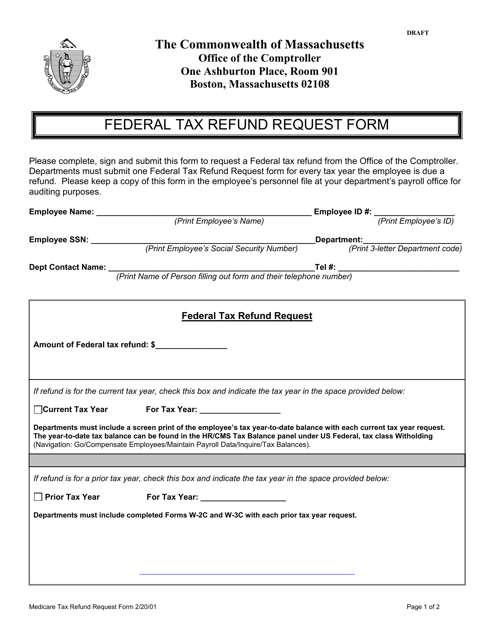

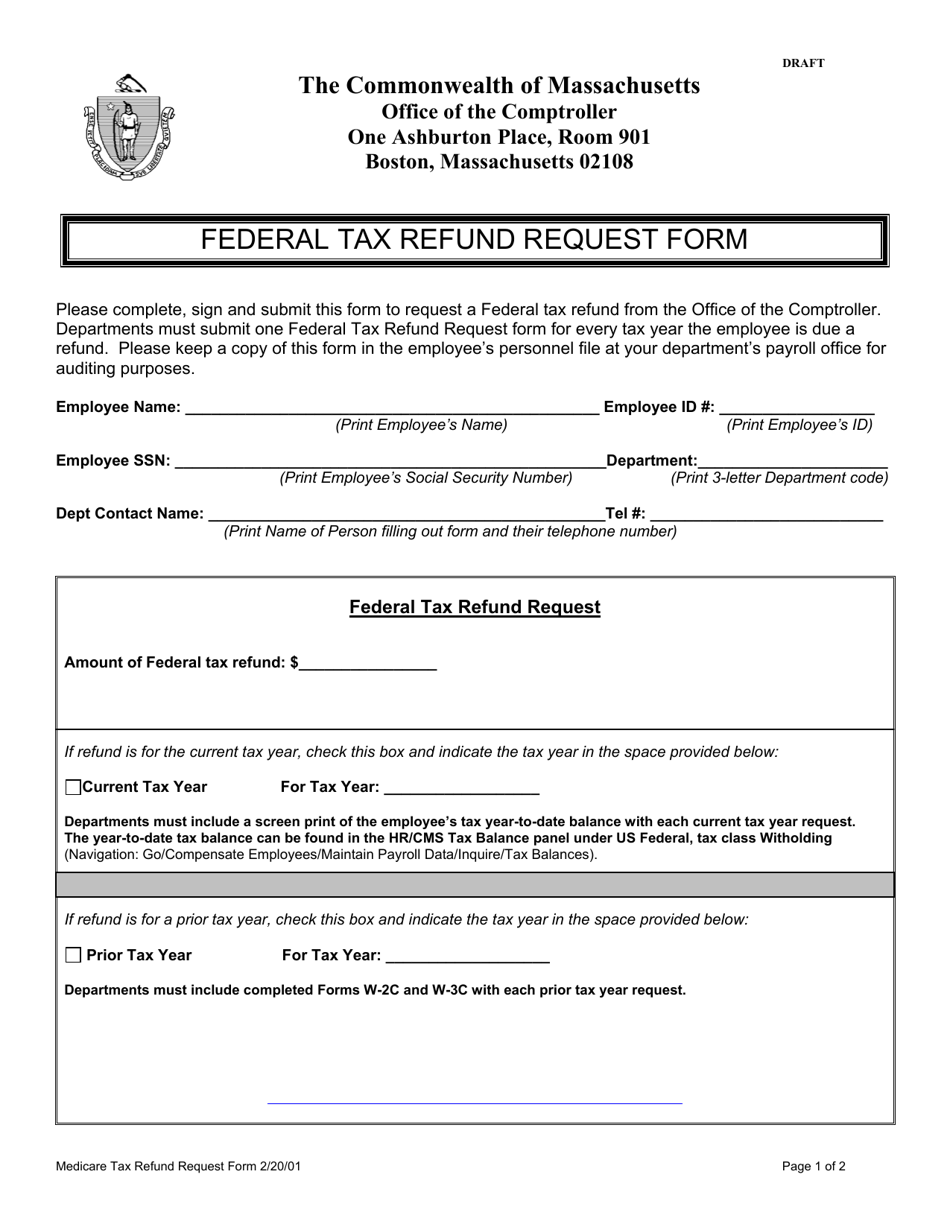

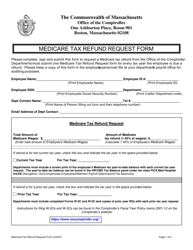

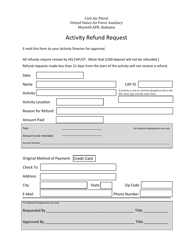

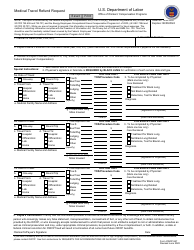

Federal Tax Refund Request Form - Massachusetts

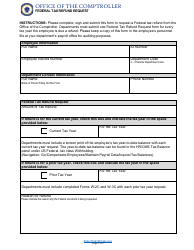

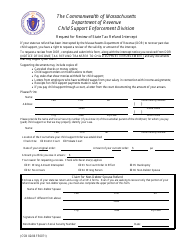

Federal Tax Refund Request Form is a legal document that was released by the Comptroller of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is the Federal Tax Refund Request Form?

