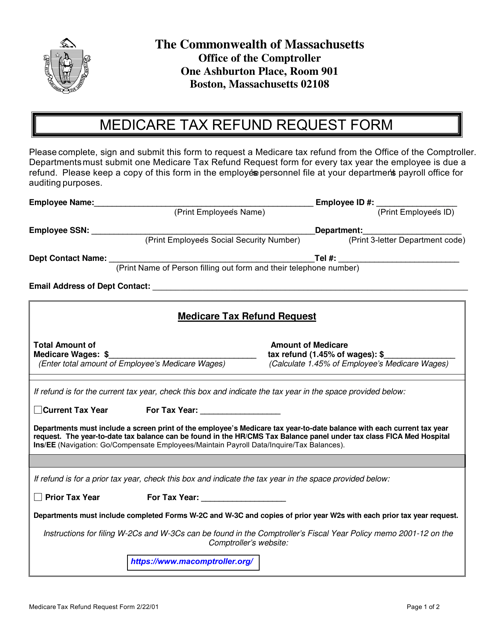

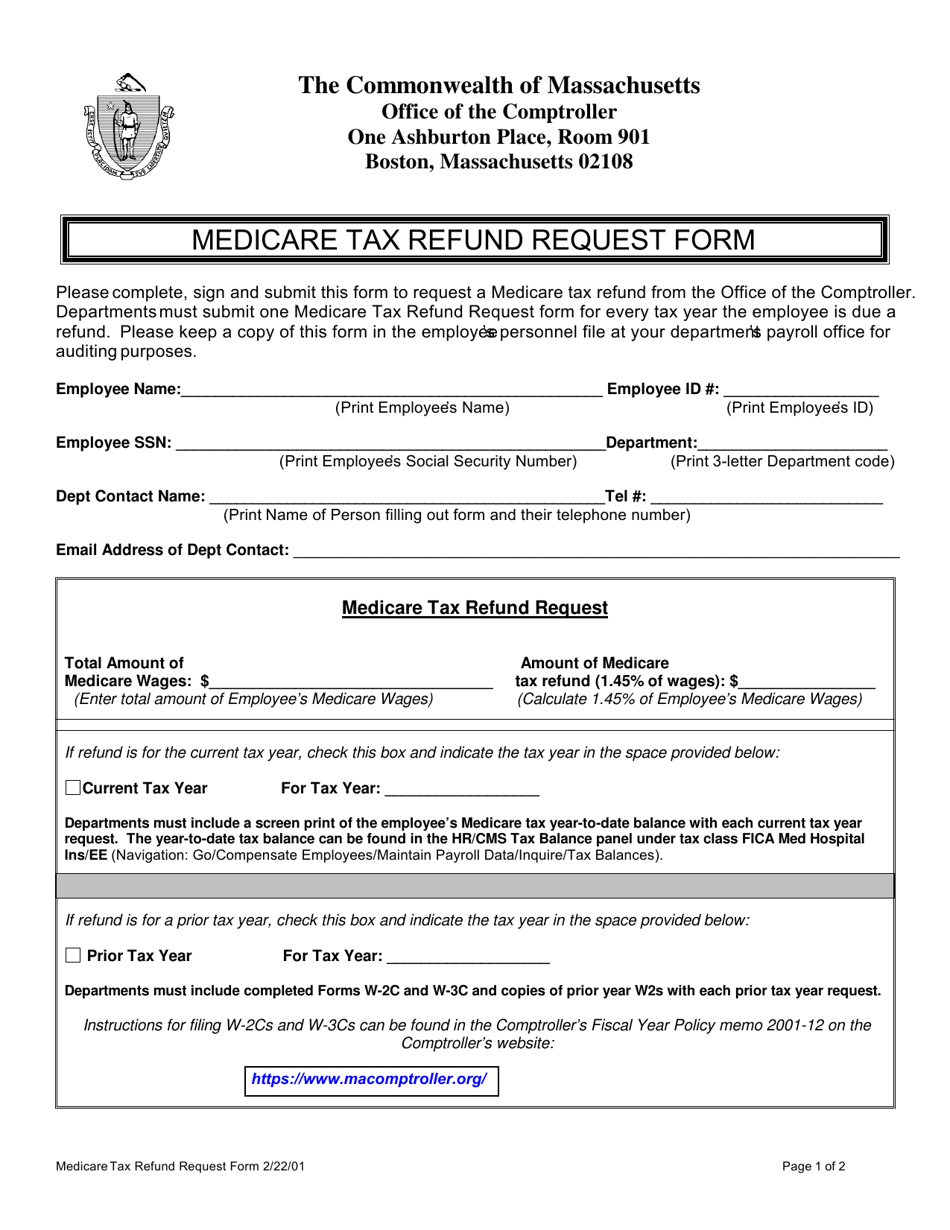

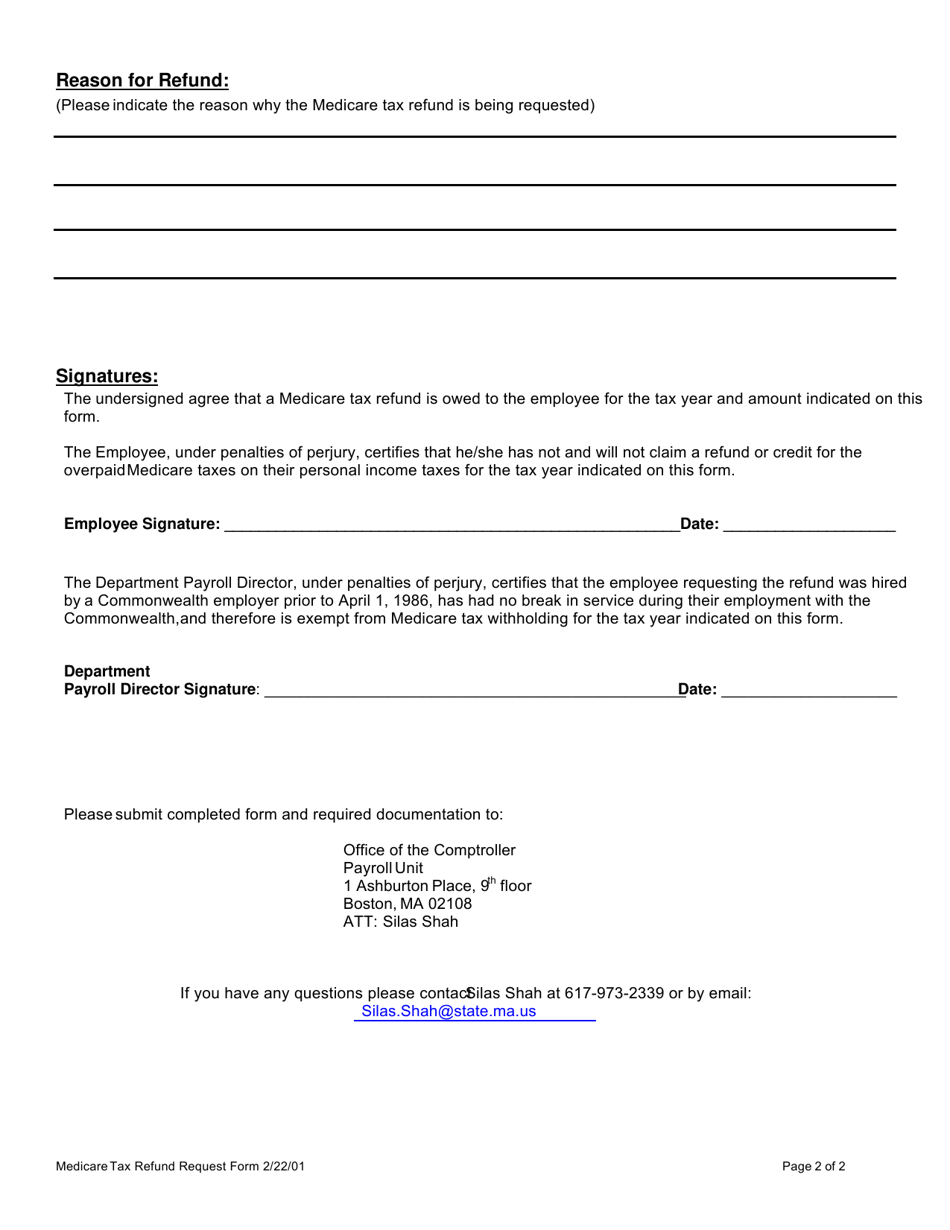

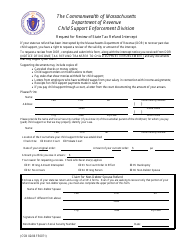

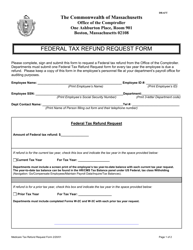

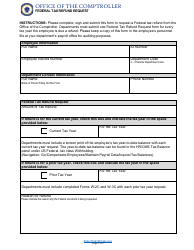

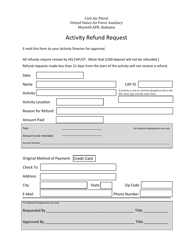

Medicare Tax Refund Request Form - Massachusetts

Medicare Tax Refund Request Form is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

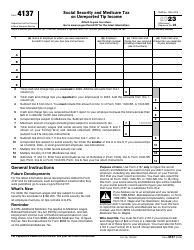

Q: What is the Medicare Tax Refund Request Form?

A: The Medicare Tax Refund Request Form is a document used in Massachusetts to request a refund of Medicare taxes.

Q: Who can use the Medicare Tax Refund Request Form?

A: Any individual or business in Massachusetts who has overpaid their Medicare taxes can use the form to request a refund.

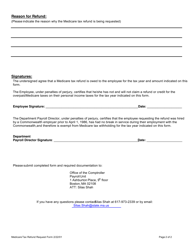

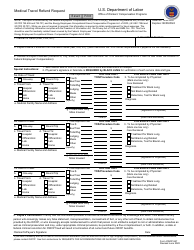

Q: What information do I need to provide on the form?

A: You will need to provide your name, address, Social Security number or taxpayer identification number, and information about your Medicare tax overpayment.

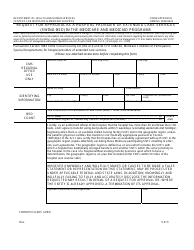

Q: Is there a deadline for submitting the Medicare Tax Refund Request Form?

A: Yes, the form must be submitted within three years from the due date of the tax return or within two years from the date of payment, whichever is later.

Q: What happens after I submit the form?

A: The Massachusetts Department of Revenue will review your request and determine if you are eligible for a refund. If approved, you will receive a refund of your overpaid Medicare taxes.

Form Details:

- Released on February 22, 2001;

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.