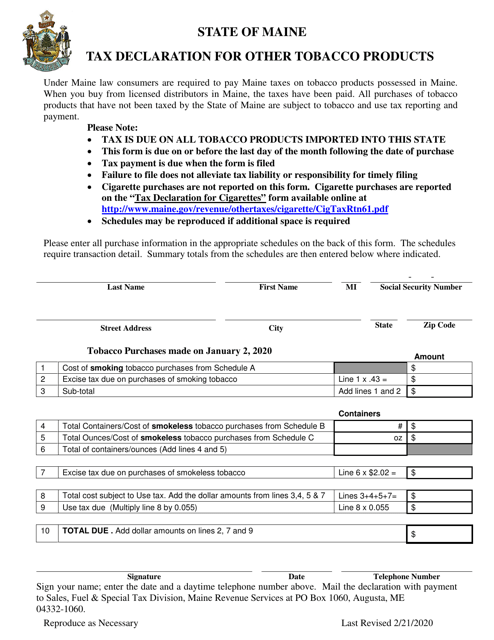

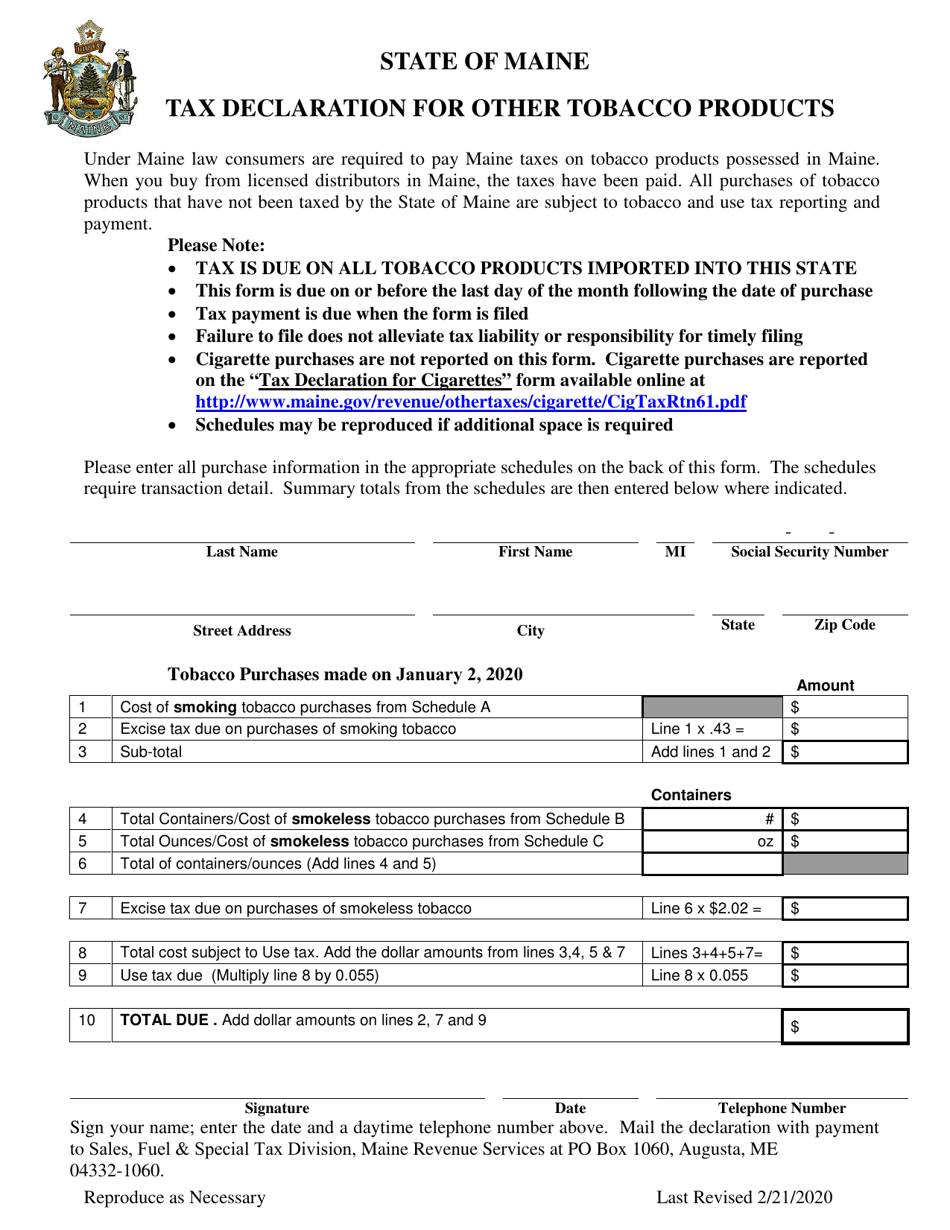

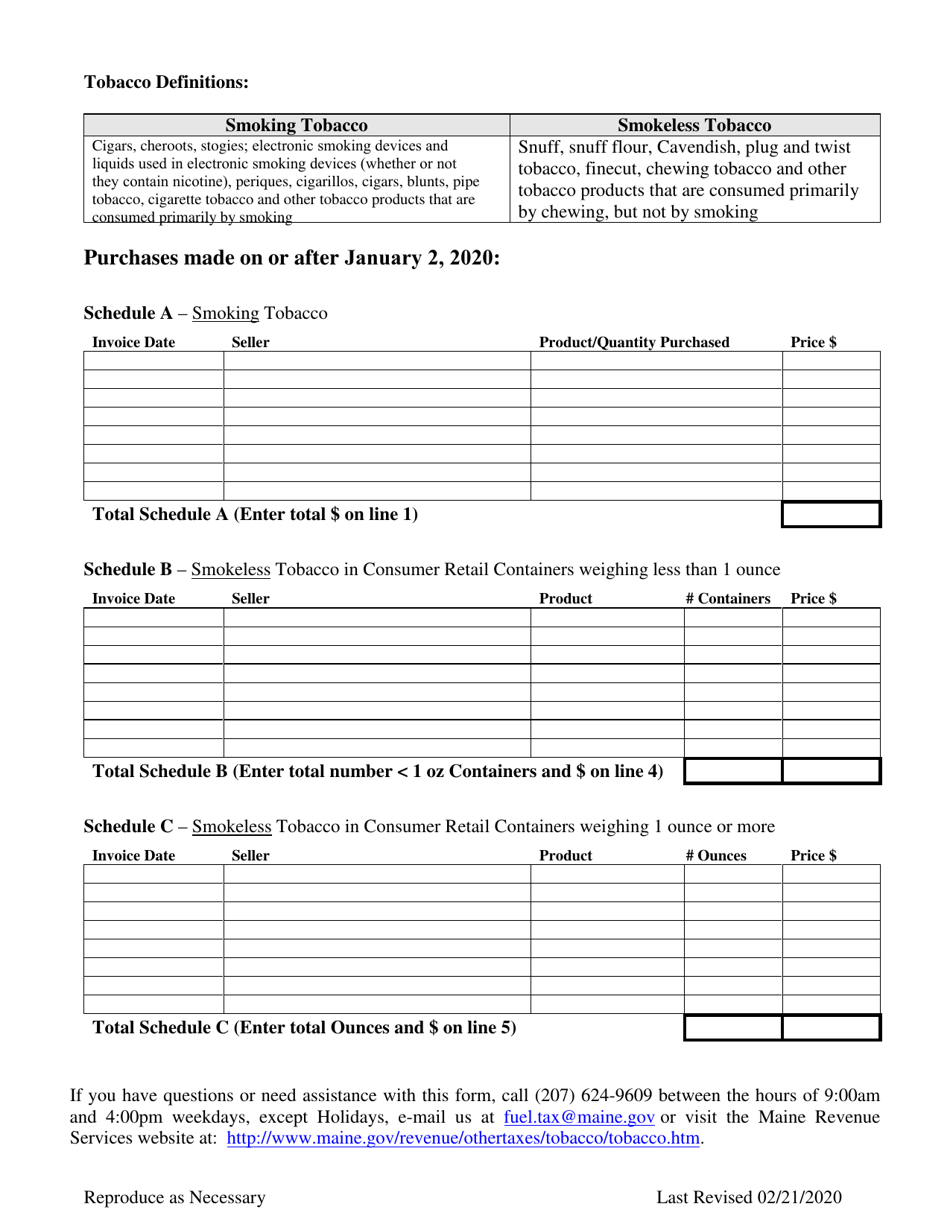

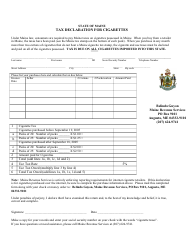

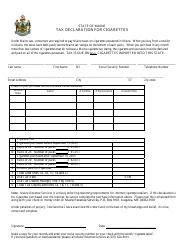

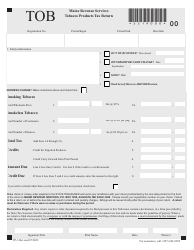

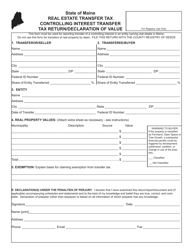

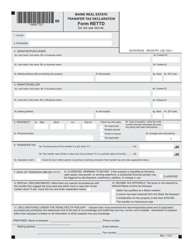

Tax Declaration for Other Tobacco Products - Maine

Tax Declaration for Other Tobacco Products is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a tax declaration for other tobacco products?

A: A tax declaration for other tobacco products is a form that must be filled out by businesses in Maine who sell or distribute tobacco products other than cigarettes.

Q: Who needs to file a tax declaration for other tobacco products in Maine?

A: Businesses that sell or distribute tobacco products other than cigarettes in Maine need to file a tax declaration for other tobacco products.

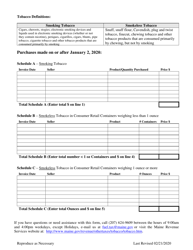

Q: What information is required in a tax declaration for other tobacco products in Maine?

A: The tax declaration for other tobacco products in Maine requires information such as the total quantity of products sold or distributed, the purchase price, and the total tax due.

Q: When is the deadline for filing a tax declaration for other tobacco products in Maine?

A: The deadline for filing a tax declaration for other tobacco products in Maine is usually the last day of the month following the end of the reporting period.

Q: Are there any penalties for not filing a tax declaration for other tobacco products in Maine?

A: Yes, there are penalties for not filing a tax declaration for other tobacco products in Maine, including late filing penalties and interest charges on the unpaid tax amount.

Form Details:

- Released on February 21, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.