This version of the form is not currently in use and is provided for reference only. Download this version of

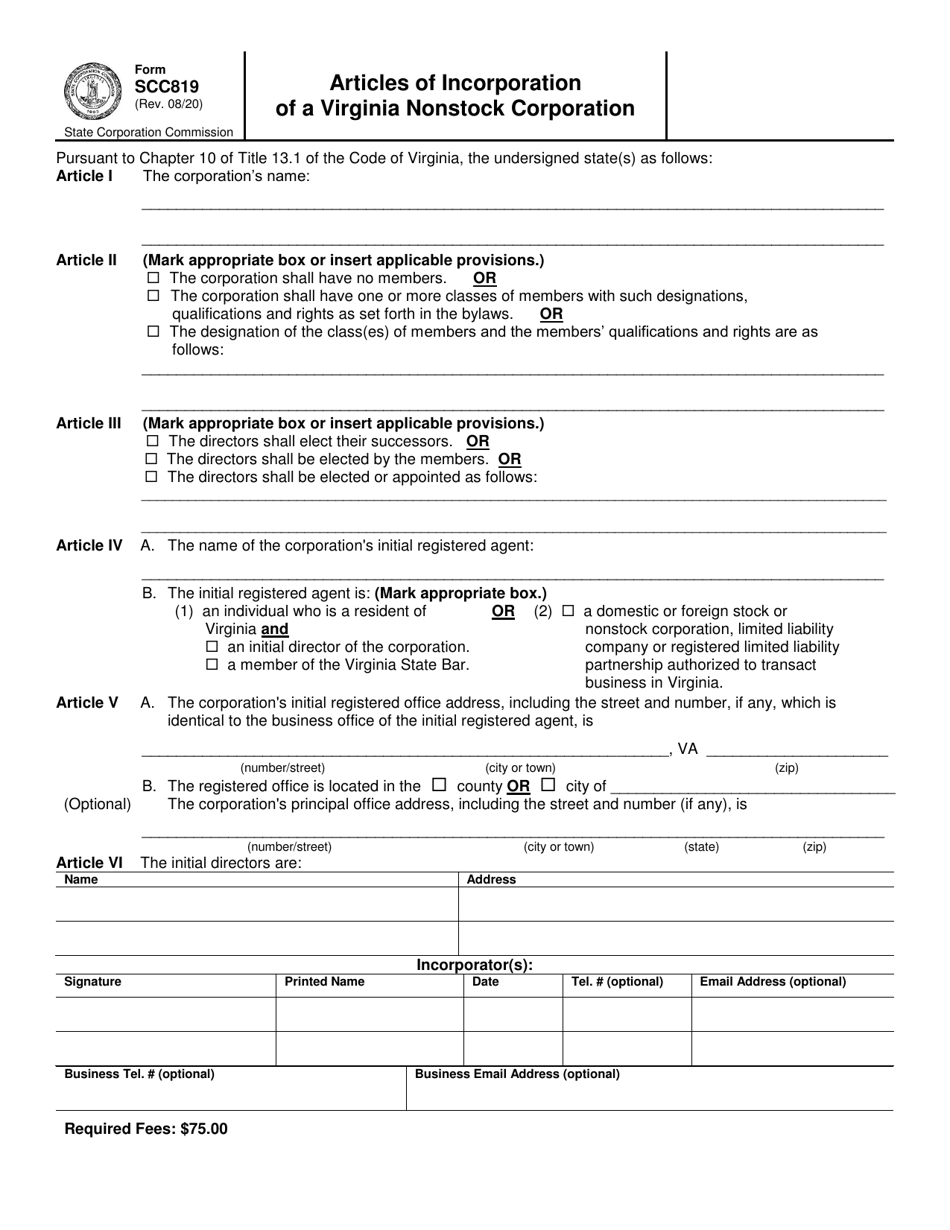

Form SCC819

for the current year.

