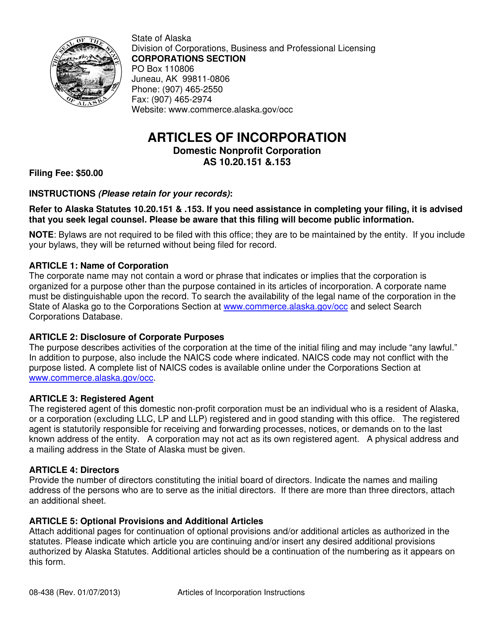

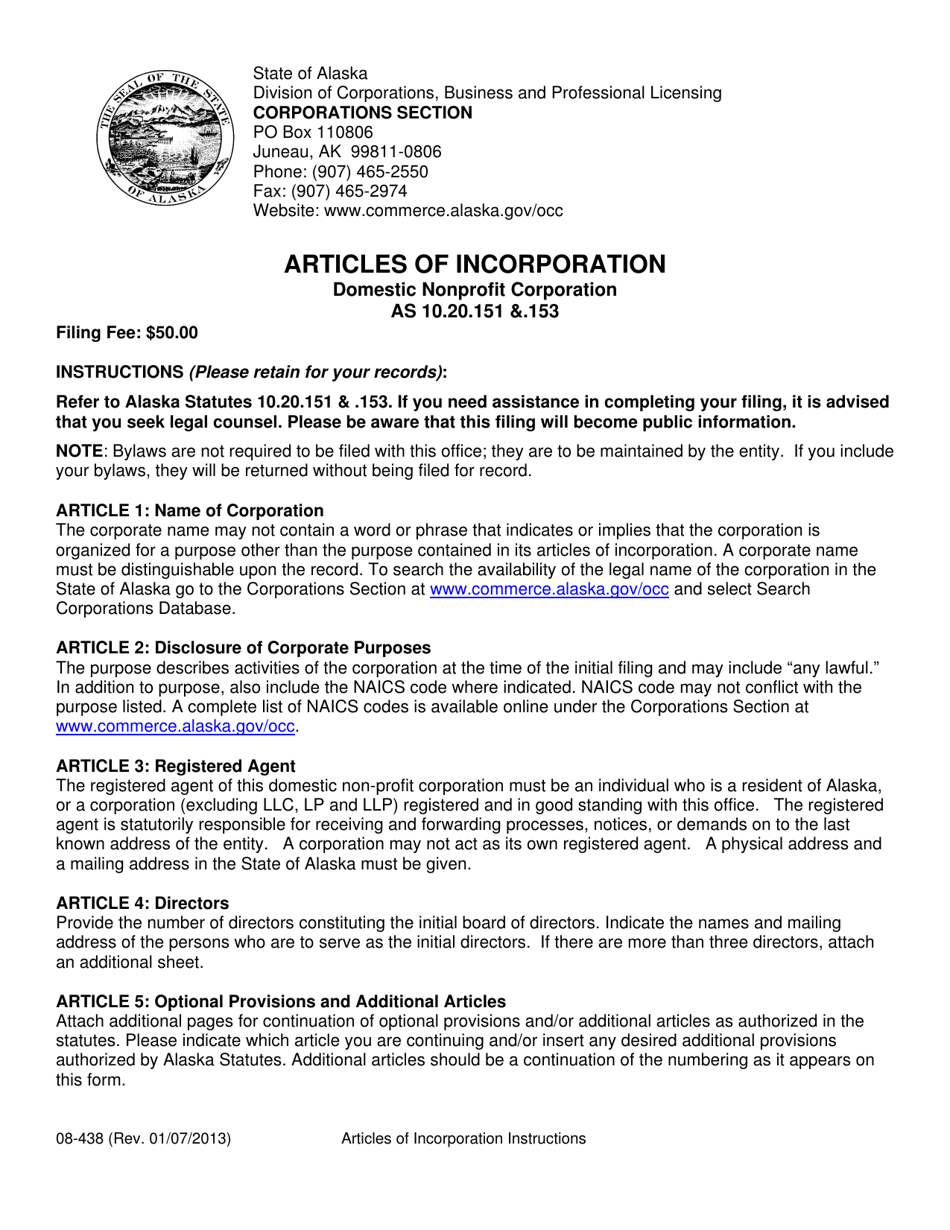

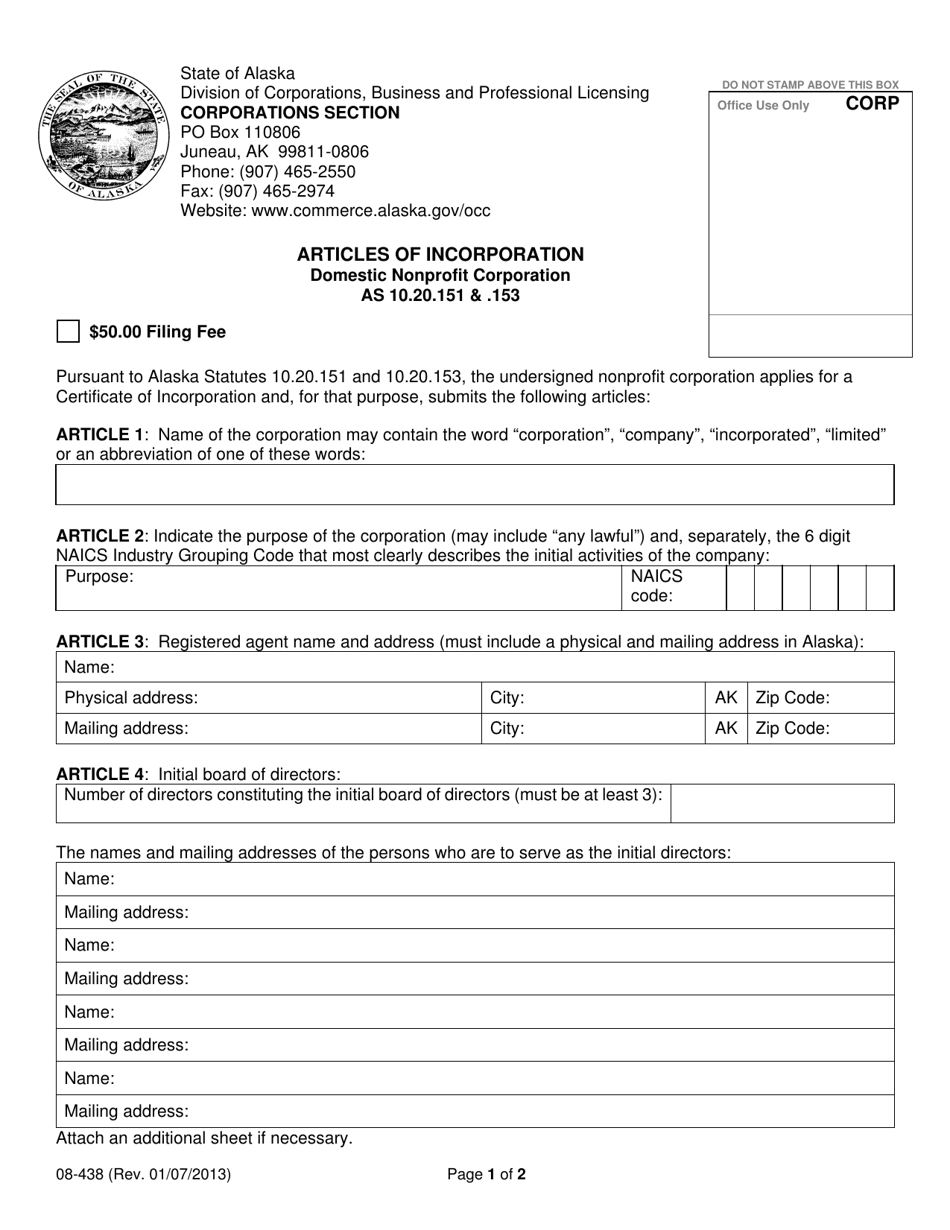

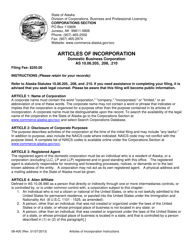

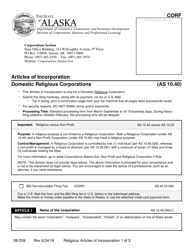

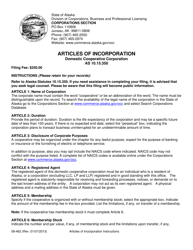

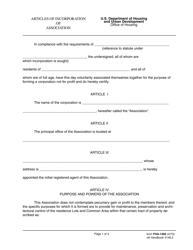

Form 08-438 Articles of Incorporation - Domestic Nonprofit Corporation - Alaska

What Is Form 08-438?

This is a legal form that was released by the Alaska Department of Commerce, Community and Economic Development - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 08-438?

