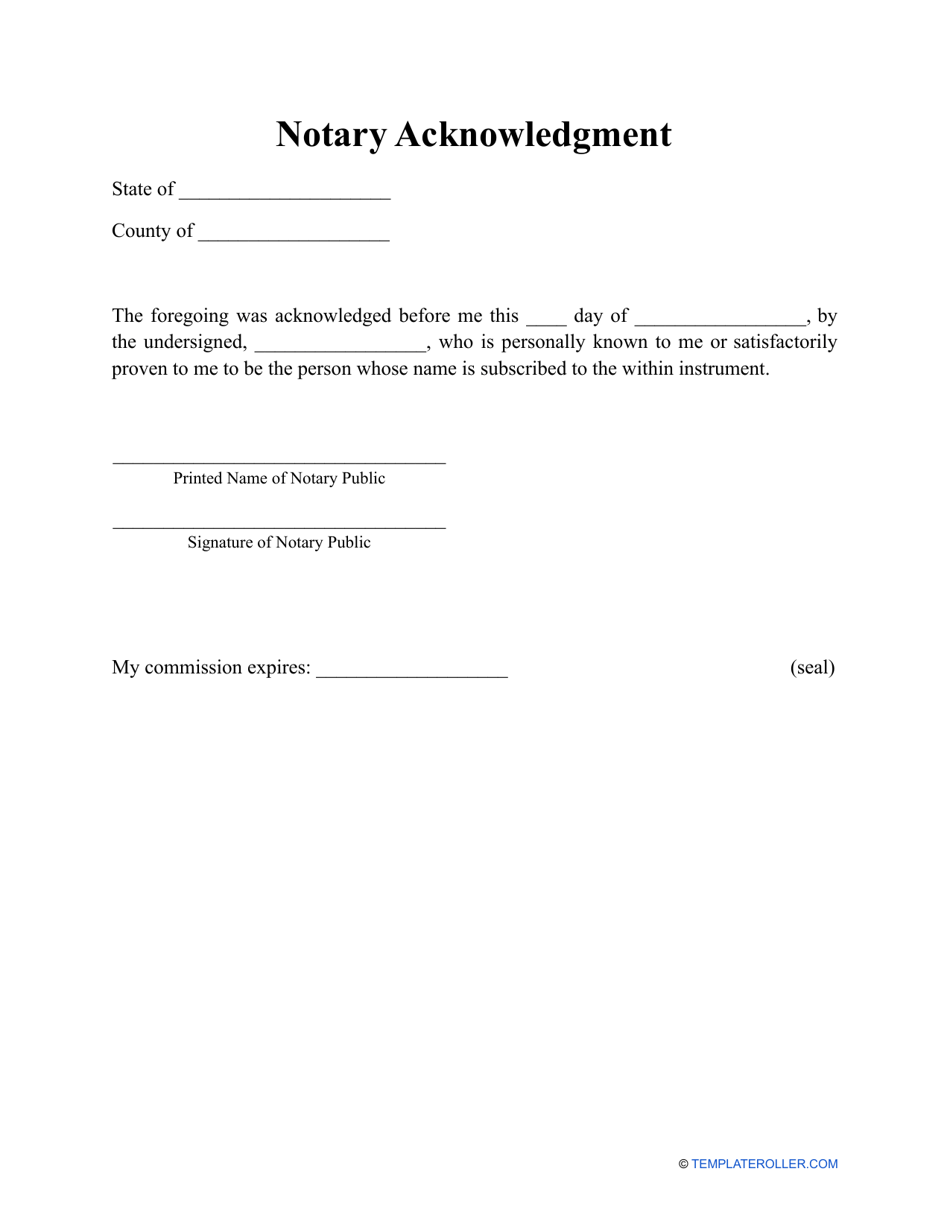

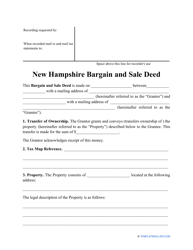

Gift Deed Form - New Hampshire

Fill PDF Online

Fill out online for free

without registration or credit card

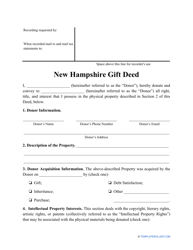

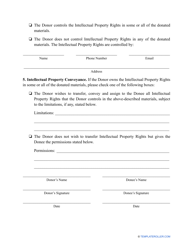

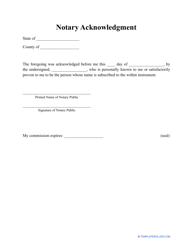

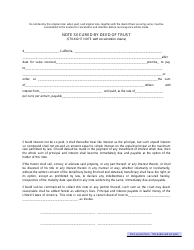

A New Hampshire Gift Deed is used when a person or party wants to donate or gift property to another person or party and it is understood that the recipient will not be expected to pay for the property. This document will require that all agreements be clearly written as any ambiguous language could result in the deed being contested in court. When completing the gift deed, a full description of the property will be required. An additional Real Estate Transfer Tax Declaration of Consideration needs to be completed by both parties (RSA 78-B:1). The gift deed and all additional materials will need to be submitted to the County Register of Deed's office in the county where the property is located.

Related Forms and Topics: