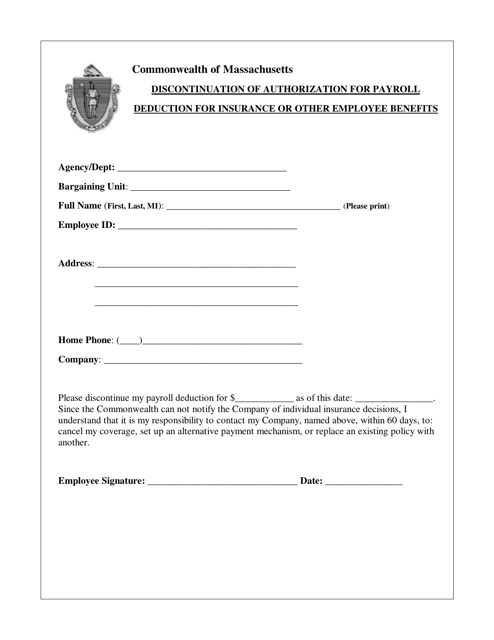

Discontinuation of Authorization for Payroll Deduction for Insurance or Other Employee Benefits - Massachusetts

Discontinuation of Authorization for Payroll Deduction for Insurance or Other Employee Benefits is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is the Discontinuation of Authorization for Payroll Deduction for Insurance or Other Employee Benefits?

A: It refers to the process of ending the practice of deducting premiums for insurance or other employee benefits from an employee's paycheck.

Q: Why would Authorization for Payroll Deduction for Insurance or Other Employee Benefits be discontinued?

A: There could be various reasons for discontinuation, such as changes in insurance providers, termination of employee benefits, or employee request.

Q: Is Discontinuation of Authorization for Payroll Deduction mandatory in Massachusetts?

A: No, it is not mandatory. It depends on the employer's policies and the agreement between the employer and employee.

Q: Can an employee object to the discontinuation of payroll deduction for insurance or employee benefits?

A: Yes, an employee can object to the discontinuation. However, the employer may have the final say based on their policies and agreements.

Q: What should an employee do if they no longer want payroll deduction for insurance or employee benefits?

A: The employee should communicate their preference to their employer and discuss the options available, such as alternative payment methods or opting out of the benefits program.

Q: Is there a legal requirement for employers to offer payroll deduction for insurance or employee benefits in Massachusetts?

A: No, there is no legal requirement for employers to offer this service. It depends on the employer's policies and the agreement between the employer and employee.

Form Details:

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.