Pine Tree Development Zone Tax Credit Worksheet - Maine

Pine Tree Development Zone Tax Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

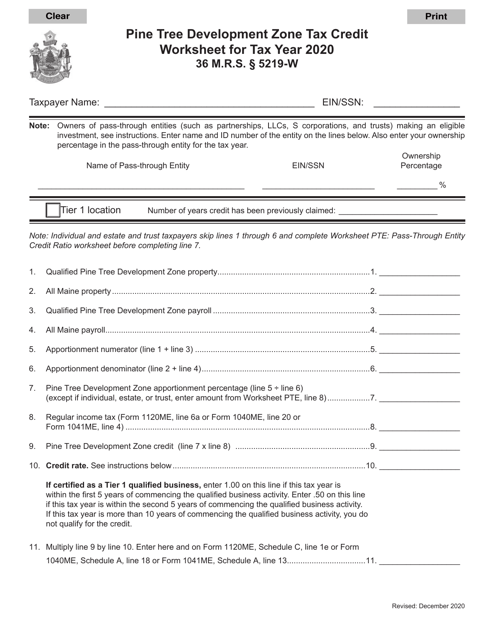

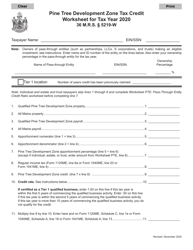

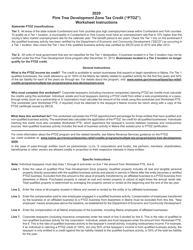

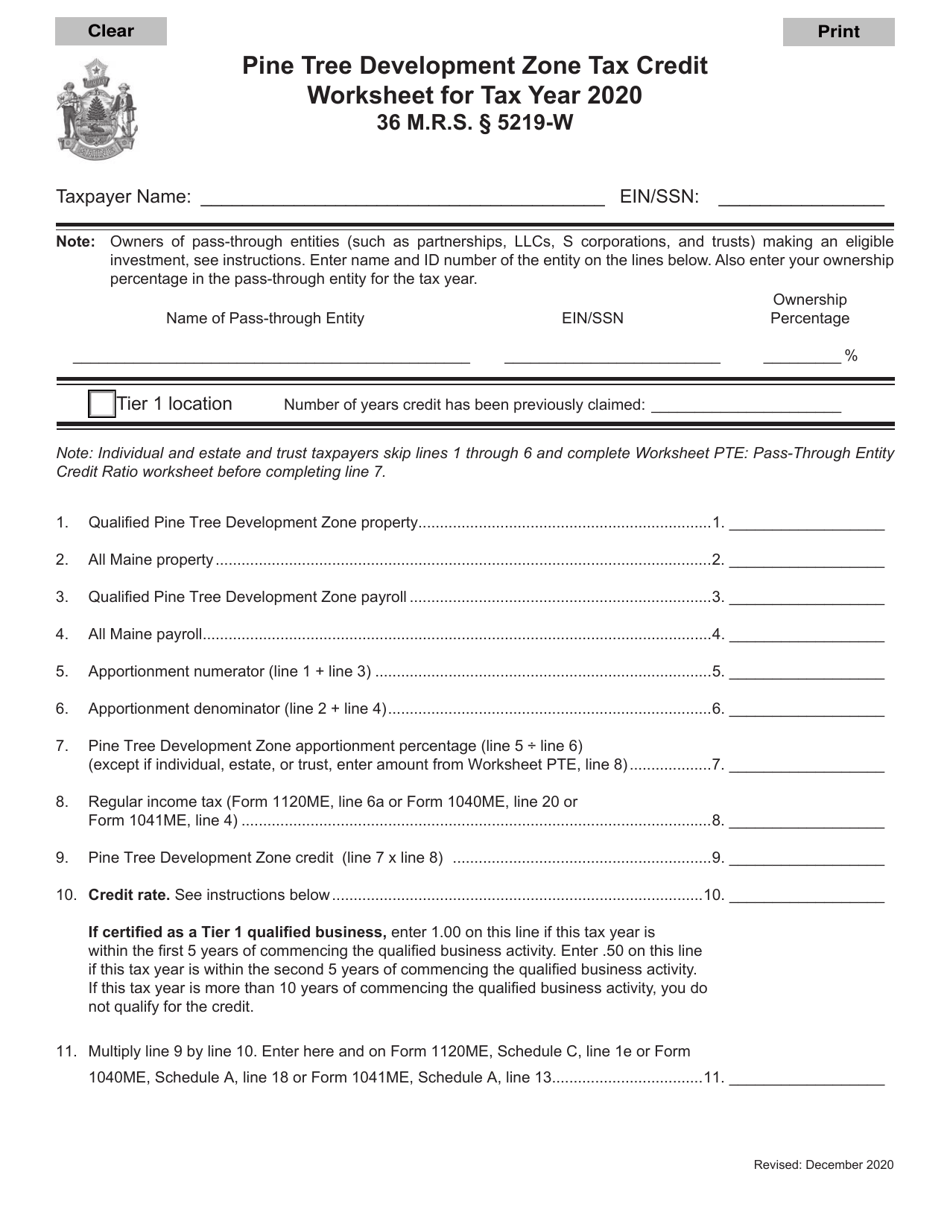

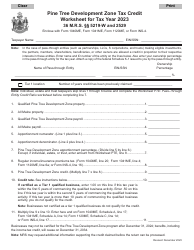

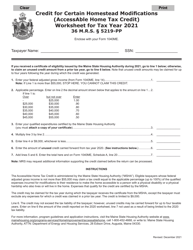

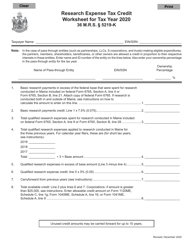

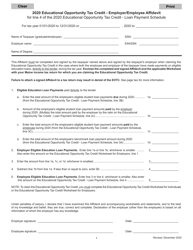

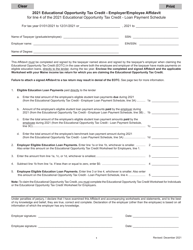

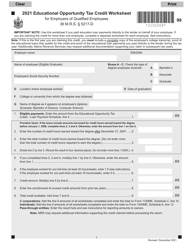

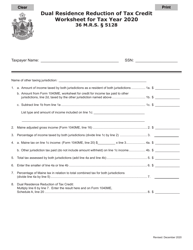

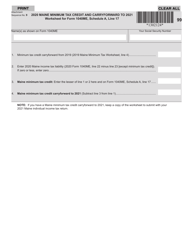

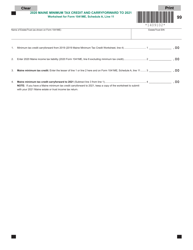

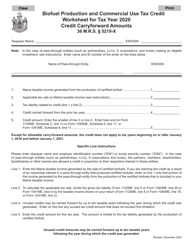

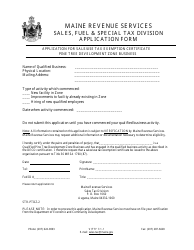

Q: What is the Pine Tree Development Zone Tax Credit Worksheet?

A: The Pine Tree Development Zone Tax Credit Worksheet is a document used in Maine to calculate tax credits for businesses operating in designated Pine Tree Development Zones.

Q: What is the purpose of the Pine Tree Development Zone Tax Credit?

A: The purpose of the Pine Tree Development Zone Tax Credit is to encourage business growth and job creation in designated Pine Tree Development Zones in Maine.

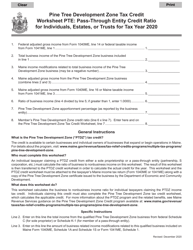

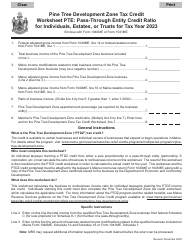

Q: Who is eligible for the Pine Tree Development Zone Tax Credit?

A: Businesses that meet certain criteria and operate within designated Pine Tree Development Zones in Maine may be eligible for the tax credit.

Q: What are Pine Tree Development Zones?

A: Pine Tree Development Zones are specific areas in Maine that have been designated as areas for targeted economic development and business expansion.

Q: What expenses can be considered for the Pine Tree Development Zone Tax Credit?

A: Expenses such as employee wages, benefits, and certain investments made in qualified property within the designated zones may be considered for the tax credit.

Q: How is the Pine Tree Development Zone Tax Credit calculated?

A: The tax credit amount is calculated based on a percentage of qualified expenses incurred by the business within the designated Pine Tree Development Zone.

Q: How can businesses claim the Pine Tree Development Zone Tax Credit?

A: Businesses must complete the Pine Tree Development Zone Tax Credit Worksheet and include it with their tax return to claim the tax credit.

Q: Are there any limitations or conditions for the Pine Tree Development Zone Tax Credit?

A: Yes, there are limitations and conditions for the tax credit, such as a maximum credit amount and requirements for maintaining employment levels in the designated zones.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.