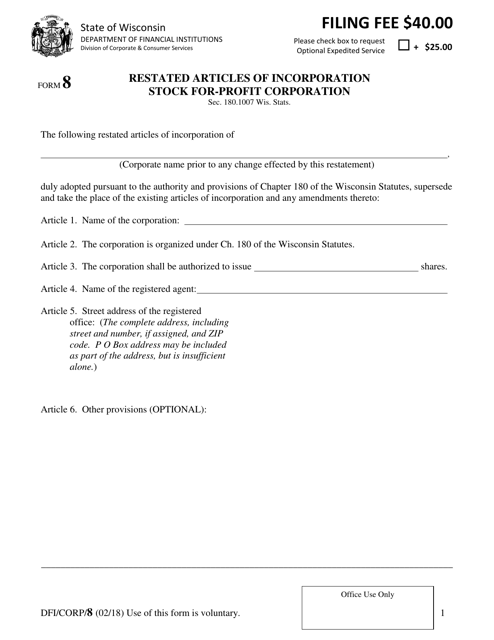

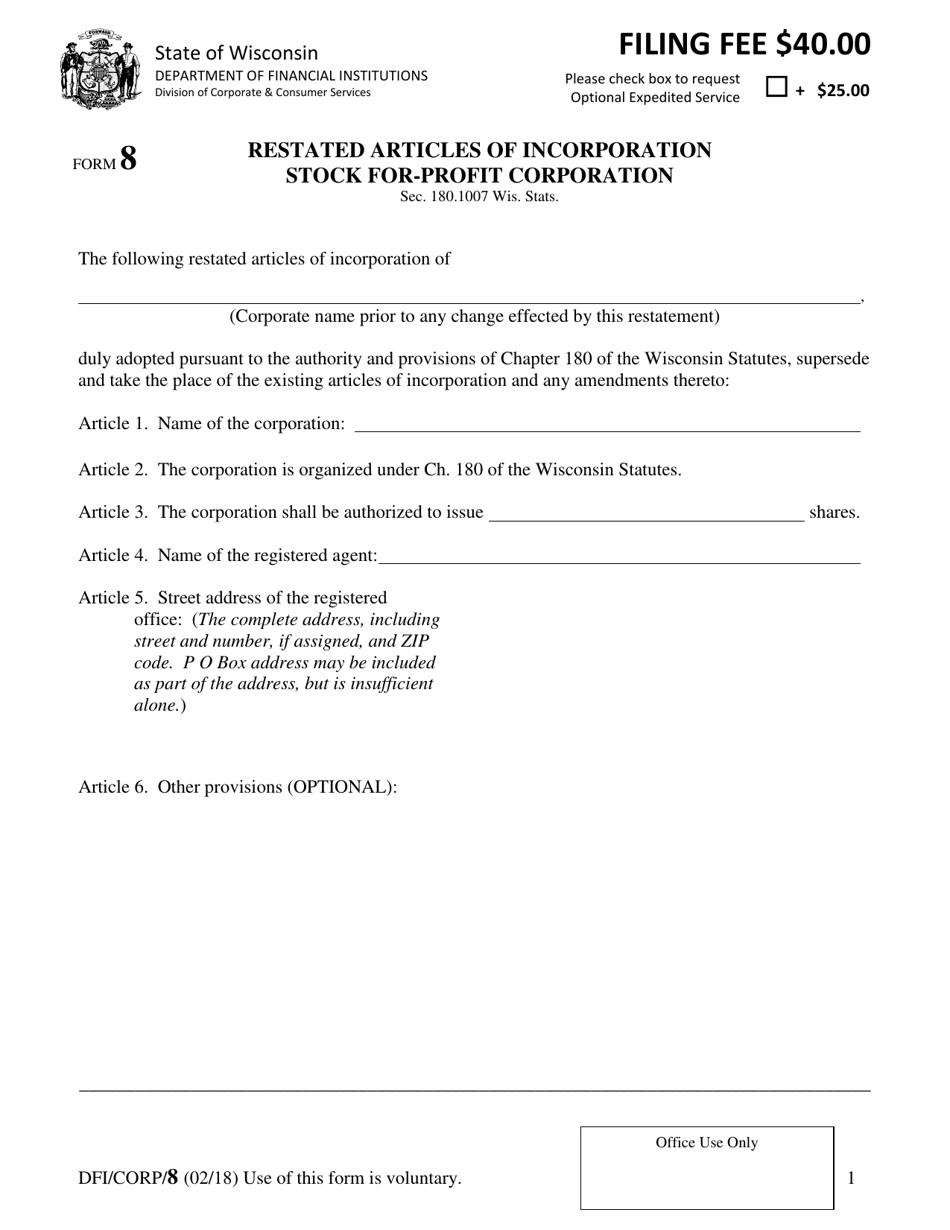

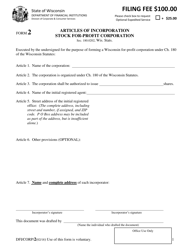

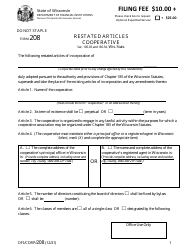

Form DFI / CORP / 8 Restated Articles of Incorporation Stock for-Profit Corporation - Wisconsin

What Is Form DFI/CORP/8?

