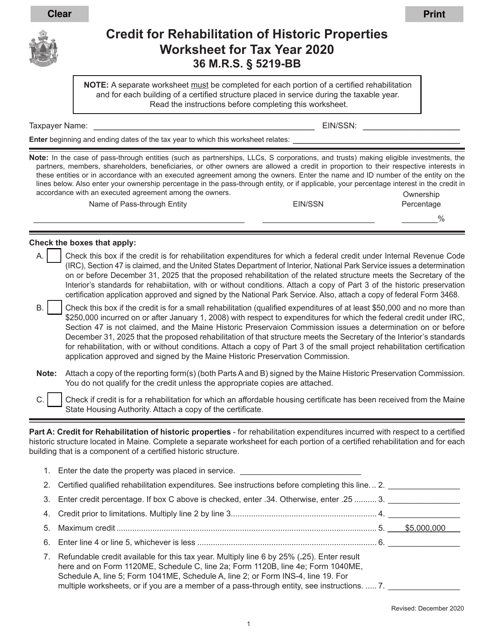

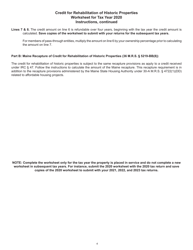

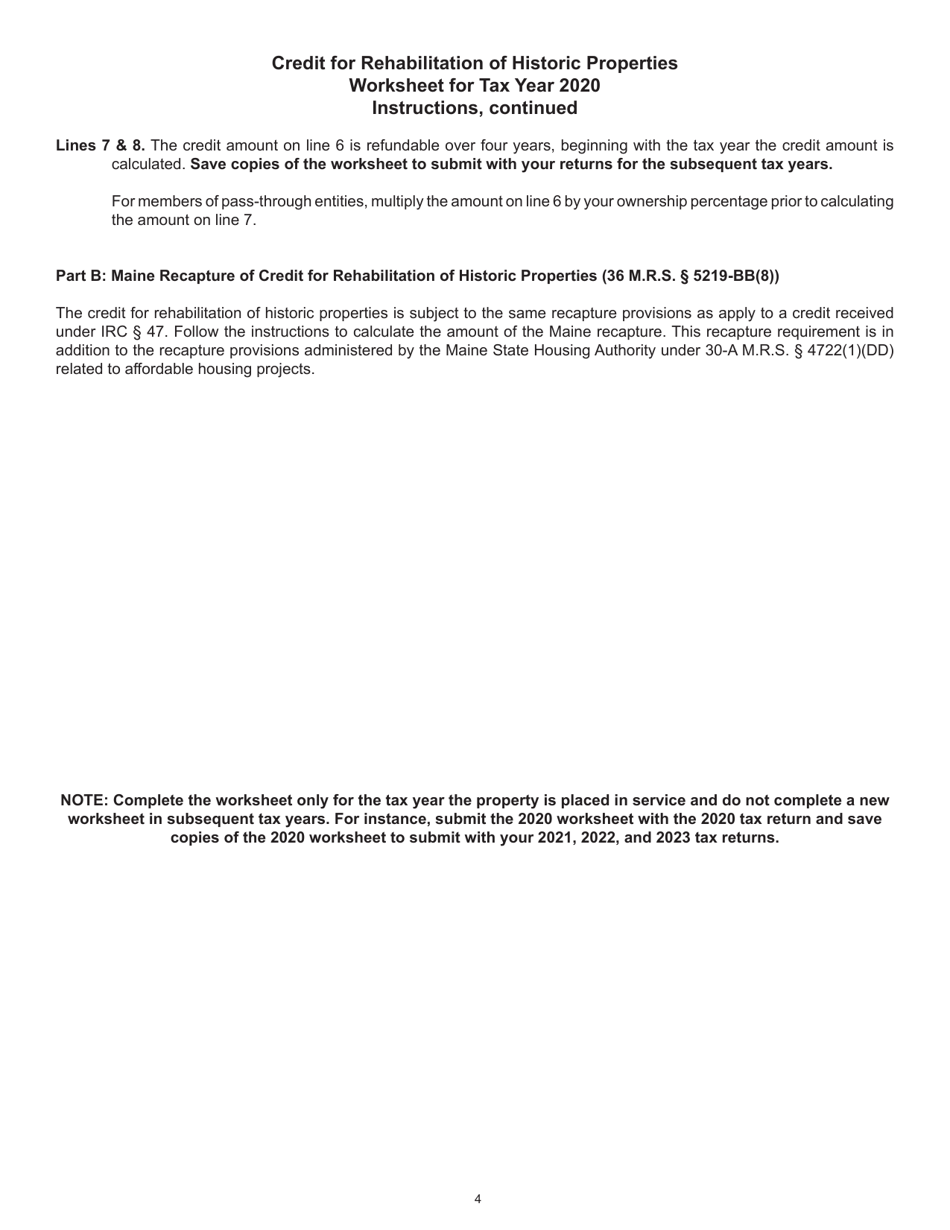

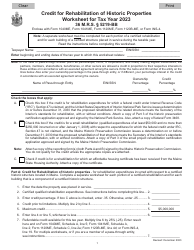

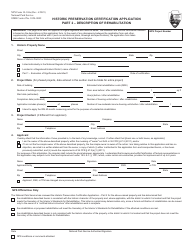

Credit for Rehabilitation of Historic Properties Worksheet - Maine

Credit for Rehabilitation of Historic Properties Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a rehabilitation tax credit?

