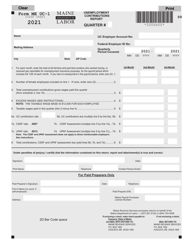

This version of the form is not currently in use and is provided for reference only. Download this version of

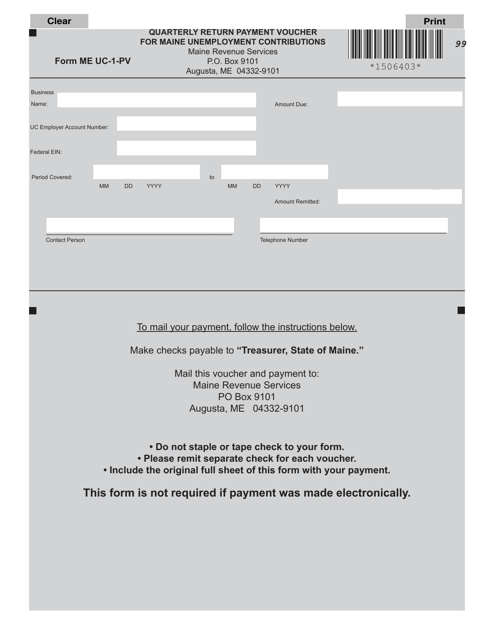

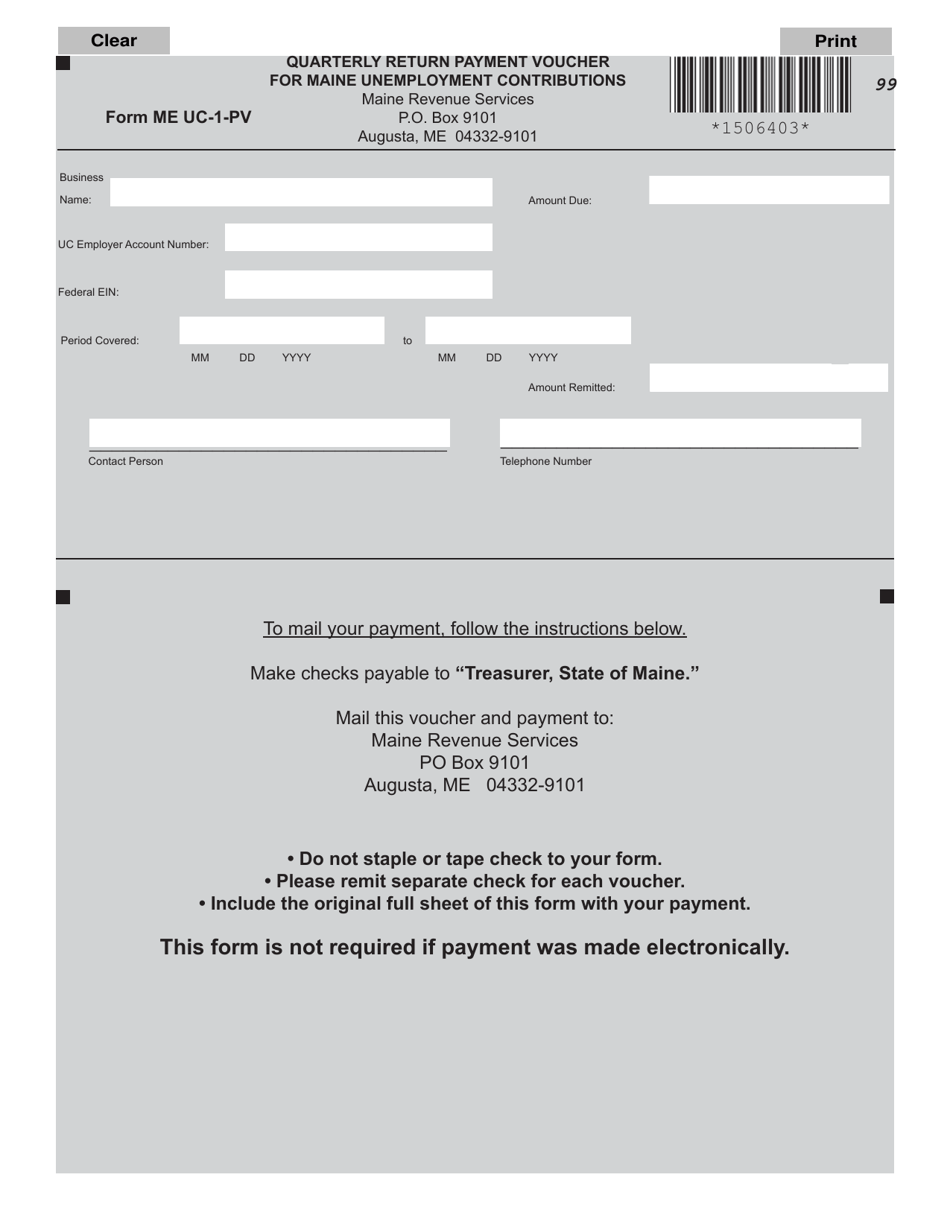

Form ME UC-1-PV

for the current year.

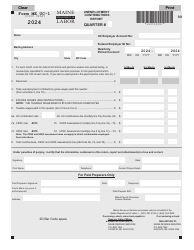

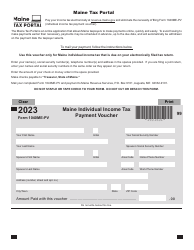

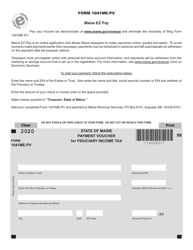

Form ME UC-1-PV Quarterly Return Payment Voucher for Maine Unemployment Contributions - Maine

What Is Form ME UC-1-PV?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ME UC-1-PV?

A: ME UC-1-PV is a Quarterly Return Payment Voucher for Maine Unemployment Contributions.

Q: Who needs to file ME UC-1-PV?

A: Employers in Maine who are liable for unemployment contributions must file ME UC-1-PV.

Q: What is the purpose of ME UC-1-PV?

A: The purpose of ME UC-1-PV is to report and pay quarterly unemployment contributions in Maine.

Q: When is ME UC-1-PV due?

A: ME UC-1-PV is due on a quarterly basis. The due date is the last day of the month following the end of each calendar quarter.

Q: Is there a penalty for late filing of ME UC-1-PV?

A: Yes, there is a penalty for late filing of ME UC-1-PV. The penalty amount varies depending on the number of days late.

Q: How do I calculate the amount to be paid on ME UC-1-PV?

A: The amount to be paid on ME UC-1-PV is calculated based on the wages subject to unemployment contributions and the applicable tax rate.

Q: What if I have no wages subject to Maine unemployment contributions for the quarter?

A: If you have no wages subject to Maine unemployment contributions for the quarter, you still need to file ME UC-1-PV and indicate zero wages.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ME UC-1-PV by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.