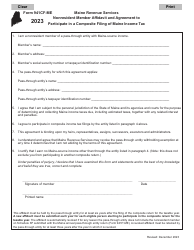

This version of the form is not currently in use and is provided for reference only. Download this version of

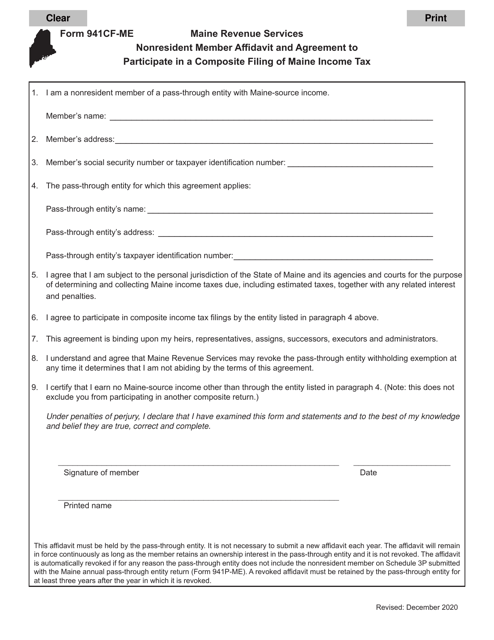

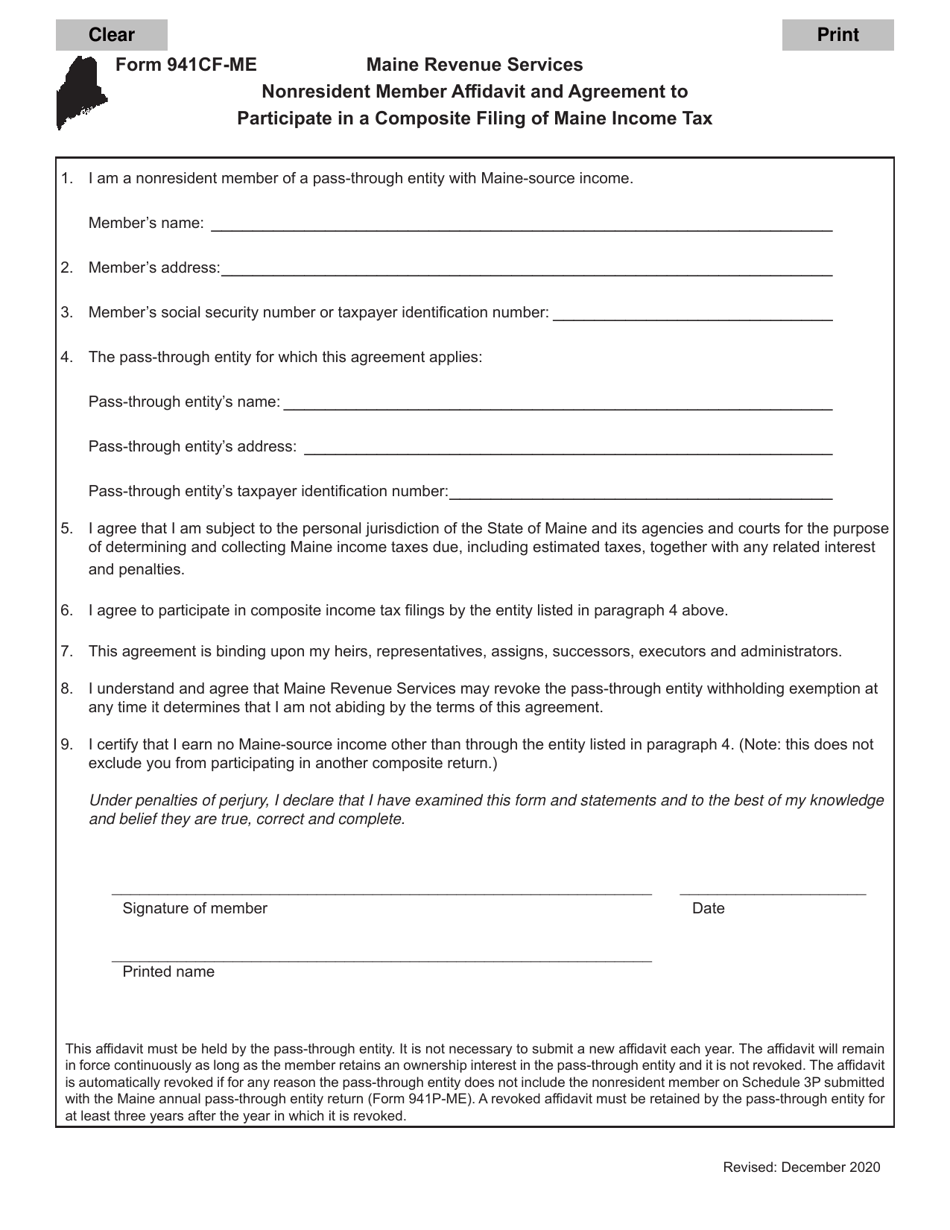

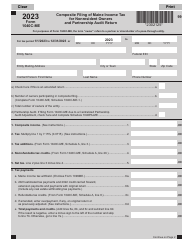

Form 941CF-ME

for the current year.

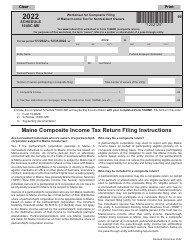

Form 941CF-ME Nonresident Member Affidavit and Agreement to Participate in a Composite Filing of Maine Income Tax - Maine

What Is Form 941CF-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

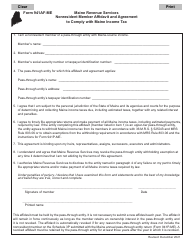

Q: What is Form 941CF-ME?

A: Form 941CF-ME is the Nonresident Member Affidavit and Agreement to Participate in a Composite Filing of Maine Income Tax.

Q: Who needs to file Form 941CF-ME?

A: Nonresident members of a partnership or S corporation in Maine who wish to participate in a composite filing of Maine income tax need to file Form 941CF-ME.

Q: What is a composite filing?

A: A composite filing is when a partnership or S corporation files a single income tax return on behalf of its nonresident members.

Q: What is the purpose of Form 941CF-ME?

A: The purpose of Form 941CF-ME is to gather information and obtain the agreement of nonresident members to participate in a composite filing of Maine income tax.

Q: When is Form 941CF-ME due?

A: Form 941CF-ME is usually due on the same date as the composite return for the partnership or S corporation, which is generally the 15th day of the fourth month following the close of the tax year.

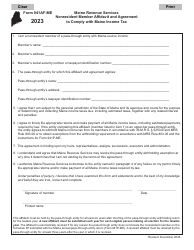

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941CF-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.