This version of the form is not currently in use and is provided for reference only. Download this version of

Form UIA4101

for the current year.

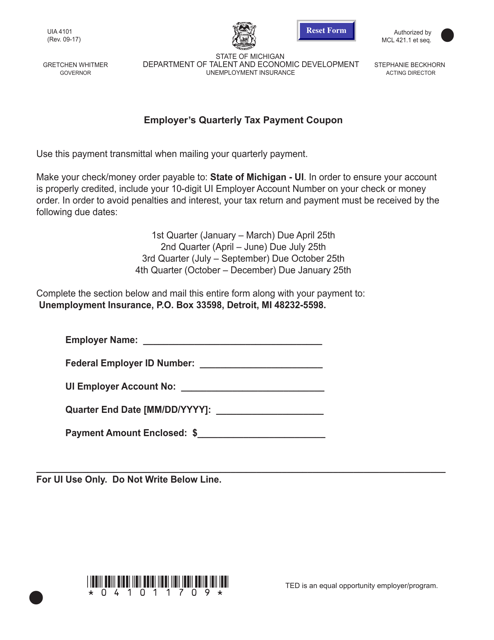

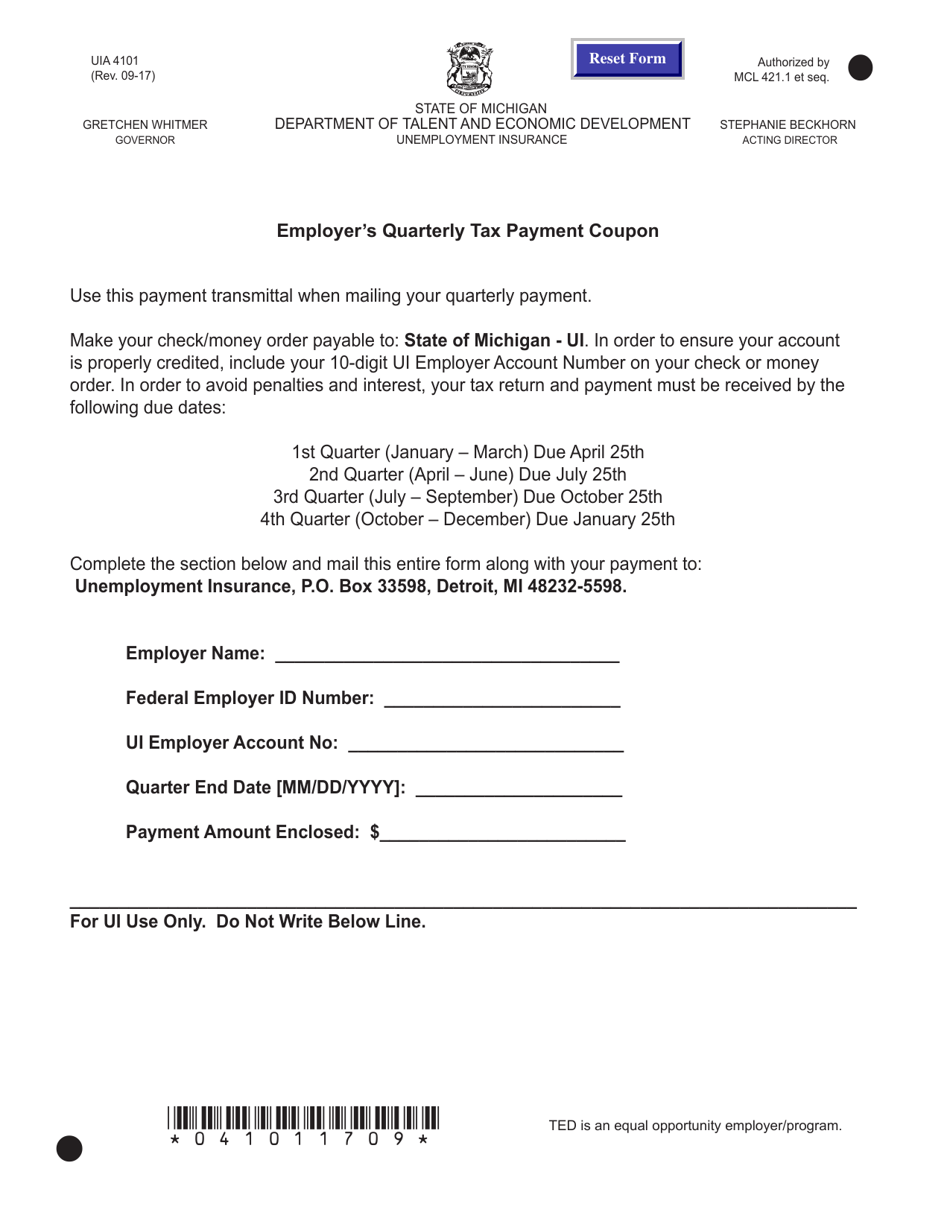

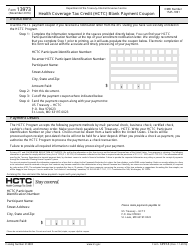

Form UIA4101 Employer's Quarterly Tax Payment Coupon - Michigan

What Is Form UIA 4101?

Form UIA4101, Employer's Quarterly Tax Payment Coupon , is a quarterly tax form issued by the Michigan Department of Labor and Economic Opportunity. In Michigan, state unemployment insurance tax is just one of several taxes that employers must pay.

Alternate Name:

- Michigan Form UIA4101.

Download a fillable PDF version of Form UIA4101 through the link below or find it on the official Michigan government website. Form MI-1040ES, Michigan Estimated Income Tax for Individuals, is a related form used for making estimated tax returns if you expect your tax return for the current year to be over $500 .

Michigan Employer's Quarterly Tax Payment Coupon

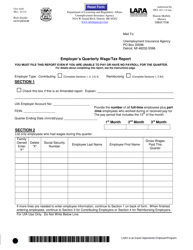

Each calendar quarter, the Unemployment Insurance Agency (UIA) mails Form UIA 1028, Employer's Quarterly Wage/Tax Report (currently unavailable online), to American contributing employers. Wage detail information is provided for every covered employee who received wages during the calendar quarter. This form is mailed about a month before the completed form is due back to the UIA. Form UIA 4101 is used as a payment transmittal when mailing a quarterly payment.

Your Michigan employer taxes are paid by checks or money orders payable to the state of Michigan (UI). In order to ensure your account is credited, include your 10-digit UI employer account number on your check. To avoid penalties and late payments, your tax return must be received by the following due dates:

- 1st Quarter (January through March) - Due on April 25th.

- 2nd Quarter (April through June) - Due on July 25th.

- 3rd Quarter (July through September) - Due on October 25th.

- 4th Quarter (October through December) - Due on January 25th.

The form (with the attached payment) should be mailed to Unemployment Insurance, PO Box 33598, Detroit, Michigan 48232-5598. If you have questions about your filing reports, you can contact the Office of Employer Ombudsman at 1-855-4UIAOEO (855-484-2636), 8:30 A.M. to 4:30 P.M. weekdays or via email at OEO@michigan.gov.