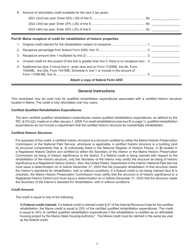

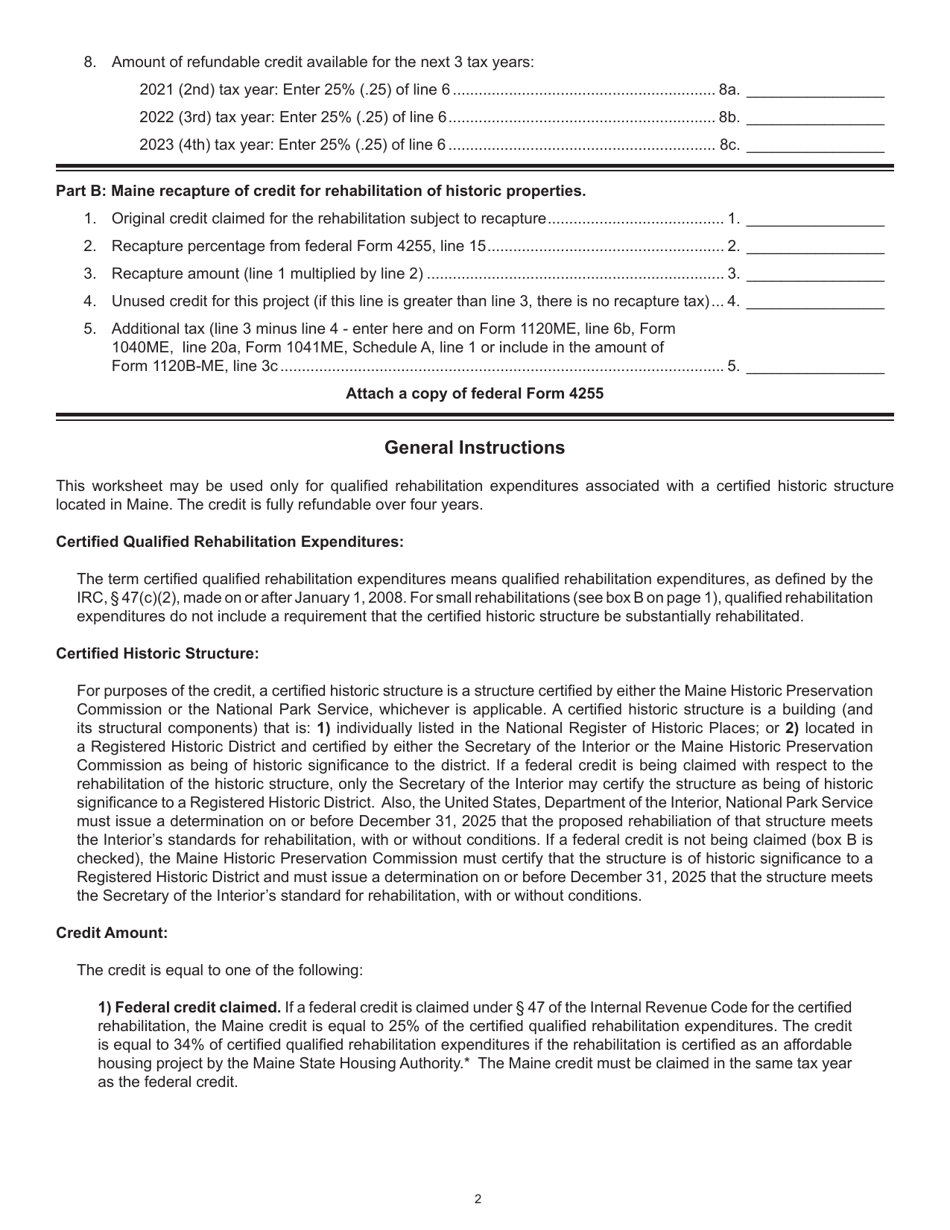

A: A rehabilitation tax credit is a financial incentive provided to individuals or businesses who invest in the rehabilitation of historic properties.

