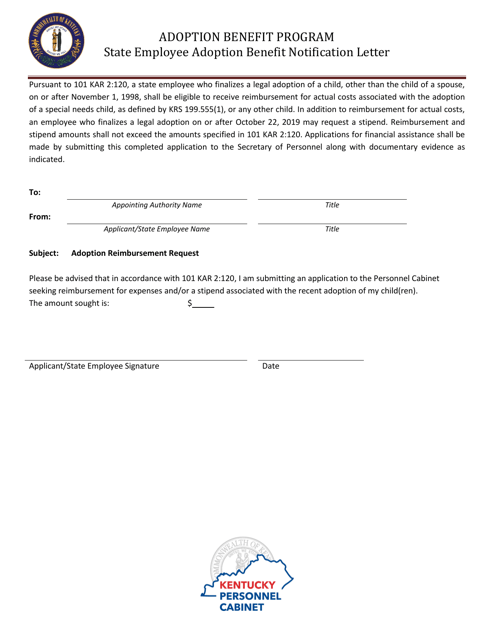

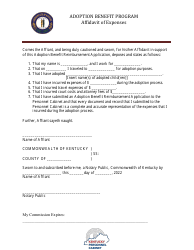

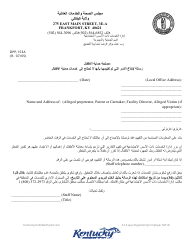

State Employee Adoption Benefit Notification Letter - Kentucky

State Employee Adoption Benefit Notification Letter is a legal document that was released by the Kentucky Personnel Cabinet - a government authority operating within Kentucky.

FAQ

Q: What is the State Employee Adoption Benefit Notification Letter?

A: The State Employee Adoption Benefit Notification Letter is a document that informs state employees in Kentucky about the adoption benefits available to them.

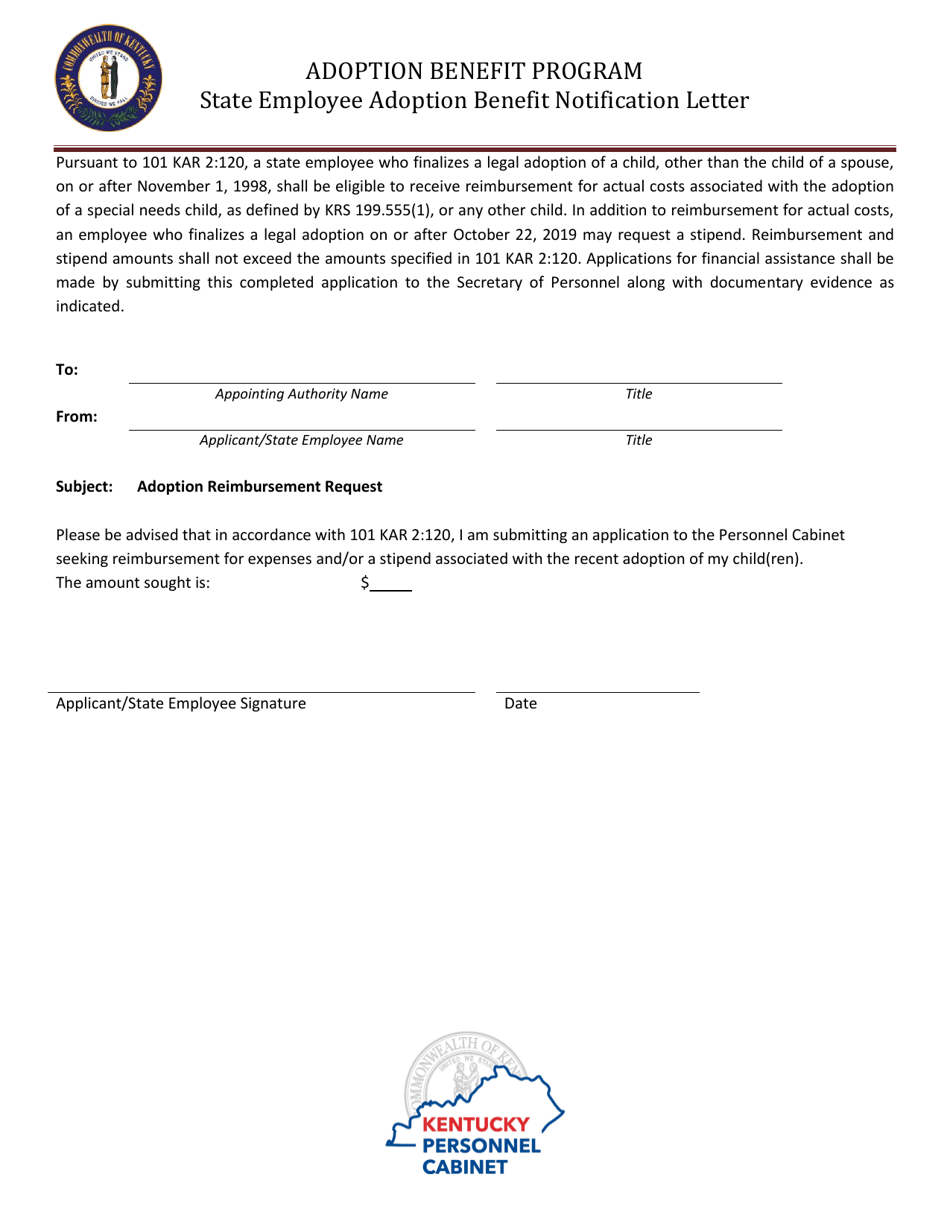

Q: What are adoption benefits for state employees in Kentucky?

A: Adoption benefits for state employees in Kentucky provide financial assistance and time off for employees who are adopting a child.

Q: Who is eligible for adoption benefits as a state employee in Kentucky?

A: All state employees in Kentucky who are eligible for health insurance benefits are also eligible for adoption benefits.

Q: What does the adoption benefit include for state employees in Kentucky?

A: The adoption benefit for state employees in Kentucky includes reimbursement for adoption expenses and up to six weeks of paid leave for the purpose of adopting a child.

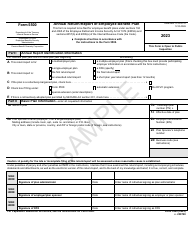

Q: How can state employees in Kentucky apply for adoption benefits?

A: State employees in Kentucky can apply for adoption benefits by completing the necessary forms and submitting them to their employer's human resources department.

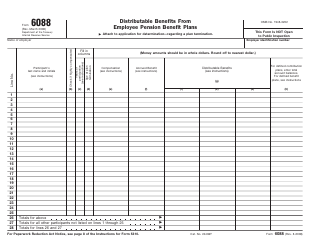

Q: Are adoption benefits taxable for state employees in Kentucky?

A: No, adoption benefits received by state employees in Kentucky are not subject to federal income tax.

Form Details:

- The latest edition currently provided by the Kentucky Personnel Cabinet;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Personnel Cabinet.