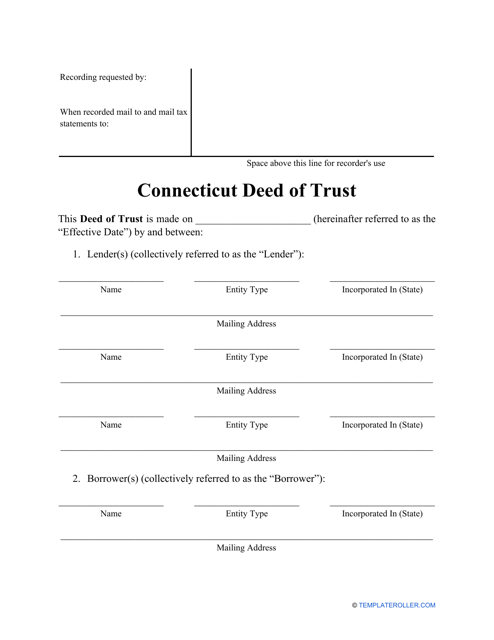

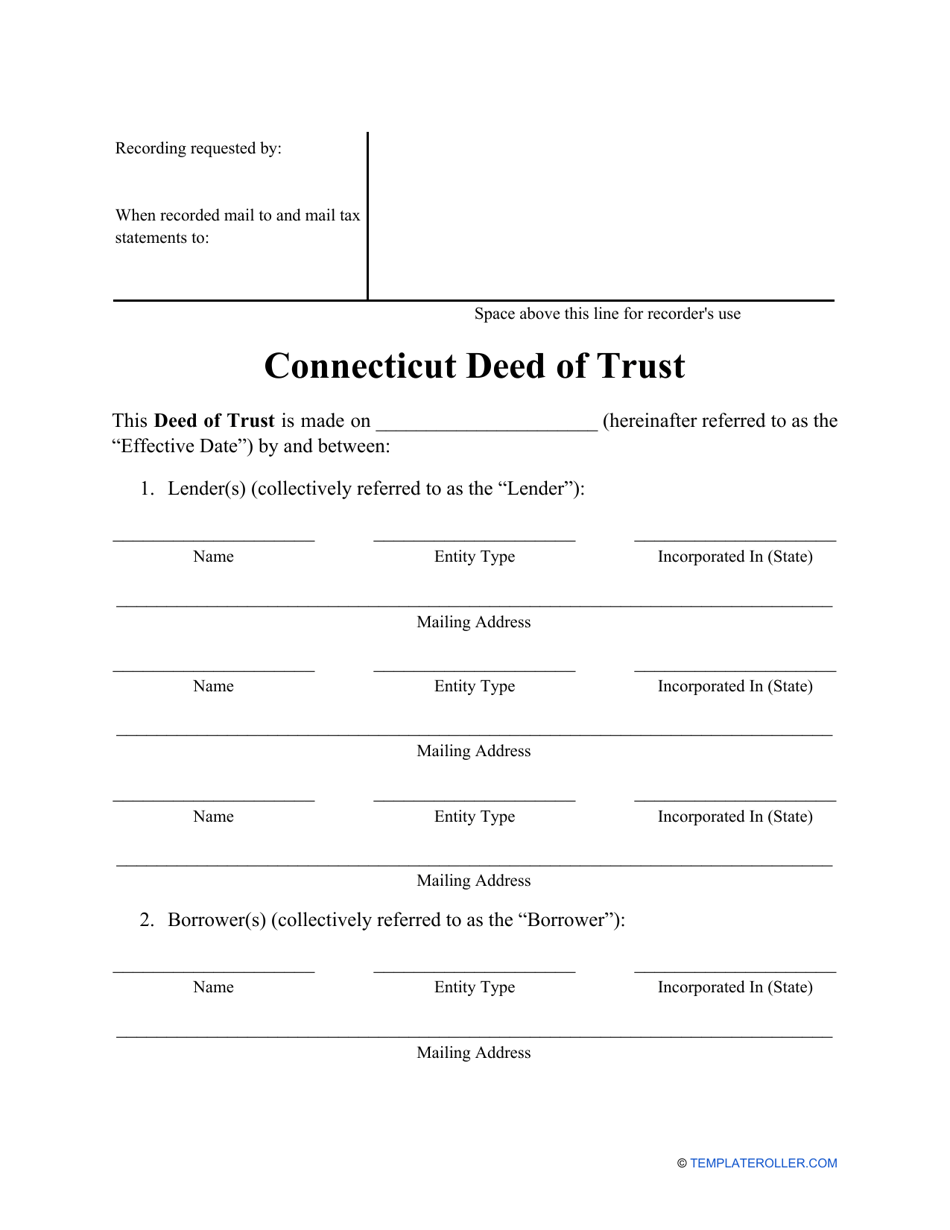

Deed of Trust Form - Connecticut

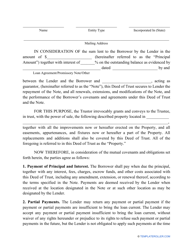

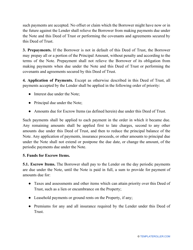

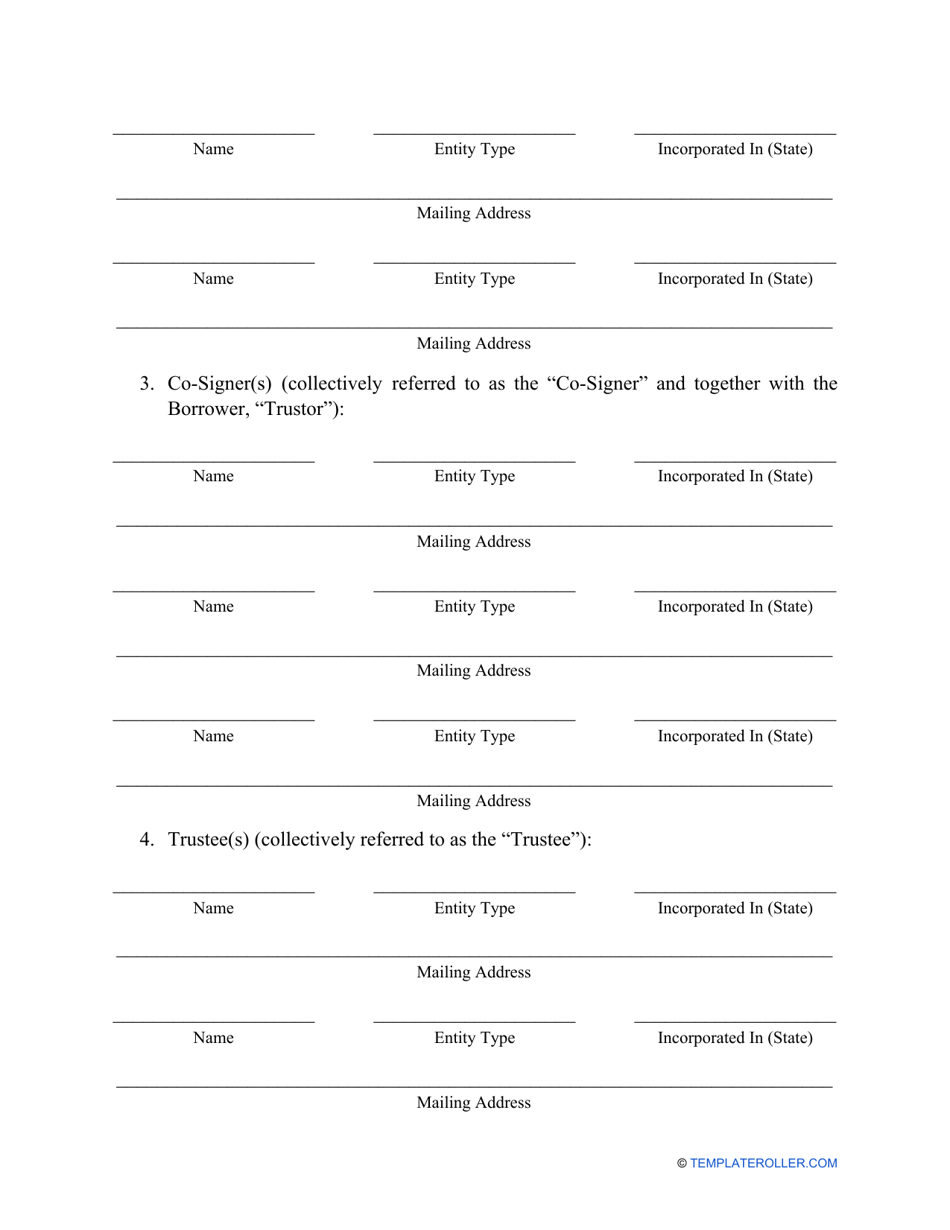