Q: Why does Maine offer a rehabilitation tax credit?

A: Maine offers a rehabilitation tax credit to encourage the preservation and revitalization of historic properties.

Q: Who is eligible for the rehabilitation tax credit in Maine?

A: Both individuals and businesses are eligible for the rehabilitation tax credit in Maine.

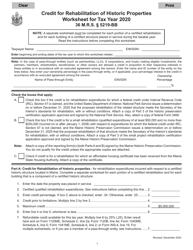

Q: How much is the rehabilitation tax credit in Maine?

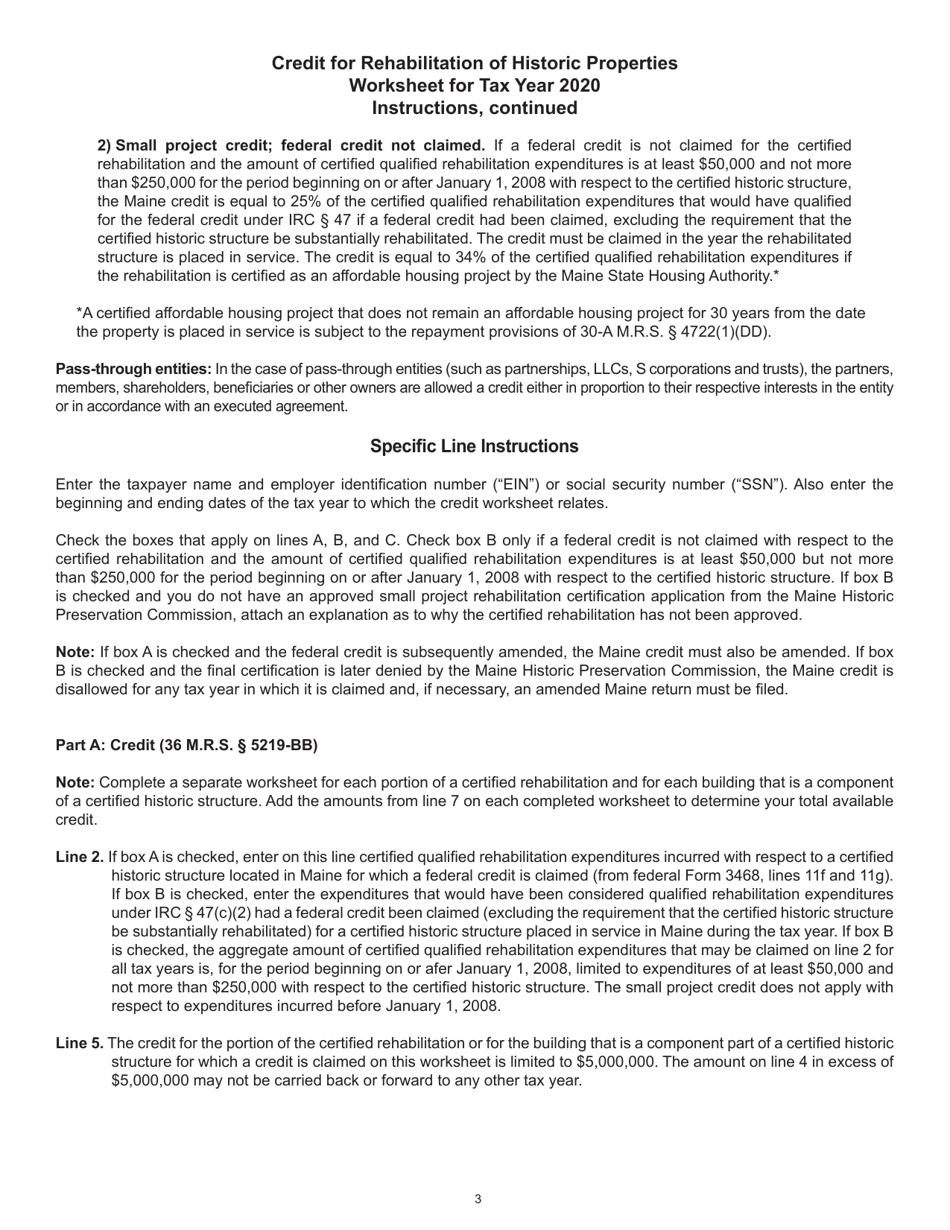

A: The rehabilitation tax credit in Maine can be up to 25% of the qualifying rehabilitation expenditures.

Q: What types of properties are eligible for the rehabilitation tax credit in Maine?

A: Properties listed on the National Register of Historic Places or determined to be eligible for listing are generally eligible for the rehabilitation tax credit in Maine.

Q: What are the requirements for the rehabilitation tax credit in Maine?

A: To qualify for the rehabilitation tax credit in Maine, the property must meet certain criteria, such as being a certified historic structure and meeting the substantial rehabilitation test.

