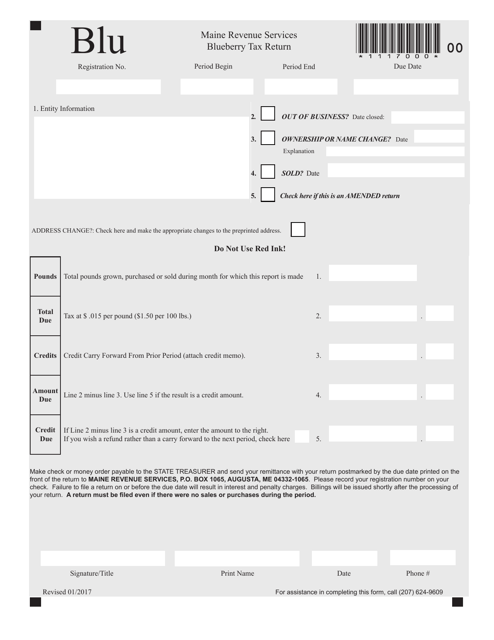

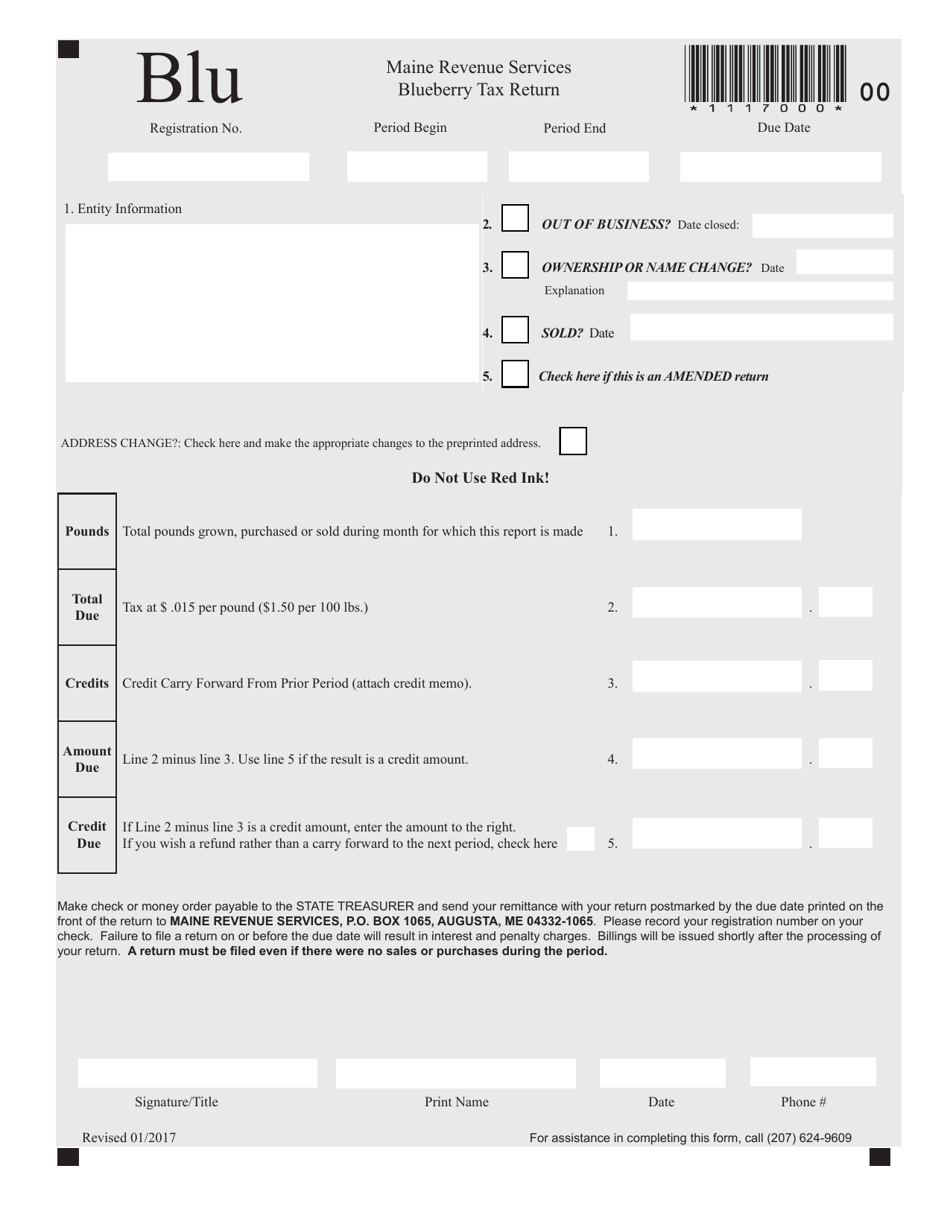

Blueberry Tax Return - Maine

Blueberry Tax Return is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Blueberry Tax Return?

A: The Blueberry Tax Return is a specific tax form used by blueberry growers in Maine.

Q: Who needs to file a Blueberry Tax Return?

A: Blueberry growers in Maine who meet certain criteria are required to file a Blueberry Tax Return.

Q: What is the purpose of the Blueberry Tax Return?

A: The purpose of the Blueberry Tax Return is to report income and expenses related to blueberry cultivation in Maine.

Q: How do I obtain a Blueberry Tax Return form?

A: You can obtain a Blueberry Tax Return form by contacting the Maine Department of Revenue Services.

Q: When is the deadline to file a Blueberry Tax Return?

A: The deadline to file a Blueberry Tax Return is typically April 15 of each year.

Q: What happens if I don't file a Blueberry Tax Return?

A: Failure to file a Blueberry Tax Return may result in penalties and interest imposed by the Maine Department of Revenue Services.

Q: Are there any deductions or credits available on the Blueberry Tax Return?

A: Yes, there may be deductions and credits available for blueberry growers in Maine. Consult the instructions for the form or a tax professional for more information.

Q: Can I e-file my Blueberry Tax Return?

A: Yes, you can e-file your Blueberry Tax Return if you choose to do so. Check with the Maine Department of Revenue Services for more details.

Q: Does filing a Blueberry Tax Return affect my federal tax return?

A: The Blueberry Tax Return is specific to the state of Maine and is separate from your federal tax return. However, the information reported on your Blueberry Tax Return may impact certain aspects of your federal tax return. It is recommended to consult a tax professional for guidance.

Form Details:

- Released on January 1, 2017;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.