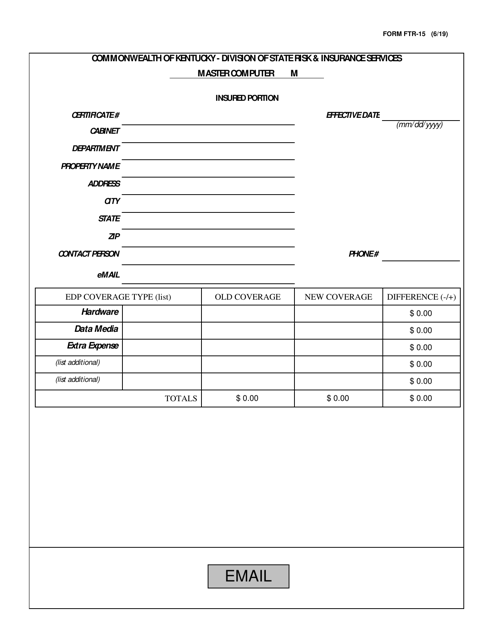

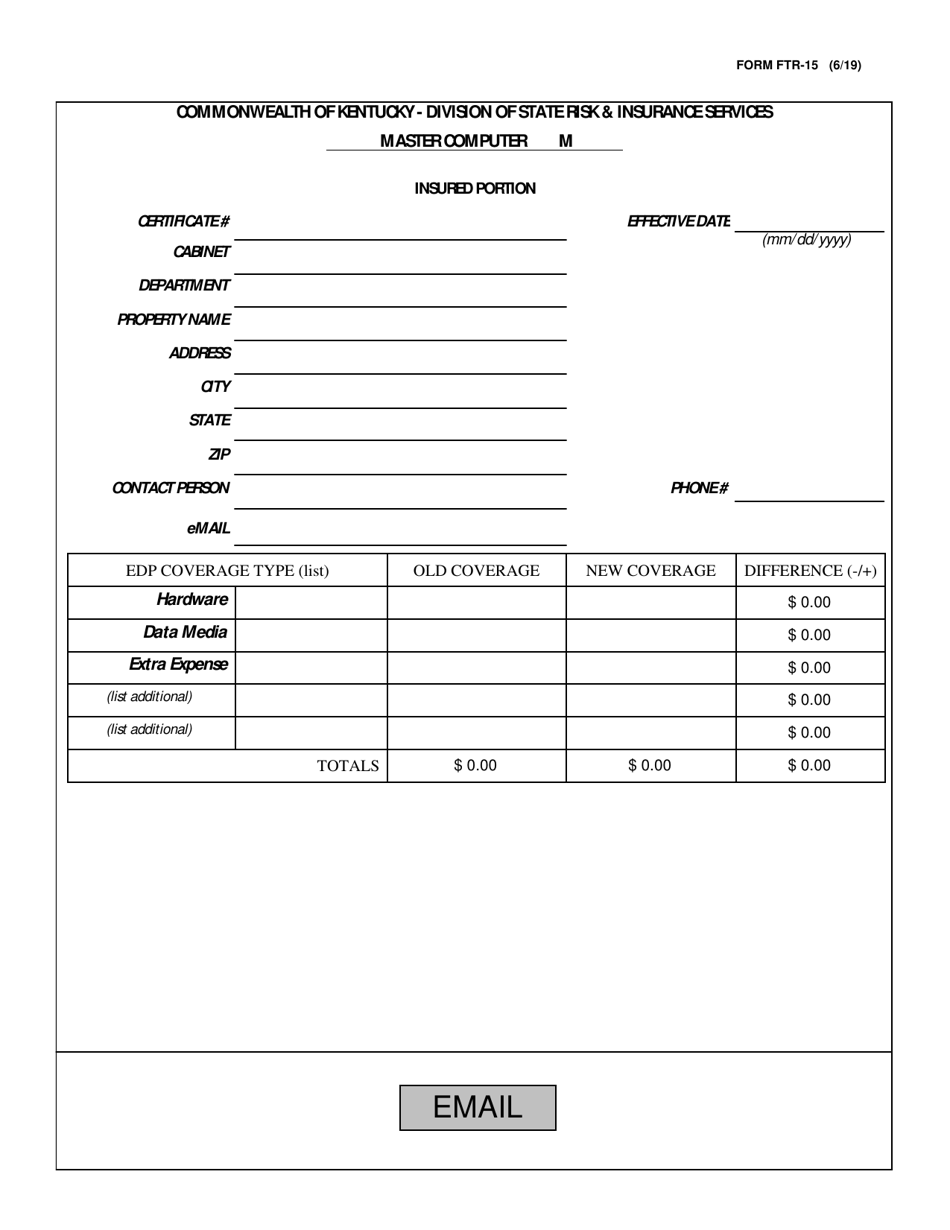

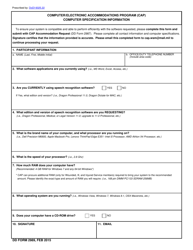

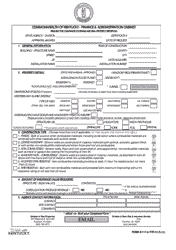

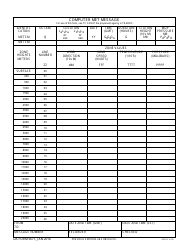

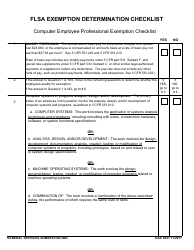

Form FTR-15 Master Computer Form - Kentucky

What Is Form FTR-15?

This is a legal form that was released by the Kentucky Finance and Administration Cabinet - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the FTR-15 Master Computer Form?

A: The FTR-15 Master Computer Form is a document used in Kentucky for reporting computer equipment owned by businesses.

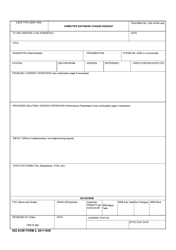

Q: Who needs to fill out the FTR-15 form?

A: Businesses in Kentucky that own computer equipment need to fill out the FTR-15 form.

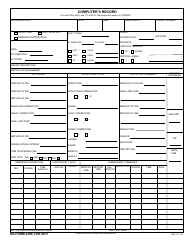

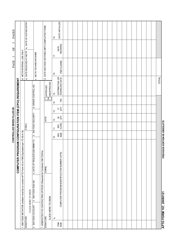

Q: What information is required on the FTR-15 form?

A: The FTR-15 form requires information such as the business name, address, contact information, and details about the computer equipment owned.

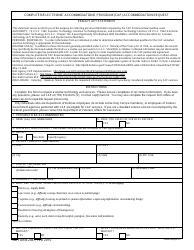

Q: Are there any fees associated with filing the FTR-15 form?

A: There are no fees associated with filing the FTR-15 form in Kentucky.

Q: When is the deadline for filing the FTR-15 form?

A: The FTR-15 form should be filed annually by April 15th of each year.

Q: What happens if I don't file the FTR-15 form?

A: Failure to file the FTR-15 form may result in penalties imposed by the Kentucky Department of Revenue.

Q: Do I need to include all computer equipment on the FTR-15 form?

A: Only computer equipment with a total original cost of $500 or more needs to be included on the FTR-15 form.

Q: Can I amend the FTR-15 form after filing?

A: Yes, you can file an amended FTR-15 form if there are any changes or corrections to the information provided.

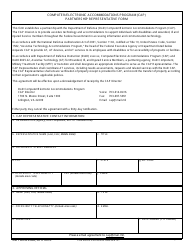

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Kentucky Finance and Administration Cabinet;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTR-15 by clicking the link below or browse more documents and templates provided by the Kentucky Finance and Administration Cabinet.