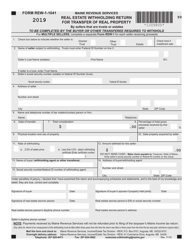

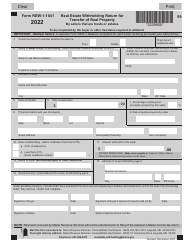

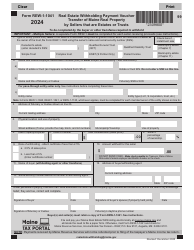

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

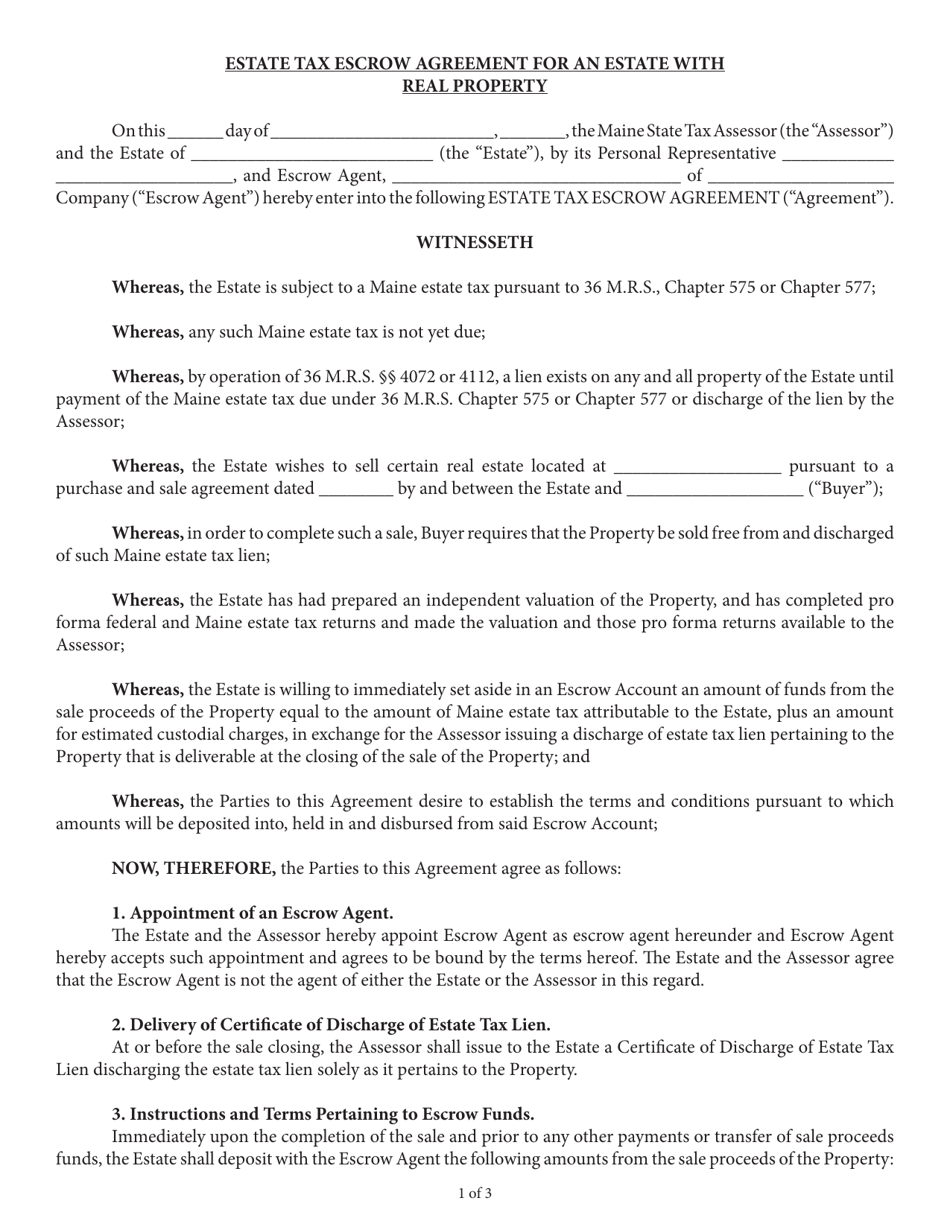

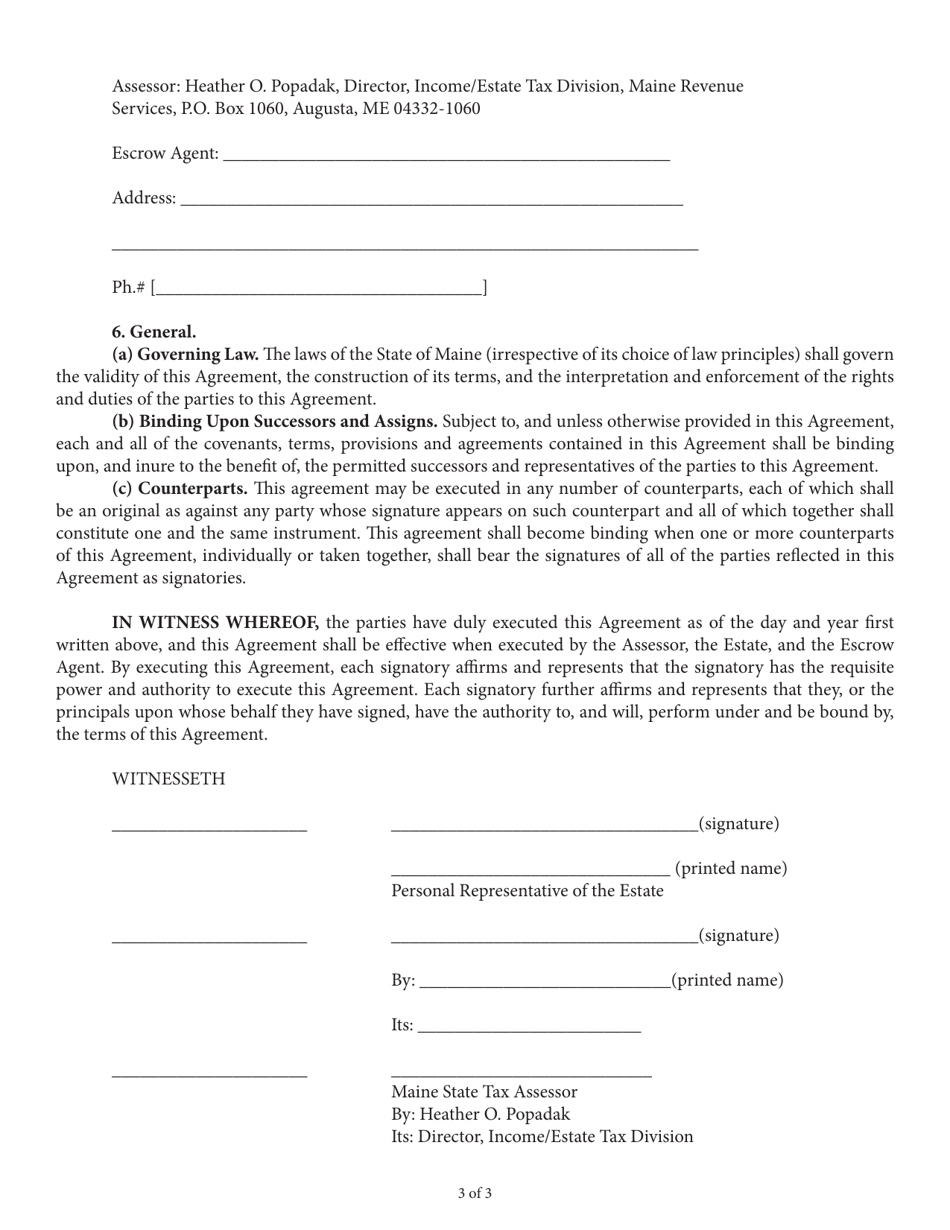

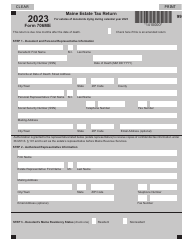

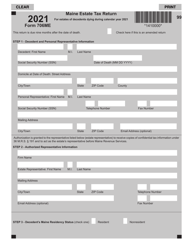

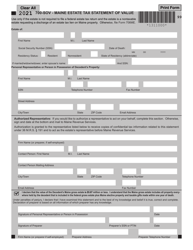

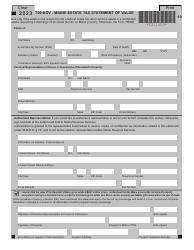

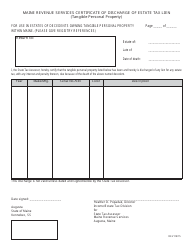

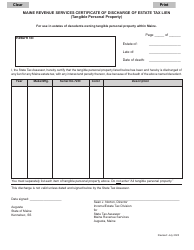

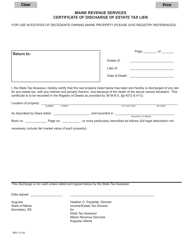

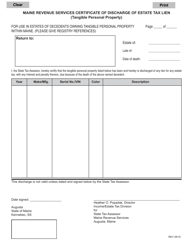

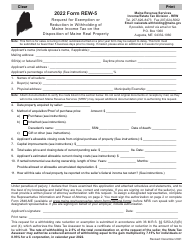

Estate Tax Escrow Agreement for an Estate With Real Property - Maine

Estate Tax Escrow Agreement for an Estate With Real Property is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is an Estate Tax Escrow Agreement?

A: An Estate Tax Escrow Agreement is a legal document that establishes an escrow account to hold funds for the payment of estate taxes.

Q: What is the purpose of an Estate Tax Escrow Agreement?

