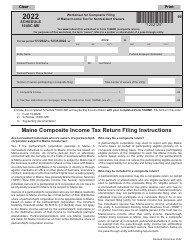

This version of the form is not currently in use and is provided for reference only. Download this version of

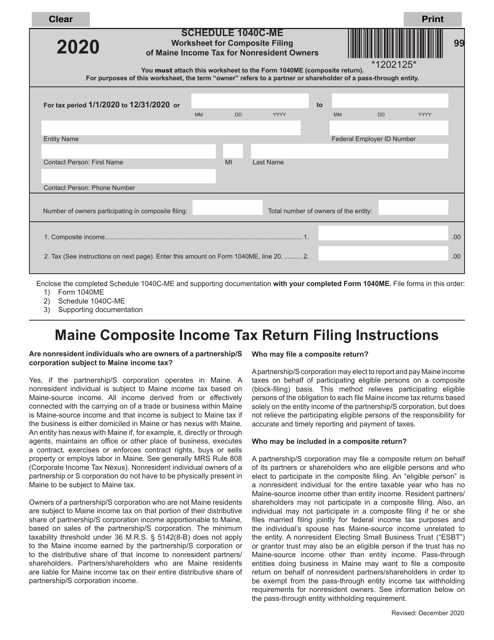

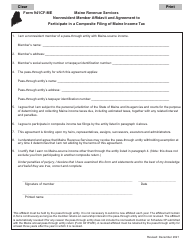

Schedule 1040C-ME

for the current year.

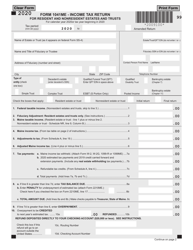

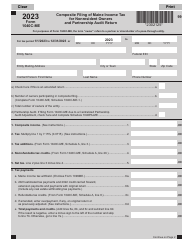

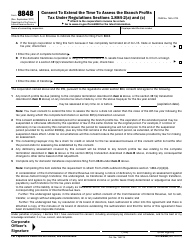

Schedule 1040C-ME Worksheet for Composite Filing of Maine Income Tax for Nonresident Owners - Maine

What Is Schedule 1040C-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule 1040C-ME worksheet used for?

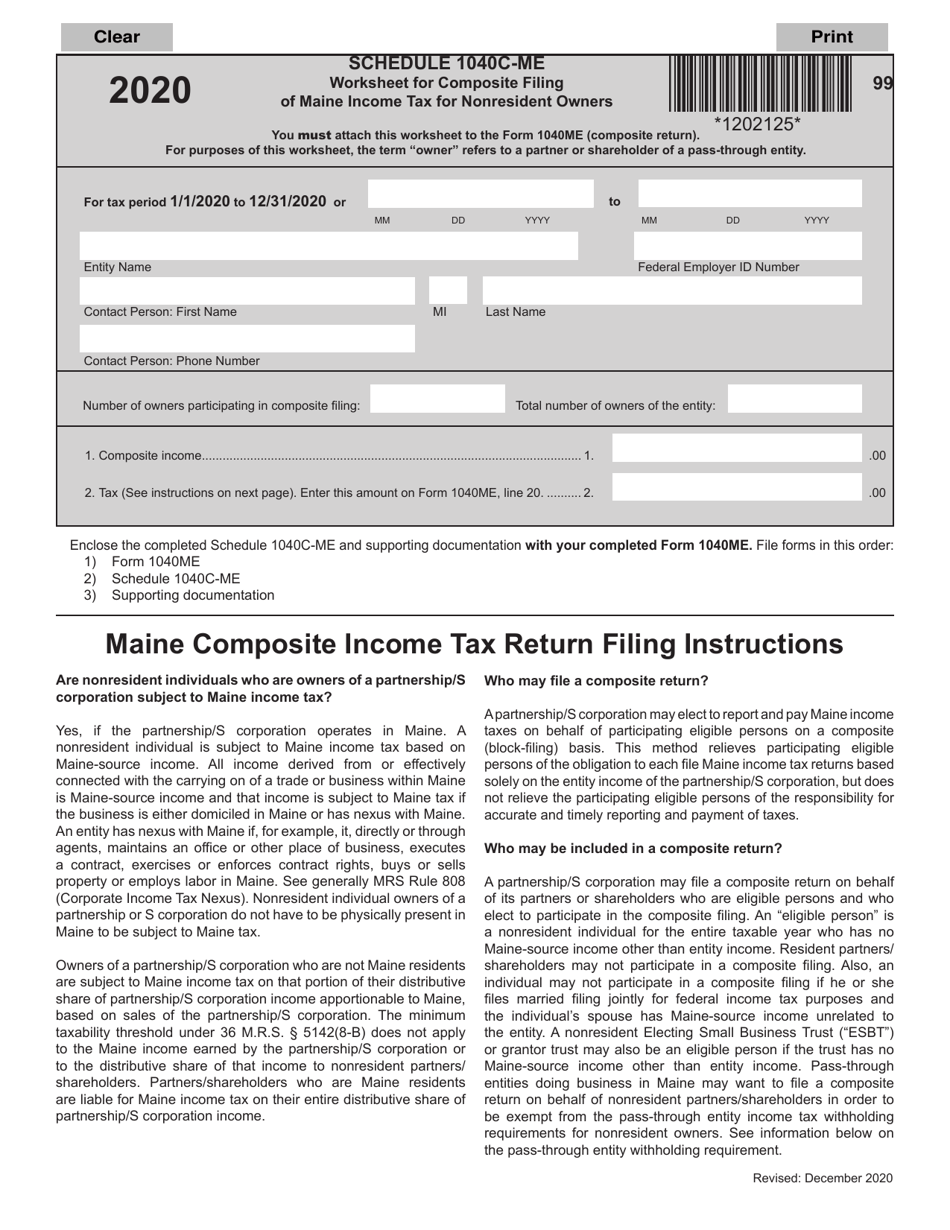

A: The Schedule 1040C-ME worksheet is used for composite filing of Maine income tax for nonresident owners.