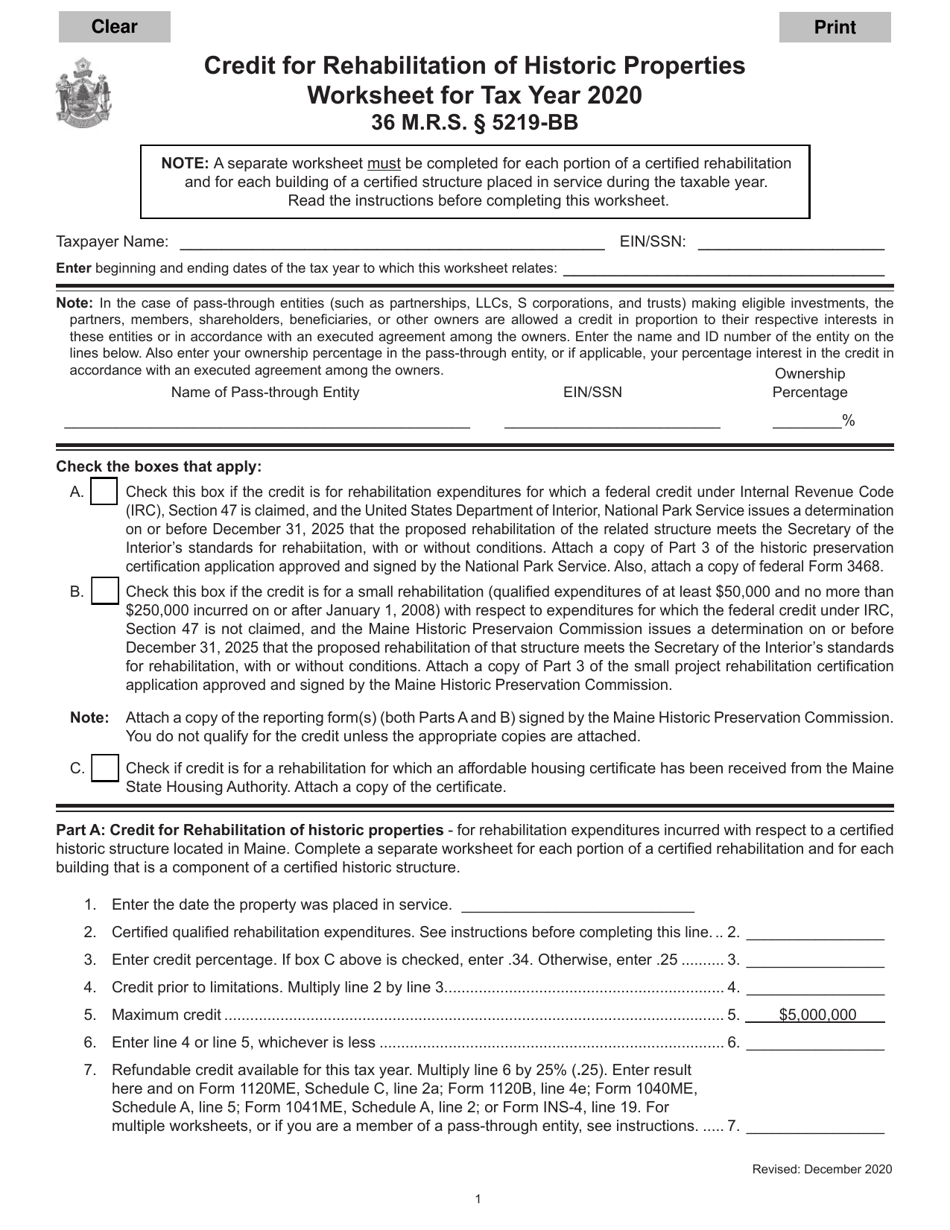

Q: Is the rehabilitation tax credit in Maine refundable?

A: Yes, the rehabilitation tax credit in Maine is refundable, meaning it can be used to offset state income tax liability or applied for a refund.

Q: Are there any limitations to the rehabilitation tax credit in Maine?

A: Yes, there are limitations to the rehabilitation tax credit in Maine, including a $5 million cap per project and a $50 million statewide cap per year.

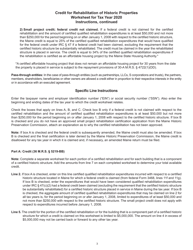

Q: How can I apply for the rehabilitation tax credit in Maine?

A: To apply for the rehabilitation tax credit in Maine, you need to submit an application to the Maine Historic Preservation Commission along with supporting documentation.

Q: Are there any other incentives for rehabilitating historic properties in Maine?

A: Yes, in addition to the rehabilitation tax credit, Maine also offers other incentives such as property tax relief and grants for preservation projects.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.