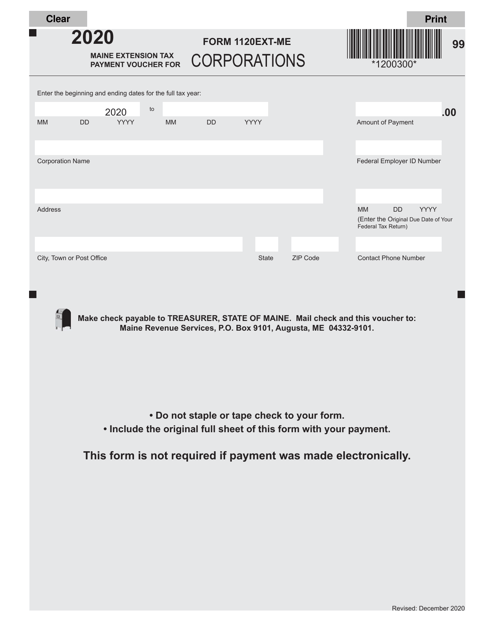

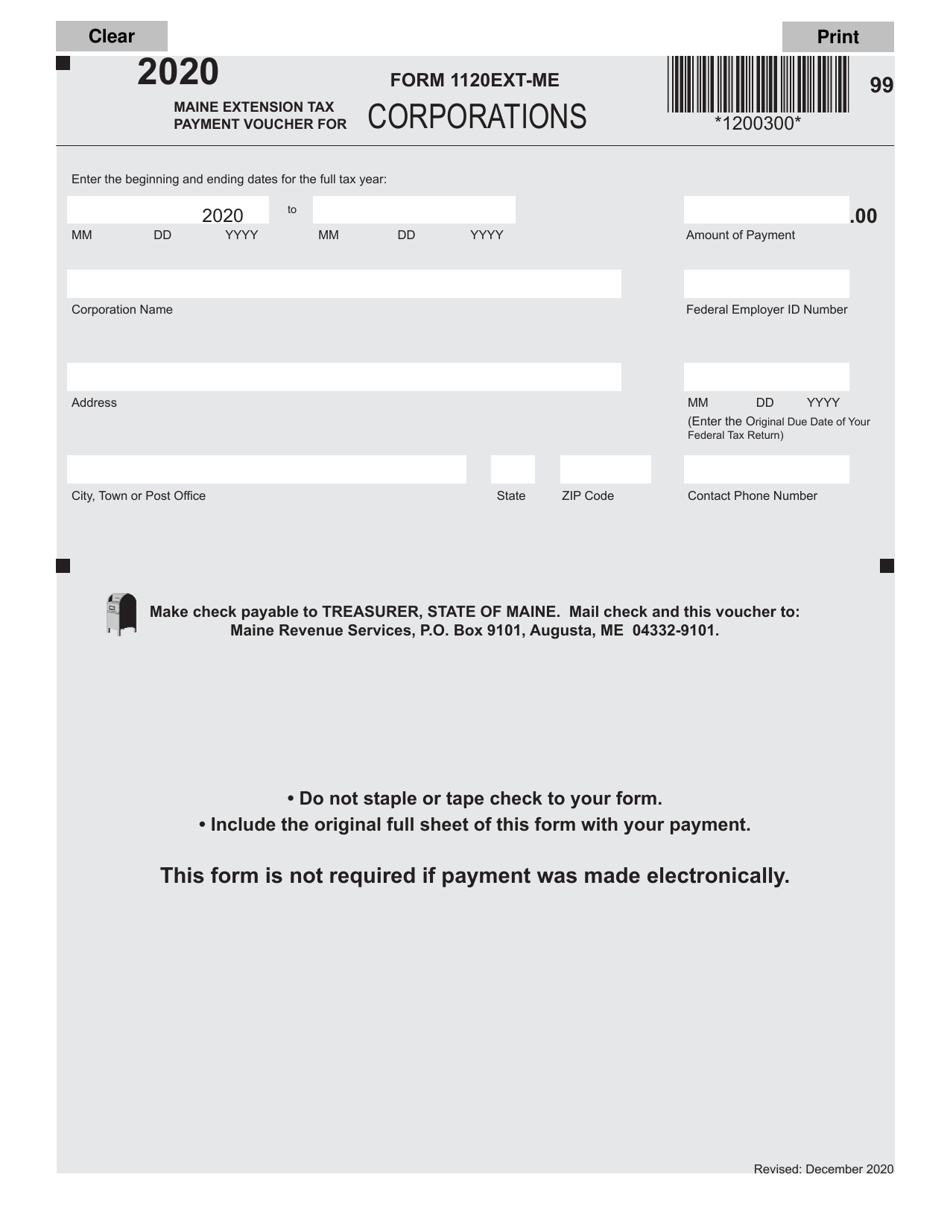

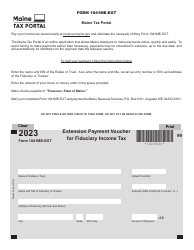

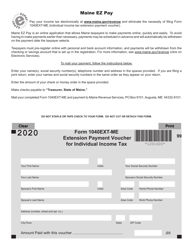

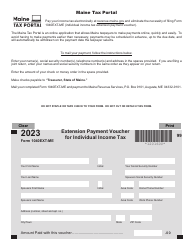

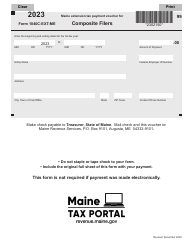

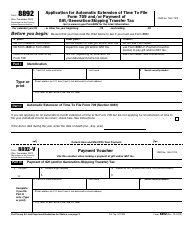

Form 1120EXT-ME Maine Extension Tax Payment Voucher for Corporations - Maine

What Is Form 1120EXT-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120EXT-ME?

A: Form 1120EXT-ME is the Maine Extension Tax Payment Voucher for Corporations.

Q: Who needs to file Form 1120EXT-ME?

A: Corporations that need to request an extension for filing their Maine corporate tax return.

Q: What is the purpose of Form 1120EXT-ME?

A: The purpose of Form 1120EXT-ME is to make an extension tax payment for Maine corporate taxes.

Q: When is Form 1120EXT-ME due?

A: Form 1120EXT-ME is due on the original due date of the Maine corporate tax return, usually on or around March 15th.

Q: Is there a penalty for not filing Form 1120EXT-ME?

A: Yes, there may be penalties for not filing Form 1120EXT-ME or paying the required amount by the due date.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120EXT-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.