A: The Federal Tax Refund Request Form is a document used to request a refund of federal taxes paid.

Q: Who can use the Federal Tax Refund Request Form?

A: Any individual who has paid federal taxes and is eligible for a refund can use the form.

Q: How do I fill out the Federal Tax Refund Request Form?

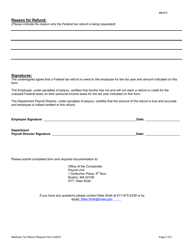

A: You need to provide your personal information, including your name, Social Security number, and address, and accurately report your income and deductions.

Q: When should I submit the Federal Tax Refund Request Form?

A: You should submit the form after the end of the tax year, typically by April 15th.

Q: How long does it take to receive a federal tax refund?

A: The time it takes to receive a federal tax refund can vary, but typically it takes about 21 days if you e-file and choose direct deposit.

Q: What if I made a mistake on my Federal Tax Refund Request Form?

A: If you made a mistake on your form, you can file an amended return using Form 1040X to correct any errors.

Q: Do I need to pay taxes on my federal tax refund?

A: No, federal tax refunds are generally not taxable income.

Q: Can I request a refund for previous tax years?

A: Yes, you can request a refund for a previous tax year by filing an amended return for that year.

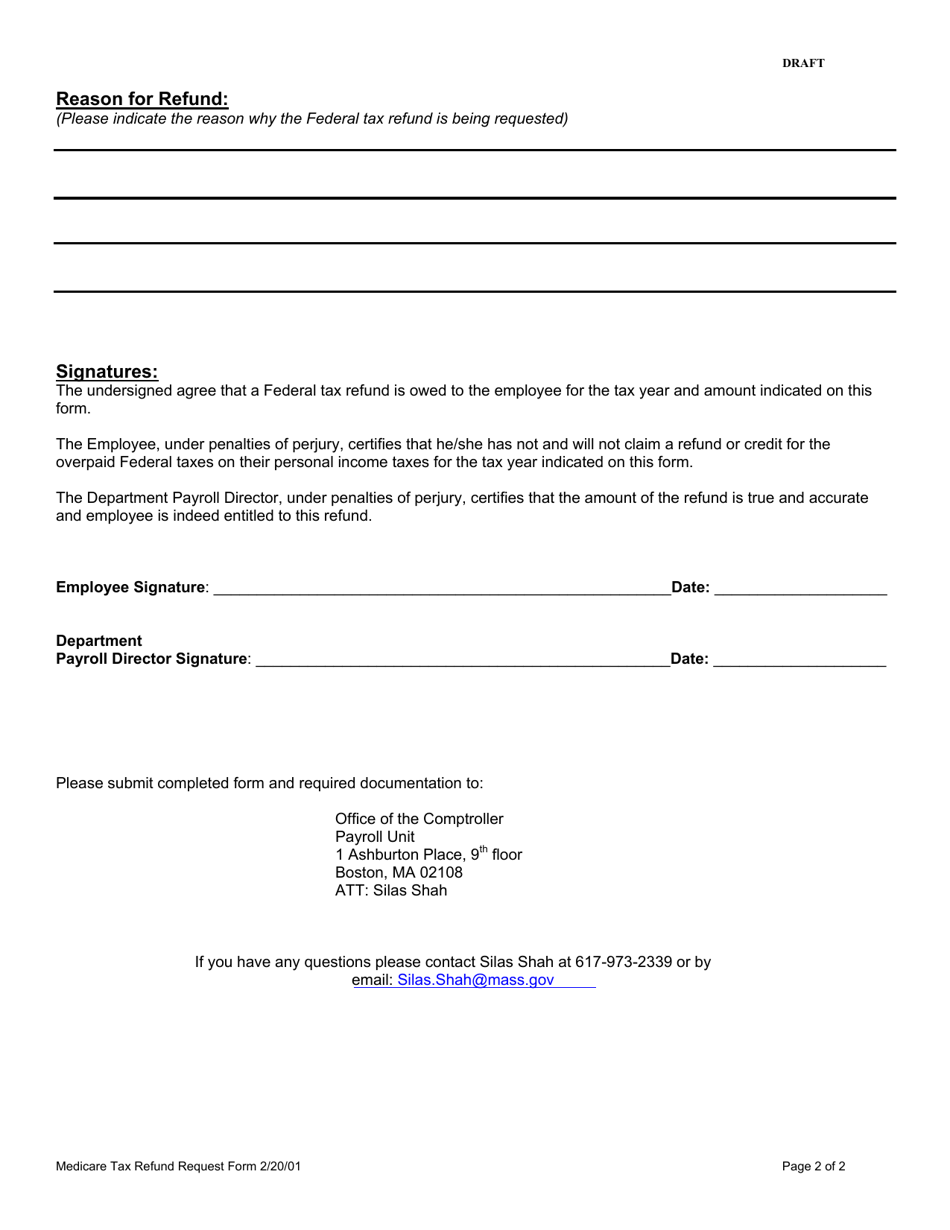

Form Details:

- Released on February 20, 2001;

- The latest edition currently provided by the Comptroller of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of the Commonwealth of Massachusetts.