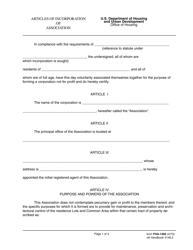

Form SCC819 Articles of Incorporation of a Virginia Nonstock Corporation - Virginia

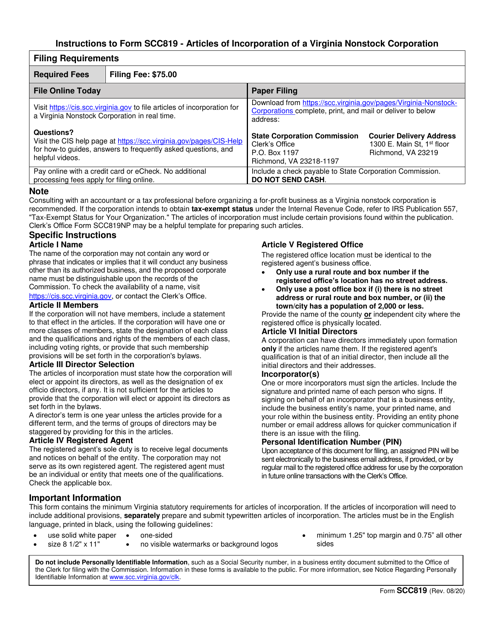

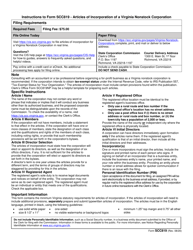

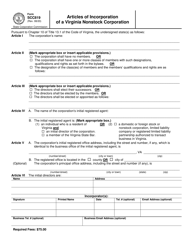

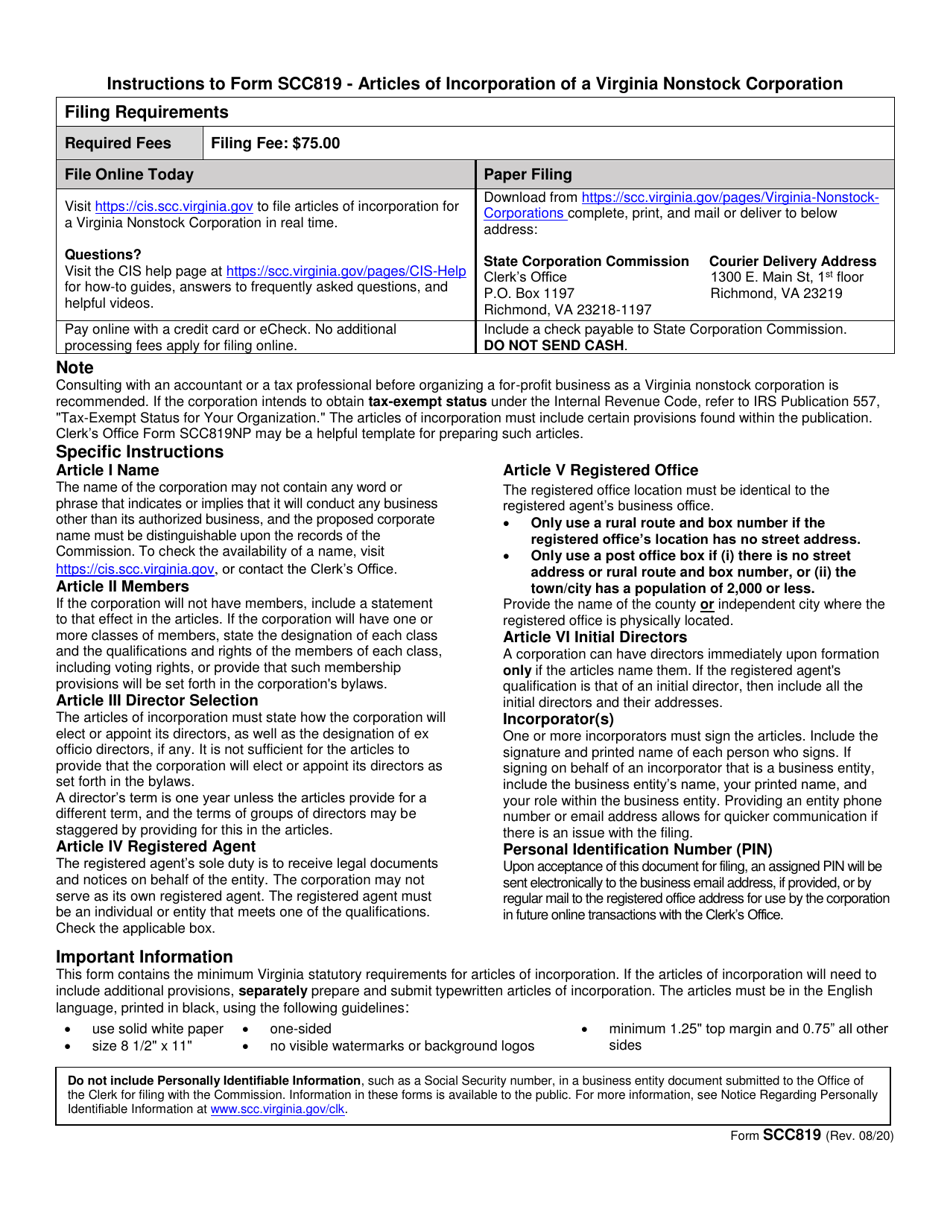

What Is Form SCC819?

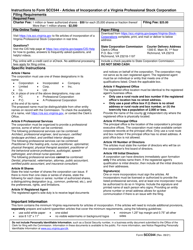

This is a legal form that was released by the Virginia State Corporation Commission - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Nonstock Corporation?

A: A nonstock corporation is a type of corporation that is not organized for the purpose of making a profit.

Q: What are the Articles of Incorporation?

A: The Articles of Incorporation are legal documents filed with the state government to establish a corporation.

Q: What is the purpose of the Articles of Incorporation?

A: The purpose of the Articles of Incorporation is to formally create a corporation and outline its basic structure and purpose.

Q: What information is included in the Articles of Incorporation?

A: The Articles of Incorporation typically include the corporation's name, purpose, registered agent, and initial directors.

Q: What is a registered agent?

A: A registered agent is a person or entity designated to receive legal and official documents on behalf of the corporation.

Q: Who can be a registered agent?

A: A registered agent can be an individual who is a resident of the state where the corporation is being formed, or a corporation that is authorized to do business in that state.

Q: What are the requirements for forming a nonstock corporation in Virginia?

A: To form a nonstock corporation in Virginia, you must file the Articles of Incorporation with the State Corporation Commission and pay the required filing fee.

