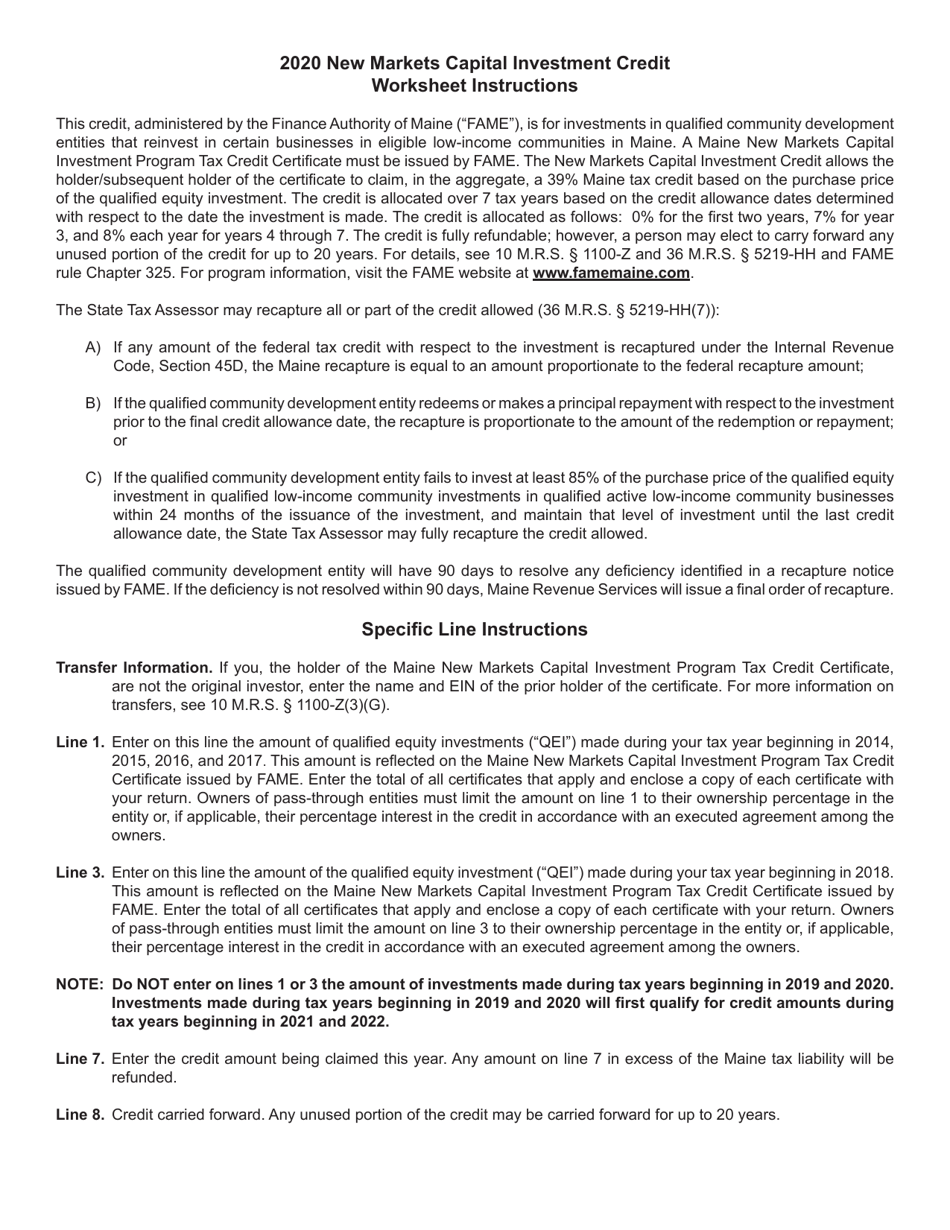

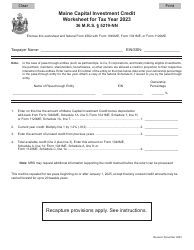

New Markets Capital Investment Credit Worksheet - Maine

New Markets Capital Investment Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

