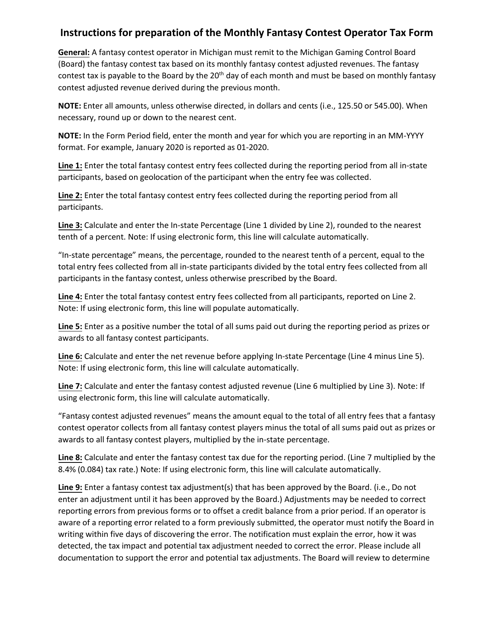

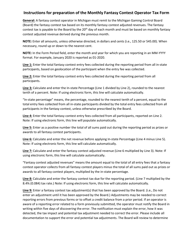

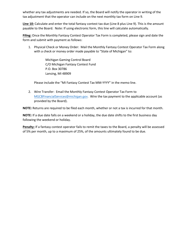

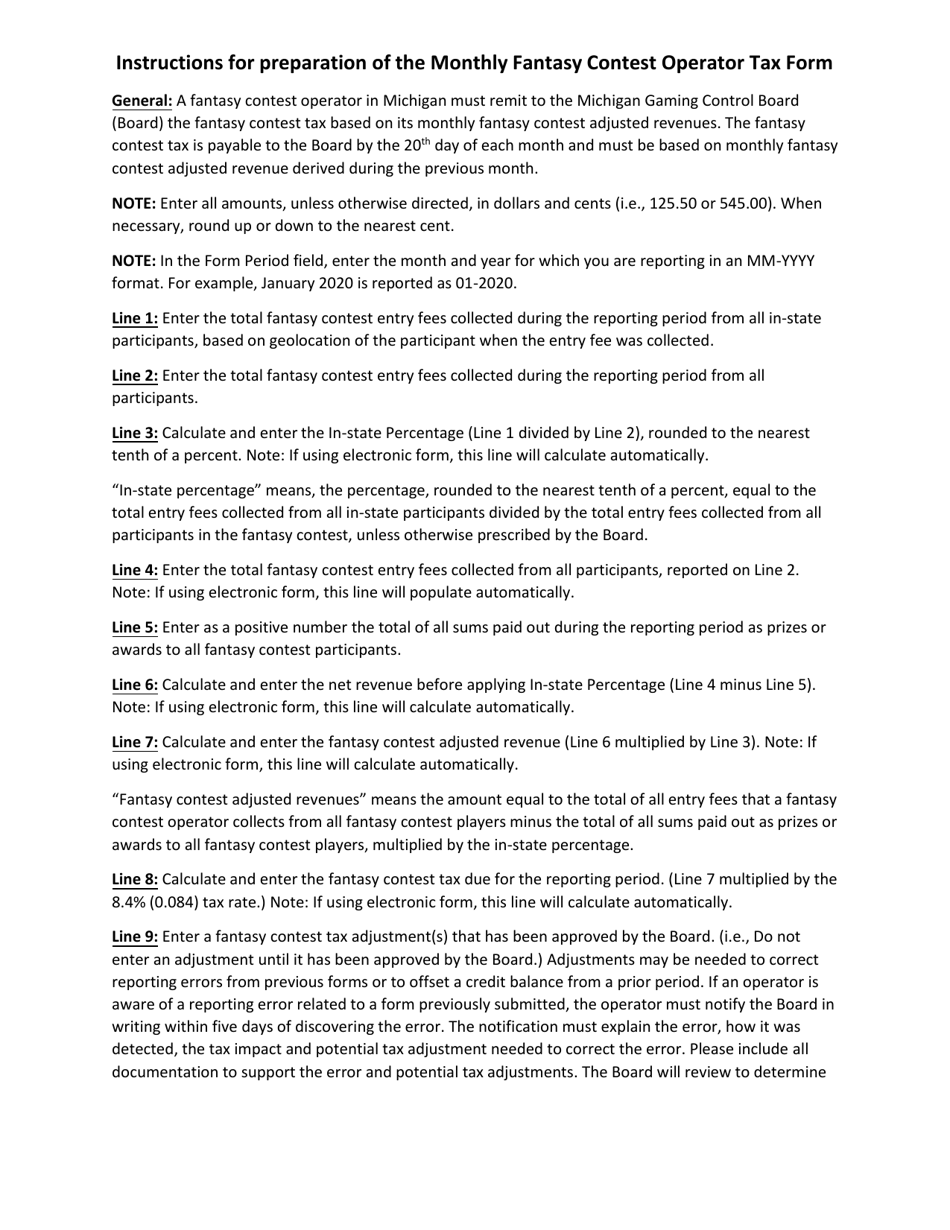

Instructions for Monthly Fantasy Contest Operator Tax Form - Michigan

This document was released by Michigan Gaming Control Board and contains the most recent official instructions for Monthly Fantasy Contest Operator Tax Form .

FAQ

Q: What is the Monthly Fantasy Contest Operator Tax Form?

A: The Monthly Fantasy Contest Operator Tax Form is a form provided by the state of Michigan for fantasy contest operators to report and pay taxes on their monthly operations.

Q: Who needs to file the Monthly Fantasy Contest Operator Tax Form?

A: Any fantasy contest operator conducting operations in Michigan is required to file the Monthly Fantasy Contest Operator Tax Form.

Q: When is the Monthly Fantasy Contest Operator Tax Form due?

A: The Monthly Fantasy Contest Operator Tax Form is due on a monthly basis, typically within a few weeks after the end of each month.

Q: What information do I need to provide on the Monthly Fantasy Contest Operator Tax Form?

A: You will need to provide information about your fantasy contest operations, such as the total amount of entry fees collected and any prizes awarded.

Q: Are there any penalties for not filing or paying taxes on time?

A: Yes, there may be penalties for not filing or paying taxes on time, including interest charges on any unpaid taxes.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Michigan Gaming Control Board.