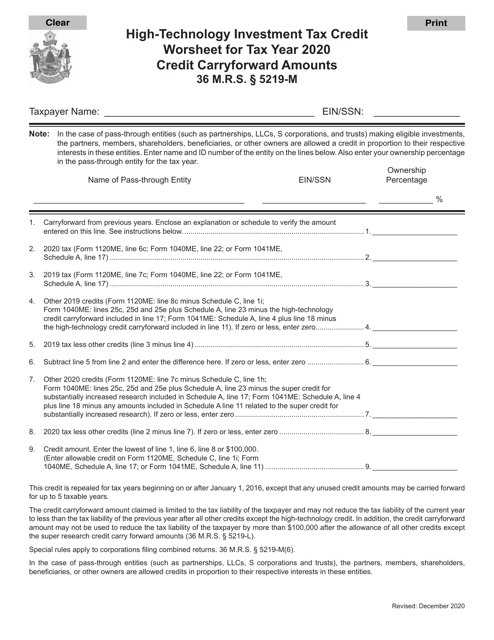

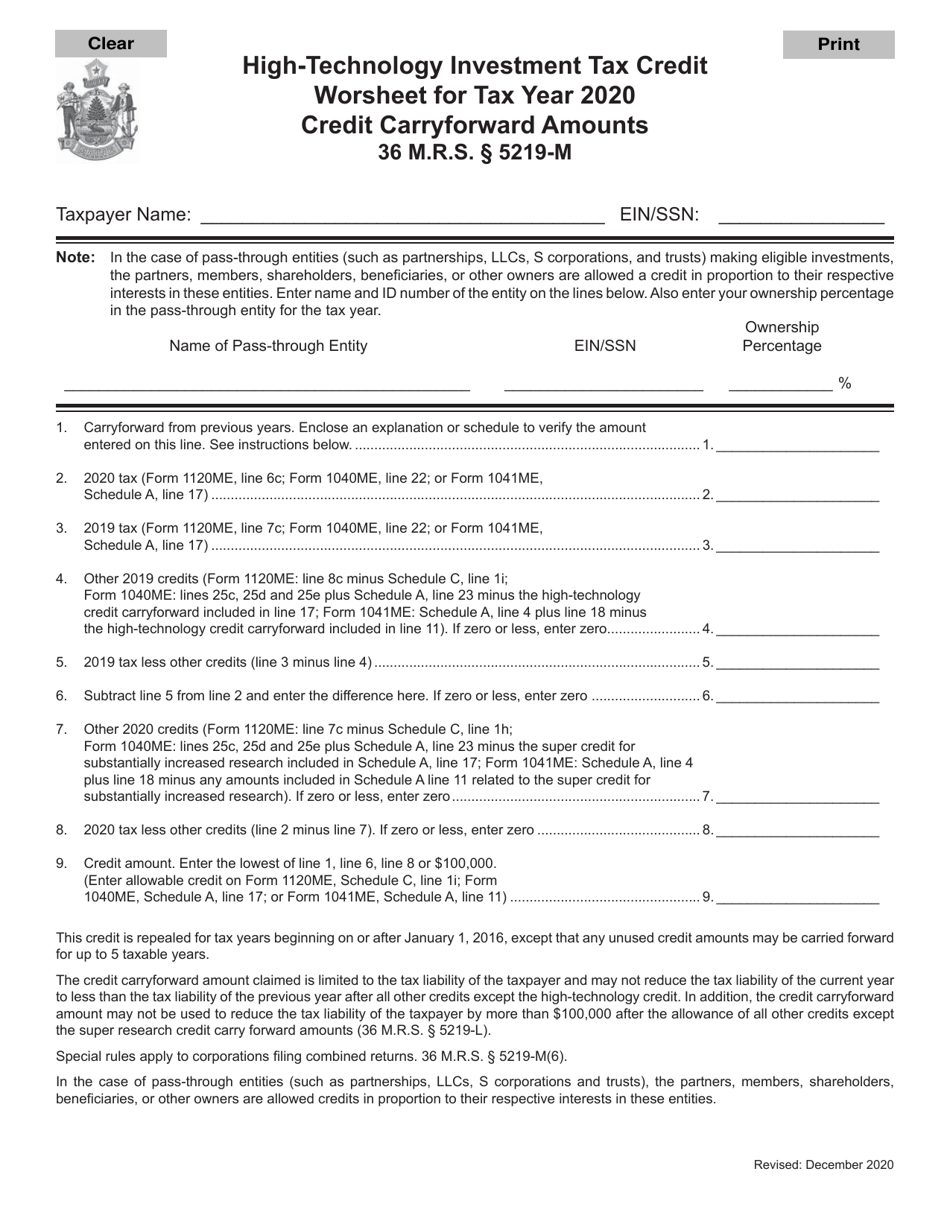

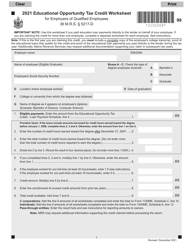

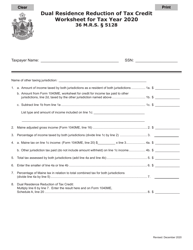

High-Technology Investment Tax Credit Worksheet - Maine

High-Technology Investment Tax Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the High-Technology Investment Tax Credit Worksheet?

A: The High-Technology Investment Tax Credit Worksheet is a document related to tax credits for high-technology investments in the state of Maine.

Q: What is the purpose of the High-Technology Investment Tax Credit Worksheet?

A: The purpose of the High-Technology Investment Tax Credit Worksheet is to help individuals and businesses calculate the tax credits they may be eligible for based on their high-technology investments.

Q: Who is eligible for the High-Technology Investment Tax Credit?

A: Individuals and businesses that make qualifying high-technology investments in Maine may be eligible for the High-Technology Investment Tax Credit.

Q: What are high-technology investments?

A: High-technology investments refer to investments in qualified research, development, and manufacturing in the fields of biotechnology, aquaculture, composite materials technology, and advanced technology forestry products.

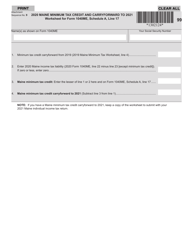

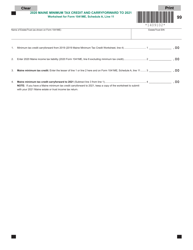

Q: How does the High-Technology Investment Tax Credit work?

A: The High-Technology Investment Tax Credit allows eligible individuals and businesses to claim a credit against their income tax liability based on a percentage of their qualified high-technology investments.

Q: Are there any limits to the High-Technology Investment Tax Credit?

A: Yes, there are limits to the High-Technology Investment Tax Credit. The maximum credit allowed in any tax year is $5 million, and there is an overall annual cap of $15 million for all taxpayers combined.

Q: What documentation do I need to claim the High-Technology Investment Tax Credit?

A: To claim the High-Technology Investment Tax Credit, you will need to provide documentation of your qualified high-technology investments, such as receipts, invoices, and other supporting documentation.

Q: Can the High-Technology Investment Tax Credit be carried forward or back?

A: Yes, the High-Technology Investment Tax Credit can be carried forward for up to 10 years or carried back for up to 5 years, subject to certain limitations and restrictions.

Q: Who should I contact for more information about the High-Technology Investment Tax Credit?

A: For more information about the High-Technology Investment Tax Credit, you should contact the Maine Revenue Services or consult with a tax professional.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.