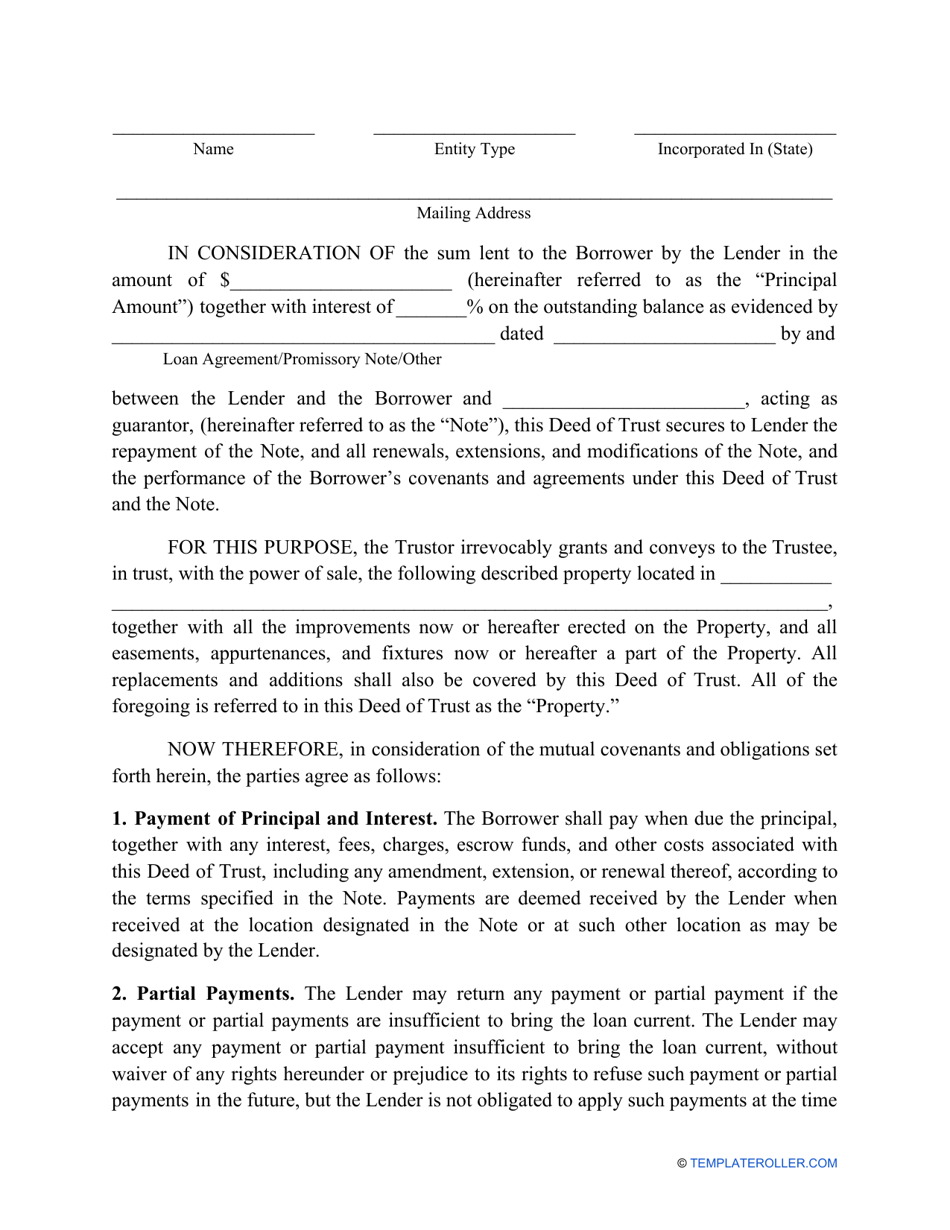

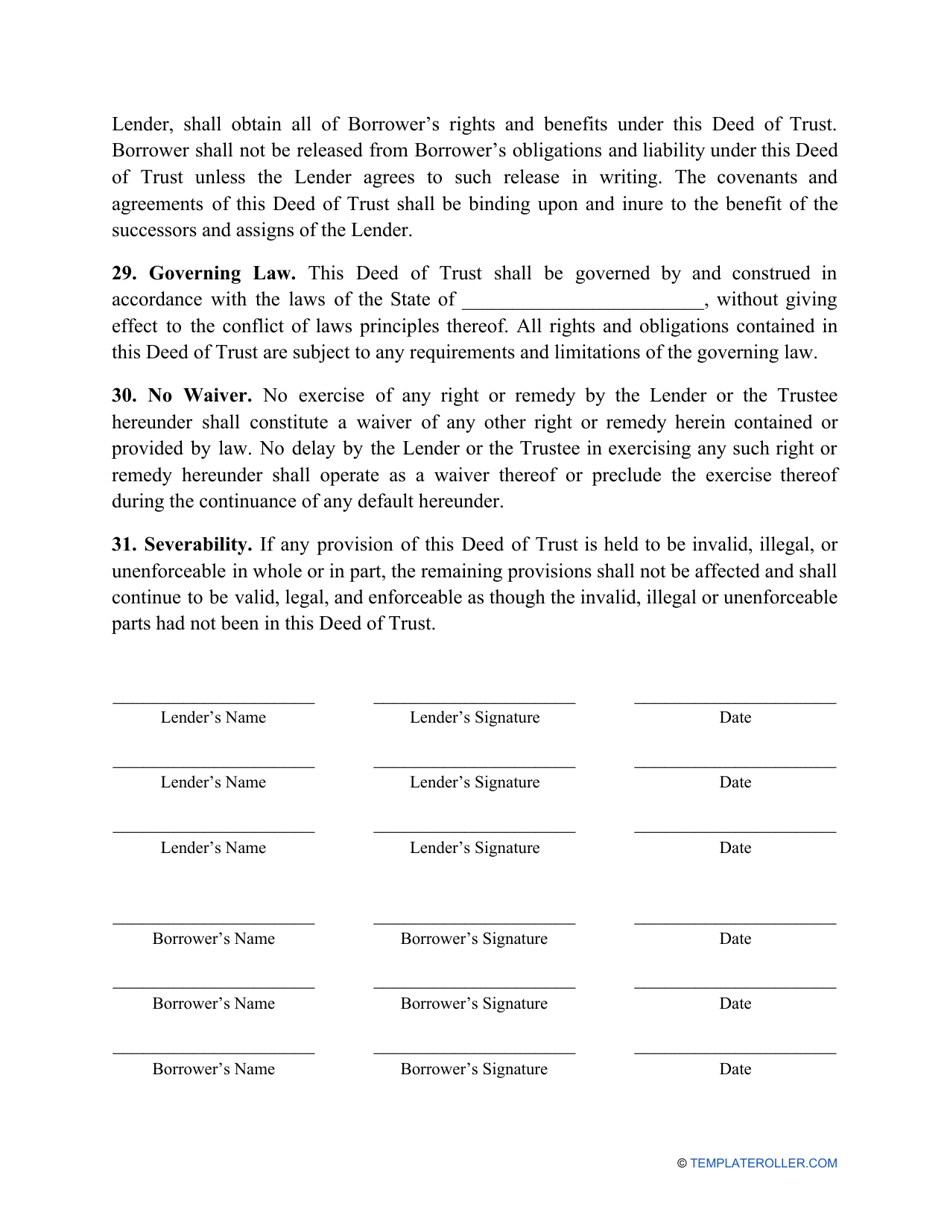

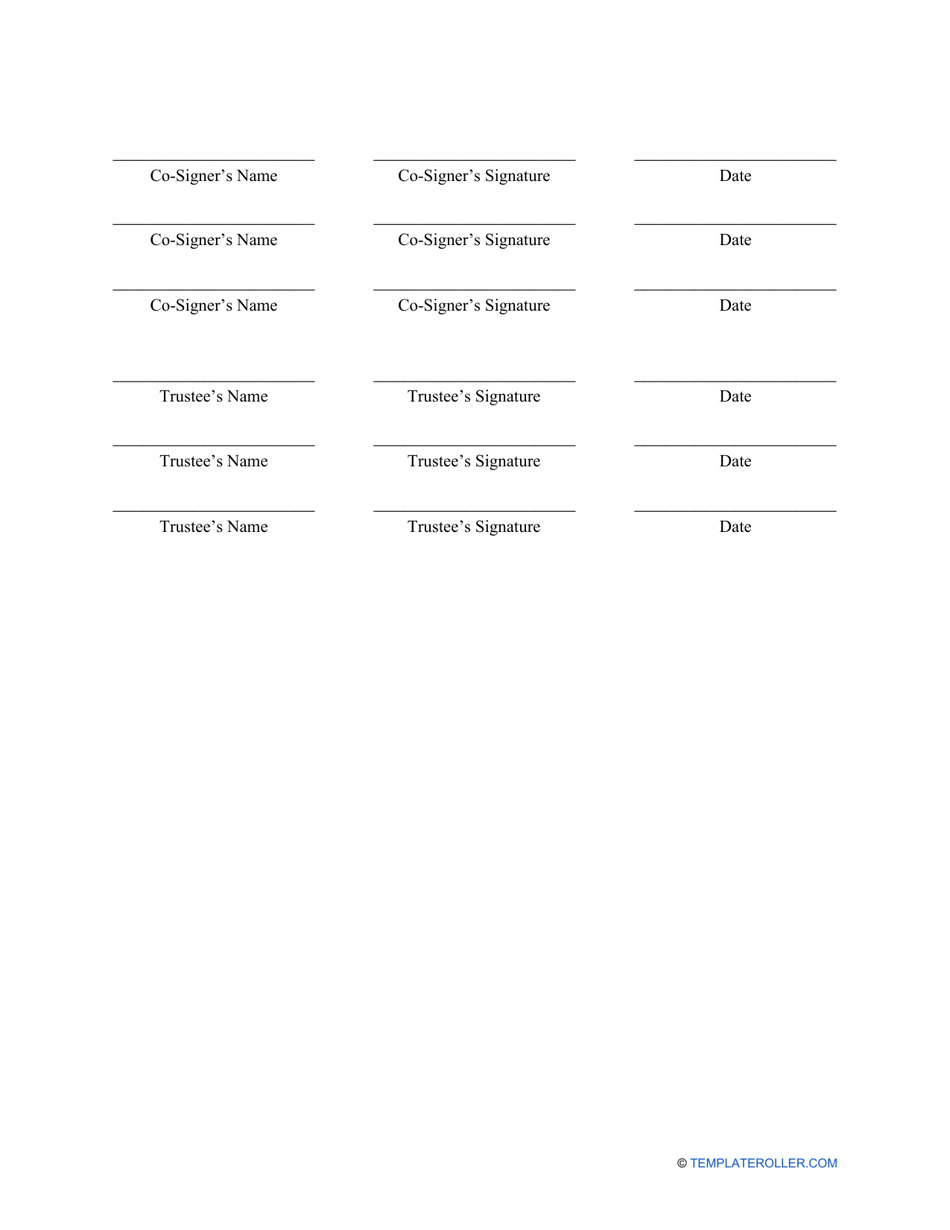

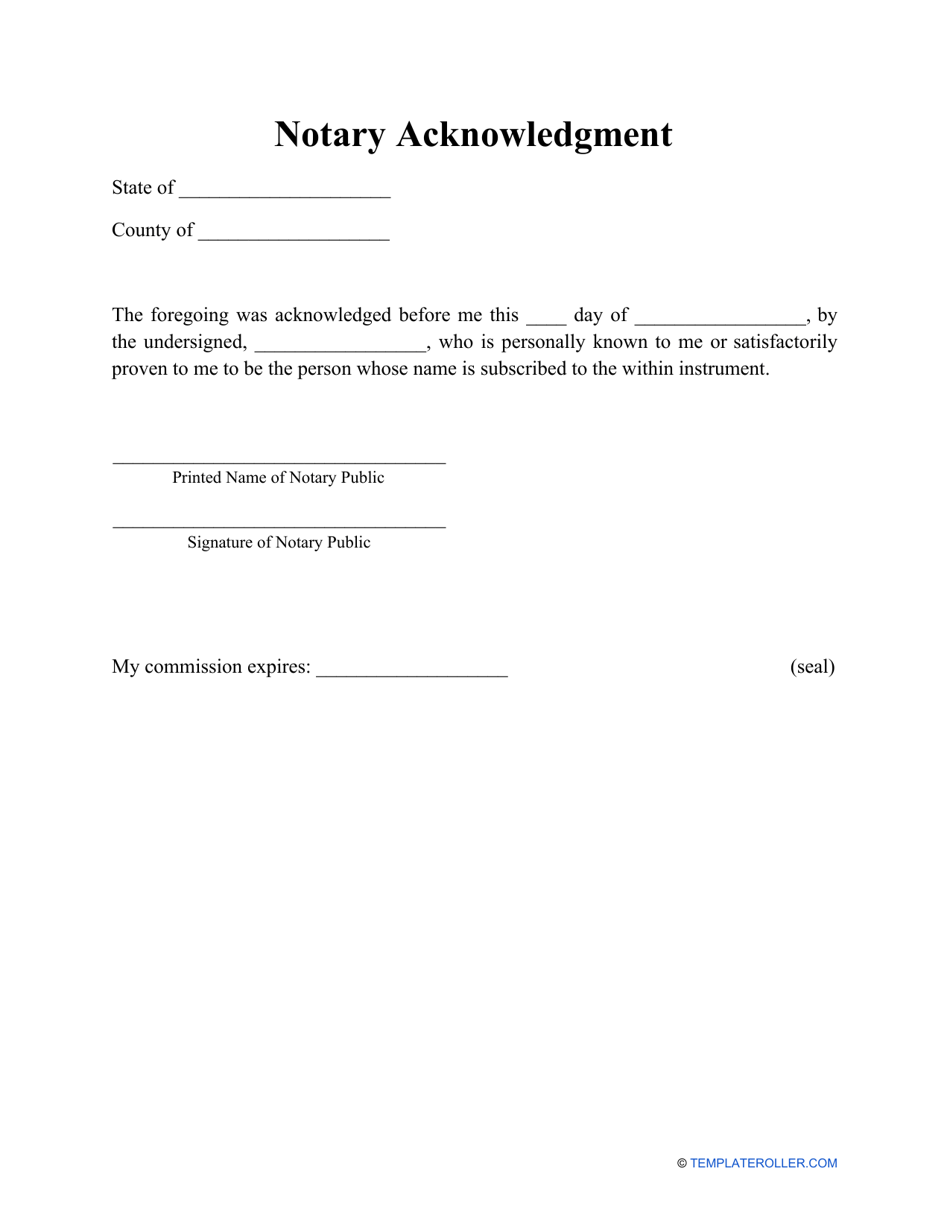

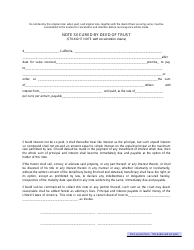

When individuals consider taking a loan to pay for their real estate purchase they should look into using a Connecticut Deed of Trust . This type of deed will secure all of the involved parties, stating that if the trustor does not pay back the loan to the beneficiary on the terms designated in the deed, the trustee will transfer the title of ownership of the real estate to the beneficiary. Before completing your deed, ensure that you made yourself familiar with the General Statutes of Connecticut and Chapter 821a in particular. In Section 47-36s, you can find a description of the deed and its effect, while Section 47-36c will supply you with a statutory form for this kind of deed. Following it, your deed of trust shall include the names of all involved parties, the amount of consideration paid, the description of the real property, encumbrances (if any), and other details.

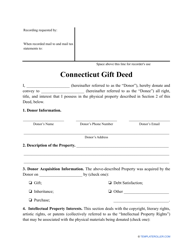

Related Forms and Topics: