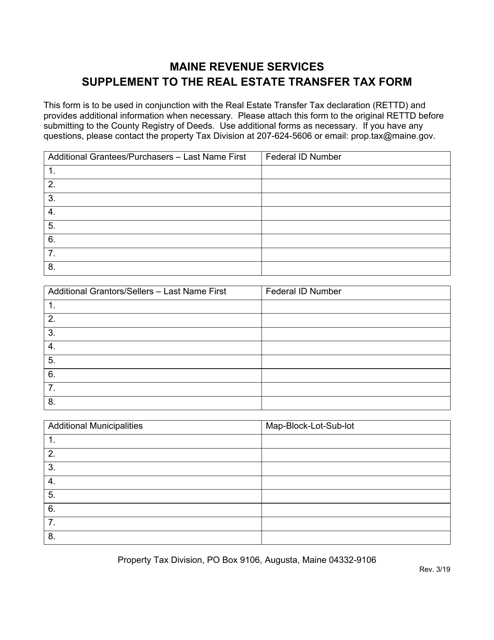

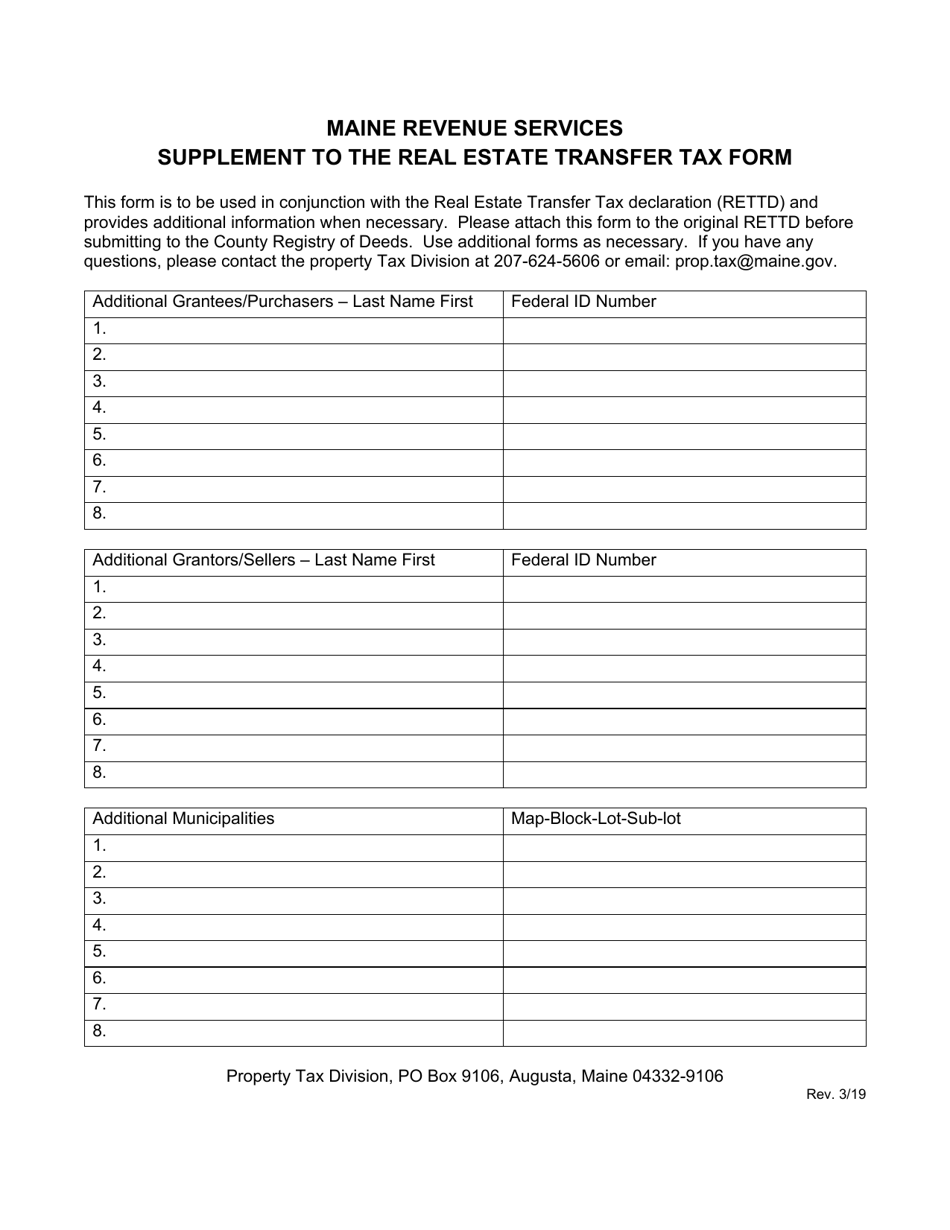

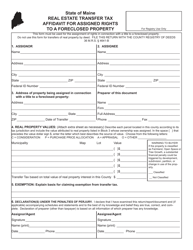

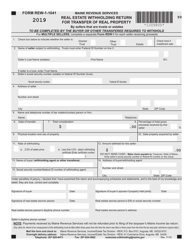

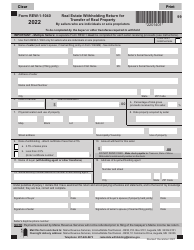

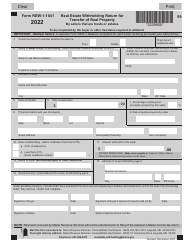

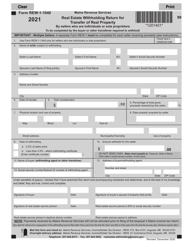

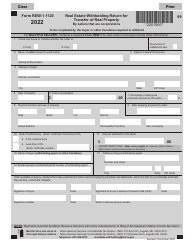

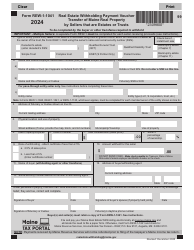

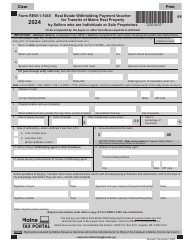

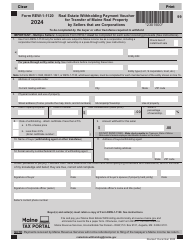

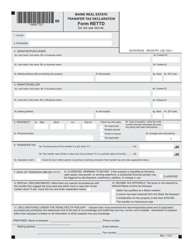

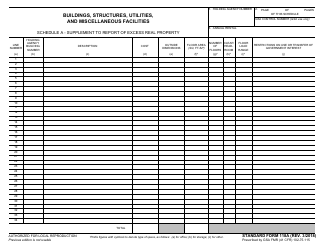

Supplement to the Real Estate Transfer Tax Form - Maine

Supplement to the Real Estate Transfer Tax Form is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Real Estate Transfer Tax Form?

A: The Real Estate Transfer Tax Form is a document used in Maine to report the transfer of property and calculate the applicable transfer tax.

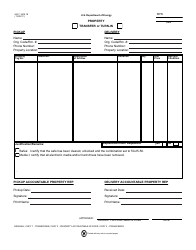

Q: Who needs to fill out the Supplement to the Real Estate Transfer Tax Form?

A: Any individual or entity involved in a real estate transfer in Maine, such as buyers, sellers, or their representatives, may need to fill out the supplement form.

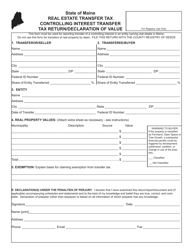

Q: What is the purpose of the Supplement to the Real Estate Transfer Tax Form?

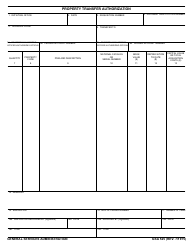

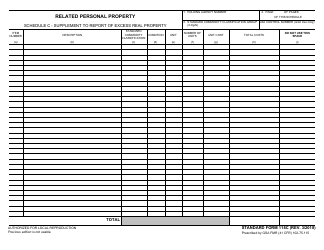

A: The supplement form provides additional information about the real estate transaction, such as property details, financing information, exemptions, and other relevant data.

Q: When should I submit the Supplement to the Real Estate Transfer Tax Form?

A: The supplement form should be submitted along with the Real Estate Transfer Tax Form at the time of the property transfer or within 30 days of the transfer.

Q: Is there a fee for filing the Supplement to the Real Estate Transfer Tax Form?

A: No, there is no separate fee for filing the supplement form. The transfer tax amount is paid based on the total consideration or value of the property being transferred.

Form Details:

- Released on March 1, 2019;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.