Q: Is a nonstock corporation eligible for tax-exempt status?

A: Yes, a nonstock corporation may be eligible for tax-exempt status if it meets the requirements set forth by the Internal Revenue Service (IRS).

Q: Can a nonstock corporation distribute profits to its members?

A: No, a nonstock corporation cannot distribute profits to its members. Any income generated by the corporation must be used to further its non-profit purpose.

Q: Can a nonstock corporation engage in business activities?

A: Yes, a nonstock corporation can engage in business activities that are related to its non-profit purpose.

Q: Can a nonstock corporation have members?

A: Yes, a nonstock corporation can have members who support its non-profit purpose, but membership is not required.

Q: What is the difference between a nonstock corporation and a for-profit corporation?

A: The main difference is that a nonstock corporation is organized for a non-profit purpose, while a for-profit corporation is organized to make a profit.

Q: Do nonstock corporations have shareholders?

A: No, nonstock corporations do not have shareholders. They are typically governed by a board of directors.

Q: What is the role of the board of directors in a nonstock corporation?

A: The board of directors is responsible for making policy decisions and overseeing the operations of the nonstock corporation.

Q: Can a nonstock corporation be dissolved?

A: Yes, a nonstock corporation can be dissolved if its members or directors vote to dissolve it in accordance with the corporation's bylaws and state laws.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia State Corporation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SCC819 by clicking the link below or browse more documents and templates provided by the Virginia State Corporation Commission.