This version of the form is not currently in use and is provided for reference only. Download this version of

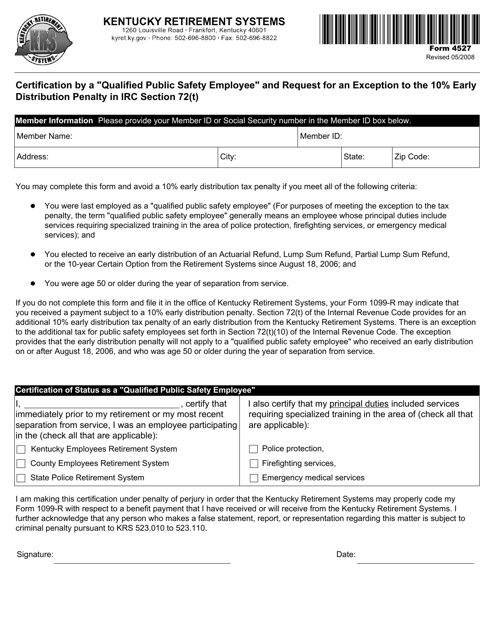

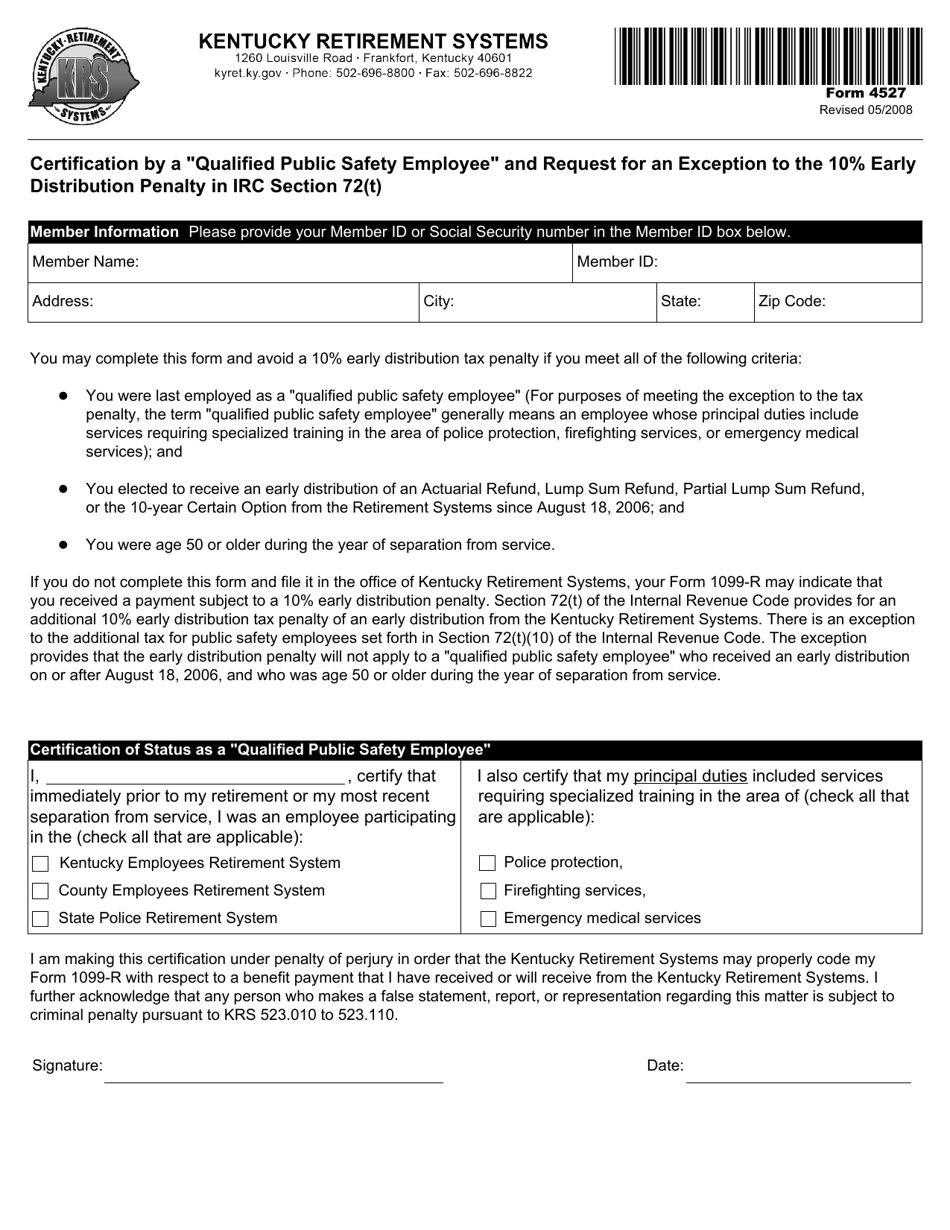

Form 4527

for the current year.

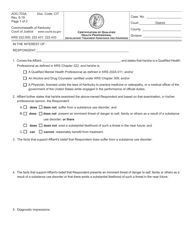

Form 4527 Certification by a "qualified Public Safety Employee" and Request for an Exception to the 10% Early Distribution Penalty in IRC Section 72(T) - Kentucky

What Is Form 4527?

This is a legal form that was released by the Kentucky Retirement System - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4527?

A: Form 4527 is a certification document used by qualified public safety employees to request an exception to the 10% early distribution penalty in IRC Section 72(T).

Q: Who can use Form 4527?

A: Form 4527 can be used by qualified public safety employees.

Q: What is a qualified public safety employee?

A: A qualified public safety employee is someone who is employed by a public agency in a position that is considered hazardous or involves protecting the public.

Q: What is the purpose of Form 4527?

A: The purpose of Form 4527 is to certify that the distribution from a retirement plan is being made to a qualified public safety employee and request an exception to the 10% early distribution penalty.

Q: What is the 10% early distribution penalty?

A: The 10% early distribution penalty is a penalty imposed by the Internal Revenue Code on certain early withdrawals from retirement plans.

Q: Why would a qualified public safety employee request an exception to the 10% early distribution penalty?

A: A qualified public safety employee may request an exception to the 10% early distribution penalty if they are experiencing financial hardship or have other qualifying circumstances.

Form Details:

- Released on May 1, 2008;

- The latest edition provided by the Kentucky Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4527 by clicking the link below or browse more documents and templates provided by the Kentucky Retirement System.