A: Form 08-438 is the Articles of Incorporation for a domestic nonprofit corporation in Alaska.

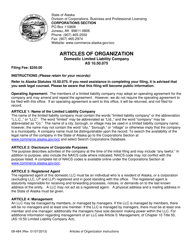

Q: What is a domestic nonprofit corporation?

A: A domestic nonprofit corporation is a type of organization that operates for a nonprofit purpose within the state it is incorporated in.

Q: What is the purpose of the Articles of Incorporation?

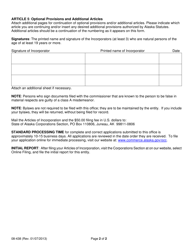

A: The Articles of Incorporation are legal documents that outline the basic information about the nonprofit corporation, such as its name, address, purpose, and initial board of directors.

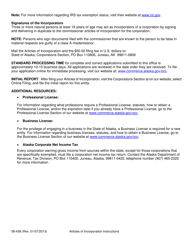

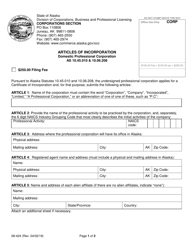

Q: What information is required in the Articles of Incorporation?

A: The Articles of Incorporation require the name of the corporation, the purpose of the corporation, the duration of the corporation, the name and address of the initial board of directors, and the name and address of the incorporator.

