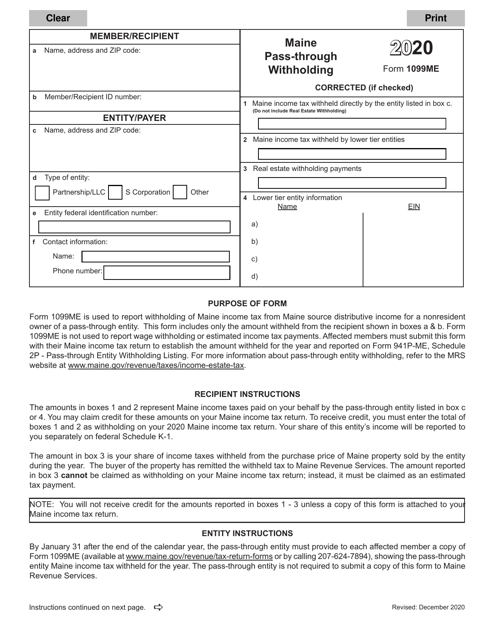

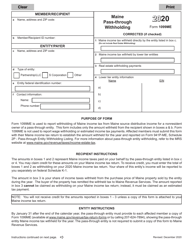

This version of the form is not currently in use and is provided for reference only. Download this version of

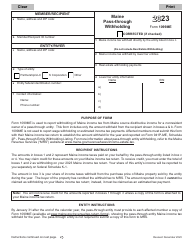

Form 1099ME

for the current year.

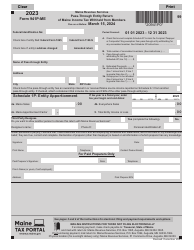

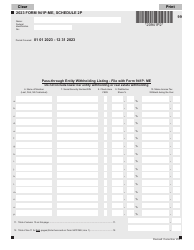

Form 1099ME Maine Pass-Through Withholding - Maine

What Is Form 1099ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1099-ME?

A: Form 1099-ME is a tax form used to report Maine pass-through withholding.

Q: Who needs to file Form 1099-ME?

A: Anyone who has withheld Maine pass-through taxes on payments made to non-resident owners or partners needs to file Form 1099-ME.

Q: What is Maine pass-through withholding?

A: Maine pass-through withholding is the tax that is withheld on payments made to non-resident owners or partners of Maine pass-through entities.

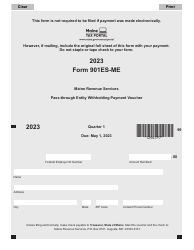

Q: When is Form 1099-ME due?

A: Form 1099-ME is due on or before January 31st of the following year.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1099ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.