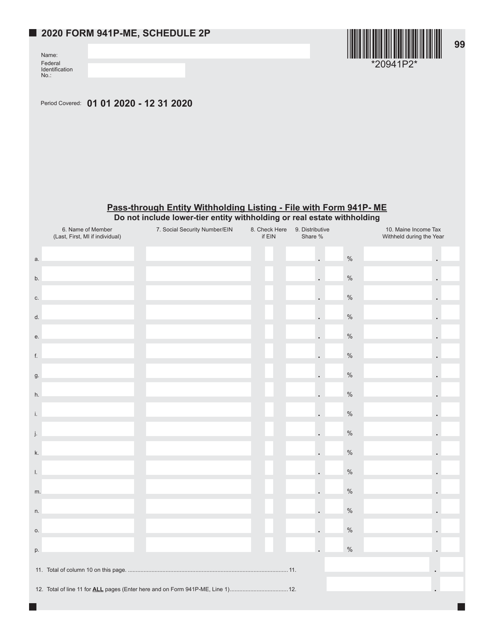

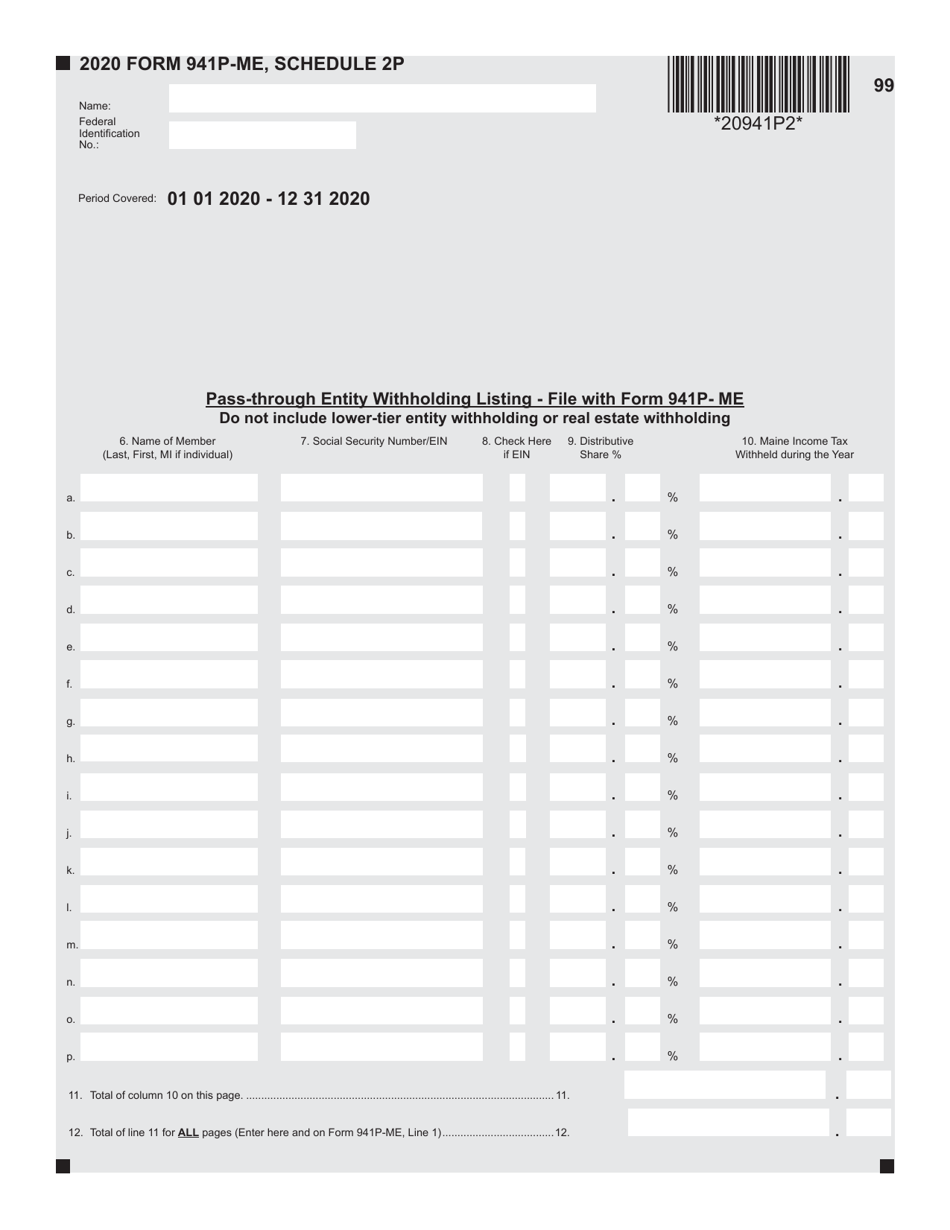

Form 941P-ME Schedule 2P Withholding Listing Page - Maine

What Is Form 941P-ME Schedule 2P?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 941P-ME Schedule 2P?

A: Form 941P-ME Schedule 2P is a tax form used in Maine to report withholding taxes.

Q: What is the purpose of Schedule 2P?

A: The purpose of Schedule 2P is to provide a listing of the amounts withheld from employees' wages.

Q: Who needs to file Schedule 2P?

A: Employers in Maine who have withheld taxes from their employees' wages need to file Schedule 2P.

Q: When is Schedule 2P due?

A: Schedule 2P must be filed quarterly. The due dates are April 30, July 31, October 31, and January 31.

Q: What information do I need to complete Schedule 2P?

A: You will need to provide the names and Social Security numbers of your employees, as well as the amounts withheld from each employee's wages.

Q: Is Schedule 2P the only form I need to file for withholding taxes in Maine?

A: No, in addition to Schedule 2P, you will also need to file Form 941P-ME to report your total Maine income tax withheld.

Q: What happens if I don't file Schedule 2P?

A: If you don't file Schedule 2P or file it late, you may be subject to penalties and interest charges.

Q: Can I file Schedule 2P electronically?

A: Yes, Maine Revenue Services offers the option to file Schedule 2P electronically.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941P-ME Schedule 2P by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.