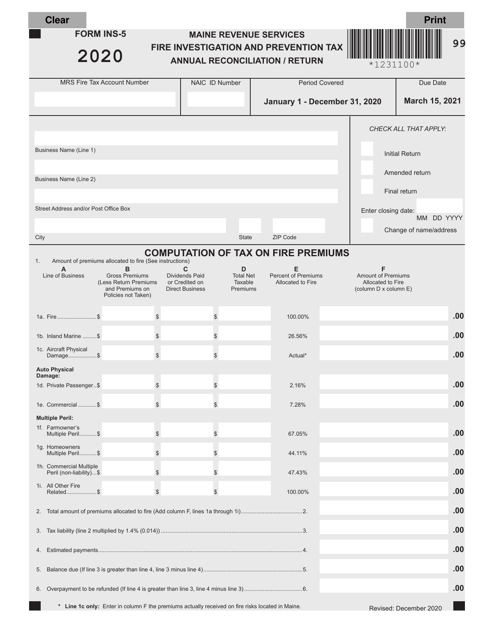

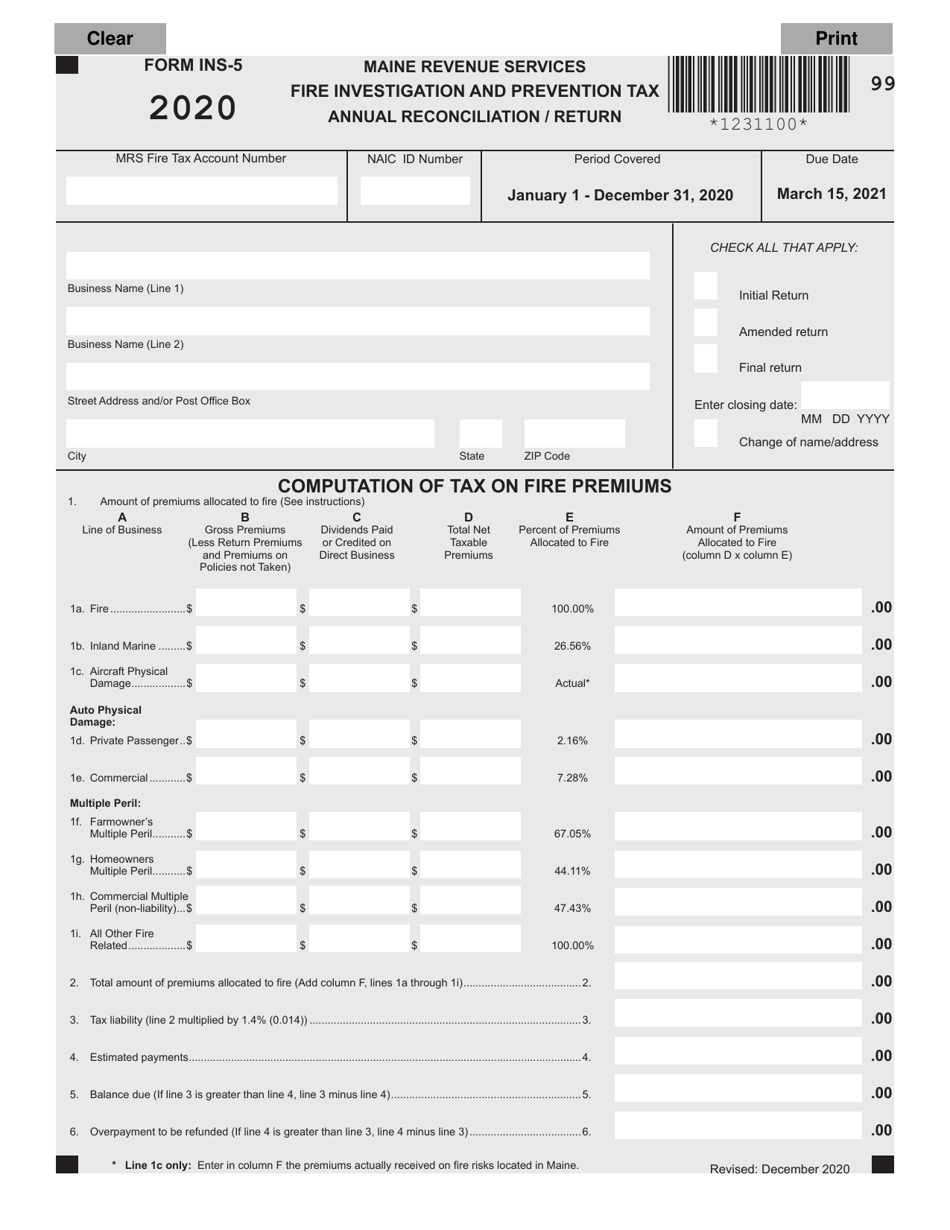

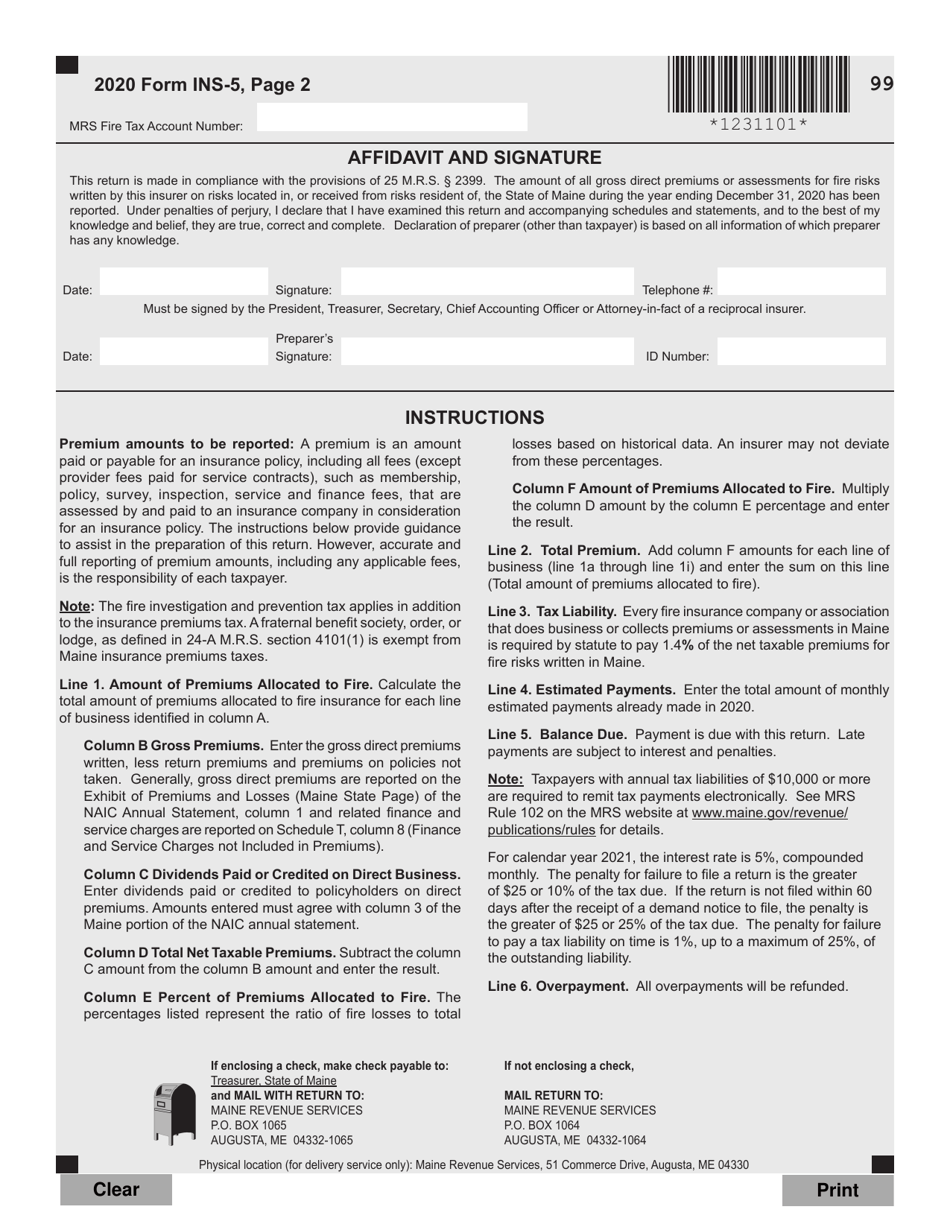

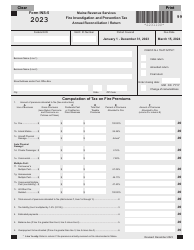

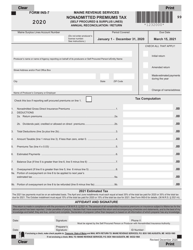

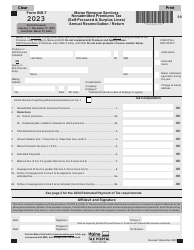

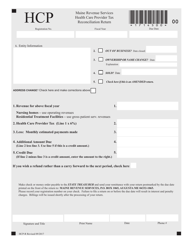

Form INS-5 Fire Investigation and Prevention Tax Annual Reconciliation / Return - Maine

What Is Form INS-5?

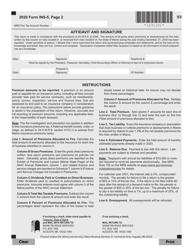

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INS-5?

A: Form INS-5 is the Fire Investigation and Prevention Tax Annual Reconciliation/Return for Maine.

Q: Who needs to file Form INS-5?

A: Fire insurers and surplus lines insurers operating in Maine need to file Form INS-5.

Q: What is the purpose of Form INS-5?

A: Form INS-5 is used to report and reconcile the fire investigation and prevention tax liability for the previous calendar year.

Q: When is Form INS-5 due?

A: Form INS-5 is due on or before March 1st of each year.

Q: Are there any penalties for not filing Form INS-5?

A: Yes, there are penalties for not filing Form INS-5 or for filing it late. It is important to file on time to avoid penalties.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INS-5 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.