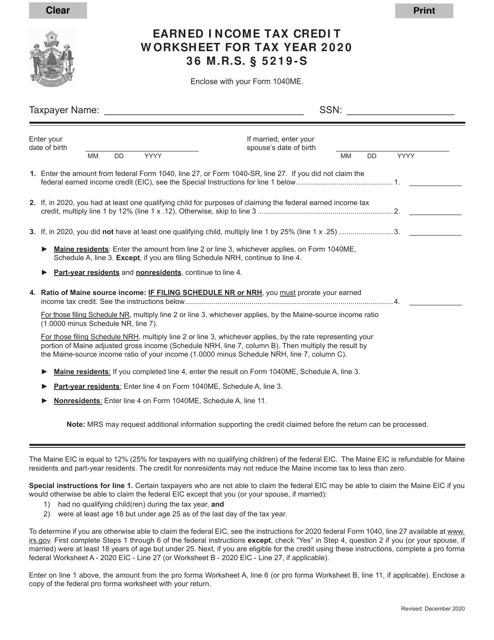

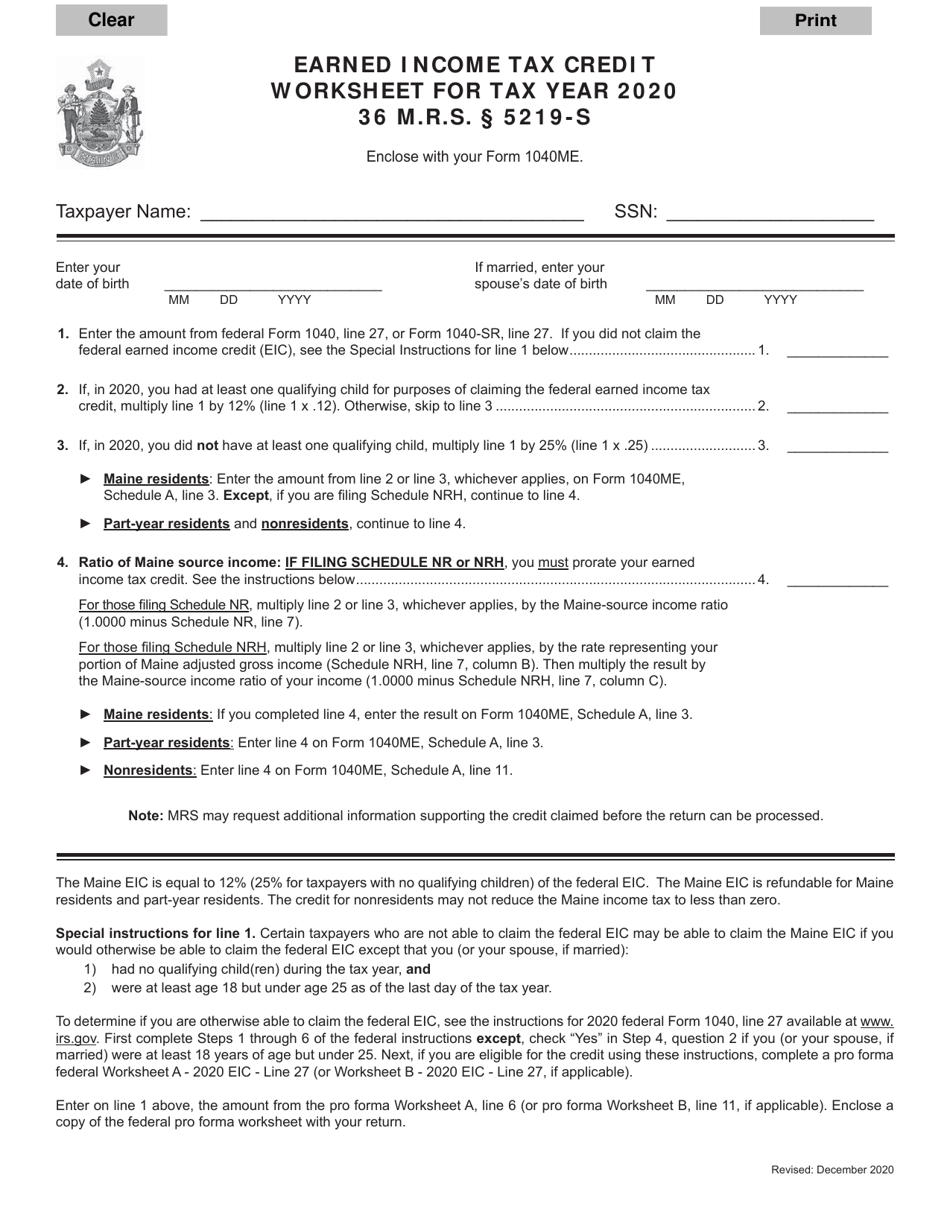

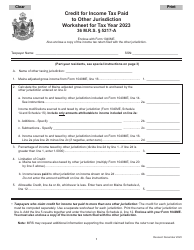

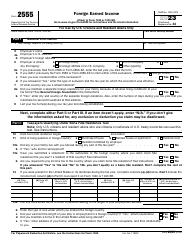

Earned Income Tax Credit Worksheet - Maine

Earned Income Tax Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Earned Income Tax Credit?

A: The Earned Income Tax Credit (EITC) is a tax benefit for low to moderate-income workers.

Q: Who is eligible for the Earned Income Tax Credit?

A: Workers who have earned income and meet certain income and filing status requirements may be eligible for the EITC.

Q: What is the purpose of the Earned Income Tax Credit Worksheet?

A: The Earned Income Tax Credit Worksheet helps you determine if you are eligible for the EITC and calculate the amount of credit you may receive.

Q: Are there any additional requirements for claiming the Earned Income Tax Credit in Maine?

A: Maine has its own additional requirements for claiming the EITC. You should review the instructions and guidelines provided by the Maine Revenue Services.

Q: What do I do after completing the Earned Income Tax Credit Worksheet?

A: After completing the worksheet, you should transfer the information to the appropriate section of your federal or state tax return, depending on which one you are filing.

Q: Can I claim the Earned Income Tax Credit if I am self-employed?

A: Yes, self-employed individuals can be eligible for the EITC if they meet the income and other requirements.

Q: Is the Earned Income Tax Credit refundable?

A: Yes, the EITC is a refundable tax credit, meaning you may receive a refund even if you do not owe any taxes.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.