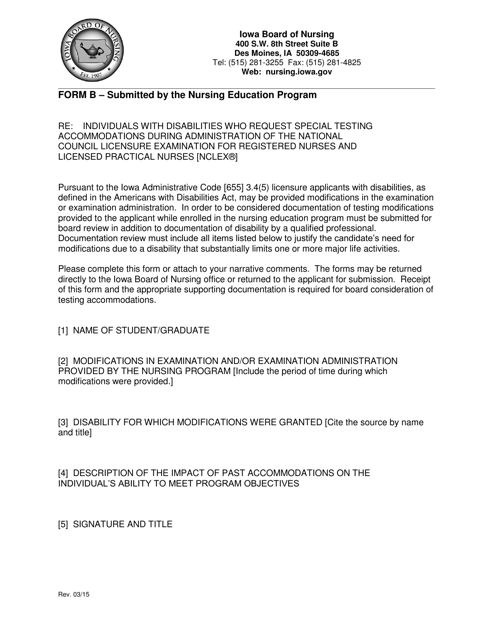

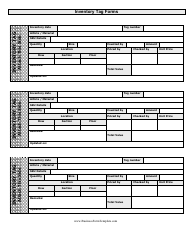

Form B - Iowa

What Is Form B?

This is a legal form that was released by the Iowa Board of Nursing - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B?

A: Form B is a document used in Iowa for tax purposes.

Q: Who needs to file Form B?

A: Residents of Iowa who have taxable income need to file Form B.

Q: What information is required on Form B?

A: Form B requires information about your income, deductions, and credits.

Q: When is the deadline to file Form B?

A: The deadline to file Form B is generally April 30th.

Q: Is there a penalty for late filing of Form B?

A: Yes, there may be a penalty for late filing of Form B.

Q: Can I claim deductions on Form B?

A: Yes, you can claim deductions on Form B to reduce your taxable income.

Q: What credits are available on Form B?

A: Form B offers various tax credits, such as the child tax credit and earned income credit.

Q: How can I get help with filling out Form B?

A: You can seek assistance from a tax professional or use the resources provided by the Iowa Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Iowa Board of Nursing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B by clicking the link below or browse more documents and templates provided by the Iowa Board of Nursing.