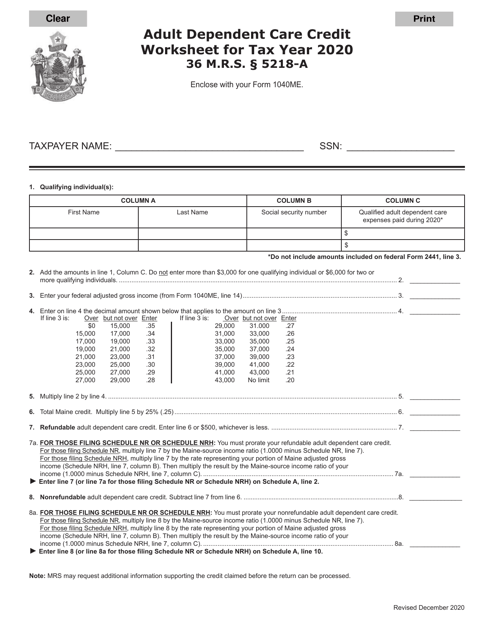

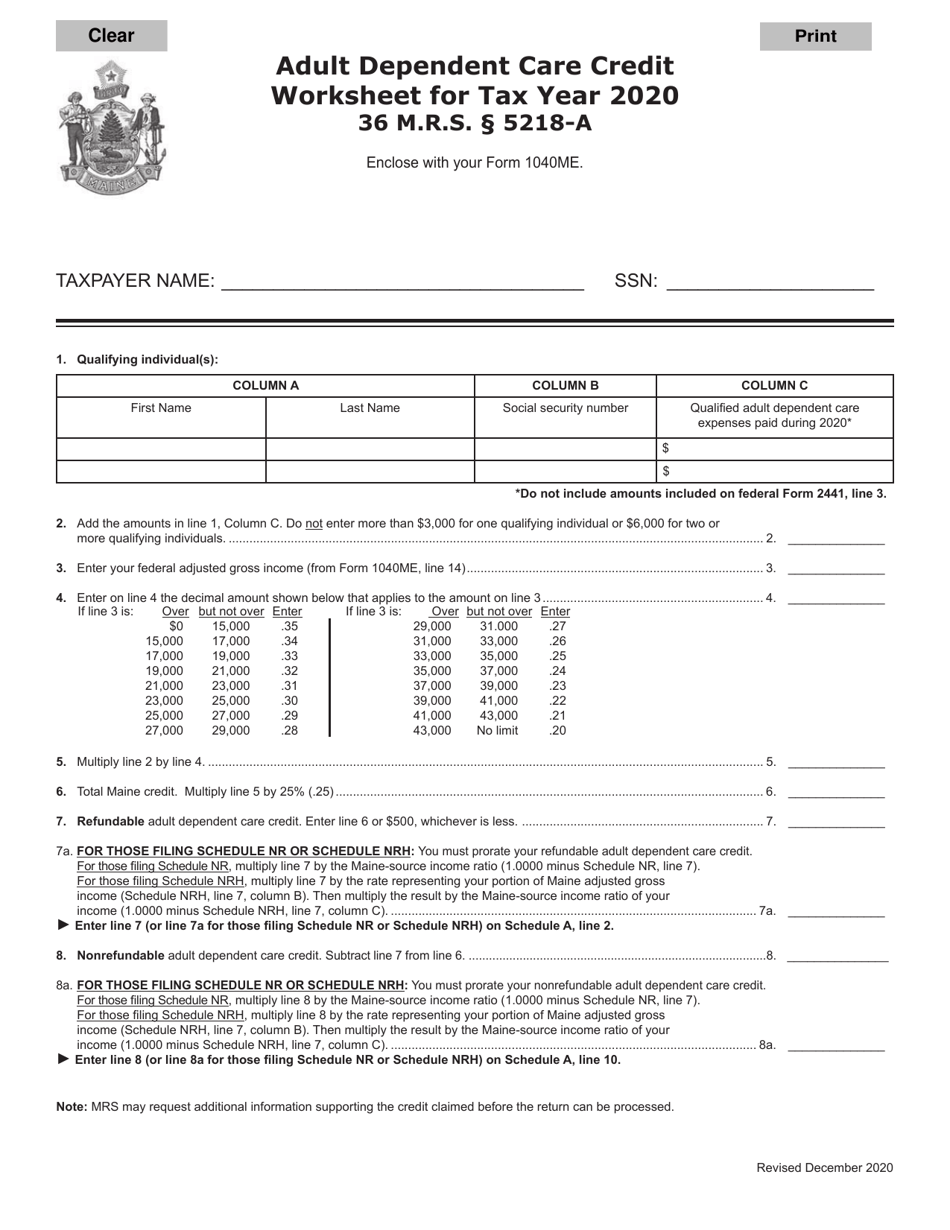

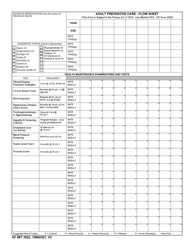

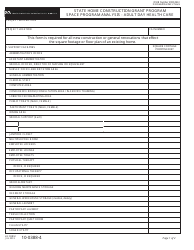

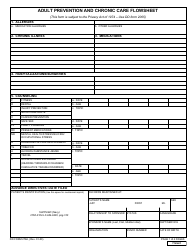

Adult Dependent Care Credit Worksheet - Maine

Adult Dependent Care Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

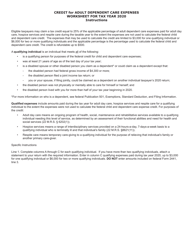

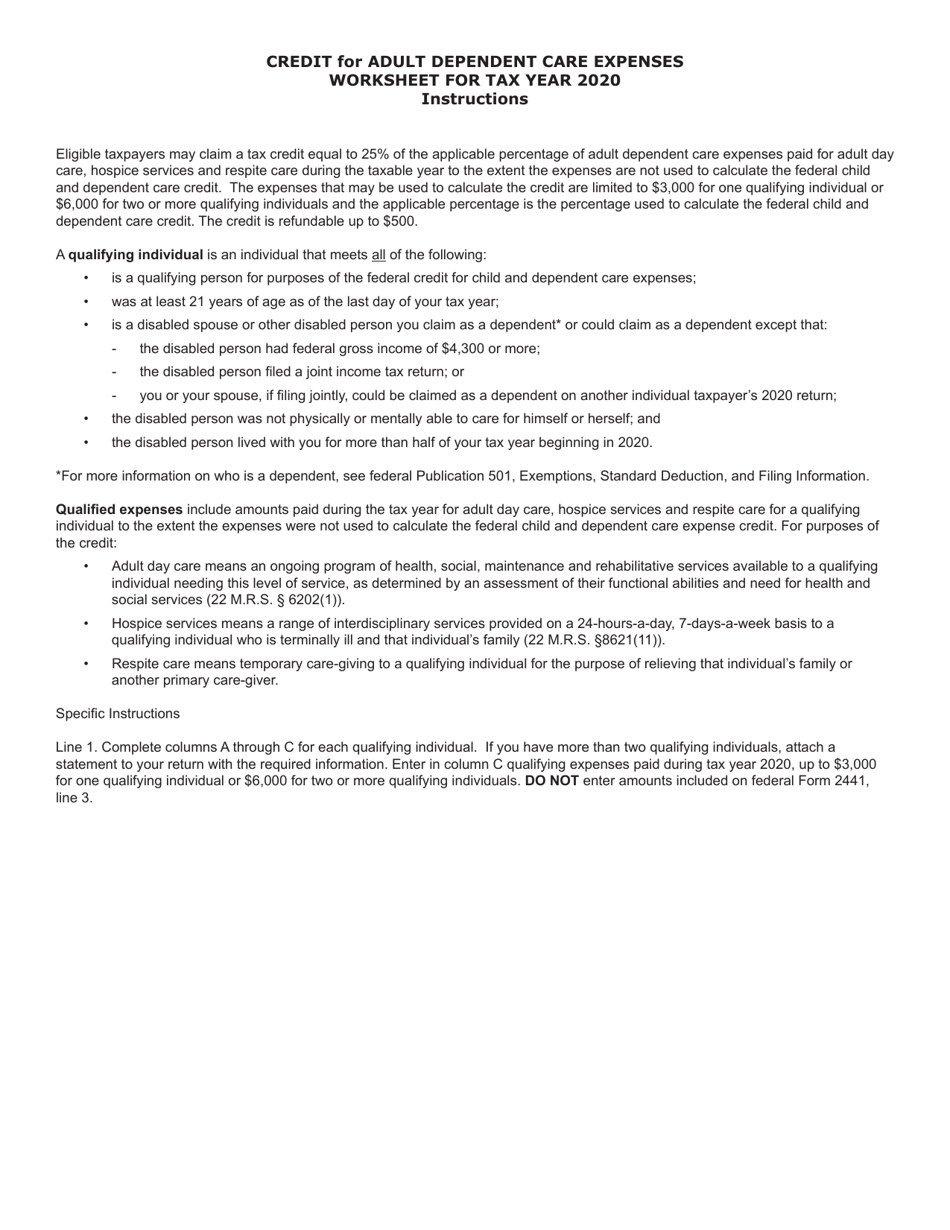

Q: What is the Adult Dependent Care Credit?

A: The Adult Dependent Care Credit is a tax credit for expenses paid to care for a dependent adult.

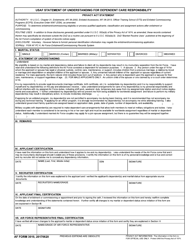

Q: Who is eligible for the Adult Dependent Care Credit?

A: Maine residents who paid expenses for the care of a dependent adult may be eligible for the credit.

Q: What is considered a dependent adult?

A: A dependent adult is someone who is physically or mentally incapable of caring for themselves and requires care.

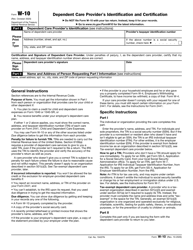

Q: What expenses qualify for the Adult Dependent Care Credit?

A: Expenses for services provided by a licensed caregiver, adult day care centers, or care provided in the individual's home may qualify.

Q: Is there a limit to the amount of the credit?

A: Yes, the maximum credit amount is $500 for each dependent adult.

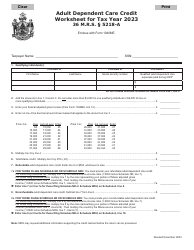

Q: How do I claim the Adult Dependent Care Credit?

A: You need to complete the Adult Dependent Care Credit Worksheet and include it with your Maine income tax return.

Q: Are there any income limits for the Adult Dependent Care Credit?

A: No, there are no income limits for claiming the credit.

Q: Can I claim the Adult Dependent Care Credit if I receive reimbursement from insurance or other programs?

A: You can still claim the credit for the amount of expenses not covered by insurance or other programs.

Q: Is the Adult Dependent Care Credit refundable?

A: No, the credit is non-refundable, but any unused portion can be carried forward to future tax years.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.