A: The purpose of an Estate Tax Escrow Agreement is to ensure that there are sufficient funds available to pay estate taxes when they become due.

Q: Who typically creates an Estate Tax Escrow Agreement?

A: An Estate Tax Escrow Agreement is typically created by an attorney or a financial institution that is involved in the administration of an estate.

Q: What is real property?

A: Real property refers to land and any structures or improvements that are permanently attached to that land, such as houses, buildings, or other fixed structures.

Q: Why is an Estate Tax Escrow Agreement necessary for an estate with real property?

A: An Estate Tax Escrow Agreement is necessary for an estate with real property to ensure that there are sufficient funds available to pay estate taxes, which may be assessed based on the value of the real property.

Q: Does an Estate Tax Escrow Agreement only apply to estates in Maine?

A: No, an Estate Tax Escrow Agreement can be used in any state where estate taxes are assessed.

Q: Can an Estate Tax Escrow Agreement be modified or terminated?

A: Yes, an Estate Tax Escrow Agreement can be modified or terminated with the consent of all parties involved.

Q: What happens if there are not enough funds in the escrow account to pay the estate taxes?

A: If there are not enough funds in the escrow account to pay the estate taxes, additional funds may need to be obtained or the real property may need to be sold to cover the tax liability.

Q: Who is responsible for funding the escrow account?

A: The responsibility for funding the escrow account is typically outlined in the Estate Tax Escrow Agreement and may vary depending on the terms of the agreement.

Q: Can an Estate Tax Escrow Agreement be used for other types of taxes?

A: While the primary purpose of an Estate Tax Escrow Agreement is to cover estate taxes, it may also be used to hold funds for other types of taxes that may be assessed on the estate.

Q: Are there any legal requirements for an Estate Tax Escrow Agreement?

A: The specific legal requirements for an Estate Tax Escrow Agreement may vary by state, so it is important to consult with an attorney familiar with the laws in your state when creating or modifying an agreement.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.