This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

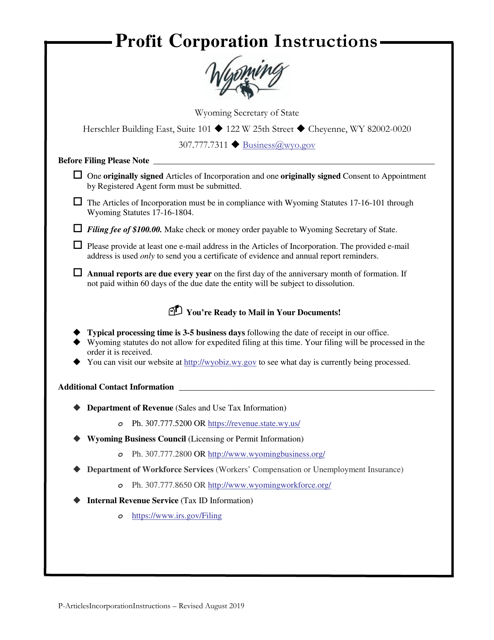

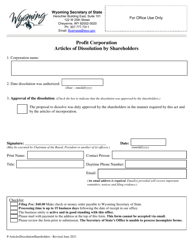

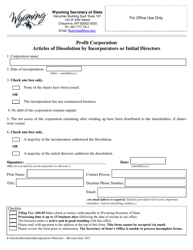

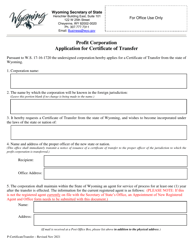

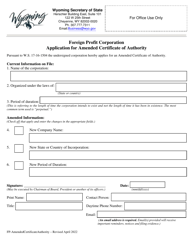

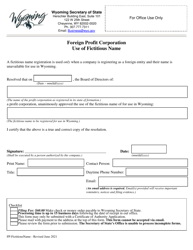

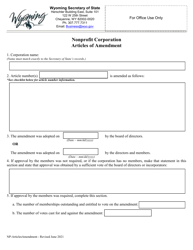

Profit Corporation Articles of Incorporation - Wyoming

Profit Corporation Articles of Incorporation is a legal document that was released by the Wyoming Secretary of State - a government authority operating within Wyoming.

FAQ

Q: What is the purpose of Articles of Incorporation?

A: The purpose of Articles of Incorporation is to legally establish a corporation.

Q: What is a Profit Corporation?

A: A Profit Corporation is a type of corporation that aims to generate profit for its shareholders.

Q: What is the significance of incorporating in Wyoming?

A: Incorporating in Wyoming can offer benefits such as asset protection, tax advantages, and ease of corporate governance.

