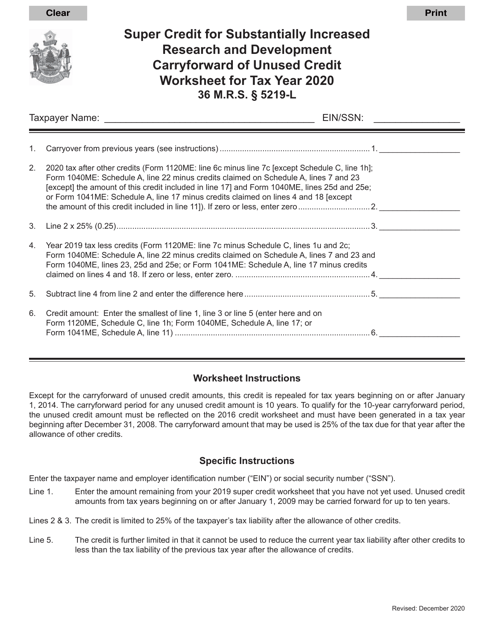

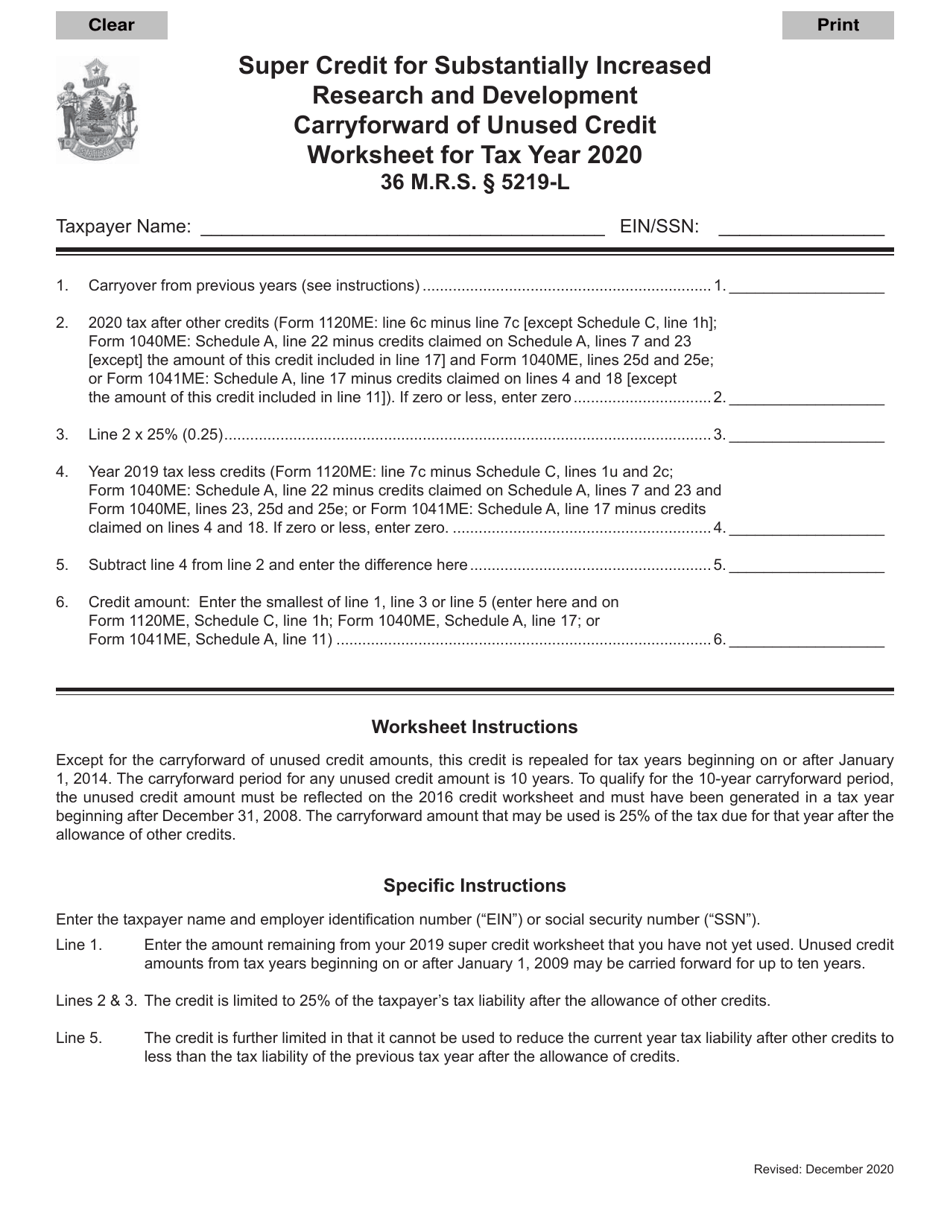

Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet - Maine

Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Super Credit for substantially increased research and development carryforward of unused credit worksheet?

A: The Super Credit is a tax incentive offered by the state of Maine to encourage research and development activities.

Q: Who is eligible for the Super Credit?

A: Businesses that have claimed and carried forward the research and development credit for at least two consecutive tax years and have a substantial increase in qualified research expenses in the current tax year are eligible.

Q: What is a substantial increase in qualified research expenses?

A: A substantial increase refers to an increase of at least 100% in qualified research expenses compared to the average expenses over the previous two tax years.

Q: How is the Super Credit calculated?

A: The Super Credit is equal to 10% of the substantial increase in qualified research expenses for the current tax year.

Q: Can the Super Credit be carried forward?

A: Yes, any unused portion of the Super Credit can be carried forward for up to 7 years.

Q: Is there a limit to the amount of Super Credit that can be claimed?

A: Yes, the maximum amount of Super Credit that can be claimed in a tax year is $1 million.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.