Q: Who should use the Schedule 1040C-ME worksheet?

A: The Schedule 1040C-ME worksheet should be used by nonresident owners who need to file a composite tax return for Maine income.

Q: What is composite filing?

A: Composite filing is when a pass-through entity files a tax return on behalf of its nonresident owners.

Q: What is a nonresident owner?

A: A nonresident owner is someone who owns shares or interests in a pass-through entity but does not reside in Maine.

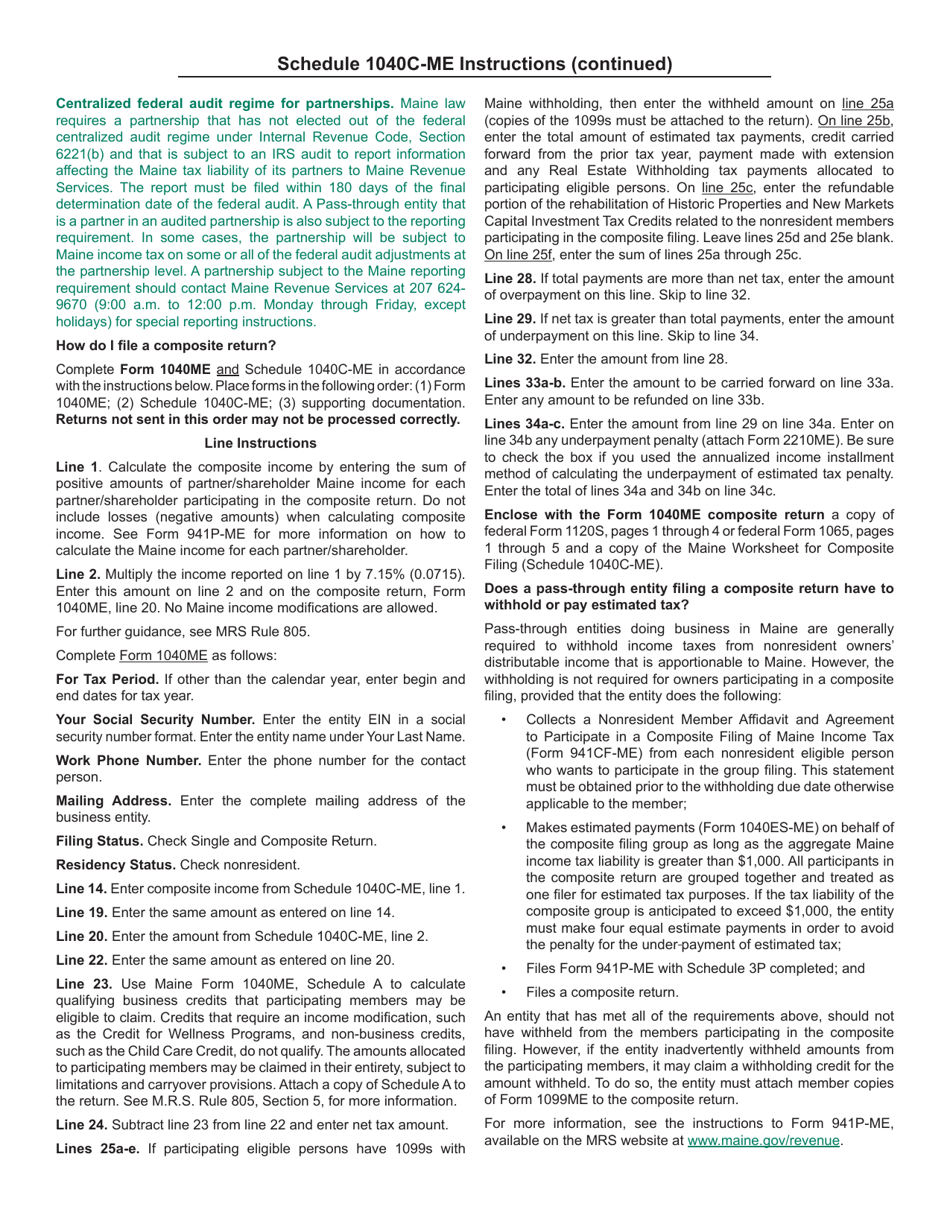

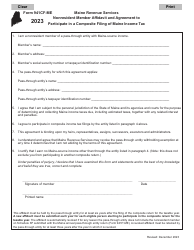

Q: What information is needed to complete the Schedule 1040C-ME worksheet?

A: To complete the Schedule 1040C-ME worksheet, you will need information such as the pass-through entity's federal identification number, the nonresident owners' names and addresses, and their share of income and deductions.

Q: Is the Schedule 1040C-ME worksheet mandatory for nonresident owners?

A: No, the Schedule 1040C-ME worksheet is not mandatory for nonresident owners. They have the option to file their own individual tax returns instead.

Q: Are there any deadlines for filing the Schedule 1040C-ME worksheet?

A: Yes, the deadline for filing the Schedule 1040C-ME worksheet is the same as the deadline for filing the pass-through entity's tax return, which is usually April 15th.

Q: What are the consequences of not filing the Schedule 1040C-ME worksheet?

A: If you do not file the Schedule 1040C-ME worksheet, you may be subject to penalties and interest on the unpaid tax amount.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1040C-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.