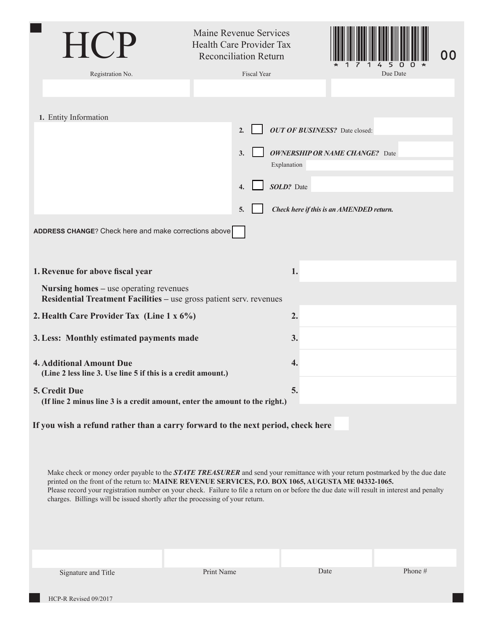

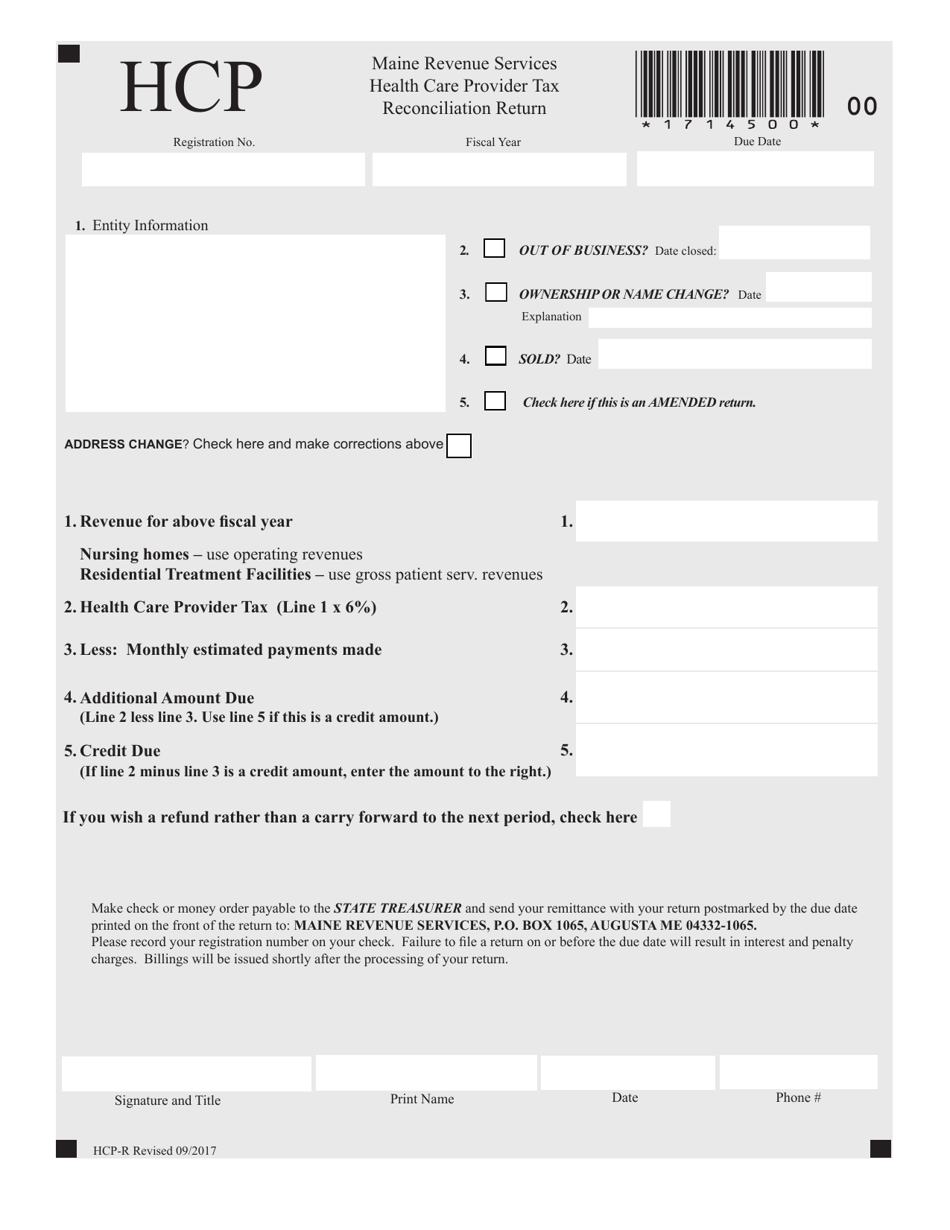

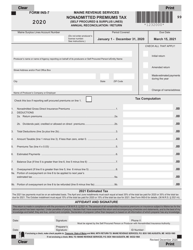

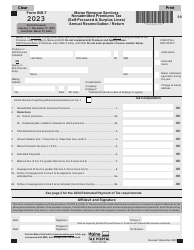

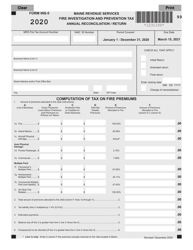

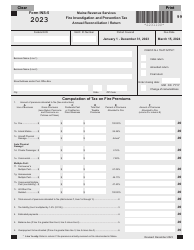

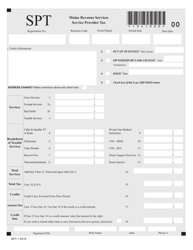

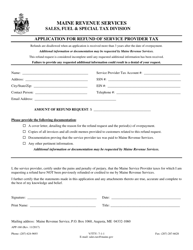

Form HCP-R Health Care Provider Tax Reconciliation Return - Maine

What Is Form HCP-R?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the HCP-R Health Care ProviderTax Reconciliation Return?

A: The HCP-R is a tax return form for health care providers in Maine.

Q: Who needs to file the HCP-R form?

A: Health care providers in Maine who are subject to the health care provider tax.

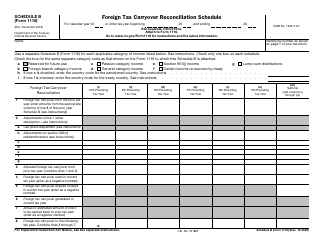

Q: What is the purpose of the HCP-R form?

A: The form is used to reconcile the health care provider tax liability for the year.

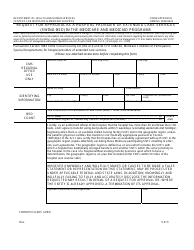

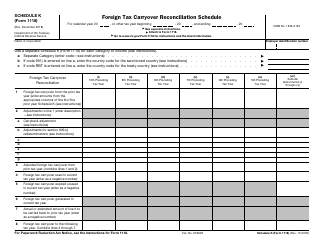

Q: What information is required on the HCP-R form?

A: The form requires the provider's name, address, federal ID number, and details about the health care services provided and the tax liability.

Q: When is the deadline to file the HCP-R form?

A: The form is due on or before April 30 of the year following the tax year.

Q: Are there any penalties for late or incorrect filing of the HCP-R form?

A: Yes, there are penalties for late or incorrect filing, including interest charges and potential legal action.

Q: Can I file the HCP-R form electronically?

A: Yes, Maine Revenue Services allows electronic filing of the HCP-R form.

Q: Is the HCP-R form applicable to health care providers in states other than Maine?

A: No, the HCP-R form is specific to health care providers in Maine.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCP-R by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.