This is a legal form that was released by the Wisconsin Department of Financial Institutions - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Restated Articles of Incorporation?

A: A Restated Articles of Incorporation is a document that updates and consolidates the information in the original articles of incorporation.

Q: What is a Stock for-Profit Corporation?

A: A Stock for-Profit Corporation is a type of corporation where shares of stock are issued to shareholders, who have ownership in the company.

Q: What is a DFI/CORP/8 form?

A: The DFI/CORP/8 form is the official form used in Wisconsin to file the Restated Articles of Incorporation for a Stock for-Profit Corporation.

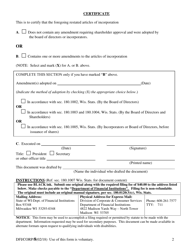

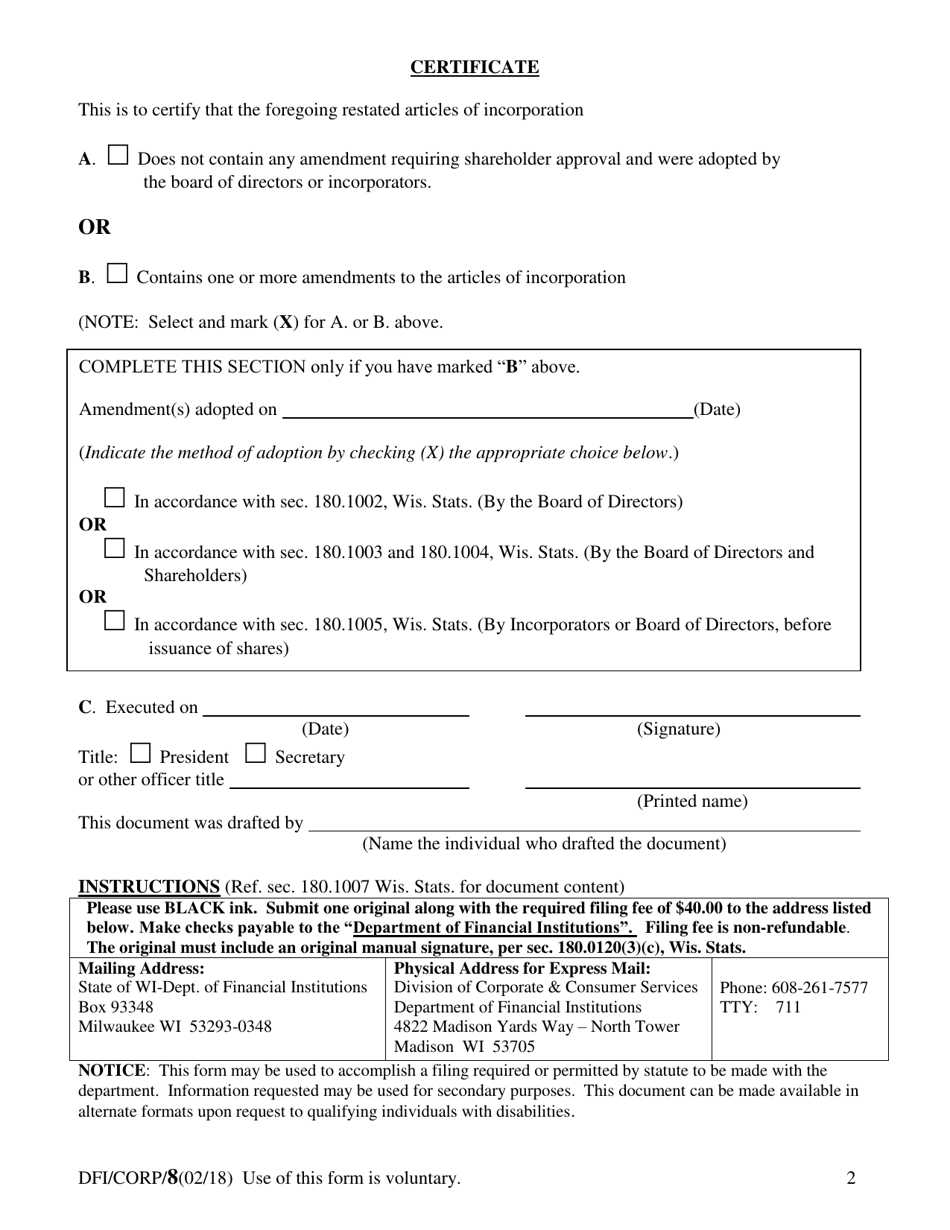

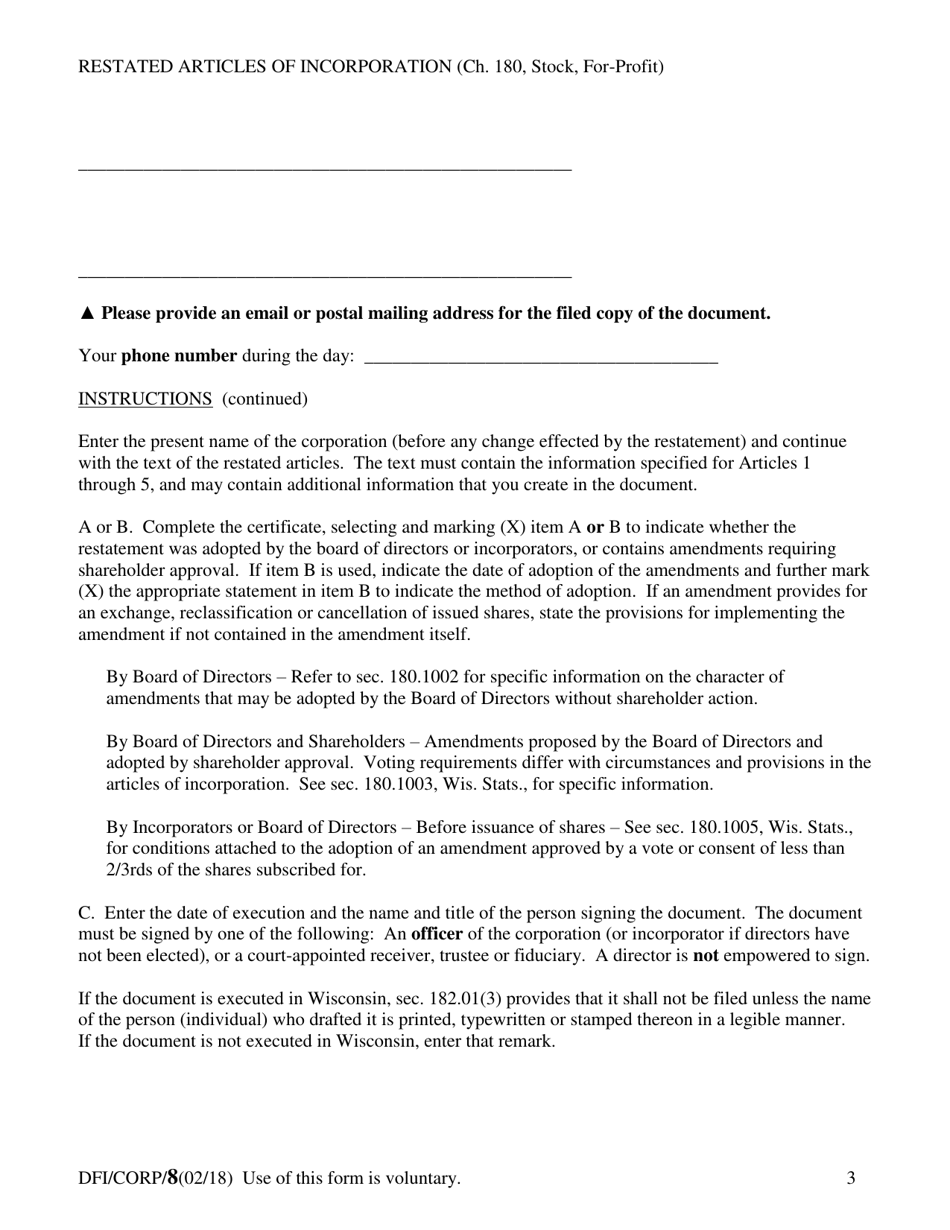

Q: Who can file the Restated Articles of Incorporation?

A: The Restated Articles of Incorporation can be filed by the officers or directors of the corporation.

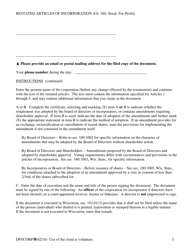

Q: Why would a corporation need to file Restated Articles of Incorporation?

A: A corporation may need to file Restated Articles of Incorporation to reflect changes in the company's name, purpose, or other key information.

Q: What is the purpose of the Restated Articles of Incorporation?

A: The purpose of the Restated Articles of Incorporation is to provide an updated and consolidated version of the company's articles of incorporation.

Q: Do I need legal assistance to file Restated Articles of Incorporation?

A: While legal assistance is not required, it may be advisable to consult with an attorney or business professional to ensure the document is filed correctly.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Wisconsin Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFI/CORP/8 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Financial Institutions.