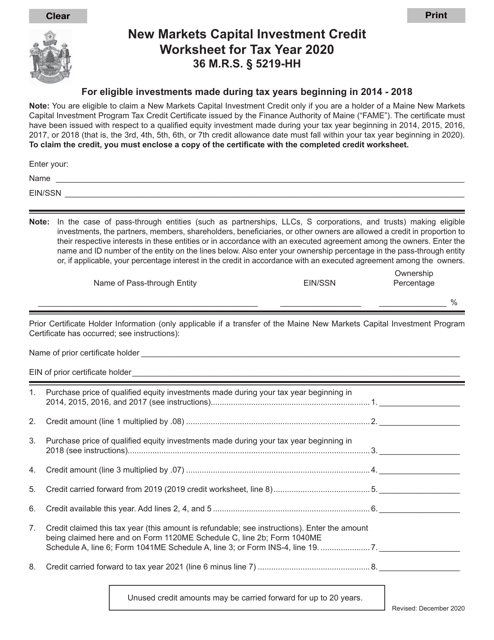

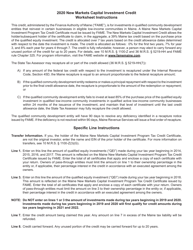

Q: What is the purpose of the New MarketsCapital Investment Credit Worksheet in Maine?

A: The purpose of the New Markets Capital Investment Credit Worksheet in Maine is to calculate and claim the New Markets Capital Investment Credit.

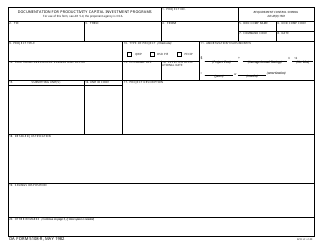

Q: What is the New Markets Capital Investment Credit?

A: The New Markets Capital Investment Credit is a tax credit available to businesses that make qualified investments in low-income communities.

Q: Who is eligible for the New Markets Capital Investment Credit?

A: Businesses that make qualified investments in low-income communities in Maine are eligible for the New Markets Capital Investment Credit.

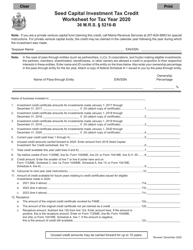

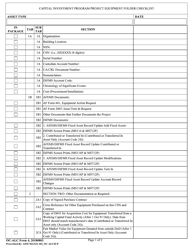

Q: What types of investments qualify for the New Markets Capital Investment Credit?

A: Qualified investments for the New Markets Capital Investment Credit include investments in certified community development entities (CDEs) that make investments in low-income communities.

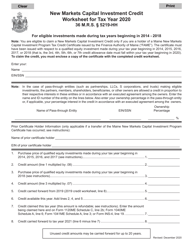

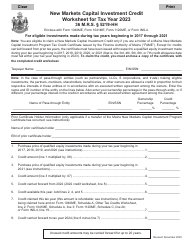

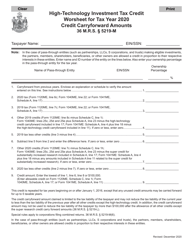

Q: How is the New Markets Capital Investment Credit calculated?

A: The New Markets Capital Investment Credit is calculated based on the amount of the qualified investment made by the business in a certified CDE.

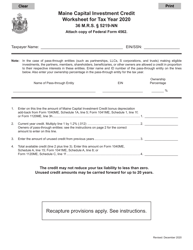

Q: How can businesses claim the New Markets Capital Investment Credit?

A: Businesses can claim the New Markets Capital Investment Credit by completing the New Markets Capital Investment Credit Worksheet and including it with their Maine tax return.

Q: Is there a limit to the amount of the New Markets Capital Investment Credit that can be claimed?

A: Yes, there is a limit to the amount of the New Markets Capital Investment Credit that can be claimed. The total credit cannot exceed $2 million per tax year.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.