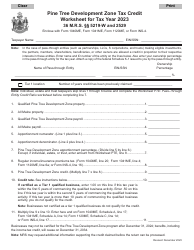

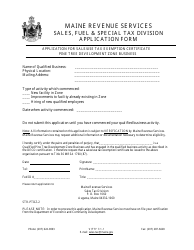

Worksheet PTE Credit Ratio Worksheet for Individuals Claiming the Pine Tree Development Zone Tax Credit - Maine

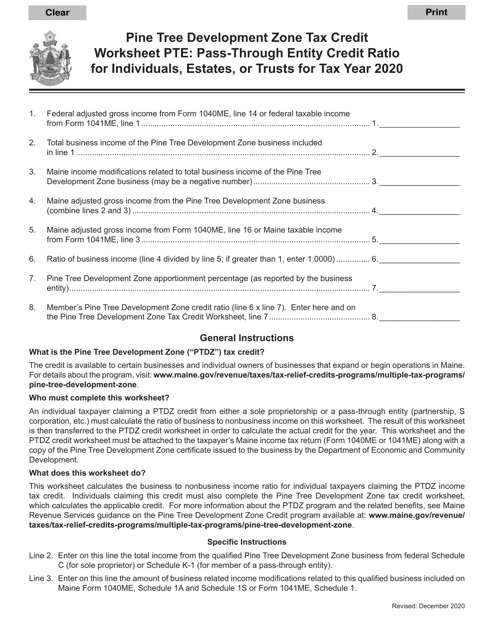

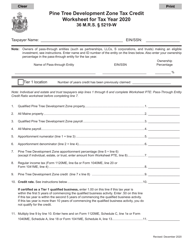

What Is Worksheet PTE?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

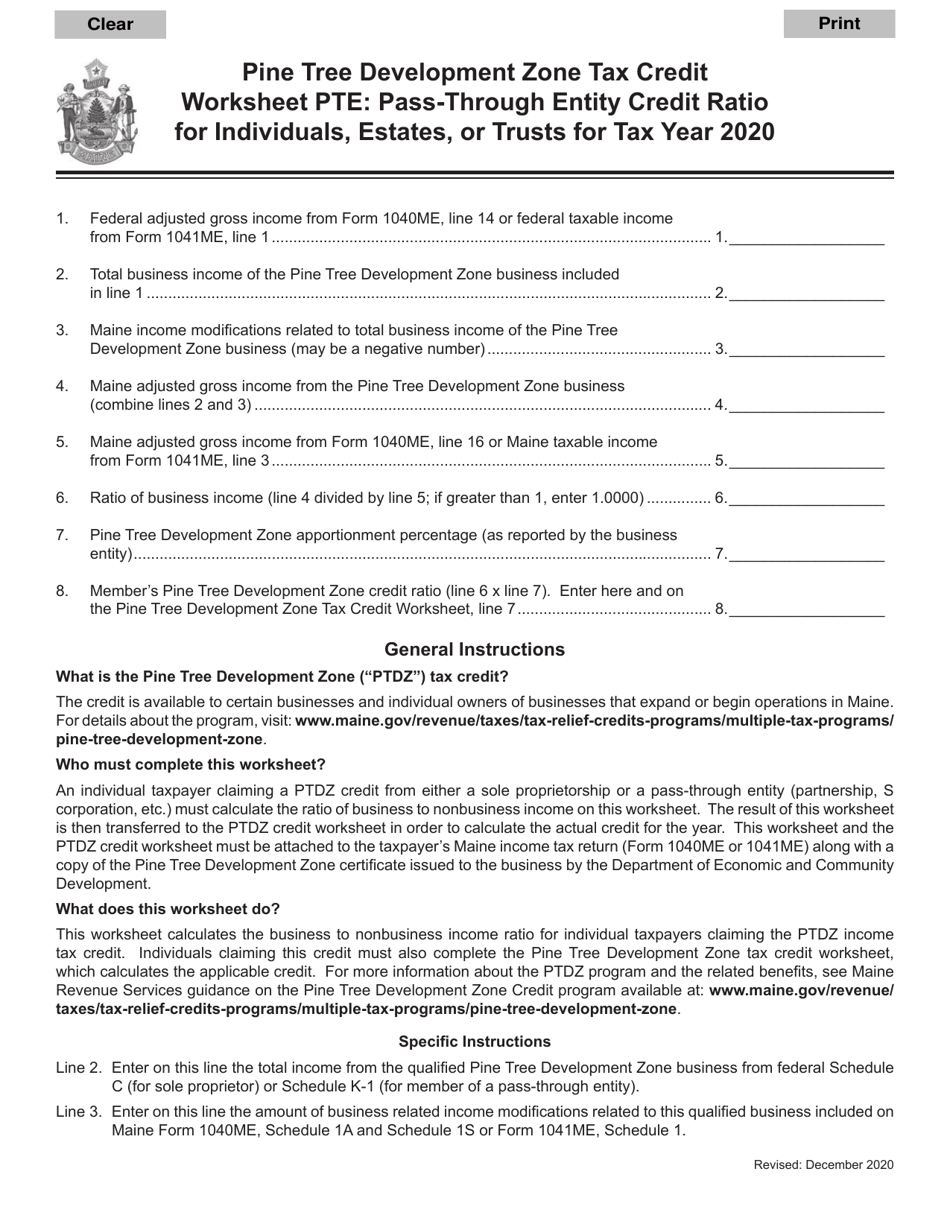

Q: What is the Pine Tree Development Zone Tax Credit?

A: The Pine Tree Development Zone Tax Credit is a tax incentive program in Maine.

Q: Who can claim the Pine Tree Development Zone Tax Credit?

A: Individuals who meet the eligibility criteria can claim the tax credit.

Q: What is the purpose of the PTE Credit Ratio Worksheet?

A: The PTE Credit Ratio Worksheet is used to calculate the credit amount for individuals claiming the Pine Tree Development Zone Tax Credit.

Q: How do I determine my eligibility for the Pine Tree Development Zone Tax Credit?

A: You must meet the criteria set by the Maine Department of Economic and Community Development to be eligible for the tax credit.

Q: What expenses are eligible for the Pine Tree Development Zone Tax Credit?

A: Expenses related to qualified activities within the Pine Tree Development Zone may be eligible for the tax credit.

Q: Is the Pine Tree Development Zone Tax Credit refundable?

A: No, the tax credit is not refundable. It can only be used to offset your Maine tax liability.

Q: Can I carry forward any unused Pine Tree Development Zone Tax Credit?

A: Yes, any unused tax credit can be carried forward for up to 10 years.

Q: Are there any limitations on the amount of the Pine Tree Development Zone Tax Credit that can be claimed?

A: Yes, there are limitations based on the amount of qualified activities and the credit ratio determined by the Maine Department of Economic and Community Development.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Worksheet PTE by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.