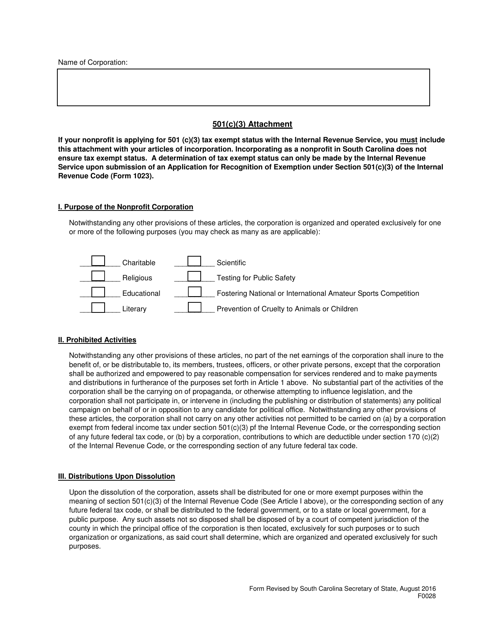

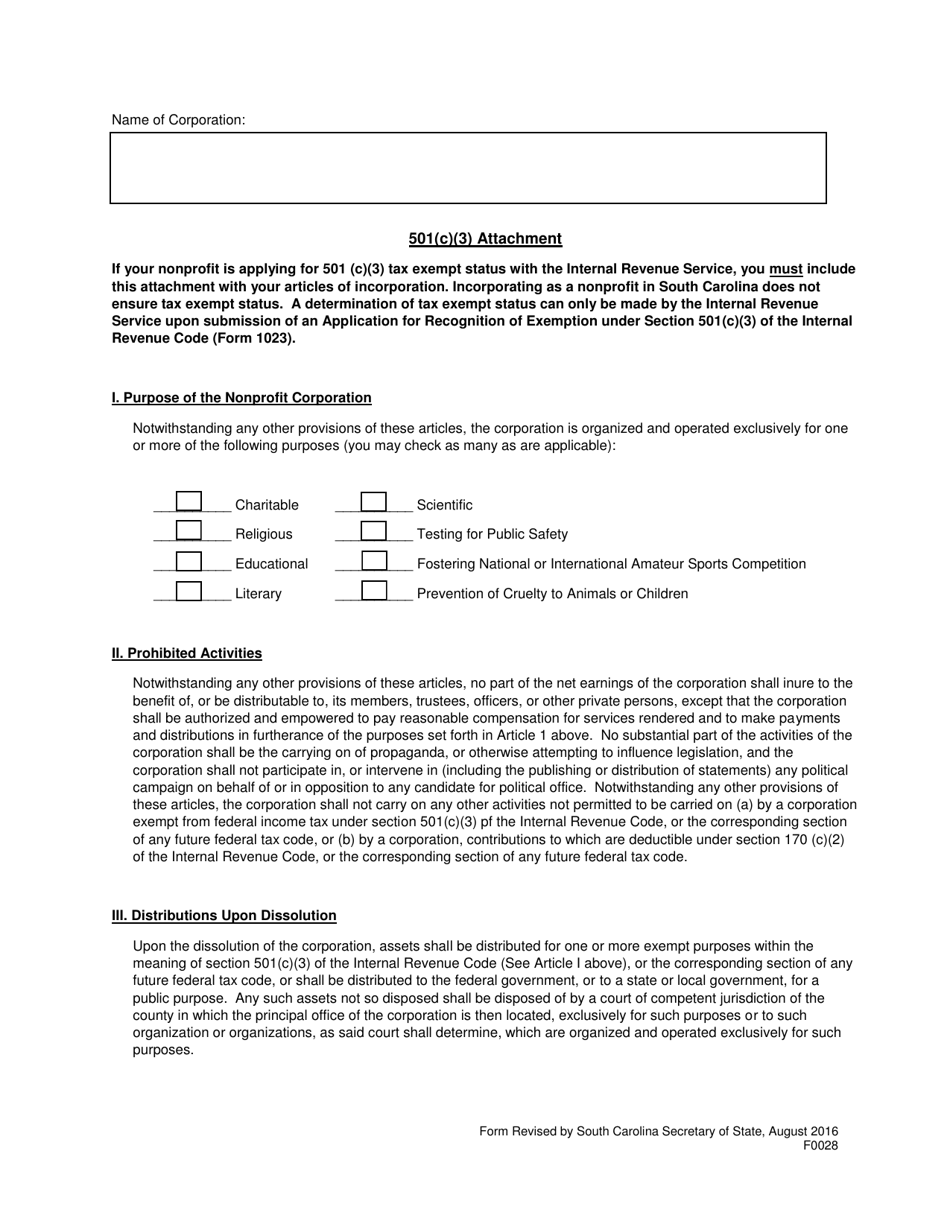

Form 0028 501(C)(3) Attachment - South Carolina

What Is Form 0028?

This is a legal form that was released by the South Carolina Secretary of State - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 0028 501(C)(3) Attachment?

A: Form 0028 501(C)(3) Attachment is a specific form used by non-profit organizations in South Carolina to provide additional information about their tax-exempt status.

Q: Who needs to fill out Form 0028 501(C)(3) Attachment?

A: Non-profit organizations in South Carolina that have a 501(c)(3) tax-exempt status from the IRS need to fill out Form 0028 501(C)(3) Attachment.

Q: What information is required in Form 0028 501(C)(3) Attachment?

A: Form 0028 501(C)(3) Attachment requires information about the non-profit organization's federal tax-exempt status, including the IRS determination letter and financial statements.

Q: When is the deadline to submit Form 0028 501(C)(3) Attachment?

A: The deadline to submit Form 0028 501(C)(3) Attachment depends on the non-profit organization's fiscal year-end date. It is generally due within six months after the end of the fiscal year.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the South Carolina Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 0028 by clicking the link below or browse more documents and templates provided by the South Carolina Secretary of State.