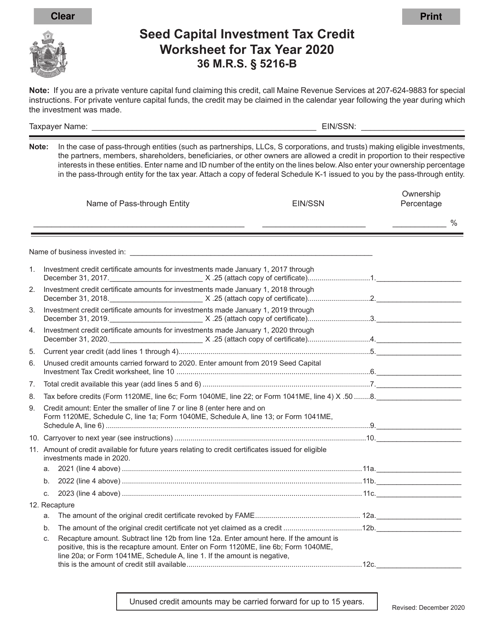

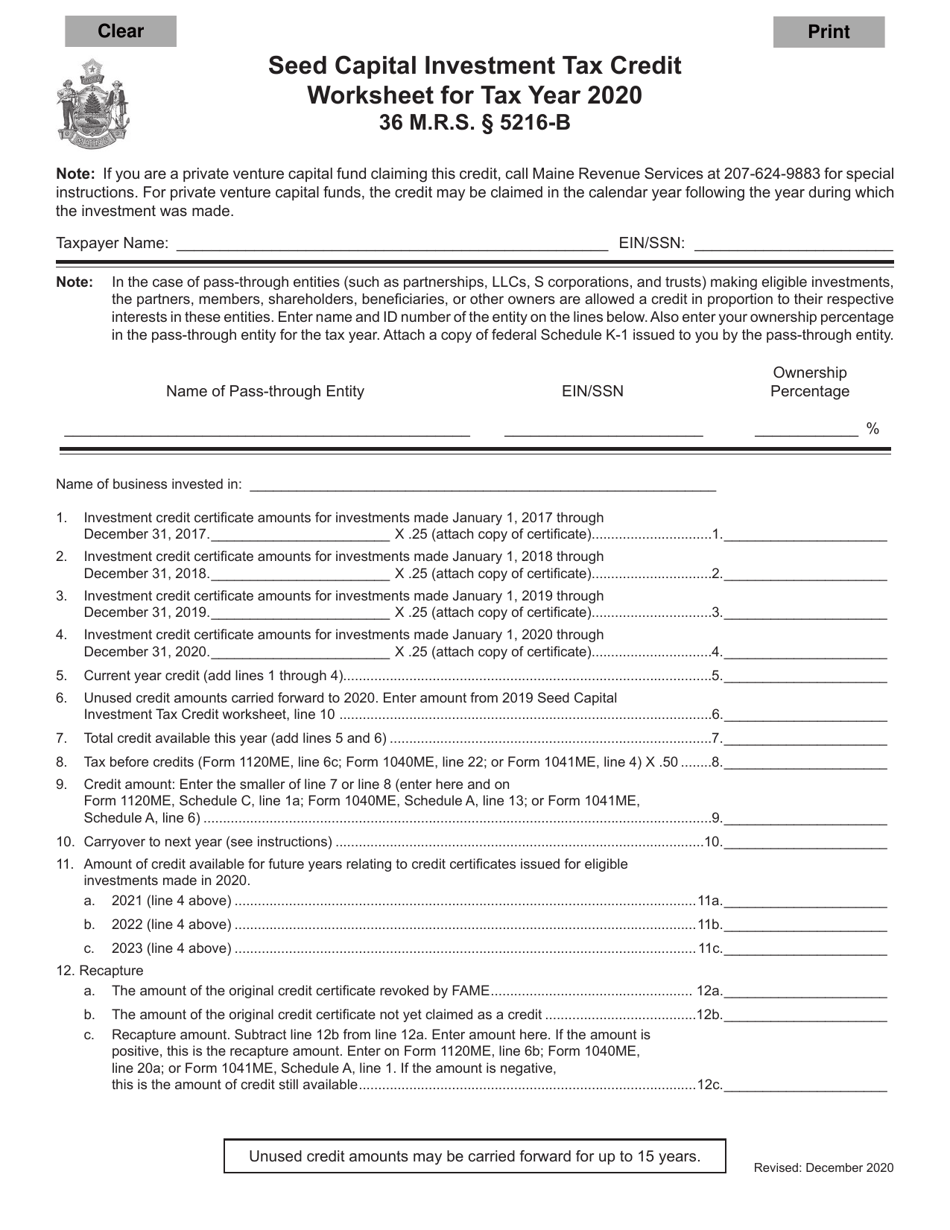

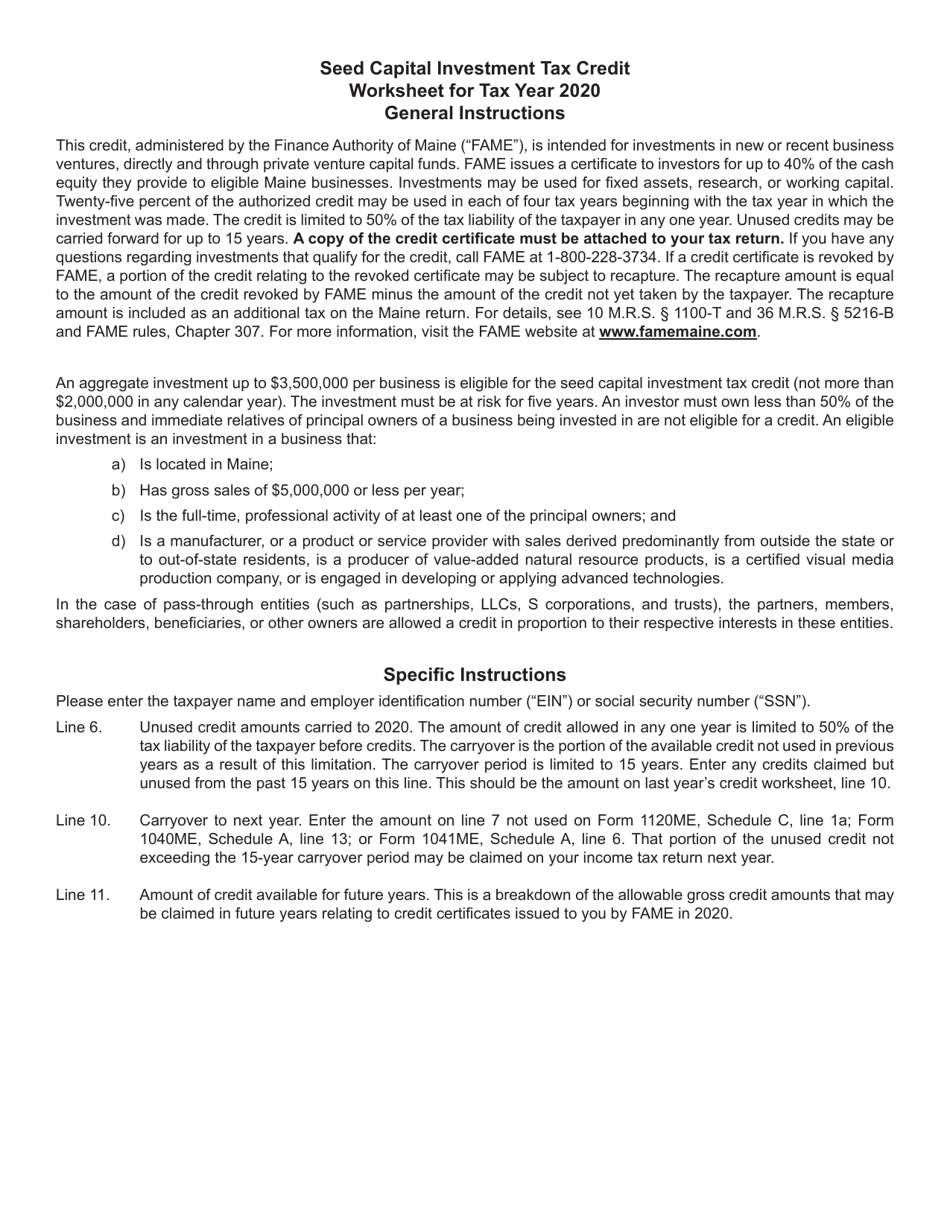

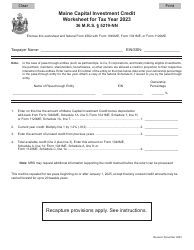

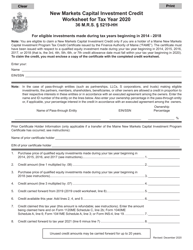

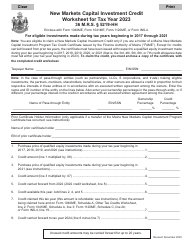

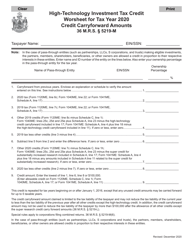

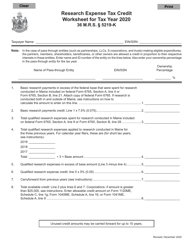

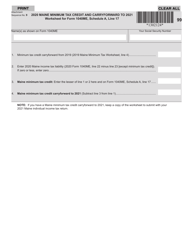

Seed Capital Investment Tax Credit Worksheet - Maine

Seed Capital Investment Tax Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Seed Capital Investment Tax Credit?

A: The Seed Capital Investment Tax Credit is a tax incentive offered by the state of Maine.

Q: Who is eligible for the Seed Capital Investment Tax Credit?

A: Individuals, partnerships, and corporations investing in eligible Maine businesses may be eligible for the tax credit.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to encourage investment in Maine's economy and support the growth of new businesses.

Q: How much is the tax credit?

A: The tax credit is equal to 40% of the amount invested, up to a maximum of $500,000.

Q: Are there any restrictions on the use of the tax credit?

A: Yes, the tax credit can only be used to offset Maine income tax liability and cannot exceed the taxpayer's tax liability in any given year.

Q: How can someone apply for the tax credit?

A: To apply for the tax credit, individuals or businesses must complete and submit the Seed Capital Investment Tax Credit Worksheet to the Maine Revenue Services.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.