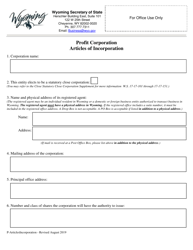

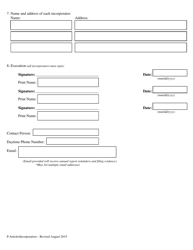

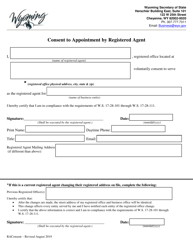

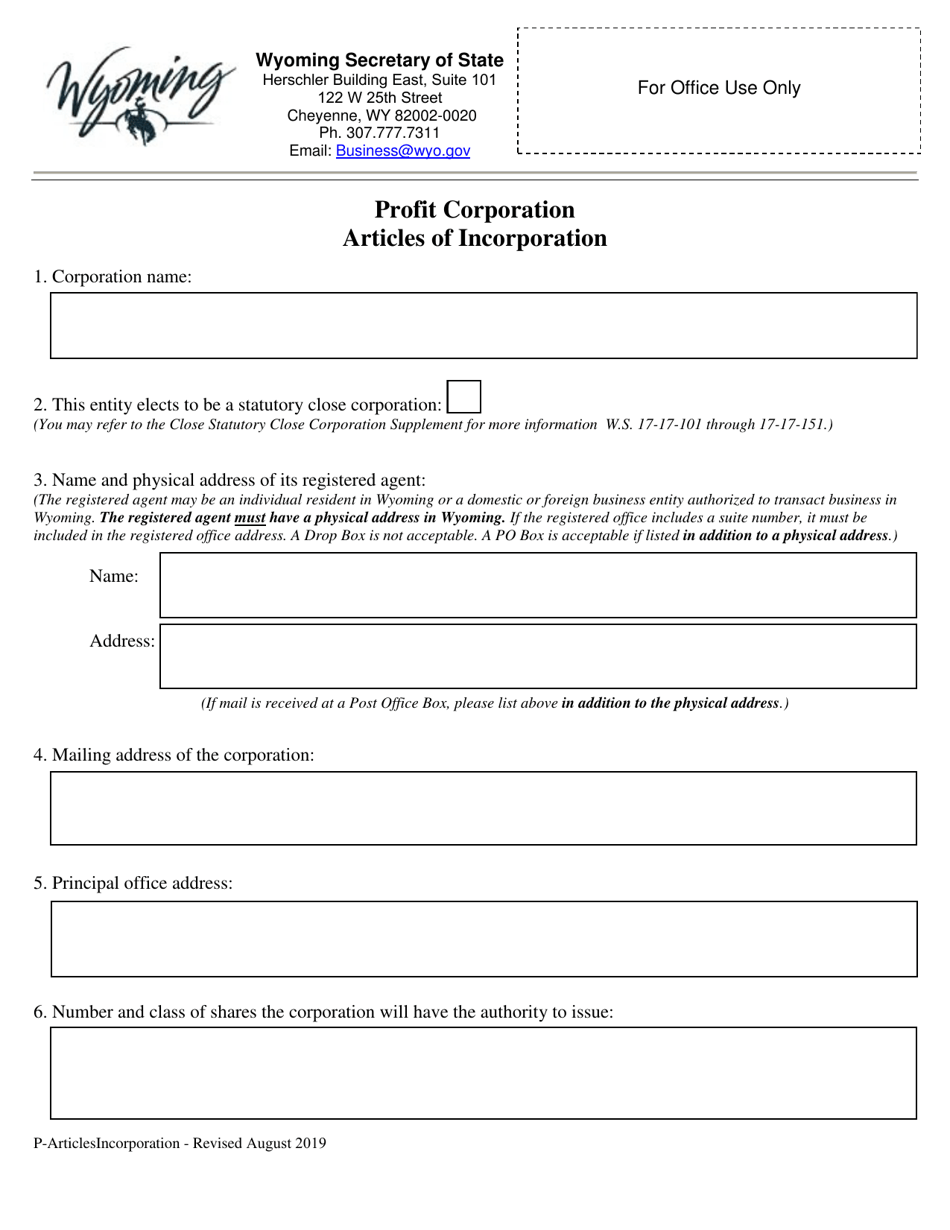

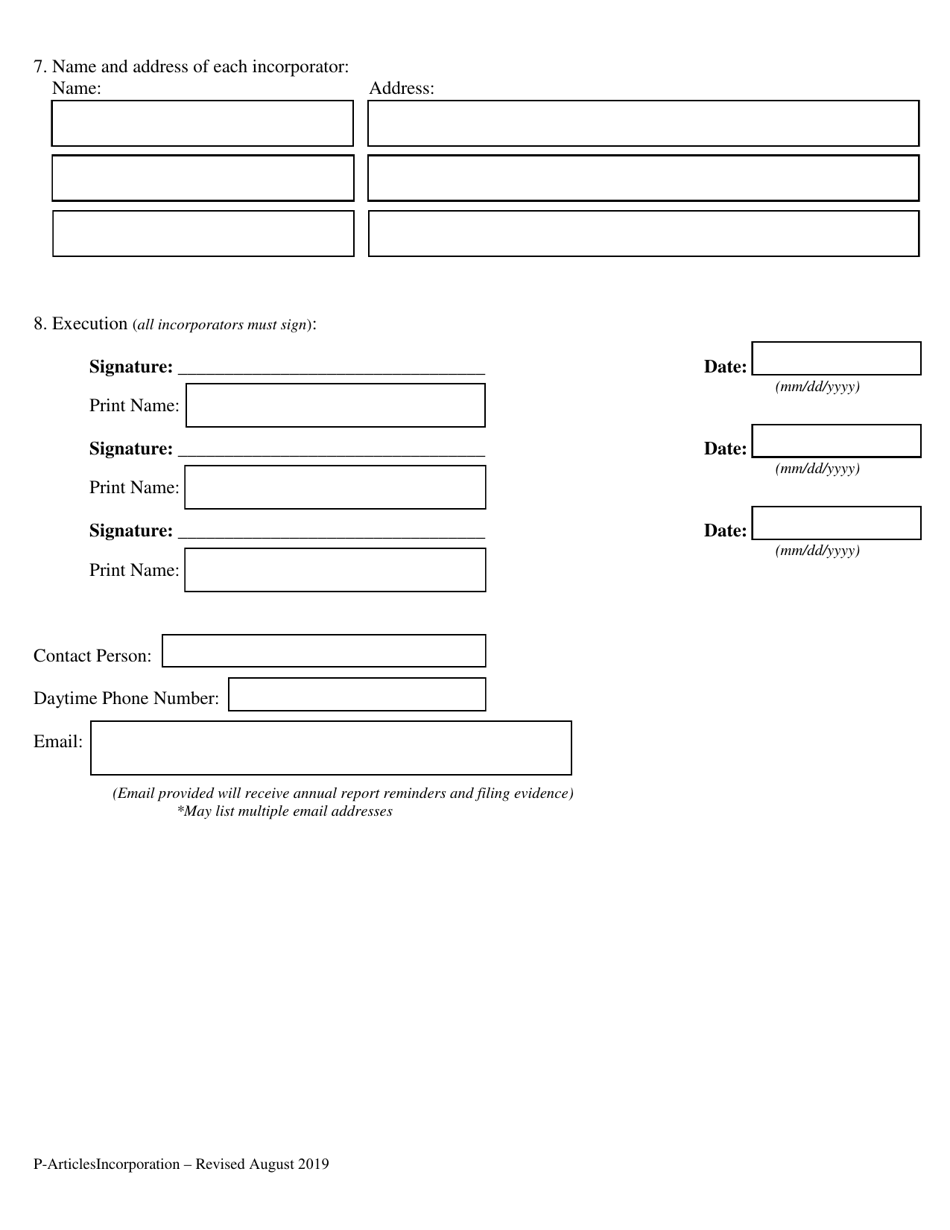

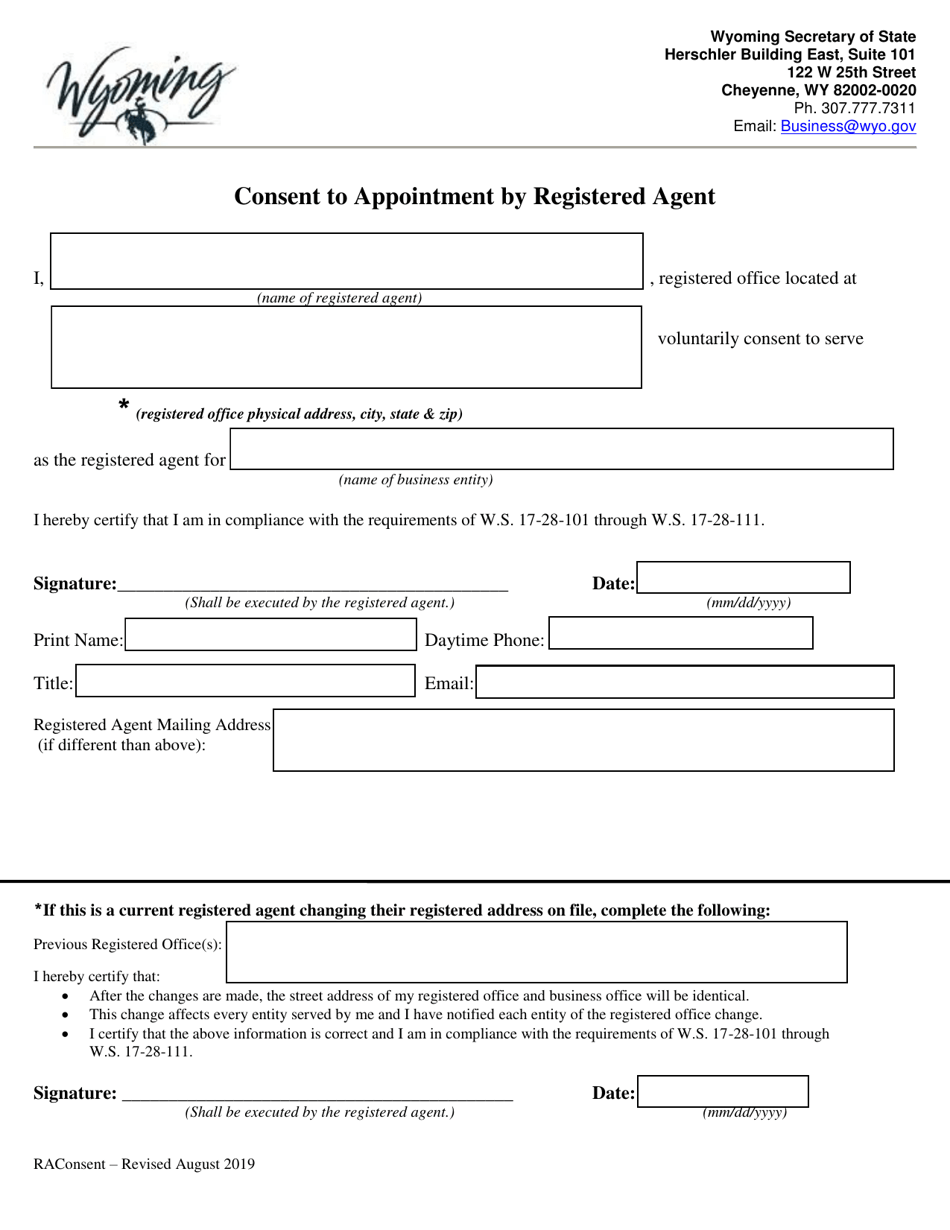

Q: What information is required in the Articles of Incorporation?

A: The Articles of Incorporation typically require company name, registered agent information, number of shares, and purpose of the corporation.

Q: What are the filing fees for the Articles of Incorporation?

A: The filing fees for the Articles of Incorporation in Wyoming vary, depending on the type of corporation and the number of authorized shares.

Q: What happens after filing the Articles of Incorporation?

A: After filing the Articles of Incorporation, the corporation is legally formed and can commence business operations.

Q: Are there any ongoing requirements for a Wyoming Profit Corporation?

A: Yes, a Wyoming Profit Corporation must file annual reports and maintain proper corporate records.

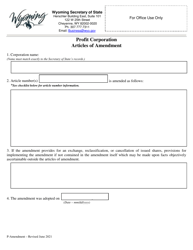

Q: Can the Articles of Incorporation be amended?

A: Yes, the Articles of Incorporation can be amended by filing a formal amendment with the Wyoming Secretary of State.

Form Details:

- Released on August 1, 2019;

- The latest edition currently provided by the Wyoming Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Wyoming Secretary of State.