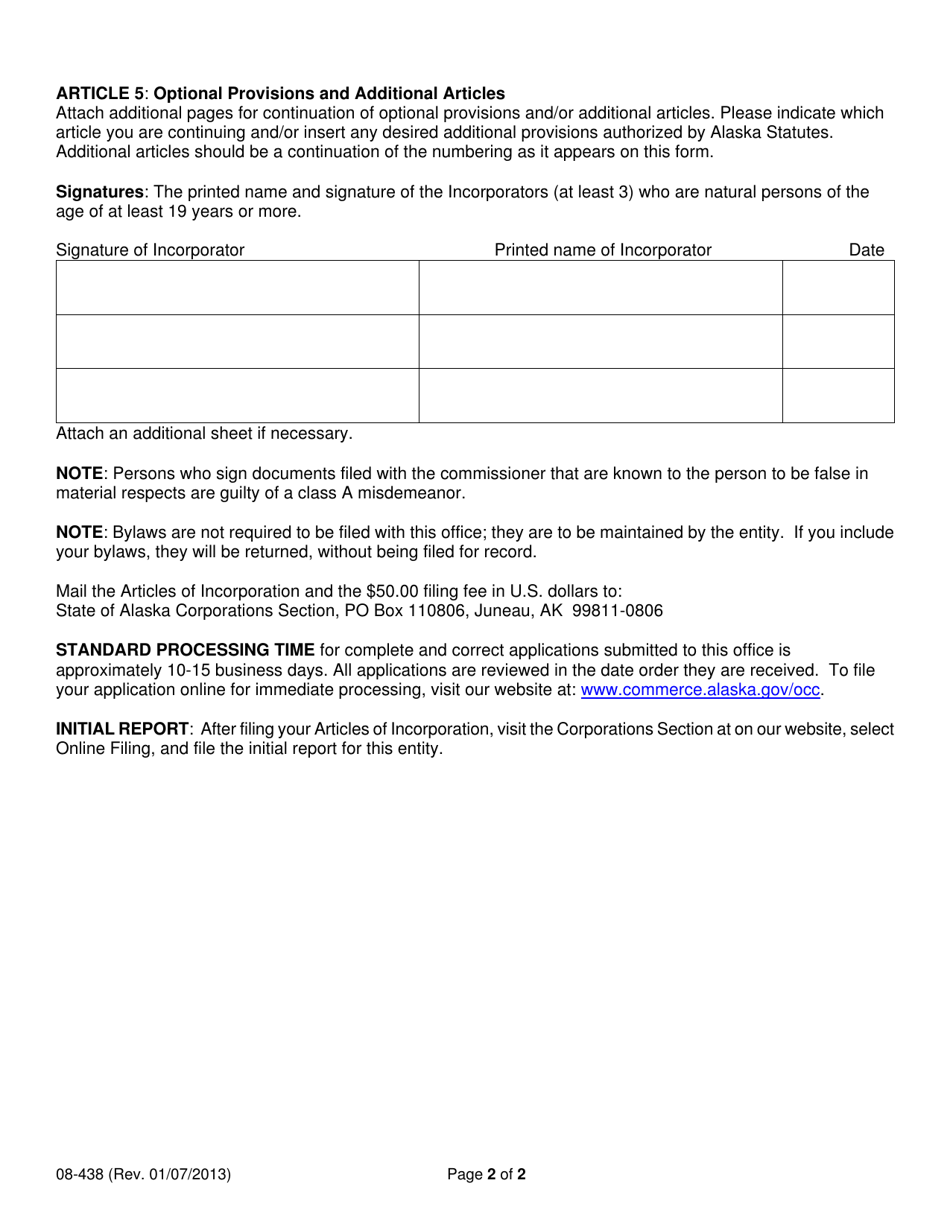

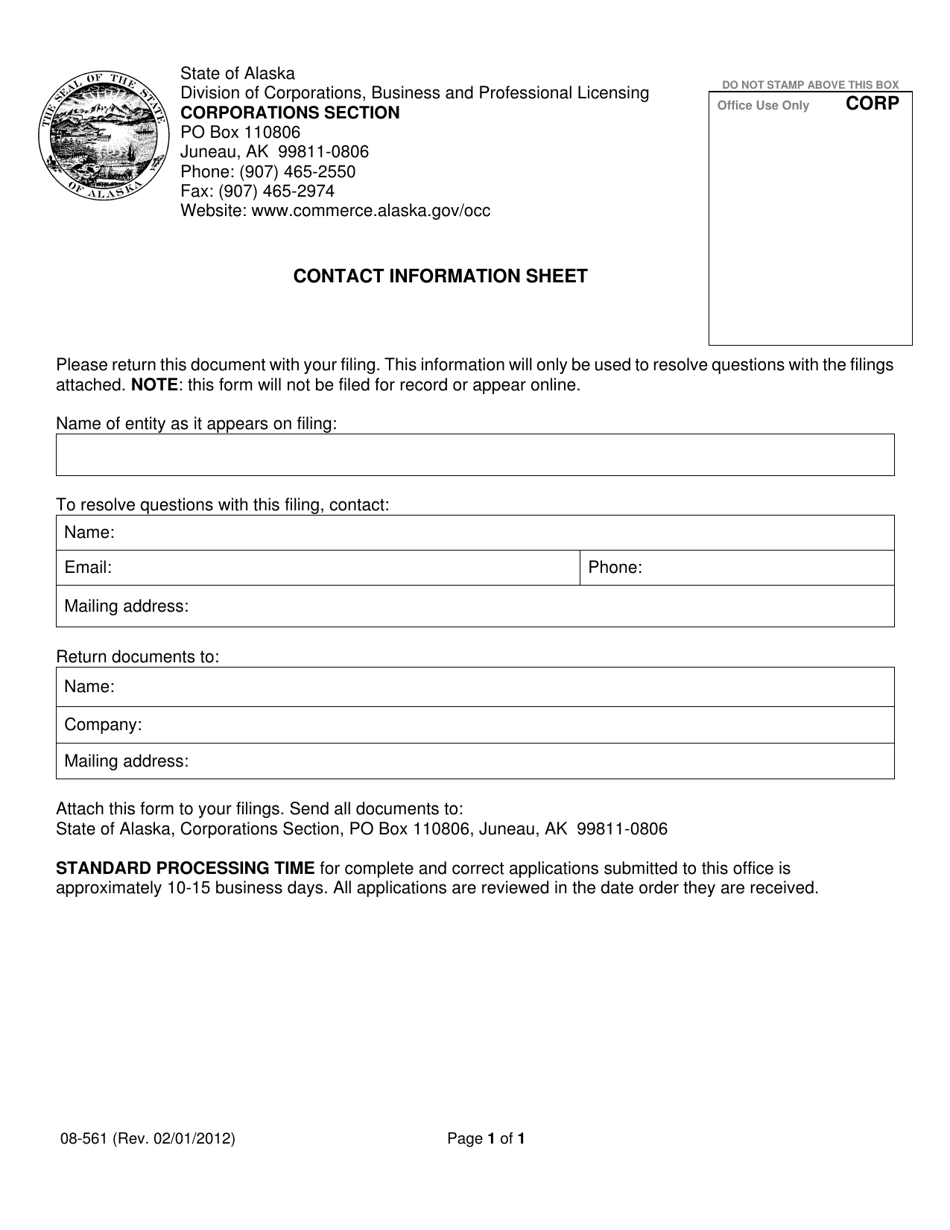

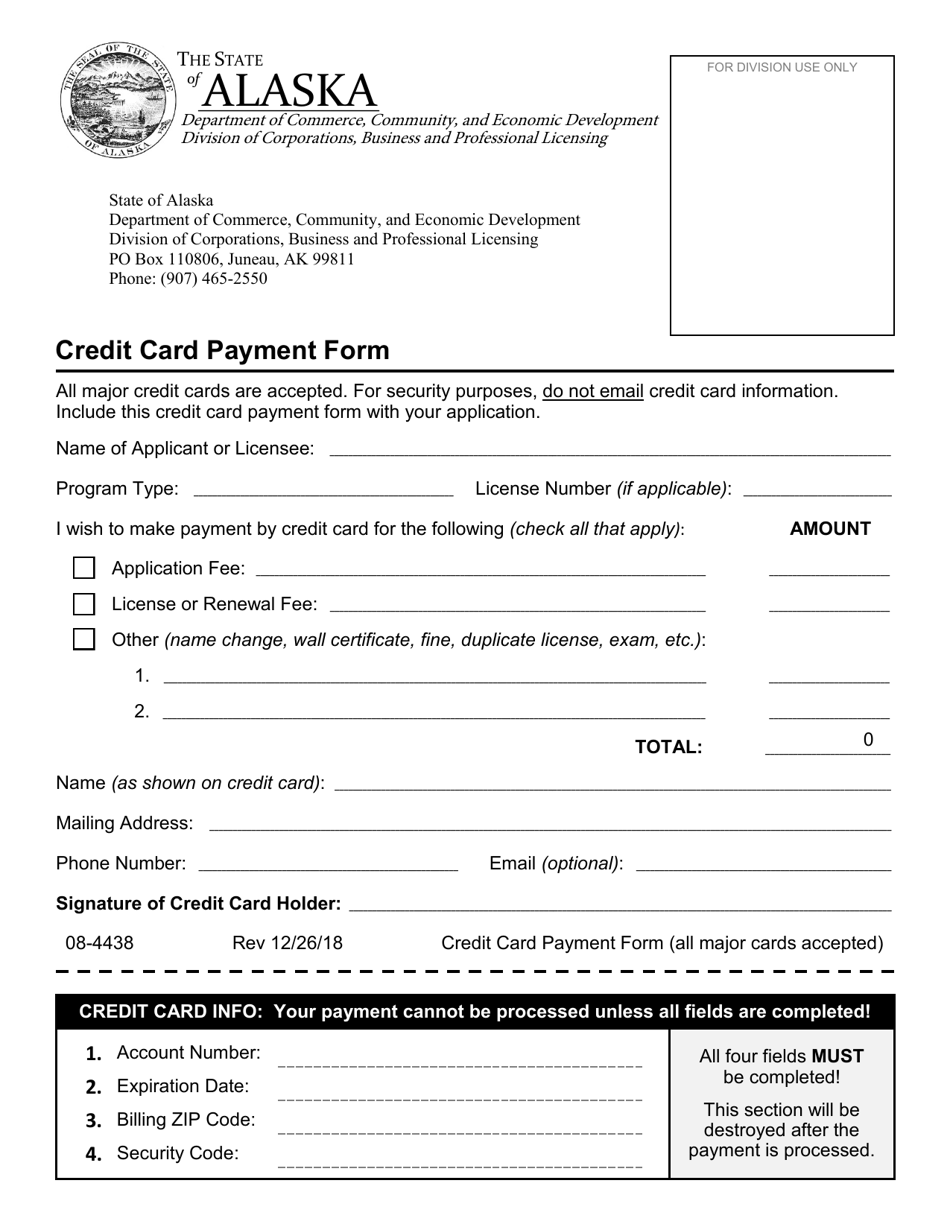

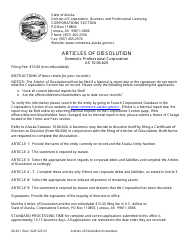

Q: How do I file Form 08-438?

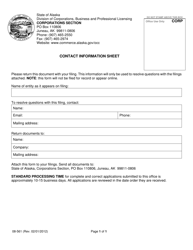

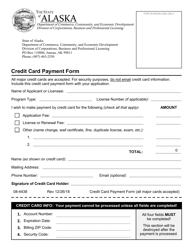

A: Form 08-438 can be filed with the Alaska Division of Corporations, Business and Professional Licensing by mail or in person.

Q: What happens after filing Form 08-438?

A: After filing Form 08-438 and paying the filing fee, the Alaska Division of Corporations, Business and Professional Licensing will review the form and, if approved, will issue a Certificate of Incorporation.

Q: Can I make changes to the Articles of Incorporation after filing?

A: Yes, changes can be made to the Articles of Incorporation after filing by filing an amendment form with the Alaska Division of Corporations, Business and Professional Licensing.

Q: Do I need to file any other documents with the Articles of Incorporation?

A: No, the Articles of Incorporation are the main document needed to create a domestic nonprofit corporation in Alaska. However, additional documents may be required for specific purposes, such as applying for tax-exempt status with the IRS.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Alaska Department of Commerce, Community and Economic Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 08-438 by clicking the link below or browse more documents and templates provided by the Alaska Department of Commerce, Community and Economic Development.